- Bitcoin ETFs are facing outflows of $671.9 million, ending a 15-day streak of crypto prices plummeting.

- Fidelity, Grayscale Lead ETF Selloff as $1 Billion Liquidates in Crypto Market in 24 Hours

Bitcoins [BTC] exchange-traded funds (ETFs) in the United States saw record-breaking single-day net outflows of $671.9 million on December 19.

This marks the largest outflow since launch and ended a fifteen-day streak of inflows BTC ETFs and an 18-day streak for Ethereum [ETH] ETFs.

Data from Farside Investors shows Fidelity’s FBTC led the outflows, losing $208.5 million. Grayscale’s GBTC and ARK Invest’s ARKB followed with outflows of $208.6 million and $108.4 million, respectively.

In contrast, BlackRock’s IBIT ETF was unchanged, with no reported net outflows or inflows.

Market sell-offs are accompanied by cryptocurrency price drops

The record outflows coincided with sharp declines in Bitcoin and Ethereum prices. Bitcoin fell 9.2% over the past 24 hours to settle at around $93,145.17, while Ethereum saw a steeper decline of 15.6%. During this period, more than $1 billion was liquidated on the crypto market.

Sosovalue data revealed that the total net assets of Bitcoin ETFs fell to $109.7 billion as of December 19, compared to $121.7 billion just two days earlier. This sharp decline has largely wiped out the gains from earlier in December.

The sell-off strengthened Bitcoin’s dominance of the crypto market, which stood at 57.4%, maintaining its position as a leading asset despite the recent turbulence.

Federal Reserve policy and broader economic concerns

The sharp decline in crypto markets has also been linked to broader macroeconomic concerns. Investors expected a 0.25% interest rate cut by the US Federal Reserve, but comments from Fed Chairman Jerome Powell indicated a more cautious outlook.

Powell indicated that there could be only two rate cuts in 2025, indicating a slower pace of monetary easing than expected.

The Federal Reserve’s hawkish sentiment also affected traditional markets, with the S&P 500 declining. Analysts believe that this uncertainty may have put further pressure on the crypto market as risk sentiment turned away from growth assets.

