- Trump proposes a strategic Bitcoin reserve and positions it along with traditional commodities as national reserves.

- Peter Schiff Warns Bitcoin Reserves Could Lead to US Hyperinflation and Dollar Devaluation Risks.

In July, former US President Donald Trump made headlines by promising to set up a strategic Bitcoin [BTC] to book.

This bold initiative, if implemented, would position BTC alongside traditional commodities like oil, natural gas and uranium as part of the U.S. national reserves.

The move is designed to protect against unforeseen supply disruptions and underlines BTC’s growing role in the country’s economic strategy and its shift toward the integration of digital assets.

That said, Trump’s potential creation of a strategic Bitcoin reserve could influence BTC’s price movement, although it remains uncertain whether this will lead to a bullish or bearish trend.

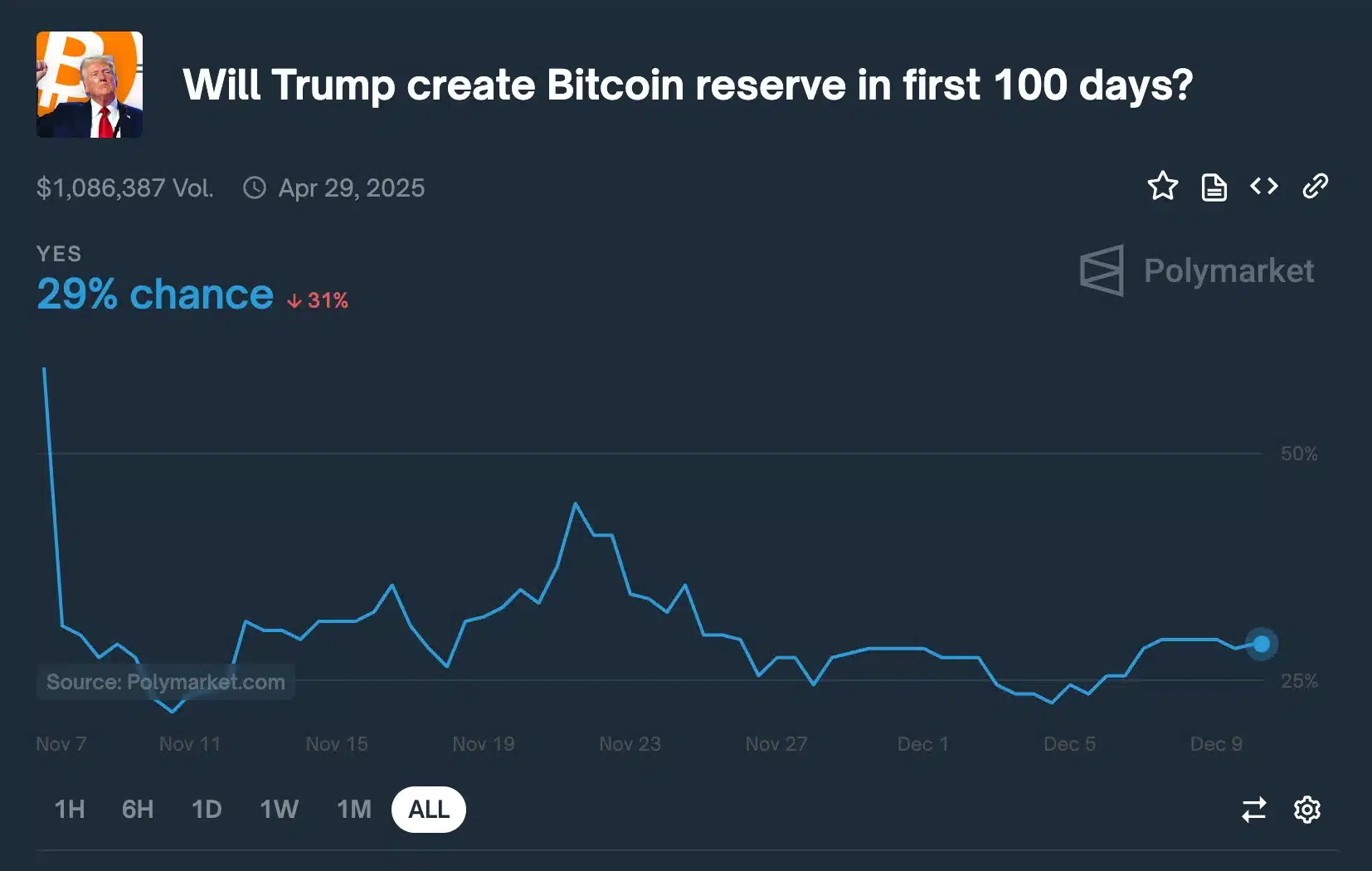

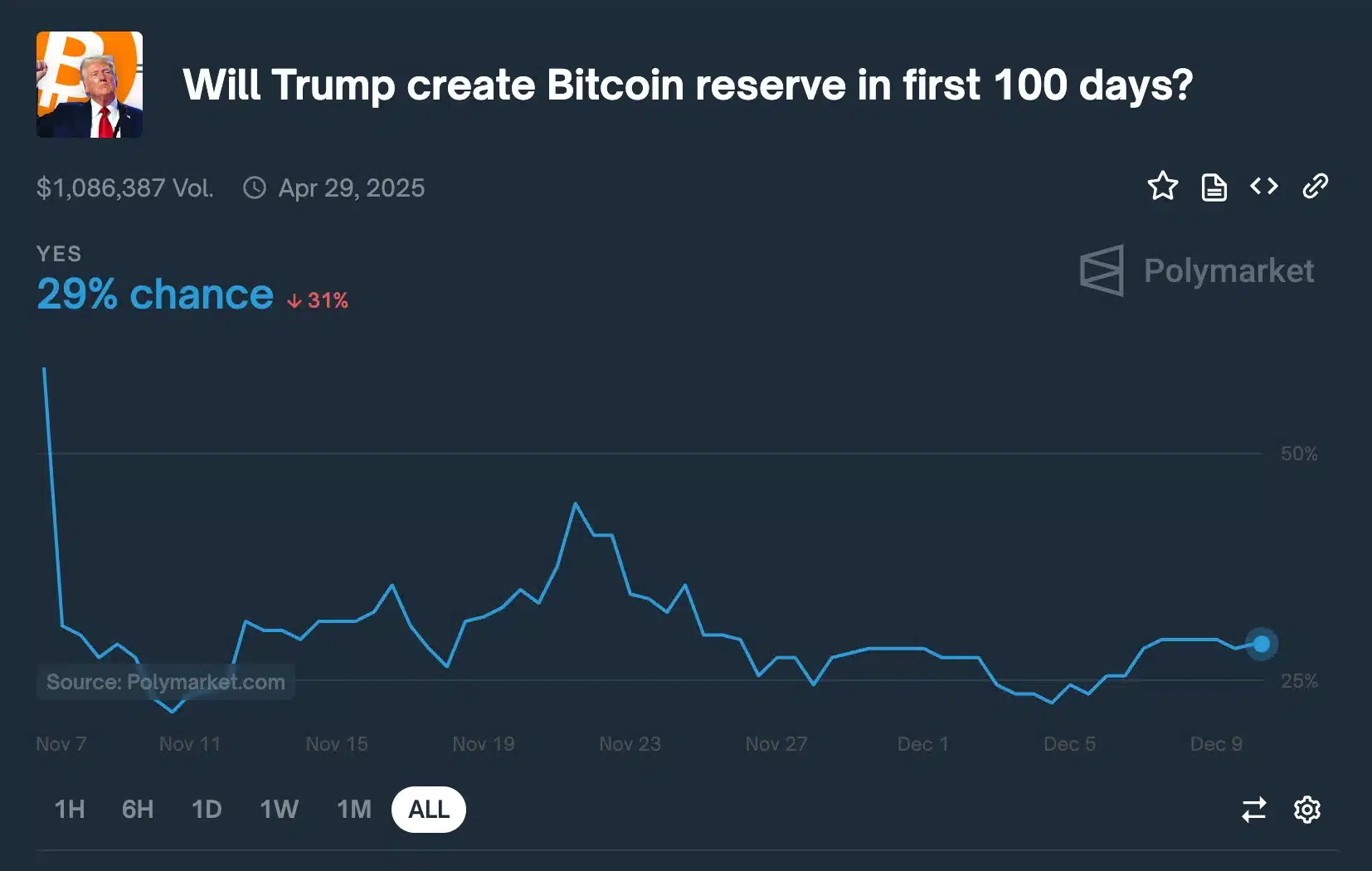

Polymarket trend on the US Bitcoin Reserve

According to predictions from Polymarkt to the question: “Will Trump create a Bitcoin reserve in his first 100 days?” the probability is 29% as of the last update.

This is a slight increase from the previous 27%, although it previously peaked at 45%.

Source: Polymarkt

The current trend suggests that investor confidence in the realization of the reserve is still cautious, with less than 50% betting on its creation, reflecting the uncertainty within the crypto industry.

Managers weigh in

Yet several key figures and entities actively support the idea of a strategic Bitcoin reserve.

