- Ethereum ETFs registered $ 10 million, so that the total outskirts of $ 100 million in the past two days

- Is the falling CME ETH yield behind the constant outflow?

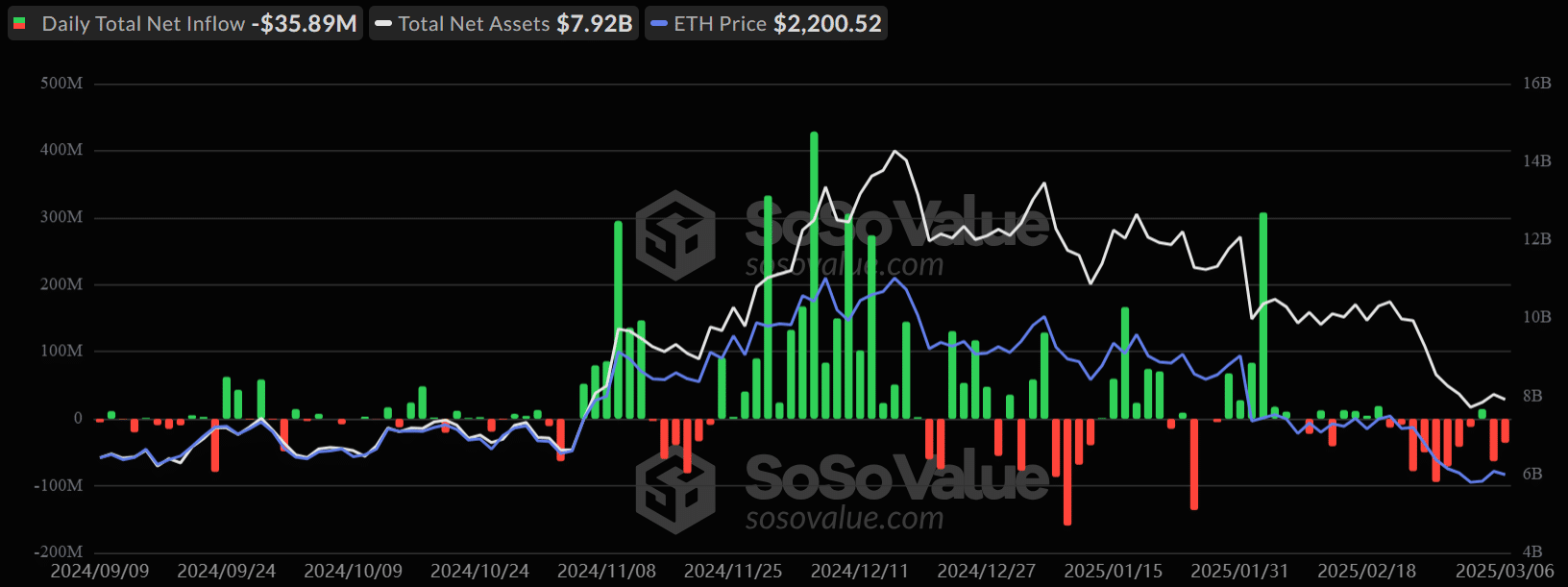

The US Ethereum [ETH] ETFs registered another $ 35.89 million daily outflow on March 6, which marked the second day of venting. The renewed risk-off sentiment followed a short break on Tuesday, after 8-day consecutive flow.

Source: SOSO value

In general, ETF investors have removed more than $ 400 million from the product in the past two weeks.

This differed greatly from the stable inflow that was seen at the beginning of February. Especially when the market route was deepened in the middle of the current Trump rate.

ETH CME -PRODUCT PROPPLESS

In February, ETFs saw relatively higher raising than BTC ETFs – a trendcoinbase analysts linked to irresistible high yield from CME ETH Basic Trade.

For the unknown, the trade in that institutions keeps spot ETF buying and opening a corresponding discount on CME Futures to business the price difference (revenue).

