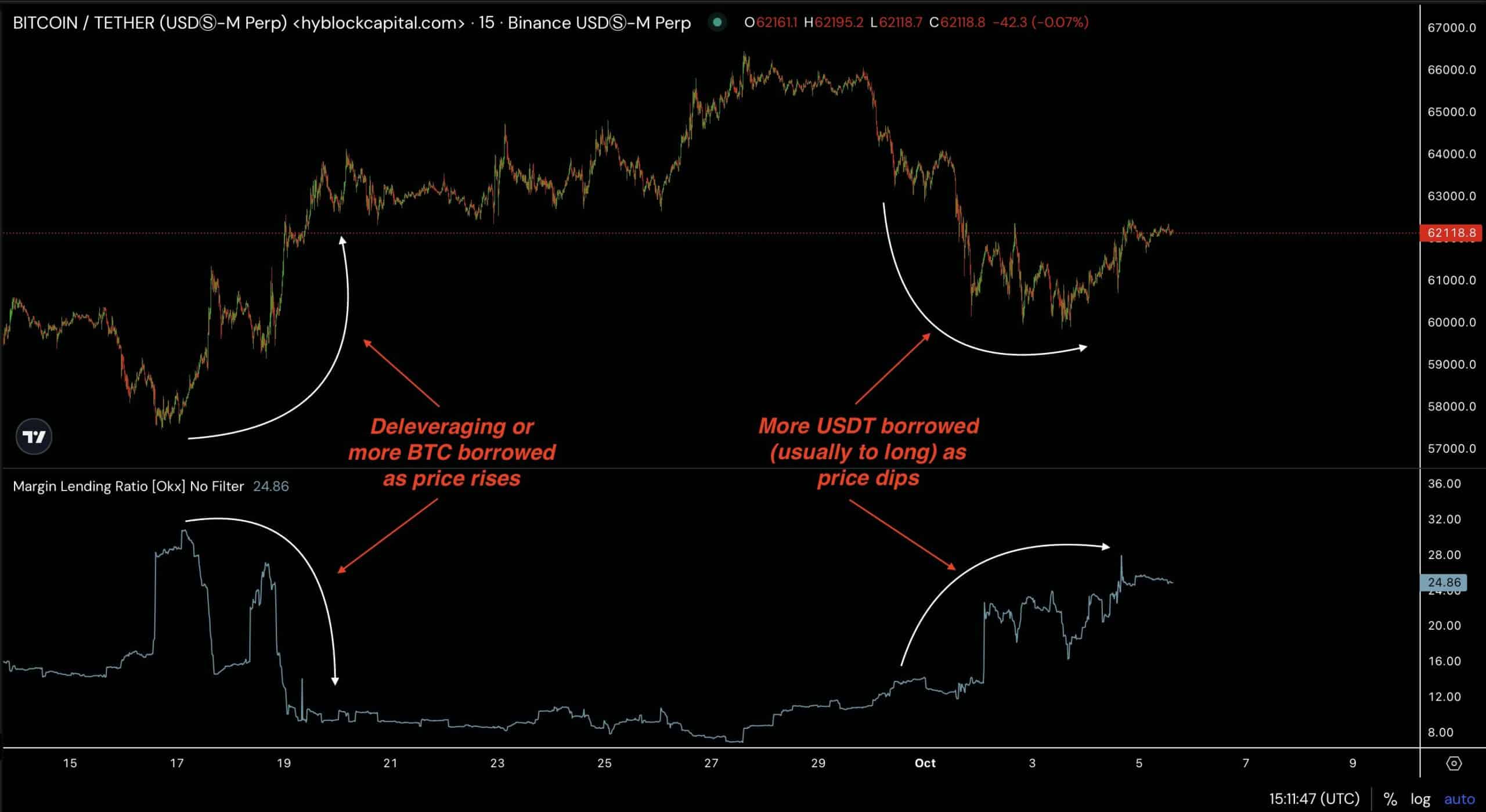

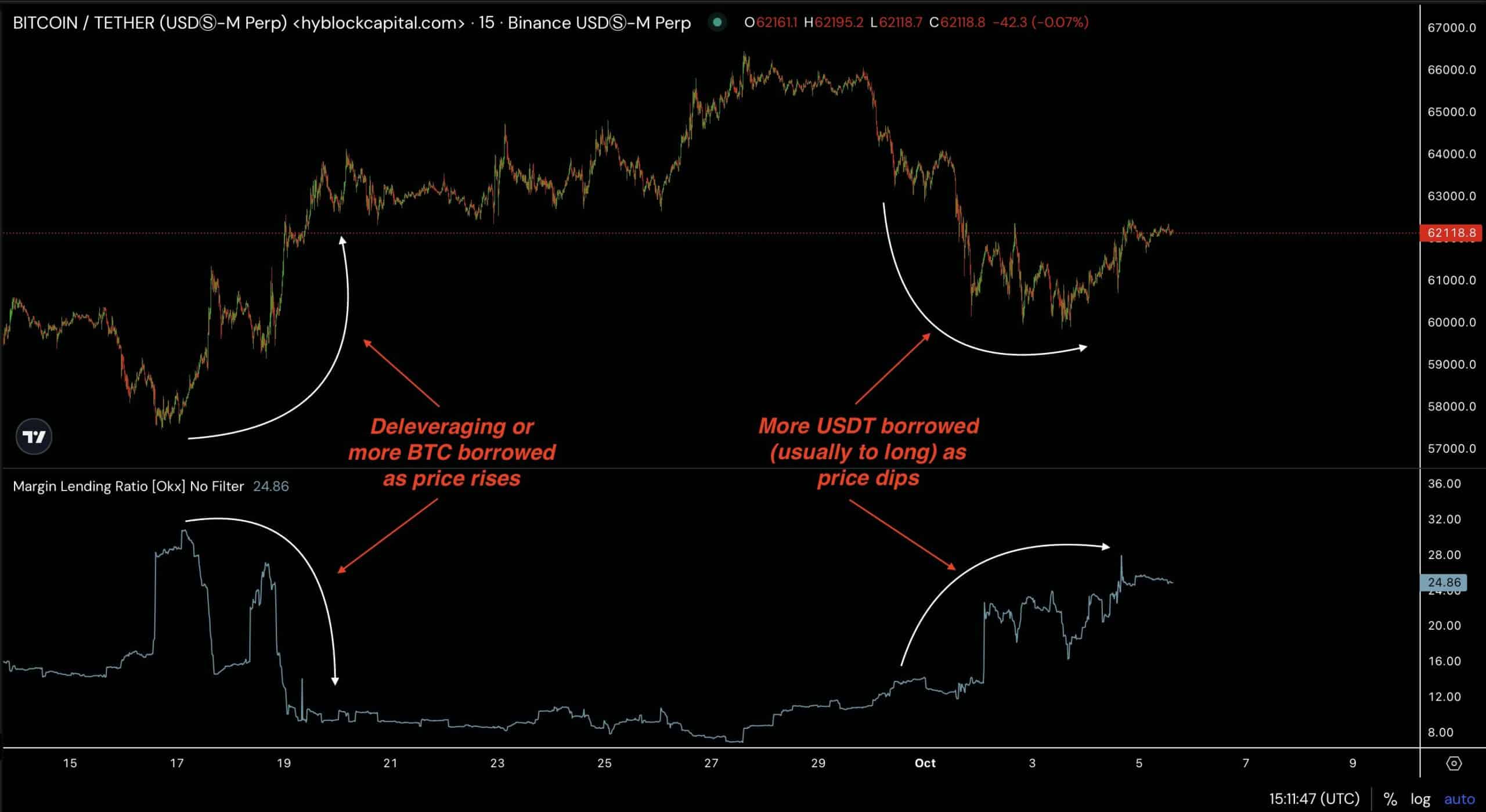

- More USDT loans than Bitcoin during price drops.

- The liquidation heatmap that points the way for BTC is over.

Bitcoin [BTC] appears to have found a local bottom near the midpoint of the downtrend channel it has been following for the past seven months.

