- Bitcoin keeps strong because the global markets remain very responsive to rates

- The US government could buy Bitcoin using income from rates

Since the re -election of Donald Trump, Crypto’s adoption has become one of the most important agendas of the administration. President Trump even promised to make the United States the crypto capital of the world. Recently, however, the question of how to provide income to collect crypto assets, especially Bitcoin [BTC]has been centrally.

The Trump administration has now been released with a plan to generate income for Bitcoin acquisition. During an interview, Bo Hines, executive director of digital assets, said That the US government can buy Bitcoin using tariff income. Apart from the tariff income, the government is also considering reviewing Gold certificates with the American treasury and to use the extra financing to buy more Bitcoin.

With higher rates, the Trump government wants to yield more income from external governments. If such income in Bitcoin is channeled, the government can acquire a considerable amount. Worth to point out that financial markets and the wider crypto market have responded very differently to these rate episodes.

How does Bitcoin respond to rates?

According to SantimentBitcoin continues to show resilience because the global financial markets remain very reactive for shifting tariff announcements from the Trump administration.

Although volatility that results from rates still influence Bitcoin, data on chains revealed that the cryptocurrency has relative strength.

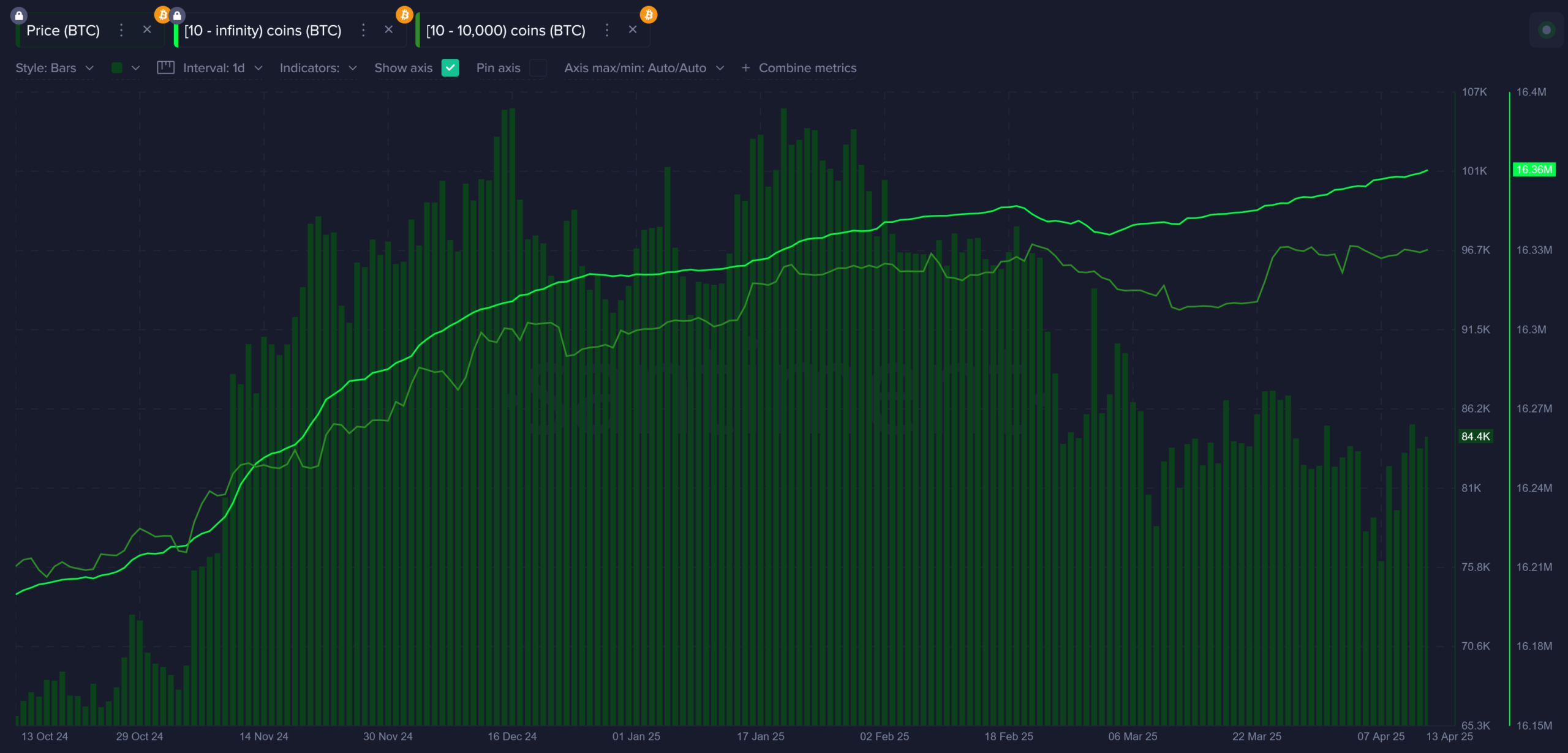

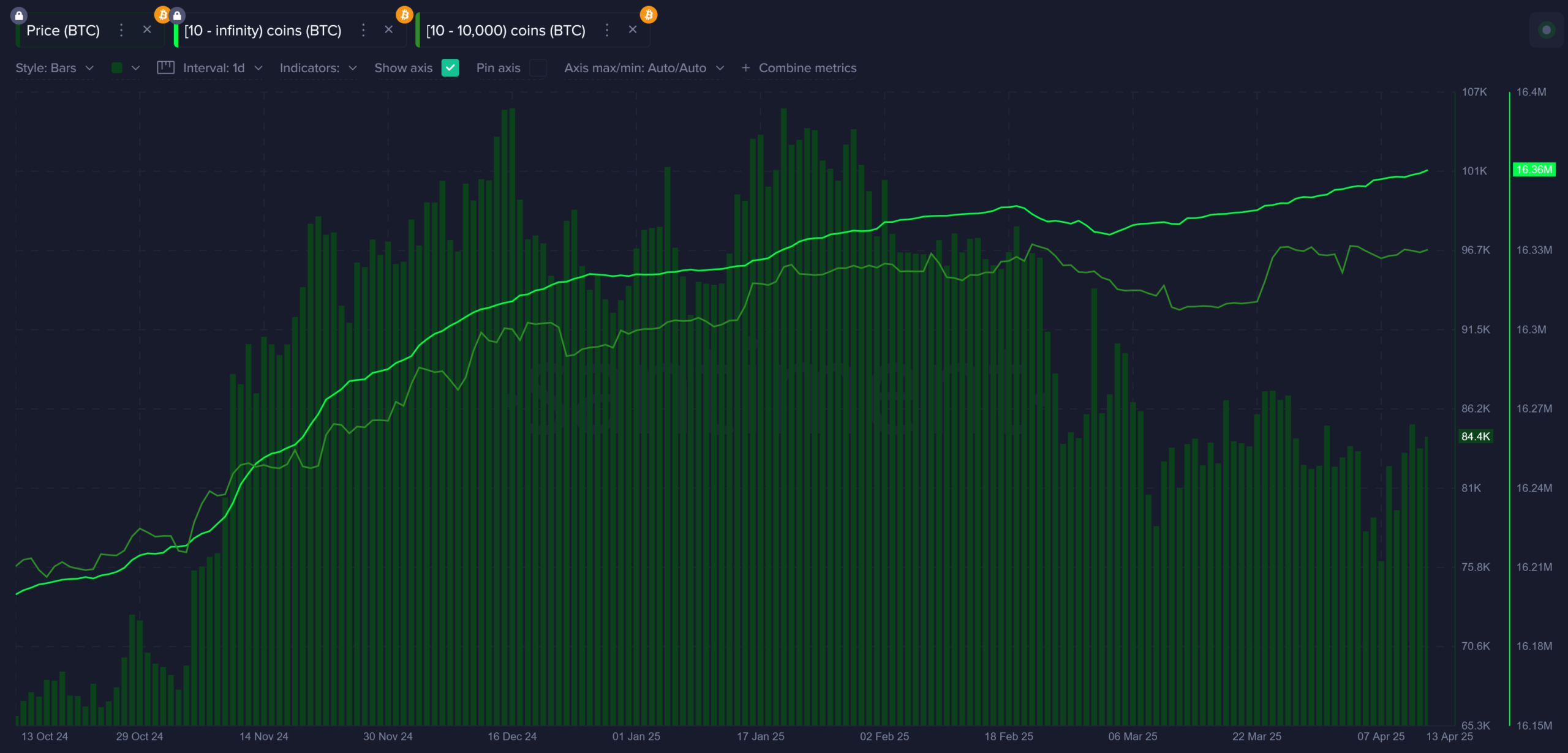

Source: Santiment

For example, portfolios with 10 or more BTC have continued to rise and climb to a record high of 16.36 m BTC.

Such a peak in sharks and whales suggested that large holders are bullish and perhaps Bitcoin will expect to be firm during this period of uncertainty.

