- BTC’s network problems have reached an all-time high and have stayed there.

- This is happening as BTC tries to reclaim its ATH.

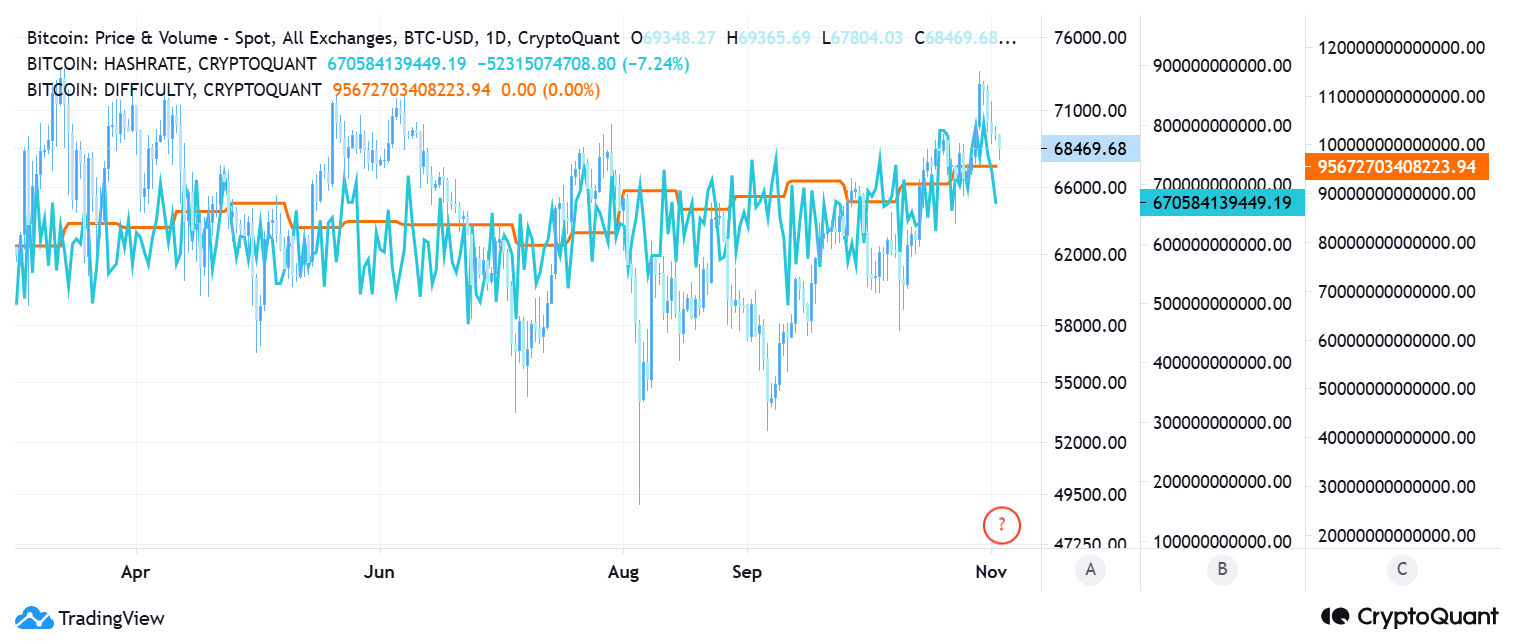

Bitcoins [BTC] The network problems have continued their relentless rise and have reached new highs. As this benchmark for mining challenges increases, investors are wondering whether the price movement will reflect this upward trend or face a ceiling.

Examining BTC mining metrics, including hashrate and difficulty, provides insight into the potential price impacts and resilience of the broader network.

Increasing network problems indicate interest in Bitcoin mining

Bitcoin’s network problems, a key metric that is adjusted approximately every two weeks, are reaching unprecedented levels. Analysis of the network problems CryptoQuant showed that it has not fallen after climbing to over 95 trillion.

The difficulty reflects how difficult it is for miners to solve complex cryptographic puzzles and earn BTC rewards. As the difficulty increases, it implies more miners competing for Bitcoin, a sign of strong network participation and security.

Source: CryptoQuant

Higher difficulty often coincides with higher hashrates, showing confidence in Bitcoin’s long-term potential, especially as institutions invest in mining infrastructure. This increasing interest and investment in mining could support Bitcoin’s price by adding stability to the network.