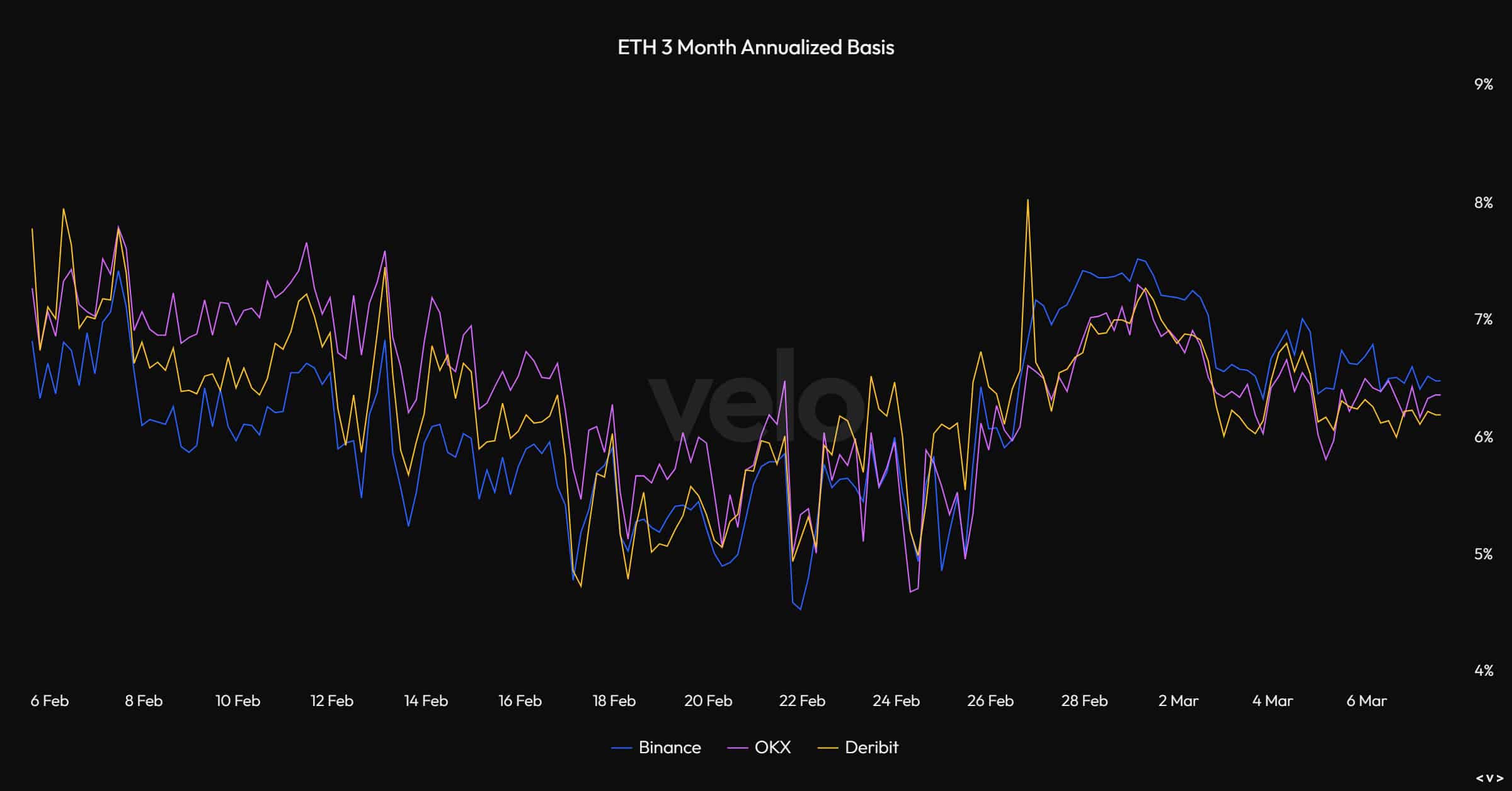

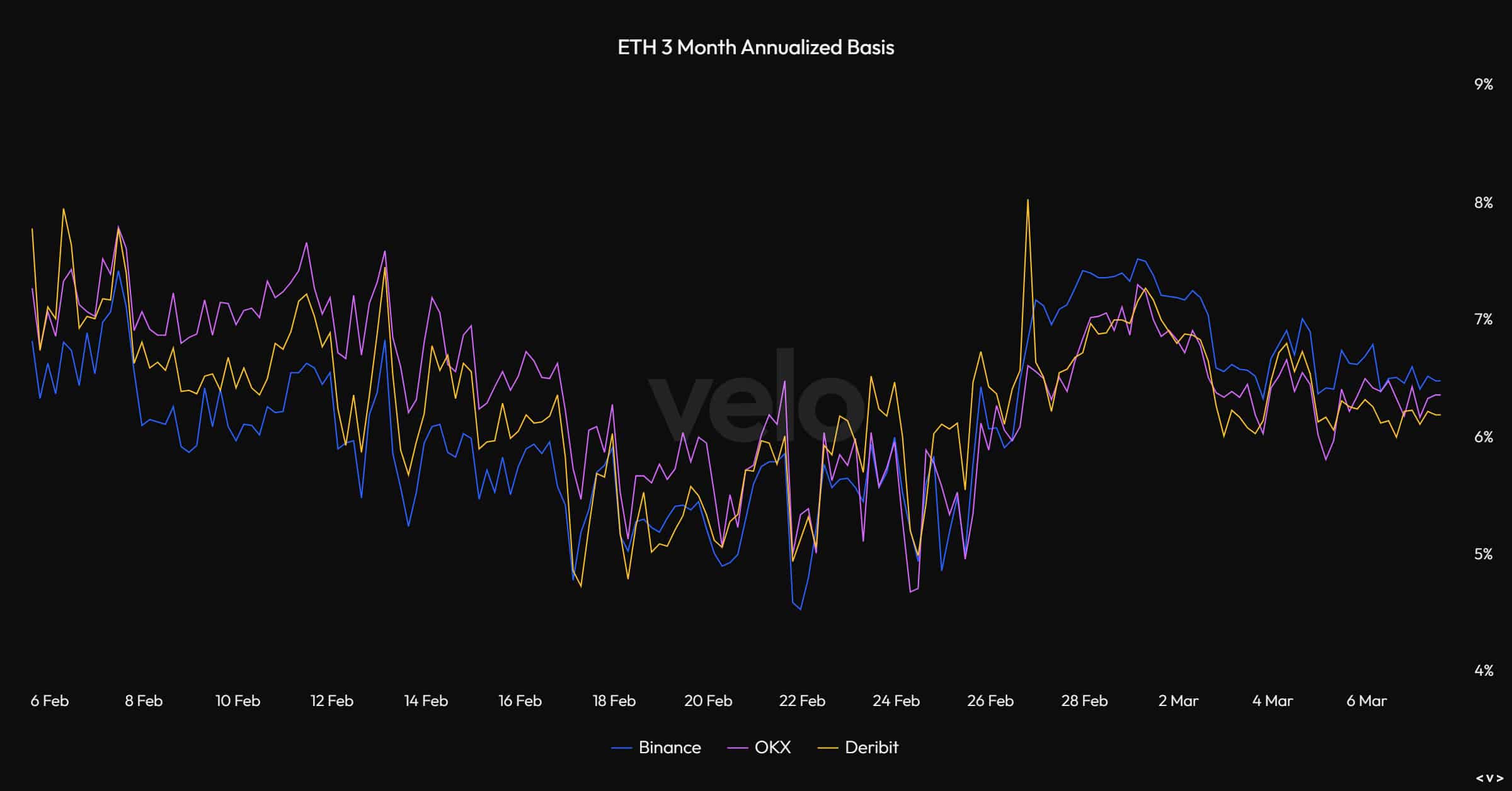

Source: VELO

According to Velo, the ETH yield increased to 8% by the end of February and was characterized by strong ETF flows.