For example, Senator Cynthia Lummis, a prominent advocate for digital assets, has strongly recommended that the US move forward with setting up such a reserve.

Mathew Siggel, head of digital assets research at VanEck, has also expressed full support for the proposal, highlighting its strategic potential.

Furthermore, Anthony Pompliano, founder and CEO of Professional Capital Management, has suggested that the US should immediately print $250 billion and use it to invest in BTC, highlighting its value as a hedge in uncertain financial times.

“The United States should print $250 billion on the first day of Donald Trump’s presidency and put 100% of the proceeds into Bitcoin.”

Not everyone shared the same boat

As expected, not everyone shares the same position on the proposal.

For example, Peter Schiff recently raised concerns, arguing that its approval could impact both the US dollar and Bitcoin.

He stated,

“Eventually, so many dollars would be printed to buy Bitcoin that the US would experience hyperinflation, rendering the dollar completely worthless. Once the dollar is worthless, the US can no longer continue buying Bitcoin.”

Adding to the controversy was former US Treasury Secretary Larry Summers, who said:

“Of all the prices to support, why would the government choose to support by building up a sterile supply, a bunch of Bitcoin? There is no other reason than to pander to generous contributors to special interest campaigns.”

As investor uncertainty continues, it remains to be seen whether Trump’s plan will become a reality or remain just a vision.

Meanwhile, according to the latest data from CoinMarketCapBTC is trading at $98,451.73 after dropping 1.43% in the past 24 hours.