- Uniswap was the number one DEX with a 24-hour volume of $984.47 million.

- It was the biggest contributor to ETH’s blazing activity in April.

The world’s largest decentralized exchange (DEX) Uniswap [UNI] considered a proposal to launch the third iteration of its protocol on the layer-1, proof-of-stake network, Fantom [FTM]in an effort to adapt and expand its reach to other blockchain ecosystems.

The proposal underwent a “temperature control” board vote, set to end on May 31.

Read Uniswaps [UNI] Price forecast 2023-2024

Uniswap in extension mode

The proposal was made by Blockchain@Columbia, a Columbia University organization for distributed ledger technology, in collaboration with Fantom and Axelar, a cross-chain communication platform.

The proponents stated that since the expiration of Uniswap V3’s Business Source License (BSL) on April 1, it has become easier for other players in the DeFi landscape to use V3 design to gain market share on other blockchains like Fantom.

Therefore, it was imperative for Uniswap to have a quick presence on Fantom to stay ahead of the curve.

In addition, Fantom’s effectiveness as a fast, low-cost solution was also cited as another key reason for the expansion.

The proposal added that if the rollout goes ahead, Uniswap will gain 30% of the current DEX volume on Fantom. At the time of writing, Fantom was the sixth largest chain in terms of DEX volume with transactions worth $46.68 million settled in the past 24 hours, according to DeFiLlama.

Several proposals to expand Uniswap beyond Ethereum [ETH] originated in 2023. After successfully deploying the BNB Chain, a green light for Polygon [MATIC] zkEVM-V3 integration was recently given in April.

Uniswap remains DeFI’s crown jewel

Uniswap was the number one DEX in the Web3 space with 24-hour volume of $984.47 million, more than half the total volume on the second-ranked DEX, PancakeSwap [CAKE].

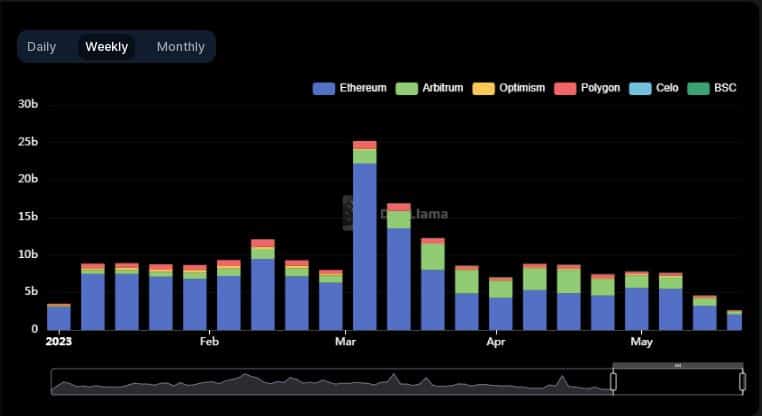

Despite its dominance, volume on the DeFi giant has been steadily declining since hitting all-time highs in March.

Source: DeFiLlama

Crypto data aggregator CoinGecko revealed that Uniswap was the largest contributor to ETH burning activity in April, totaling 21,479.9 ether in April 2023. The rise in ETH burned was fueled by a growing number of memecoin transactions.

1/ Which protocol burned the most $ETH?

From April 2023, @Uniswap remained the largest protocol that burned the most $ETHwith a total of 29,333.8 ether burned.

Read the full study: https://t.co/GEdUPigeTp pic.twitter.com/mcs7yYZPaJ

— CoinGecko (@coingecko) May 24, 2023

Is your wallet green? Check out the Uniswap Profit Calculator

However, the governance token UNI did not react enthusiastically to the new proposal. At press time, it was valued at $4.95, down 0.52% in the 24-hour period, per CoinMarketCap.