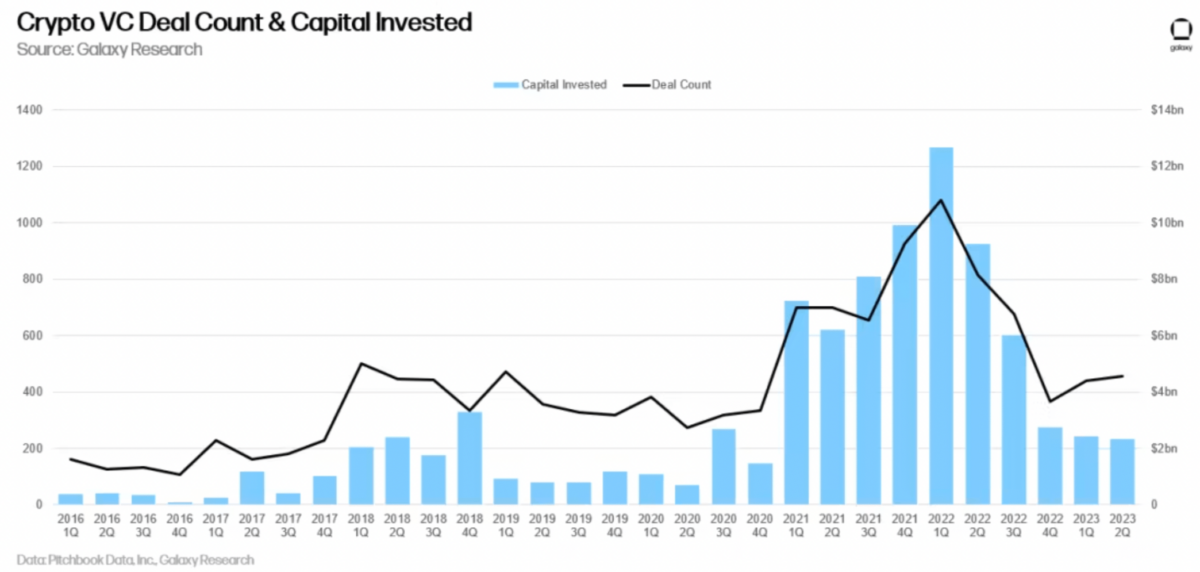

Venture capital (VC) investments in the cryptocurrency and blockchain sector are on a downward trajectory, according to a recent report from Galaxy Research. In the second quarter of 2023, crypto and blockchain companies received $2.3 billion from VC firms, a significant decrease from the same period last year when more than $8 billion was invested. Looking further back to the COVID-19 pandemic, the crypto industry experienced a massive surge in venture capital, with a record $13 billion invested in Q1 2022. The current challenging business climate coupled with rising interest rates has led to a reduction in the dealflow, according to the report.

“The invested capital has not yet found a clear bottom. Rising rates continue to reduce allocators’ willingness to bet on long-tail risk assets such as venture funds,” the report said. This decline marks the fifth consecutive quarter of decline in VC investment in crypto companies. With the digital asset space still in its infancy, venture capital has continued to play a vital role in providing funding to startups in exchange for equity or tokens.

Not all bad news

Interestingly, while the total investment amount has decreased, the number of deals has decreased slightly increasedrising from 439 in the previous quarter to 456. The report also noted significant 275% growth in deals with companies focused on privacy and security products, while infrastructure-based solutions were up 114 percent.

In terms of sectors within the crypto space, startups focused on trading, exchanges, investments and loans attracted the most capital, with an investment of $473 million.

Here are the biggest deals of the quarter, by sector and industry:

- Layer 2/Interop sector experienced the biggest deal of the quarterwith LayerZero raising $120 million Series B round;

- Companies focused Web3, NFTs, Gaming, DAOs and the Metaversecollectively received $442 million;

- The biggest deal in the Web3 and NFT space for the quarter was cross-chain NFT marketplace Magic Eden, and the recent $52 million deal.

- Blockchain solutions provider Auradine had the largest infrastructure deal for $81 million; And

- River Financial had the largest trade/exchange deal at $35 million.

A light at the end of the crypto tunnel?

Despite regulatory challenges, the report suggests crypto startups in the US are still attracting a lot of attention from venture capitalists. This indicates that recent regulatory action by the US Securities and Exchange Commission (SEC) has not completely deterred investors.

With Ripple Labs’ minor legal victory against the SEC, in which a judge ruled that selling XRP on exchanges does not constitute “security,” and a high level of legal scrutiny devoted to the SEC’s pre-approval of Coinbase’s 2021 S -1 filing, some in the Web3 space are wondering if the aggressive approach taken by US-based regulators could mean a big change.

The Galaxy report found that 45 percent of capital invested in crypto companies was focused on US-based companies, followed by the United Kingdom at 7.5 percent, Singapore at 5.7 percent, and South Korea at 3.1 percent. .

However, the drop in VC funding is not exclusive to the crypto sector, according to the report. Tougher monetary conditions have impacted the ability of venture capital firms to continue to raise funds for investments in a variety of industries in 2023, including the ongoing bear market coupled with “the spectacular blowouts of several venture capital backed firms in 2022″, leading many allocators to turn to ” burned”. ”

Editor’s Note: This article was written by an nft now contributor in collaboration with OpenAI’s GPT-4.