Bitcoin (BTC)’s current sideways price action has investors wondering what the future holds for the world’s largest cryptocurrency. The upcoming rate hikes by the Federal Reserve (Fed) could pose the next big challenge for Bitcoin, according to to the crypto market analysis firm Blofin Academy.

Is Bitcoin Ready for the Heat of Rate Hikes?

The US economy has shown great resilience in recent months, prompting the Fed to consider raising interest rates to prevent inflation. However, this could be bad news for the crypto market as higher interest rates tend to make traditional investments more attractive, potentially leading to a decline in demand for Bitcoin and other cryptocurrencies.

The correlation between interest rates and Bitcoin’s price action has been observed in the past. When interest rates rise, investors tend to move their money into traditional investment vehicles such as stocks and bonds, leading to a decline in demand for cryptocurrencies.

However, it is worth noting that Bitcoin is often viewed as a hedge against inflation, meaning it can still be attractive to investors in times of economic uncertainty.

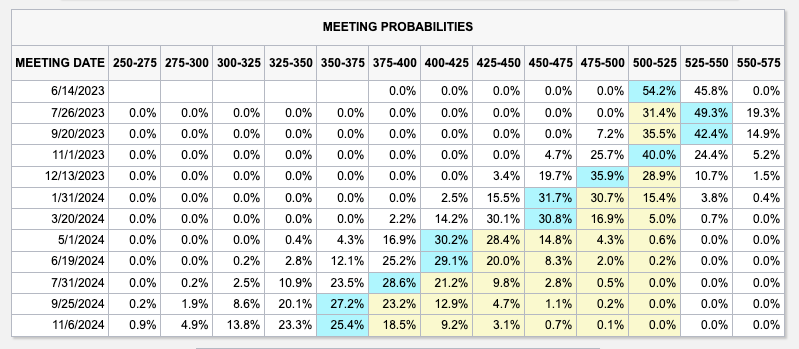

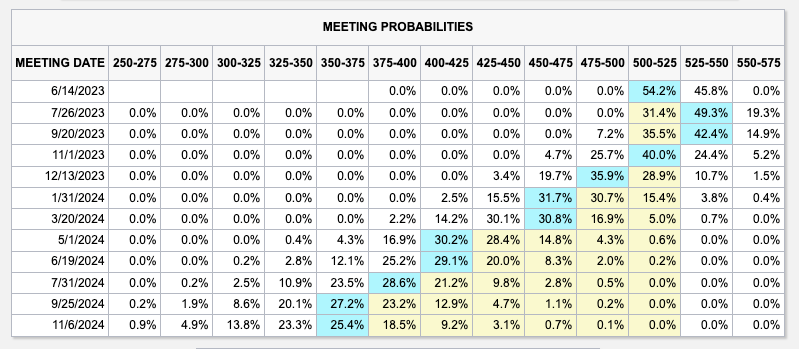

The next scheduled Fed meeting will take place on June 14, 2023, where the central bank will likely discuss the possibility of raising interest rates in response to the current state of the US economy.

Macrodeterminants keep crypto traders waiting

Noelle Acheson, owner of the “Crypto Is Macro Now” newsletter. warned against investors who are currently entering the crypto market. While the upside potential for Bitcoin remains significant, Acheson suggests there is currently no compelling reason for investors to take on additional risk.

According to Acheson, there are currently few macro determinants, such as debt limit negotiations and the Fed’s interest rate policy, leaving investors to wait for more clarity before making major investment decisions. As a result, there is a sense of caution in the market as traders wait to see how these macro factors play out.

Despite the lack of clarity, Acheson notes that there isn’t much incentive for existing crypto holders to sell their holdings. This suggests that the current wait and see isn’t necessarily a sign of bearish sentiment in the market, but rather a period of caution as investors wait for more information.

Acheson also notes that there may be some downside movement in the near term, but belief in a potential rally is not strong enough to justify the possibility of missing out on potential gains. As a result, there has been some buying and selling in the market, but not enough to significantly increase volatility despite low volumes and liquidity.

At the time of writing, Bitcoin is trading at $26,700, reflecting a 1.2% increase over the past 24 hours. However, the 50-day moving average (MA) has placed the largest cryptocurrency in a narrow range between $26,200 and $26,800. This means that Bitcoin may struggle to surpass its current trading range in the near term, as the 50-day MA is currently at the top of this range on the 1-hour chart, making it challenging to break.

While Bitcoin has seen some upside in recent weeks, the current trading range suggests that further gains may be limited until there is a significant shift in market sentiment or the emergence of a bullish catalyst.

Featured image from iStock, chart from TradingView.com