- Uniswap retested key resistance levels as bullish indicators pointed to a possible breakout

- Market sentiment is positively aligned with reduced selling pressure and open interest

Uniswap [UNI] has captured the market’s attention with its sharp price movements and the increase in its network activity, sparking speculation about its long-term bullish potential in the DeFi landscape. At the time of writing, UNI was trading at $14.60, after a daily gain of 14.33%.

This price rally, coupled with growing user engagement, indicated renewed momentum. However, can Uniswap maintain its upward trajectory?

Price action indicates a possible breakout

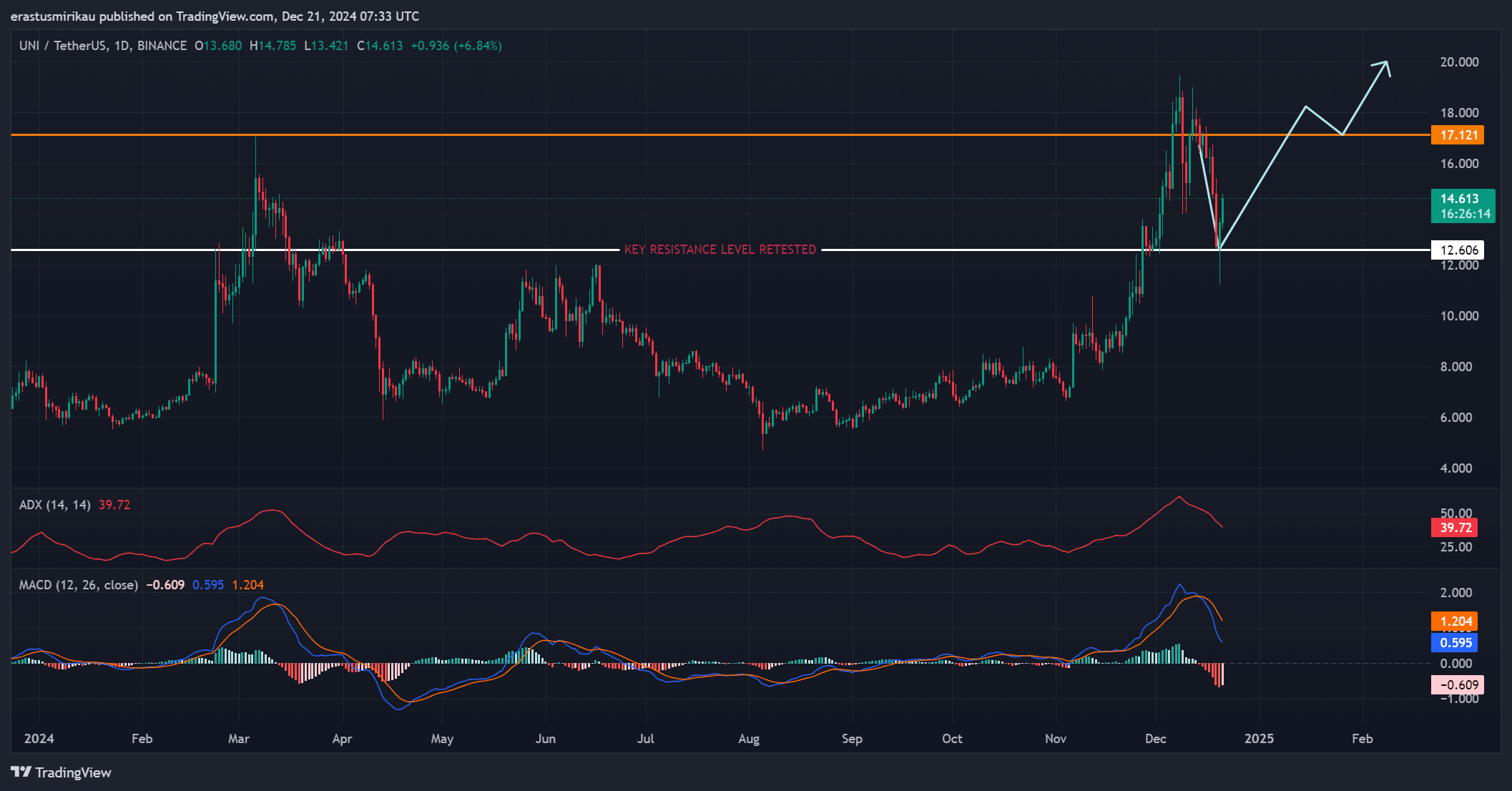

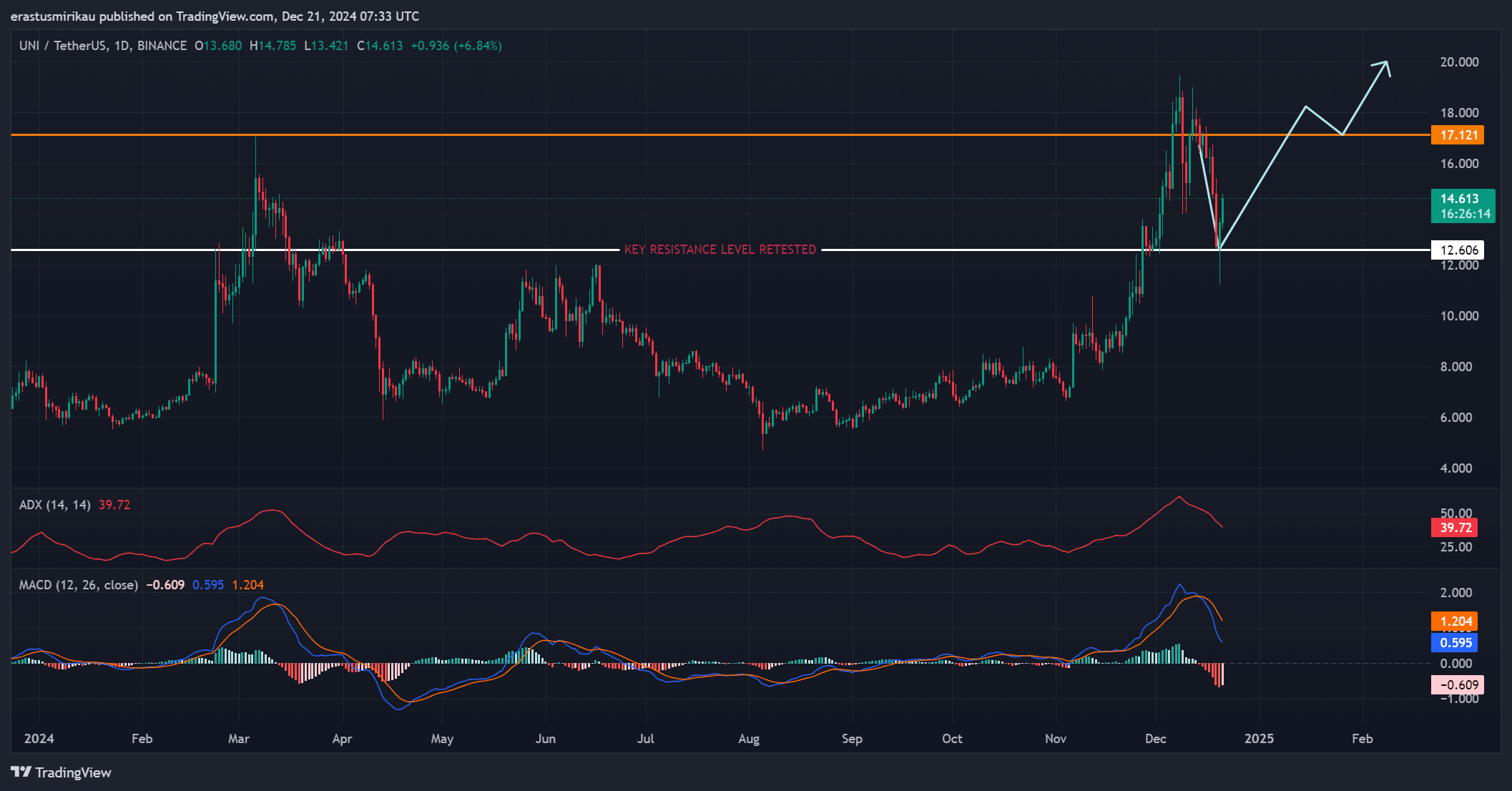

Uniswap price charts showed a clear uptrend, with UNI retesting key resistance at $17.12, while support remained firm at $12.60. Indicators such as the Average Directional Index (ADX) at 39.72 pointed to a strong trend, while the Moving Average Convergence Divergence (MACD) underlined a slight bearish divergence.

