- TRUMP has dominated spot trading volumes, growing to $38 million within a few days of launch.

- Derivatives and spot traders showed mixed market sentiment, with no clear direction.

Official Trump [TRUMP]the official memecoin of the 47th US president, Donald Trump, was launched on January 17, a few days before his inauguration and assumption of the presidential role.

A few hours after launch, it surpassed the market cap of a billion dollars, reaching $15.02 on January 19. Since then, the stock has fallen more than 50%, with the market cap at the time of writing at $7.39 billion.

AMBCrypto found that while TRUMP appeared bullish, not all market sentiment was in line with this outlook.

A volume increase could open a new path

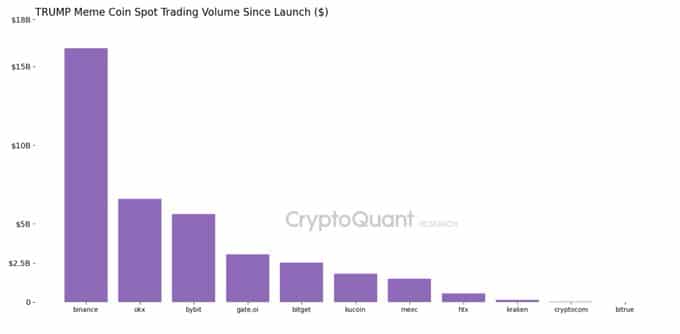

Following the launch of TRUMP on multiple centralized exchanges, total trading volume on the spot market grew significantly, reaching $38 billion, according to CryptoQuant.

Binance, the world’s largest exchange, recorded the highest total trading volume on the spot market, with a value of $16 billion.

However, TRUMP saw its highest trading volume on January 19 at $17 billionwhich had a positive impact on the price as TRUMP reached an average of $62.

Source: CryptoQuant

However, over the past 24 hours, TRUMP’s volume and price have fallen simultaneously, down 59.01% to $8.73 billion and 13.74% to $36.97, indicating weakening momentum.

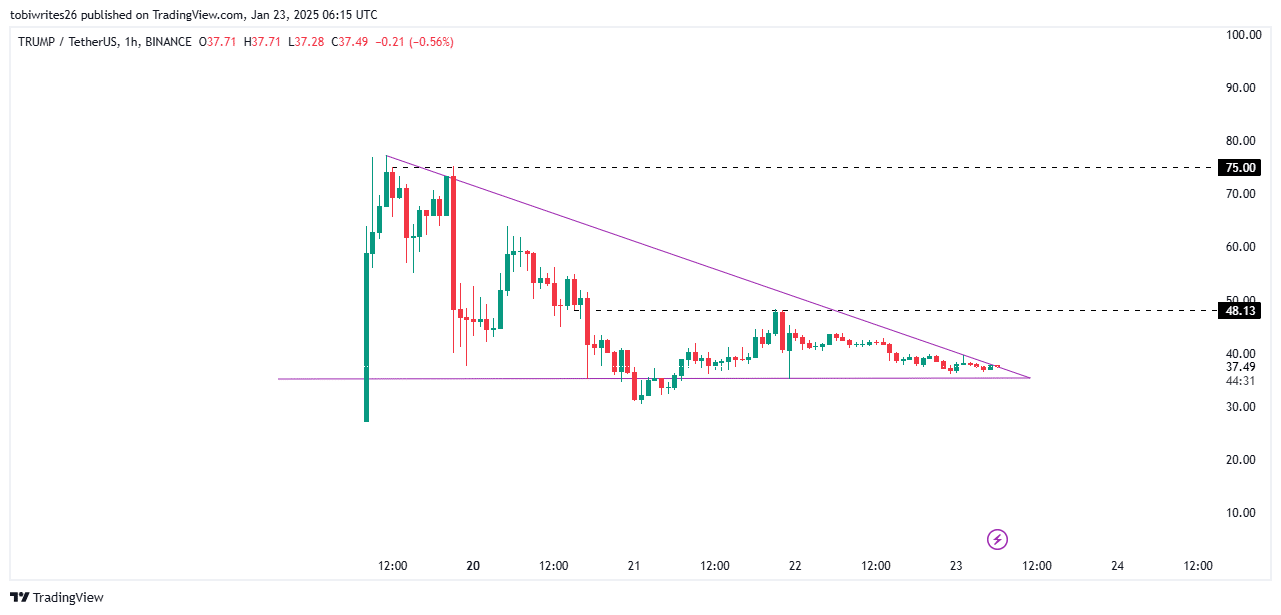

AMBCrypto noted on the chart that this weakening momentum could turn in TRUMP’s favor as it trades within a bullish structure.

TRUMP is accumulating

On the chart, TRUMP presents the potential for a rebound as it has entered a bullish accumulation zone, indicated by a symmetrical triangle pattern.

This pattern consists of converging support and resistance, within which the price trades. After a longer period of time, it usually breaks out as it approaches the point of convergence.

Source: TradingView

When this happens, there are two major price targets for TRUMP. First, it will likely regain $48.13 before making a final recovery to $75.00, close to all-time highs.

On-chain metrics are currently sending mixed signals, with no clear indication of the price’s next direction.

No clear signal ahead

Although TRUMP is in a bullish accumulation zone, there is no definitive signal as the metrics remain mixed on-chain.

The press data on Coinglass showed that although the financing rate was bullish, the net alternating current showed a bearish trend.

The funding rate measures the attitude of derivatives traders in the market. If it is positive – as in the case of TRUMP, at 0.0097% – it suggests that more traders are convinced of the market recovery.

Read official Trump’s [TRUMP] Price forecast 2025–2026

Spot traders, on the other hand, have turned bearish and started selling the token. More than $58.85 million worth of TRUMP was sold in the last 24 hours, causing downward pressure.

When key metrics send mixed signals, fundamentals can play a major role. Donald Trump’s policies, seen as a net positive for the ecosystem, could catalyze a rally.