Bitcoin’s short-lived reign as the leading NFT platform came to an end this month, with Ethereum reclaiming the top spot as NFT sales on the Bitcoin network plummeted more than 60% from December’s record highs.

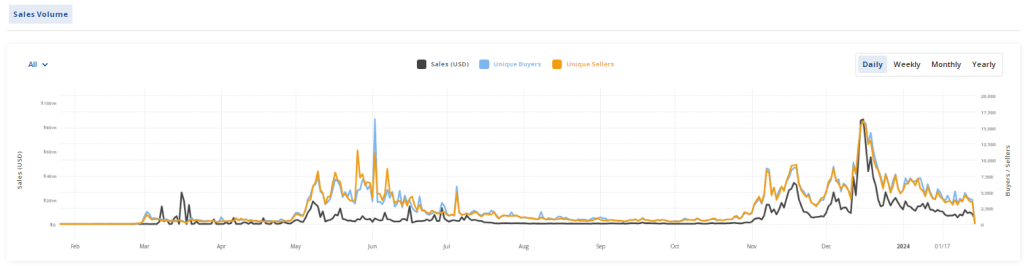

This is evident from data from the NFT analysis platform CryptoSlam a stark reversal of fortunes. After surpassing Ethereum in December with $881 million in NFT sales, Bitcoin’s January volume has sunk to $314 million two days before the end of the month. Meanwhile, Ethereum has maintained a steadier pace, registering $328 million in revenue over the past 28 days.

Bitcoin NFT is losing its appeal

This shift can be attributed to the waning passion surrounding Ordinals, a technology that allows inscriptions and non-fungible tokens directly on the computer. Bitcoin blockchain. The surge in Bitcoin NFT activity in December was largely driven by the Ordinals-related hype, which led to high fees for minting inscriptions. For example, on December 10, Bitcoin saw a one-time daily fee of $10 million due to subscription transactions.

Source: CryptoSlam

However, as the broader digital asset market faces turbulence, interest is up Ordinals has decreased significantly. Coin costs have fallen 83% since the peak of $5 million on January 14th, and are now just $848,000 as of January 28th. This decline reflects a drop in demand for blockspace for non-traditional Bitcoin transactions, further indicating reduced interest in Ordinals-based NFTs.

Source: Dune Analytics

Ethereum, on the other hand, benefits from its established ecosystem and diverse functionalities. Are NFT landscape covers a wider range of projects and applications compared to the emerging Ordinals scene on Bitcoin. This, combined with the relative stability of the Ethereum network, likely contributed to the Ethereum network’s ability to maintain user interest and NFT trading volume in December and January.

BTC market cap currently at $854 billion. Chart: TradingView.com

NFT landscape shifts: adaptability crucial

The rapid changes in the NFT landscape highlight the need for adaptability and innovation within the industry. Although Ordinals has introduced a new use case for Bitcoin, its technical limitations and long-term appeal may hinder its sustainability. Conversely, Ethereum’s flexibility and established infrastructure position it well to adapt to changing market trends and user preferences.

Additionally, the broader decline in interest in digital asset classes has likely affected both Bitcoin and Ethereum NFTs. However, Ethereum’s larger and more diverse user base, along with its established NFT ecosystem, suggest it may be better equipped to weather the current market downturn.

The future of the NFT market remains uncertain, but one thing is clear: the landscape is constantly changing and players must be able to adapt to stay ahead.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.