However, the overall bullish sentiment remains, with forecasts pointing to a possible breakout towards $20. If UNI convincingly breaks through this resistance, it could mark the start of a sustained bull run.

Source: TradingView

Address statistics show growing acceptance

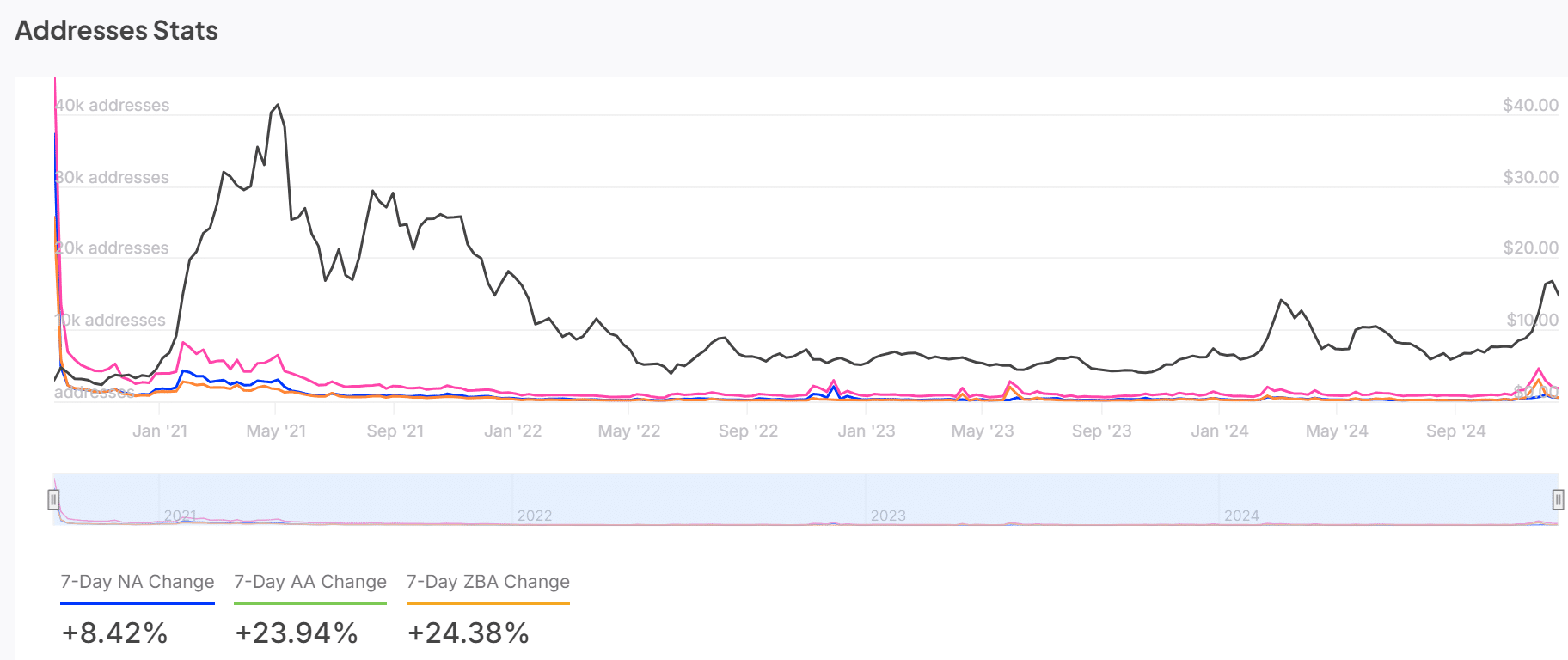

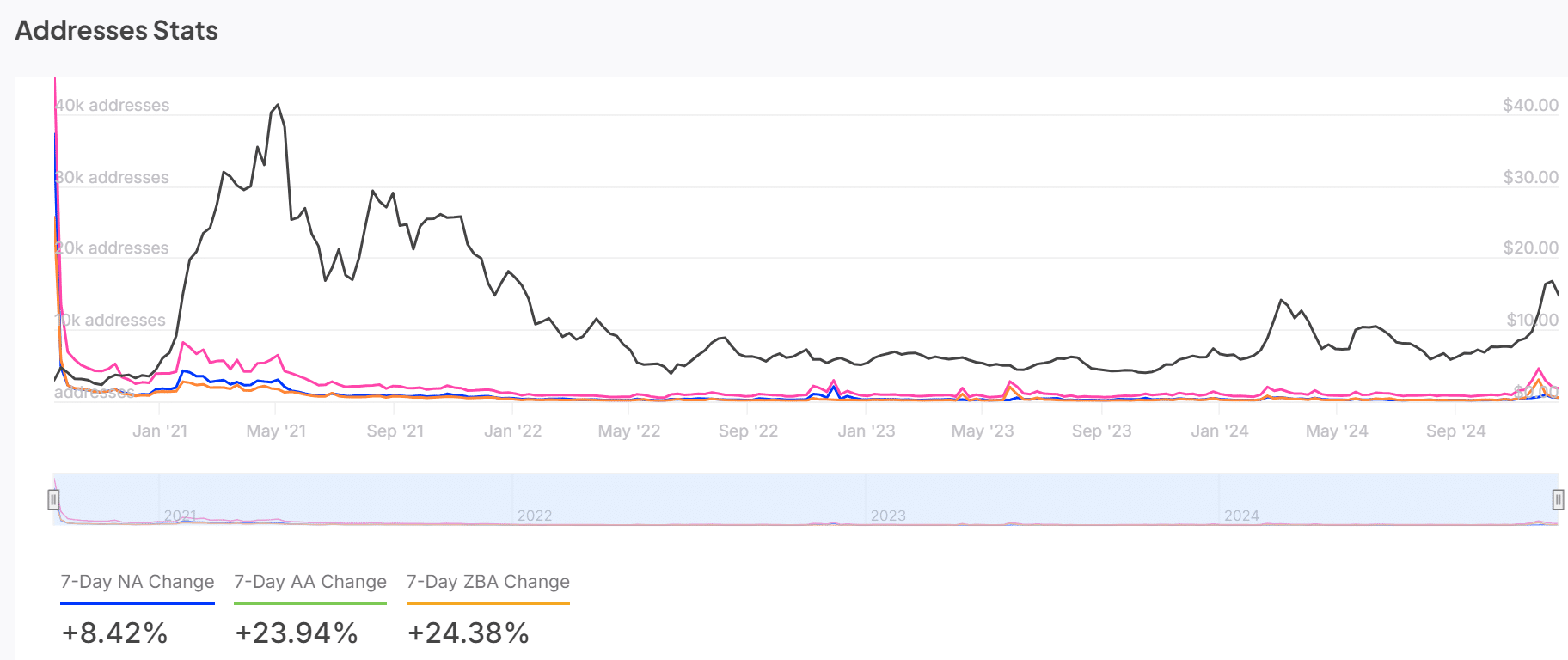

Address statistics show increasing network activity, with active addresses increasing by 23.94% and new addresses growing by 8.42% over the past week. This increase in participation highlighted an increasing interest in UNI, driven by its utility in the DeFi space.

Therefore, the strong engagement seemed to be in line with the price momentum, indicating confidence among both users and investors.