After briefly touching $66K, BTC began to correct, leading many traders to speculate that the fourth quarter could bring bullish momentum to the broader cryptocurrency market.

An interesting metric supporting this sentiment is the shift from borrowing BTC during price increases to borrowing USDT during price decreases.

Traders are increasingly borrowing USDT to “buy the dip” and increase their exposure to Bitcoin, which is a positive indicator for the coming quarter.

Source: Hyblock Capital

Bitcoin breaks the market structure

Bitcoin’s current price action further supports this bullish outlook. After breaking the market structure of the BTC/USD pair, the price fell to reach a higher low after significant long liquidations.

This local bottom now forms the basis for a possible rise. To maintain the bullish trend, BTC must break above the Daily 200 Moving Average (200MA) and surpass last week’s highs.

If Bitcoin can break through these resistance levels, the $70K level will become the next critical target, signaling stronger bullish momentum as the fourth quarter progresses.

Source: TradingView

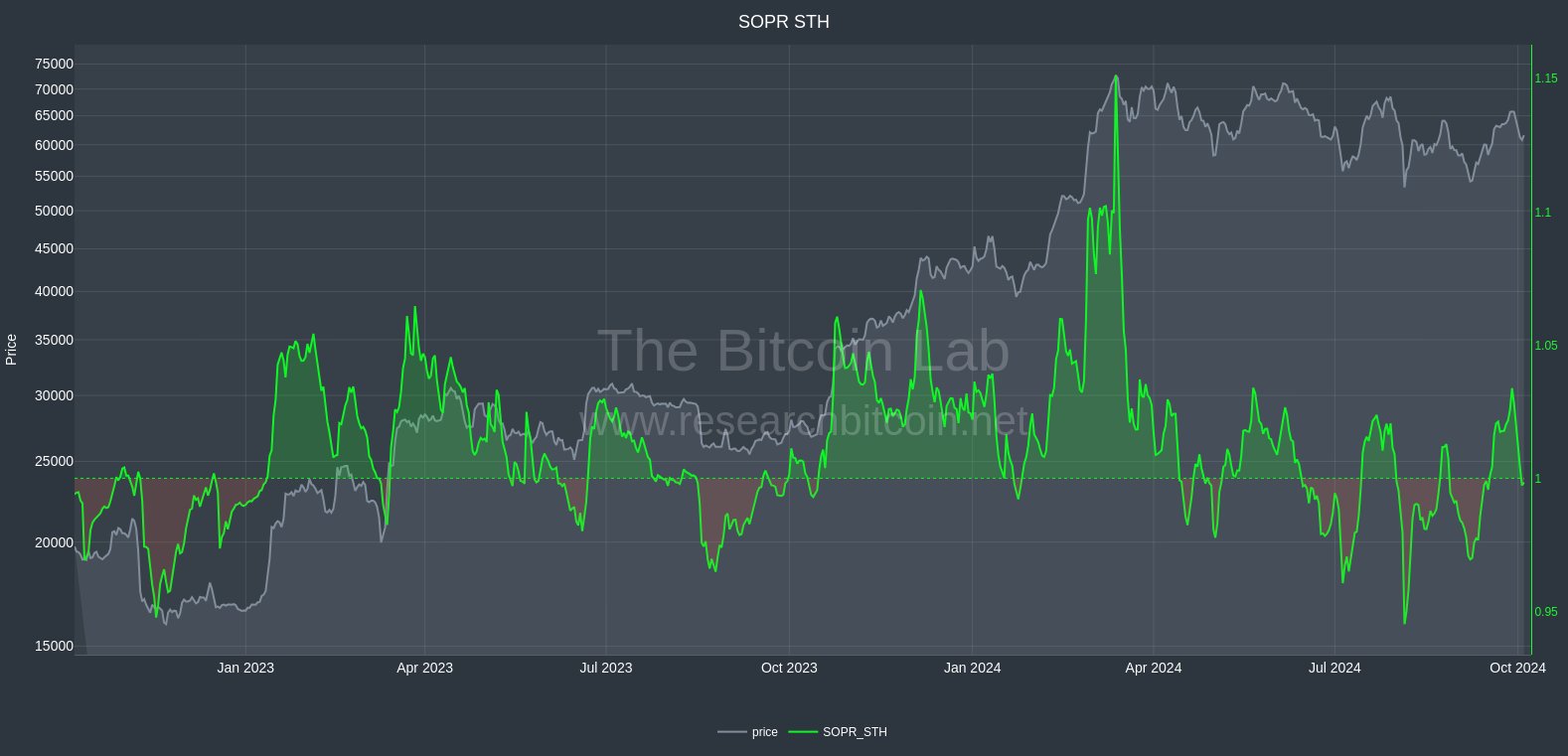

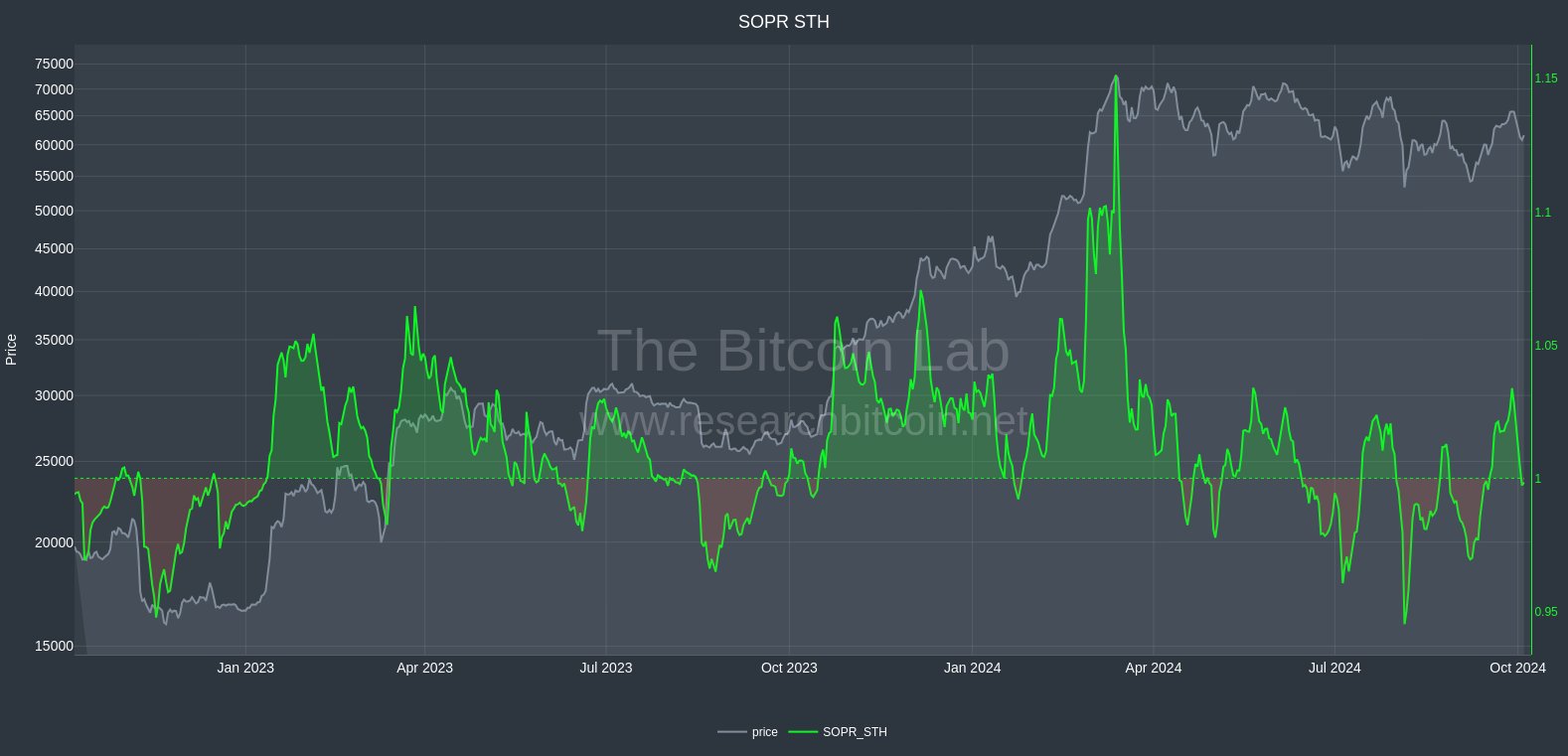

Retest short-term holder MVRV and SOPR

Additional metrics such as the Bitcoin Short-Term Holder MVRV and SOPR also indicate positive results.