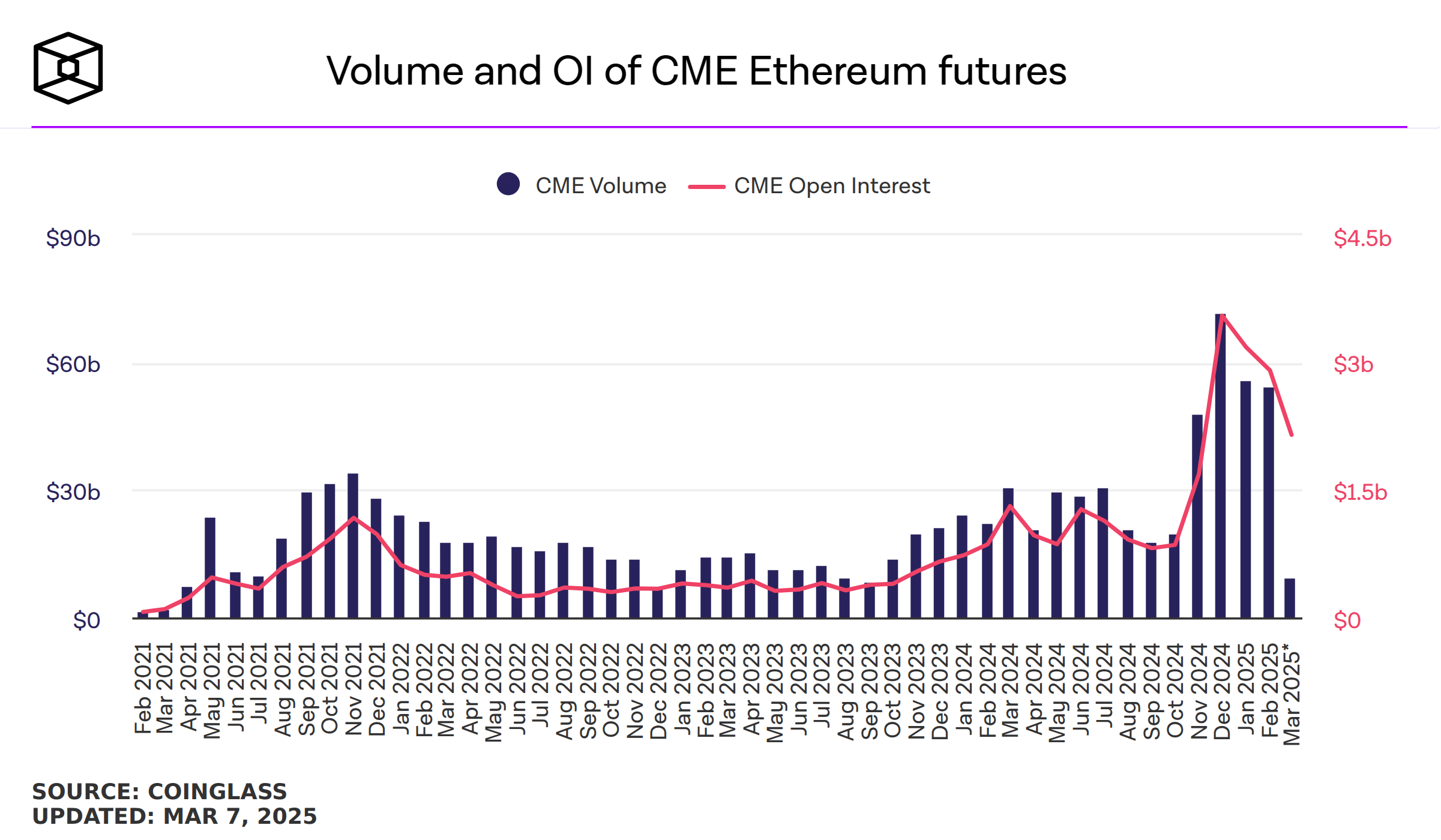

However, the proceeds fell to 6%in March. This can be the trek of trade and ETFs dented. In fact, the idea was also strengthened by the CME Futures Open Interest (OI) rate.

