Vitalik Buterin, the co-founder of Ethereum, has reportedly captured more than $1 million in the Optimism Bridge.

This revelation follows a broader investigation by Arkham, a blockchain intelligence firm, which found that numerous crypto addresses have significant amounts of money tied up in bridging contracts on various networks.

Cross-Chain Challenges: Ethereum wallets struggle with locked assets

A wallet address that received 50 Ethereum (ETH) from Buterin’s identifiable Ethereum Name Service (ENS) address vitalik.eth has seen $1.05 idle over the past seven months. If they are truly connected to Buterin, these funds represent only a portion of his massive cryptocurrency holdings worth $781 million.

Arkham’s investigation revealed that significant amounts of money have been similarly committed to bridging contracts at numerous crypto addresses. These include addresses associated with major entities such as crypto exchange Coinbase and various DeFi whales.

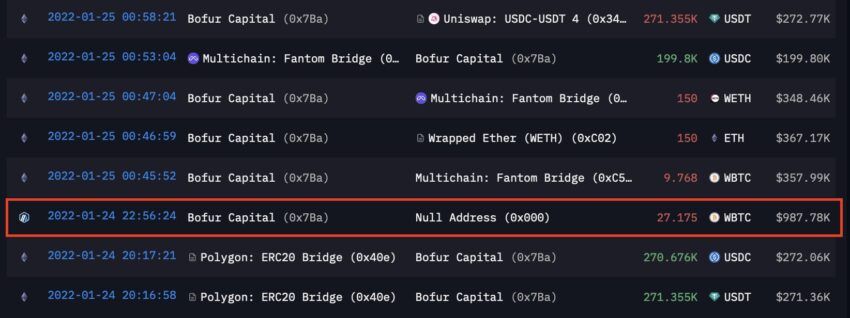

For example, a wallet associated with Bofur Capital has $1.8 million worth of wrapped Bitcoin (WBTC) sitting in the Arbitrum Bridge for 27 months.

“Bofur Capital’s 27 Bitcoin has been in the Arbitrum Bridge for over two years now and is now worth almost $2 million,” Arkham said.

Read more: How to use Arbitrum Bridge to bridge Ethereum tokens

Bofur Capital’s transaction of 27 Bitcoin. Source: Arkham

Furthermore, Thomasg.eth, the pseudonymous founder behind the decentralized air transportation solution Arrow, has $800,000 worth of ETH sitting idle on the same bridge.

Additionally, Coinbase attempted to bridge $75,000 in USD Coin (USDC) to Ethereum via the Optimism Bridge six months ago. Despite the successful transfer, these funds were not found on Ethereum’s fundamental layer. This situation indicates an overlooked recovery process or a deliberate pause in claiming the transferred assets.

Cross-chain bridges like Optimism are crucial in blockchain networks like Ethereum. Bridges facilitate the movement of assets across different blockchains without the need for a central authority, with the aim of solving interoperability issues inherent in blockchain architectures.

The situations involving Buterin and others illustrate the complexity and risks of managing funds on decentralized platforms. There is a chance that the owners of these wallets may have deliberately left their belongings within these bridges. Nevertheless, the possibility of these funds getting stuck due to technical issues cannot be ignored.

Read more: How to use the polygon bridge: a step-by-step guide

In addition, these bridges pose significant safety risks. They have become focal points for cyber attacks, with billions of dollars lost in recent years.

Notable security breaches include the $650 million Ronin Bridge hack by North Korea’s Lazarus Group and the $100 million theft of the Harmony Horizon Bridge, highlighting the vulnerability of these critical network connections.