Both metrics retest their neutral “1” line, indicating that if they bounce out of this position, it will confirm a more bullish outlook for BTC.

This is a crucial time for short-term speculators, as a rebound here would further fuel price appreciation, potentially rewarding both short-term traders and long-term holders.

Source: The Bitcoin Lab

Such a scenario would increase the chances of BTC reaching new highs before the end of the year.

Enormous liquidity rests above it

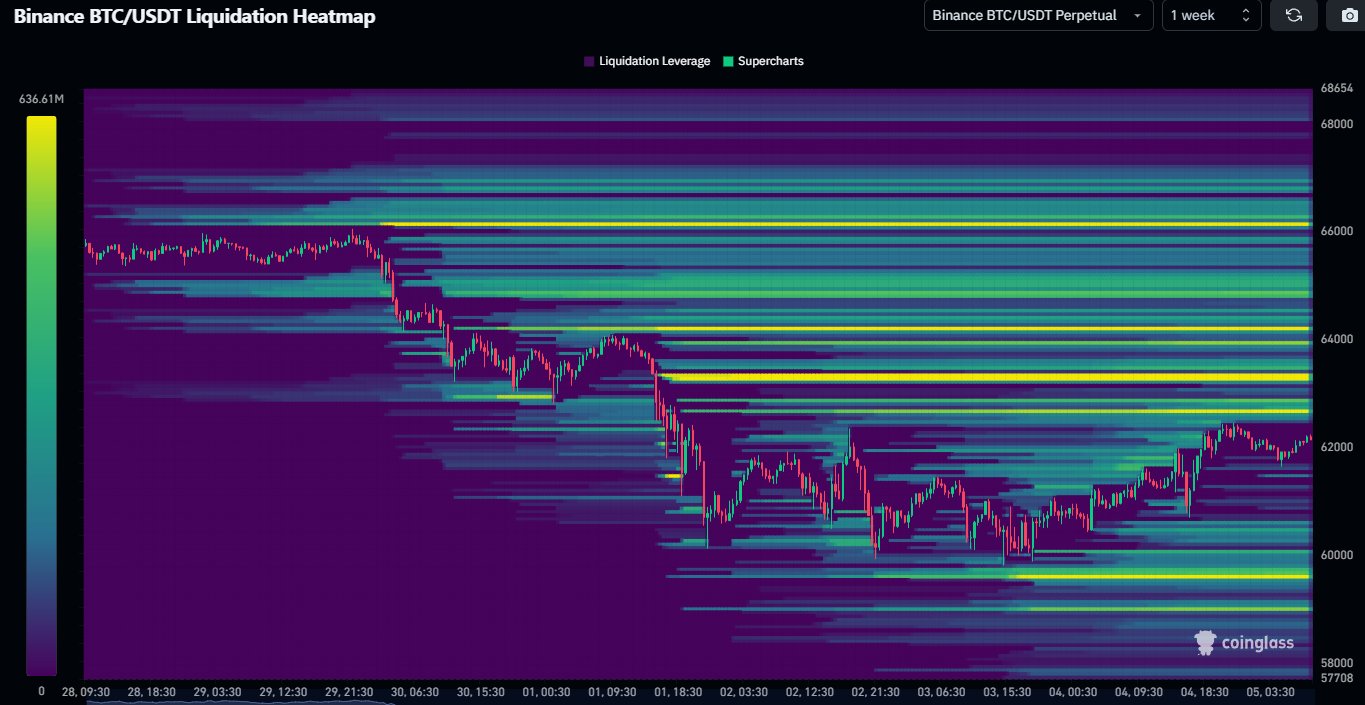

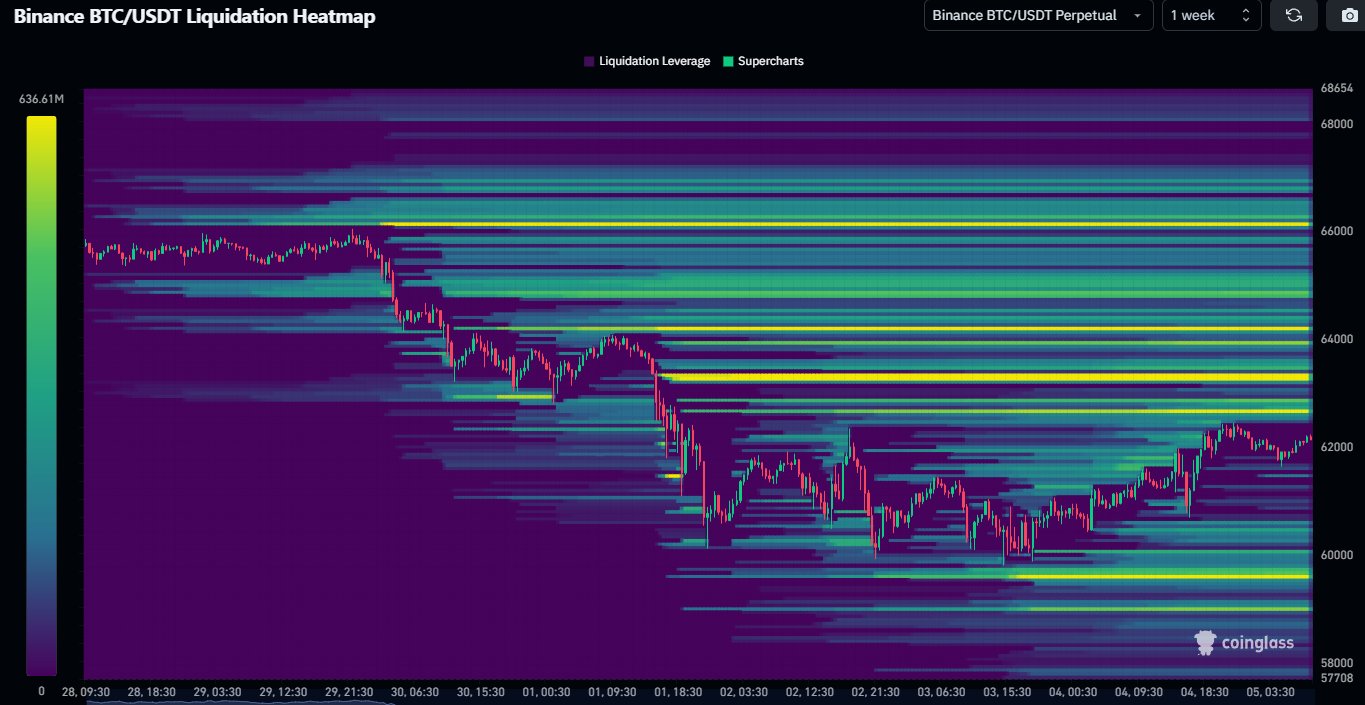

Furthermore, the Bitcoin liquidation heatmap shows that a significant amount of liquidity is now above the current price level.

Since price movements often trend towards areas of high liquidity, this suggests that BTC is poised for an upward move.

The most substantial liquidity zone is between $63,000 and $66,000, meaning Bitcoin could experience a “short squeeze” if its upward momentum gains momentum in the coming days.

While there is some liquidity below $60,000, it is not as concentrated, indicating that the path of least resistance is upwards.

Source: Coinglass

Read Bitcoin’s [BTC] Price forecast 2024–2025

Bitcoin appears well positioned for potential gains as the fourth quarter progresses. Figures such as increased USDT lending, hitting a local bottom and the liquidity hitmap all point to a bullish outlook.

With the $70,000 level in sight, BTC may be gearing up for a strong close to the year, rewarding traders who have positioned themselves for the next move higher.