Source: IntoTheBlock

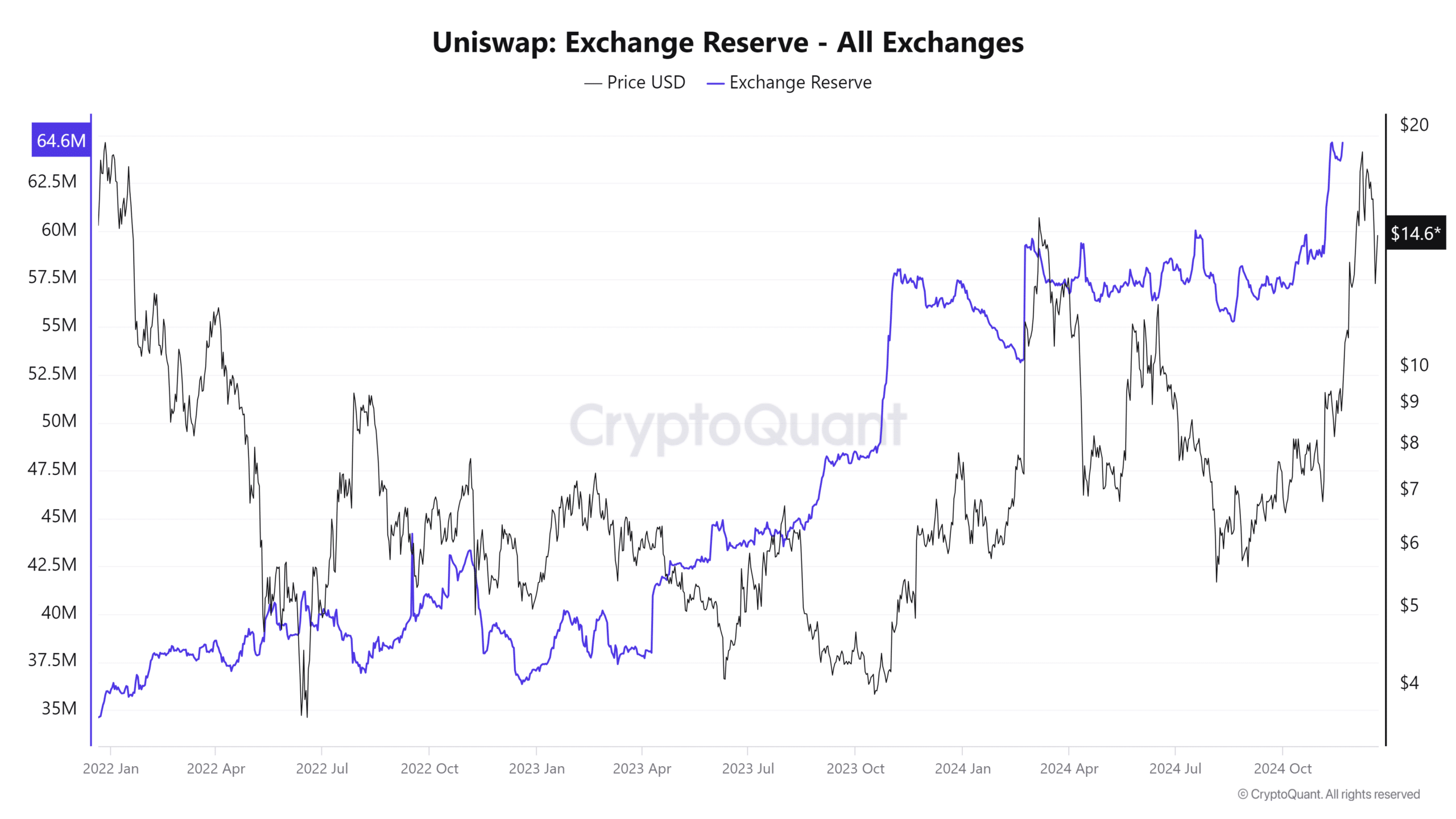

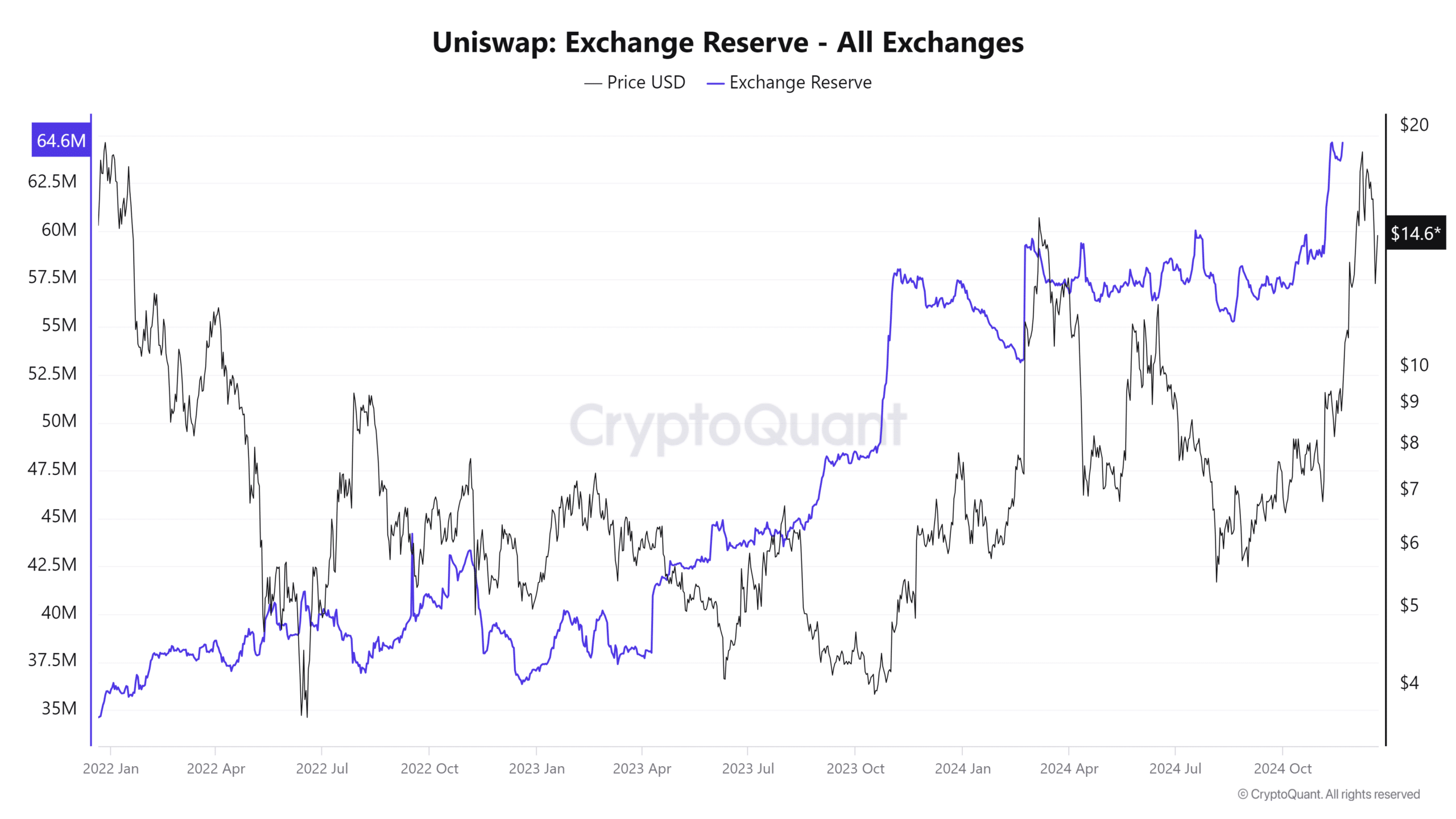

UNI transactions and foreign exchange reserves indicate positive trends

Uniswap’s total number of transactions grew by 1.12% over the past 24 hours, reaching 6.7K according to CryptoQuant’s analyses. While this change is modest, it reflected consistent activity on the network. Moreover, foreign exchange reserves fell by 0.64% over the same period, indicating reduced selling pressure.

This drop suggested that holders are optimistic about potential profits and have refrained from transferring their tokens. Consequently, reduced reserves increase the likelihood of a sustained price increase.