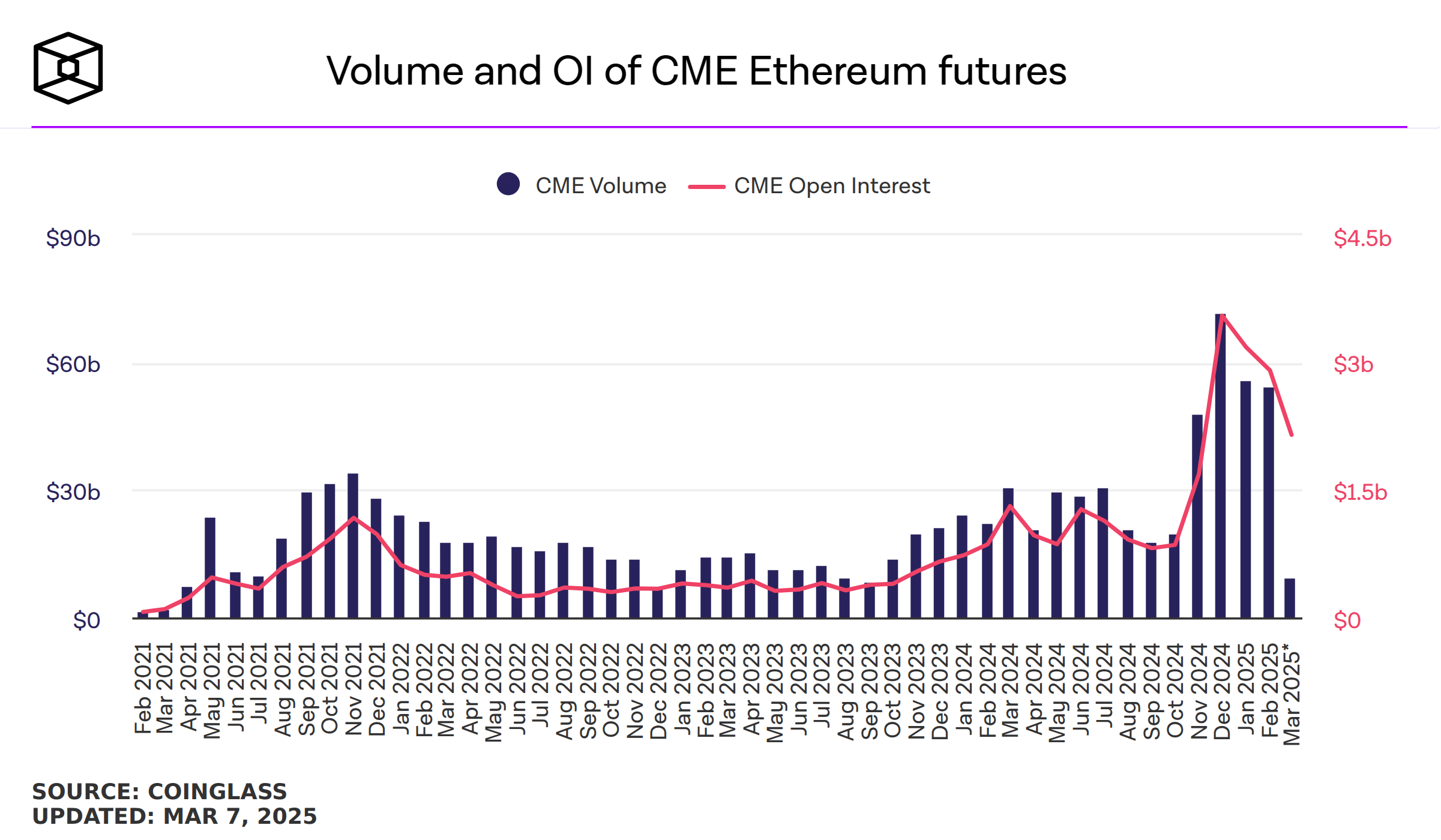

The OI was steadily declined in 2025 and slips from $ 3.18 billion to $ 2.15 billion in March, suggesting that a slight settlement or Carry-Trade players lock positions.

Source: The Block

However, the wider weak market sentiment did not make things better for the King Altcoin. As such, the adjacent risk of the Altcoin in general can remain.