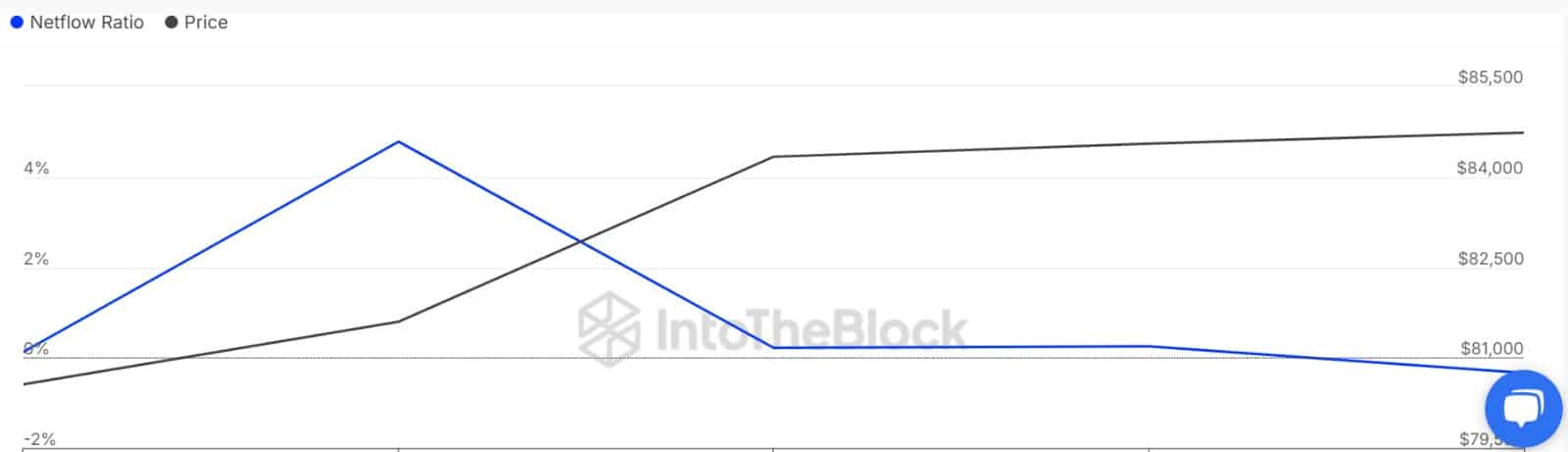

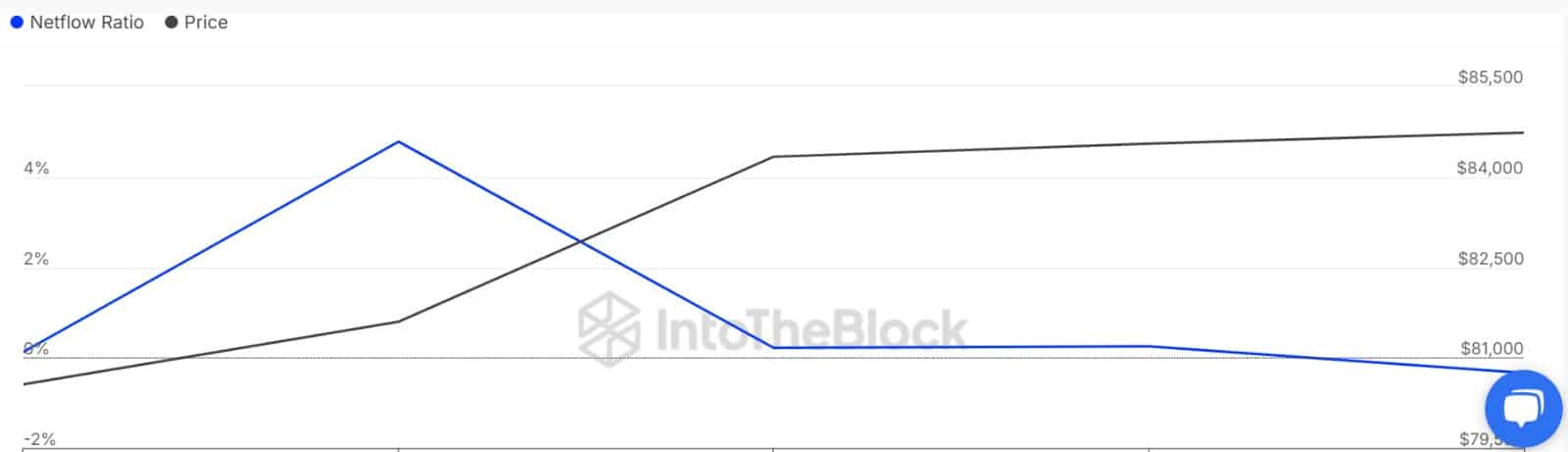

Source: Intotheblock

Looking at the Netflow of the big holders to exchange the Netflow ratio, we can see that whales have not sold. In fact, the whale flow ratio to exchanges fell to a weekly low of -0.34% -a sign of bullish sentiments between whales.

Moreover, the amount of available BTC that is at trade fairs is still immersing, because there are more and more signs of traders who hold the long term. This means that despite market fluctuations that arise from rates, bitcoin holders and investors have continued.

Source: Santiment

This market behavior can be validated by the continuing decrease in the risk position on the sales side.

It fell to 0.001 in April. It suggested that investors, especially long -term holders, are currently less encouraged to sell. These investors therefore expect the price to rise higher in the nearby team.

Source: Checkonchain

That is why channeling tariff income to Bitcoin will restore confidence for retail traders and every market participant will become bullish.

This announcement is good news for BTC and could help the price higher. Especially as the trust of investors in the administration returns.

What does it mean for BTC?

Although the rates have negatively influenced the financial market, Bitcoin has kept strong and strongly recovered from a rate -related dip.

Therefore, with BTC that strongly holds in a time of uncertainty such as now, policy dary about rates is a good thing for the crypto. If the US government gets income from rates and Bitcoin starts to buy, both investors and holders will positively perceive the rates. Such a shift in sentiment will hollow out concern within the market.

If such a scenario takes place, we could see great benefits. Due to a shift in rate -related sentiment, Bitcoin will reclaim the daily levels for the order of around $ 88,500. However, if investors are not fully convinced about the policy, the crypto continues to consolidate between $ 83k and $ 85k.