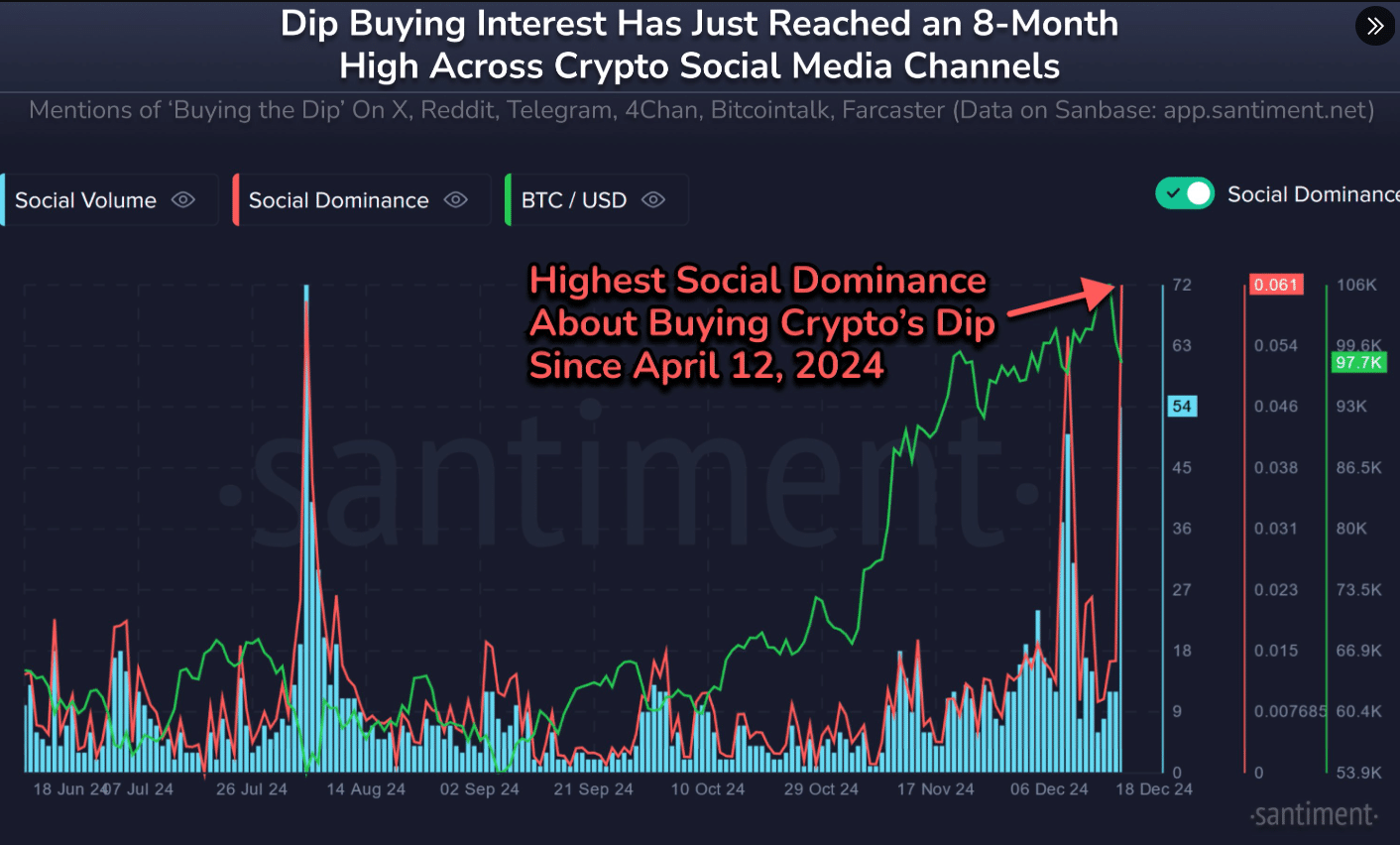

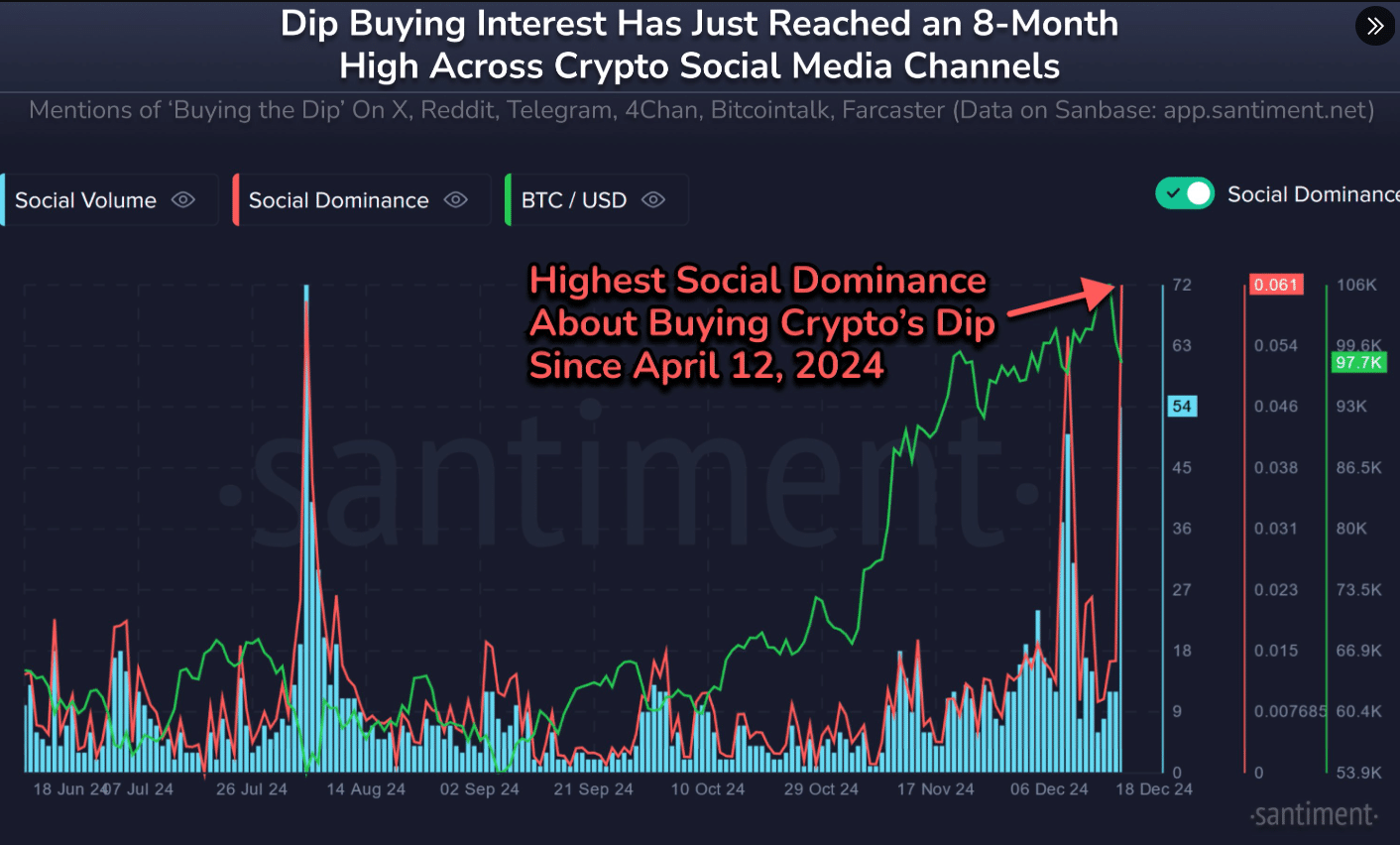

Increasing ‘buy the dip’ sentiment amid market uncertainty

Despite the market downturn, a flurry of ‘buy the dip’ discussions were observed on social media platforms. Facts van Santiment showed that mentions of “buying the dip” reached their highest level in more than eight months.

Source:

The last time this sentiment peaked was in April, when Bitcoin’s price fell from $70,000 to $67,000 before continuing its decline.

Read Bitcoin’s [BTC] Price forecast 2024-25

While some traders remain cautious, the renewed discussions suggest that a segment of investors remains optimistic about potential recovery opportunities in the crypto market.