The Optimism native token OP is now in the firing line and there are millions of tokens ready to be released into circulation. This threatens the price of the altcoin, which is already in a downward spiral after conducting its third airdrop.

Optimism set to unlock 24 million tokens

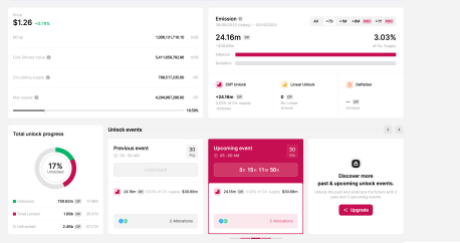

In the latest iteration of its token unlock events, the Optimism Network is looking at more than 24 million tokens being unlocked and put into circulation. On-chain token tracking website Token unlocks reports that the 24.16 million token is worth approximately $30.7 million at current prices.

The token unlock event will take place on September 30, less than four days from the time of writing. This brings the equivalent of 3.03% of the total OP supply into circulation at once.

24.16 million tokens set to be unlocked | Source: Token Unlocks

This comes just a month after the network locked an equivalent amount on August 30. As with the August unlock, the 24.16 million tokens will be allocated to two groups. 12.75 million tokens worth $16.19 million will go to Core Contributors and 11.41 million tokens worth $14.49 million will go to Investors.

The Optimism unlock event is the largest of the more than $54 million in token unlocks expected to take place over the next seven days. Other notable unlocks include SUI unlocking 4.9% of the supply worth $16.92 million and Yield Guild Games (YGG) unlocking 6.7% of the supply worth $2.55 million.

Measuring the impact on the OP price

A good way to figure out how the OP price might react is to look at its historical performance during similar events. In the case of the OP price, you don’t have to look too far back as the last token unlock happened just a month ago.

On August 30, Optimism unlocked an identical number of tokens and the price reacted negatively to this new offering. OP initially held at around $1.5, but once the unlock was completed, the price of the token fell, dropping from $1.5 to $1.3 in the space of two days.

This shows that token unlocks, especially with the size of the upcoming Optimism unlock, are inherently bearish in price. If the historical pattern holds, OP price could easily succumb to the bears and threaten the $1 mark. At the very least, the impact of this new supply could lead to a 10% drop, which would push the OP price just above $1.1.

Even now, OP is already feeling the impact of the incoming bearish sentiment. Over the past week, the price has fallen by more than 10%, leaving it below the resistance at $1.3.

OP price threatened with new unlock | Source: OPUSDT on Tradingview.com

Featured image from iStock, chart from Tradingview.com