Source: CryptoQuant

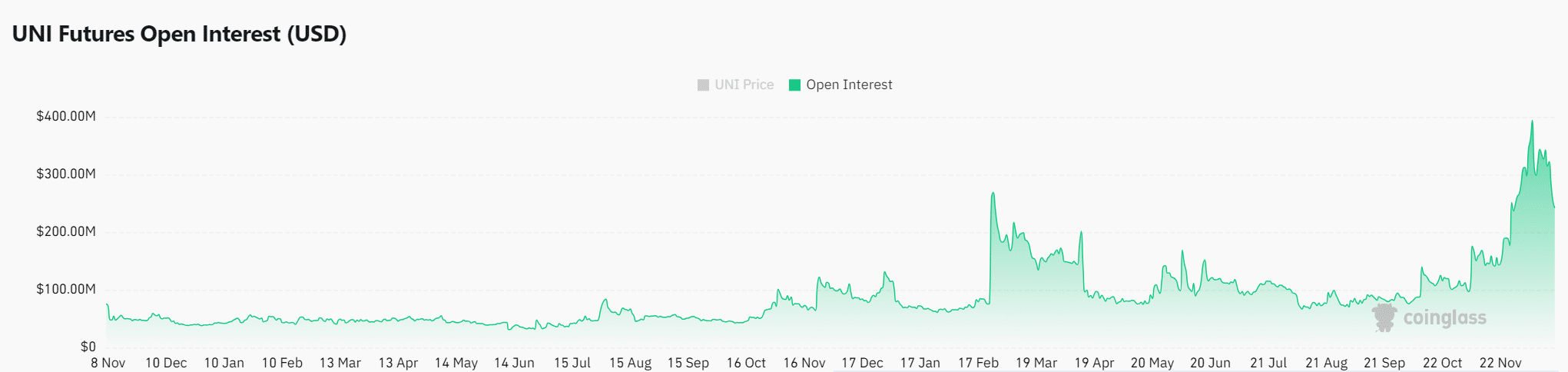

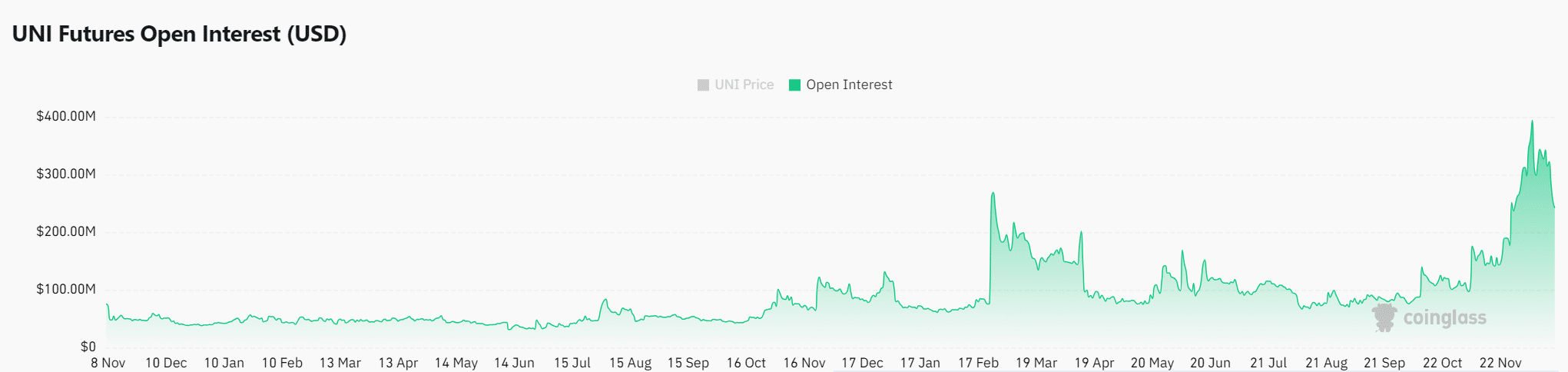

UNI market sentiment and open interest

Market sentiment further supported the bullish outlook, with Open Interest rising 5.67% to $264.24 million. This increase reflected increased speculative activity, which was a sign of confidence in UNI’s near-term potential.

Furthermore, such growing interest has often been correlated with significant price movements, which has further strengthened the case for sustainable growth.

Source: Coinglass

Read the one from Uniswap [UNI] Price forecast 2024–2025

Can Uniswap maintain its momentum?

Uniswap may be poised for further growth. With robust price action, increasing user acceptance and reduced selling pressure, UNI could be well positioned to break the key resistance at $17.12.

If this happens, a rise towards $20 or higher seems very likely.

![Uniswap [UNI] price prediction – Traders, expect THIS after altcoin’s 14% rise!](https://free.cc/wp-content/uploads/2024/12/UNI-1-1000x600.webp)