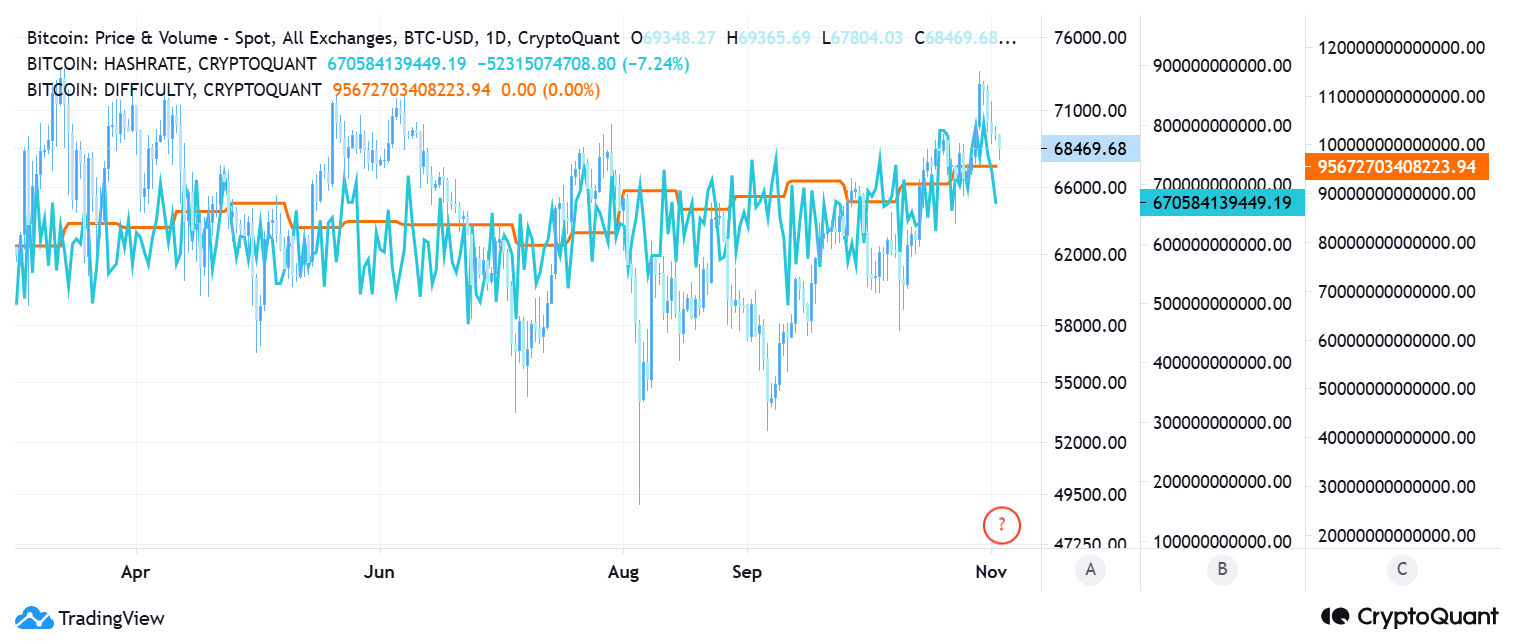

Bitcoin Price Correlation: Historical Trends and Current Context

Historically, increasing difficulty can correlate with bullish price momentum, as a secure network attracts more participants and reassures investors of Bitcoin’s resilience. However, despite these positive network fundamentals, Bitcoin’s price has recently seen a slight pullback.

Analysis shows that Bitcoin has hovered around $68,000 but failed to sustain the strong upward move that many expected. With the difficulty level high and volatility persisting, the Bitcoin price may encounter short-term resistance around $70,000.

Source: TradingView

Several factors contribute to this potential resistance. As miners incur higher costs due to the increased difficulty, they may have to sell more Bitcoin to cover costs, putting selling pressure on the market.

These dynamics, coupled with BTC’s sensitivity to broader economic trends, could dampen immediate price increases despite robust network health.

Can BTC Surpass Resistance Levels?

BTC price could break its current resistance if it maintains strong institutional interest. However, if the mining community continues to expand and maintain high difficulty levels, miners can offset costs by retaining their earnings rather than selling.

Read Bitcoin (BTC) price prediction 2024-25

Such behavior would reduce market supply, which could cause prices to rise in the medium term.

In summary, while Bitcoin’s price remains under pressure in the short term, mounting network issues underscore the asset’s increasing security and attractiveness. BTC could see upside momentum if these conditions persist, especially if economic conditions stabilize.