- Supreme Court’s refusal to review allows US to sell seized 69,370 Bitcoin.

- Trump proposes to keep Bitcoin as a strategic reserve if he is re-elected.

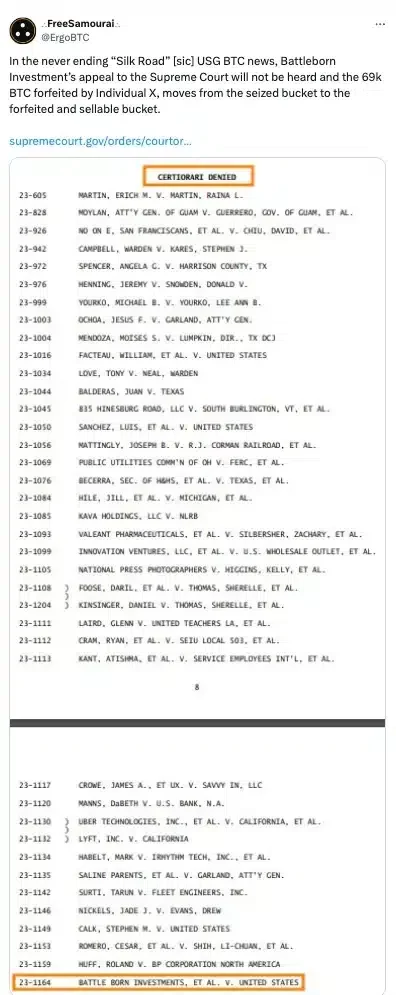

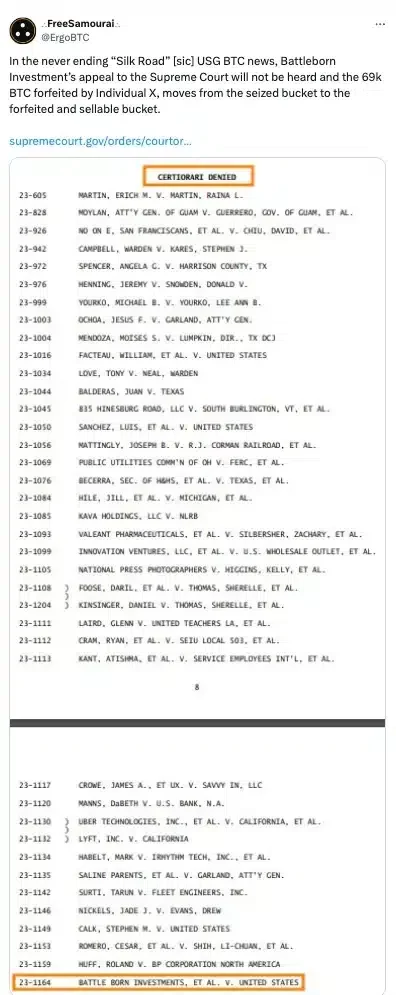

In a notable legal development, the U.S. Supreme Court has done so rejected to review an appeal over the ownership of 69,370 Bitcoin [BTC]originally confiscated from the secretive web marketplace Silk Road.

This decision stems from the Supreme Court’s refusal to grant certiorari in the case brought by Battle Born Investments against the US government.

Source: FreeSamourai/X

With the Supreme Court declining to hear the case, the US government can now proceed with the sale of the seized assets, effectively ending this legal battle.

What happened in 2022?

For those who don’t know, in 2022a federal court in California dismissed the claims of Battle Born Investments, which argued that it acquired the rights to the seized Silk Road Bitcoin through a bankruptcy estate.

Battle Born claimed that the debtor, Raymond Ngan, was “Individual X,” who allegedly stole billions in BTC from Silk Road.

Lacking convincing evidence, the court ruled against Battle Born – a decision later upheld by an appeals court in San Francisco.

With the Supreme Court’s recent decision not to review the case, Battle Born’s legal options have now been exhausted, allowing the government to liquidate the seized Bitcoin.

What impact will this have on Bitcoin?

Claims suggest that the potential sale of seized BTC by the US government could put significant pressure on the cryptocurrency market and impact Bitcoin’s price prospects.

And as expected, this announcement itself had an immediate bearish effect on the price of BTC, which was on an upward trend until recently.

According to CoinMarketCapBTC is now trading at $62,651, down 1.36% in the last 24 hours.

Transfers completed so far

Needless to say, the US government has so far transferred significant BTC holdings seized from Silk Road to new wallets.

About $2.6 billion worth of Bitcoin was moved between July and August, which generally indicates preparations for a sale.

However, these transfers may not indicate an impending sale as the US Marshals Service has a custodial agreement with Coinbase Prime, suggesting the assets were moved for safekeeping rather than liquidation.

Before any sale, regulatory protocols must still be followed by the US Marshals or other appropriate agency.

Alternative uses for the seized Bitcoin

Some US officials are proposing alternative uses for the seized Bitcoin.

Democratic Rep. Ro Khanna, for example, suggested that the government keep these assets as a strategic reserve.

Additionally, Republican presidential candidate Donald Trump also expressed interest in creating a BTC reserve, if elected.

At a recent cryptocurrency conference in Nashville, Trump promised to build a “strategic Bitcoin stockpile” when he returns to office.

He claimed,

“I announce that if elected, it will be the policy of my government, the United States of America, to retain 100% of all Bitcoin that the United States government currently owns or acquires in the future.”