- TROY was trading at levels last seen in July 2023.

- The intense demand in recent days, if it continues, could push prices much higher.

TROY [TROY] token is up nearly 72% since Monday’s trading session began. The previous week was also strongly bullish and the token rose 259% before recovering over the weekend.

The uncertainty surrounding the US elections has sidelined many investors and traders, but the TROY token remained unfazed. The $38.7 million market cap token has been trading since January 2020 and has risen almost 300% in ten days.

Traders should prepare for more profits

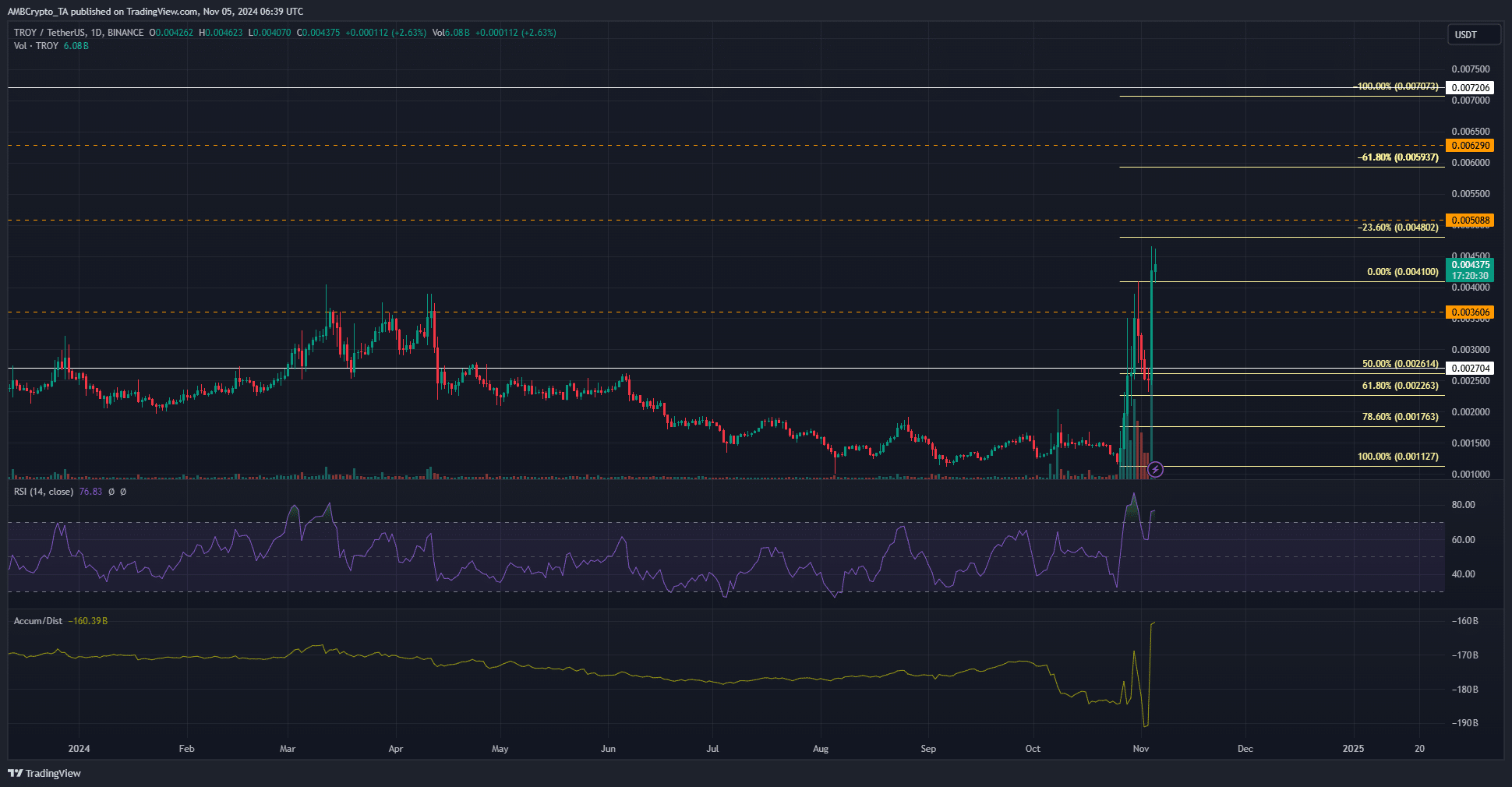

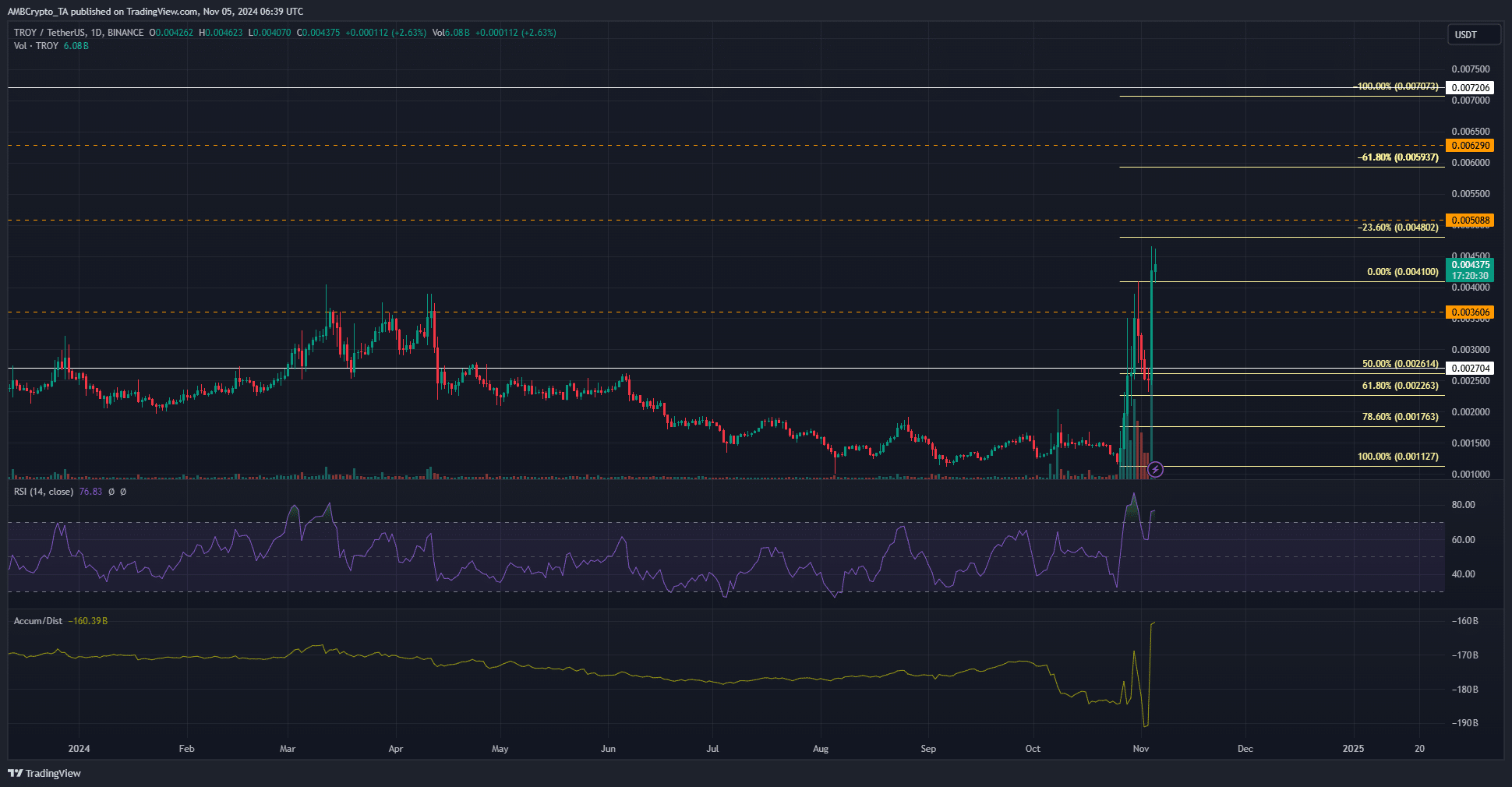

Source: TROY/USDT on TradingView

Since May, the TROY token has been in a downward trend. From its high on April 24 to its low on October 25, TROY was down 58.88% in just over six months. The recent price increase took prices to their highest level since July 2023.