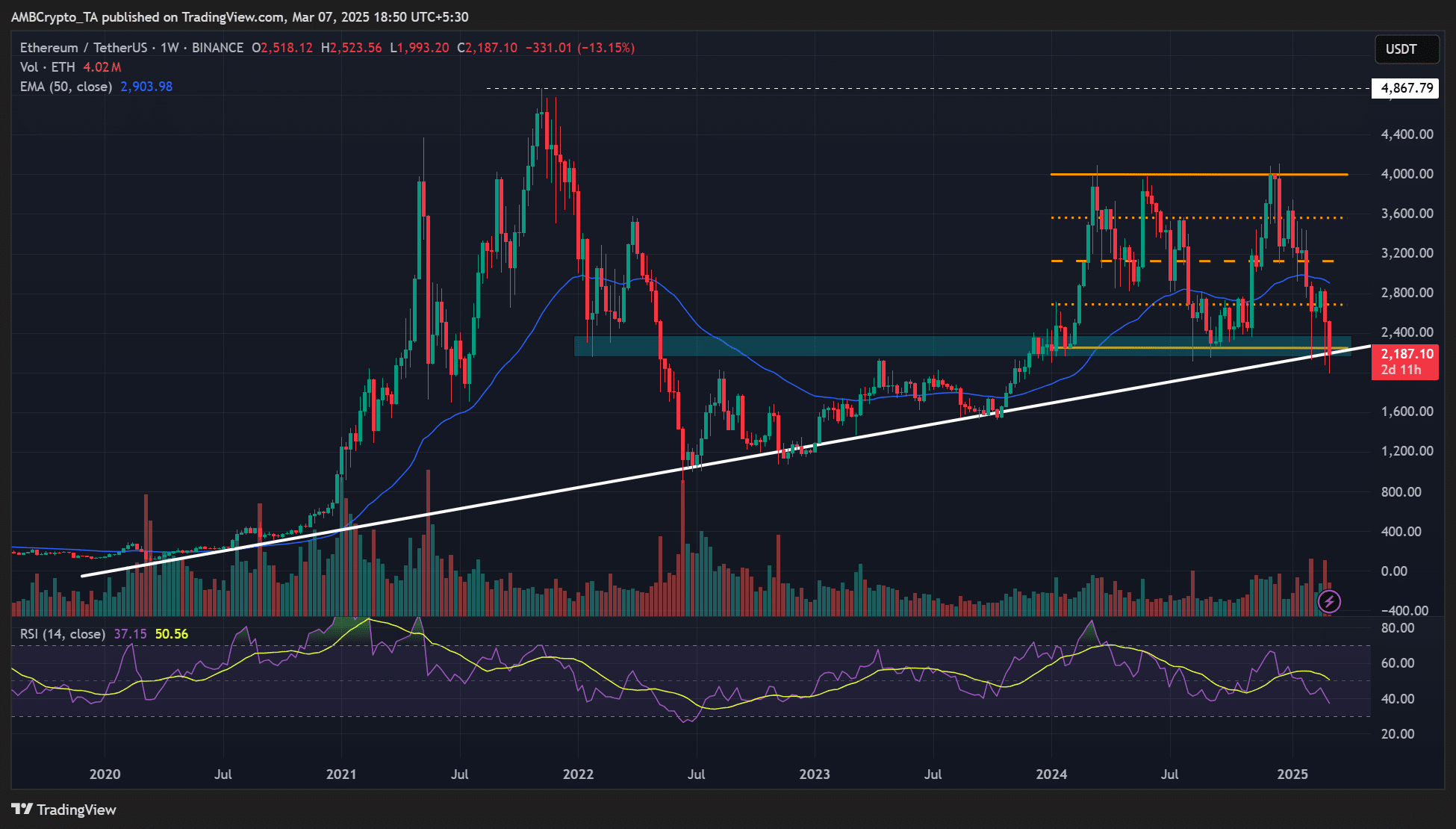

From a technical perspective, ETH seemed to be above $ 2000 at a crucial intersection of range and long-term trendline support. A infringement below the level could change the market structure of the higher period of time and the interest of traders in the Altcoin.

Source: Eth/USDT, TradingView