The A/D indicator on the daily time frame noted strong bullishness and strong demand. The RSI was above the overbought threshold, but does not necessarily indicate that a pullback is imminent.

Traders can use a bearish divergence between the price and the RSI to sell TROY and get back into the market after a pullback.

The Fibonacci levels highlighted the $0.0048 and $0.0059 as the next bullish targets.

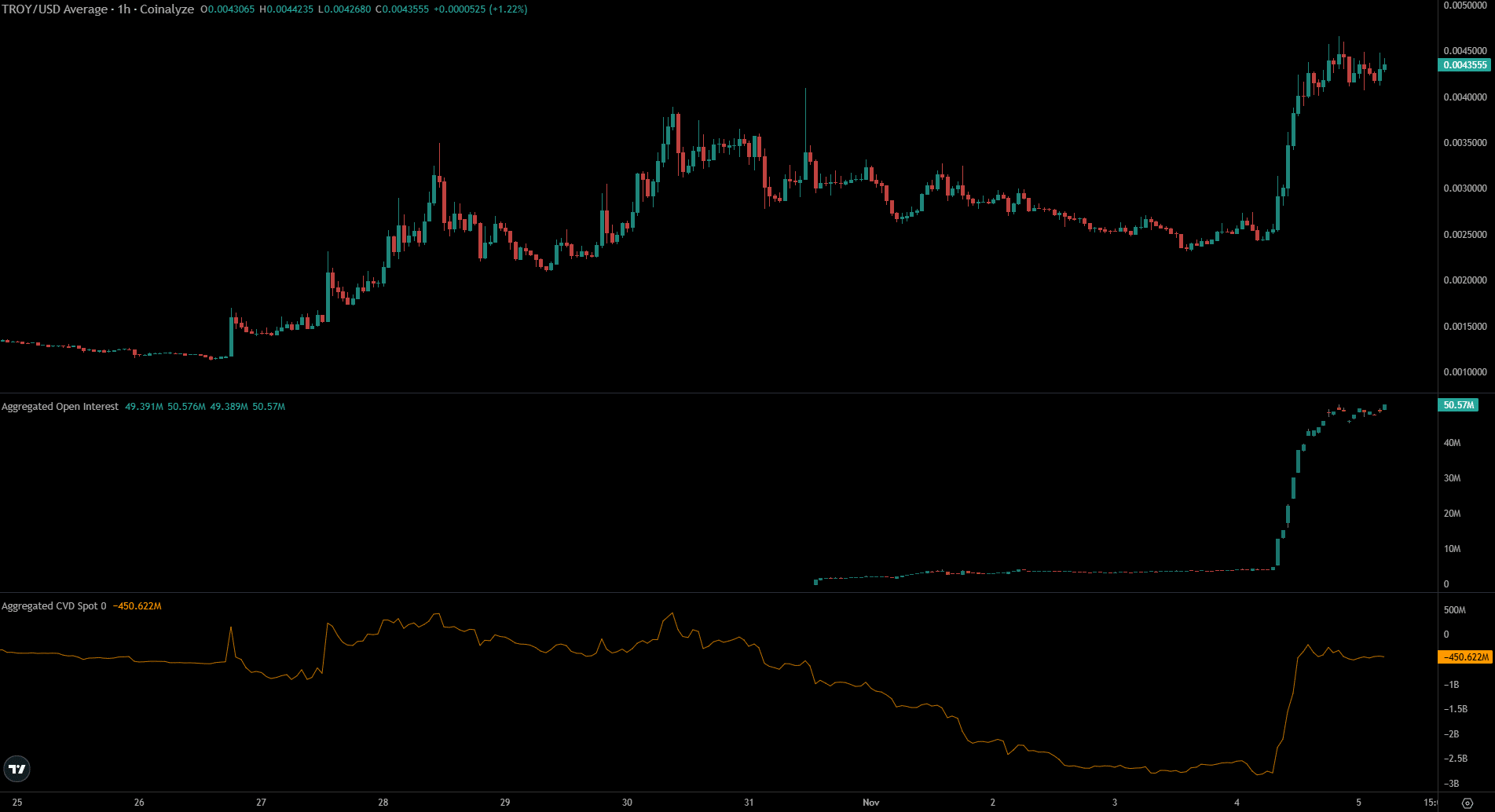

The large influx of Open Interest could lead to a hunt for long positions

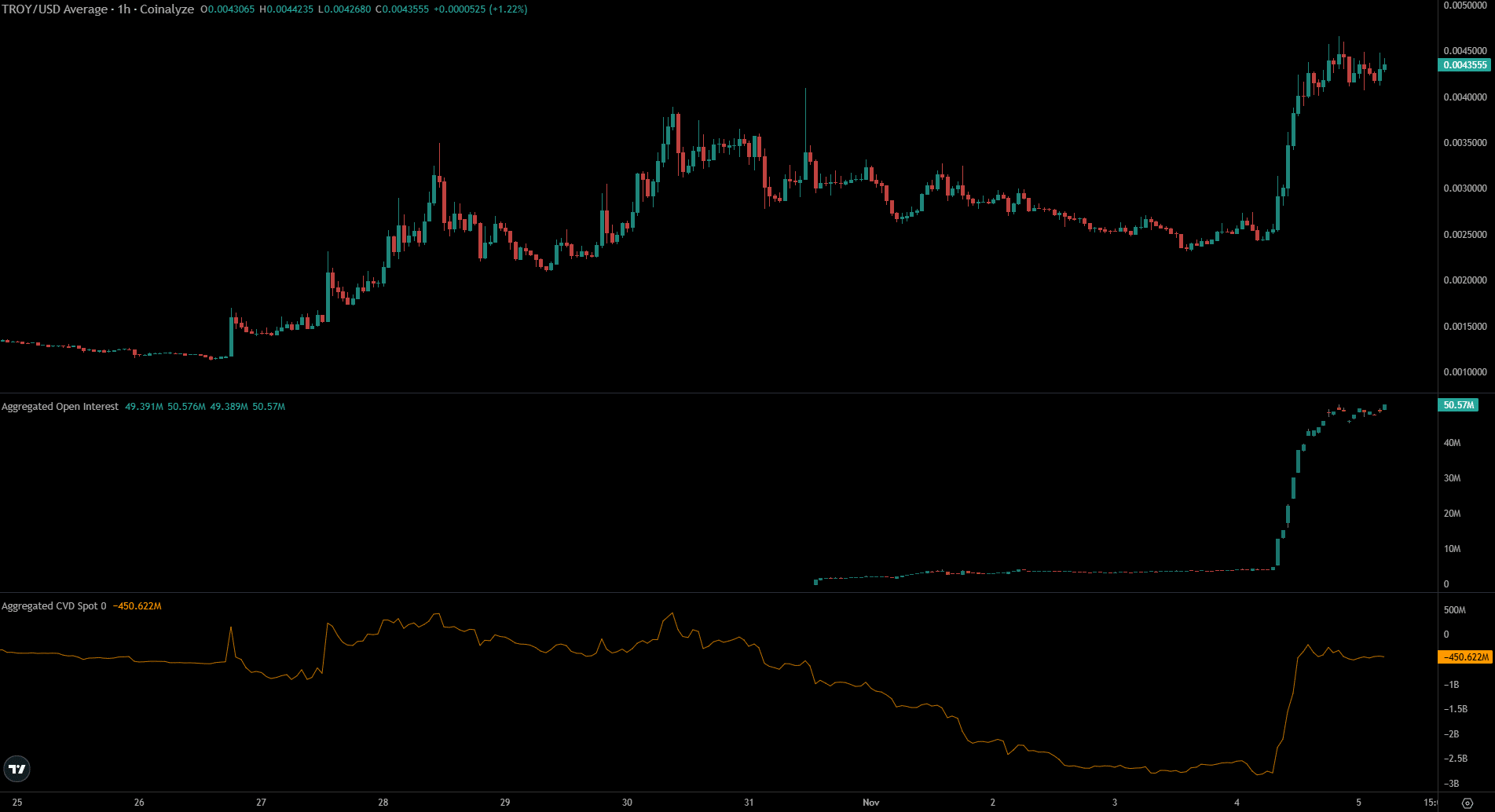

Source: Coinalyse

The price has risen almost 300% in ten days and the Open Interest has raised almost $40 million more in the last 24 hours. It rose from $4.3 million to $50.57 million, a nearly twelvefold increase.

This meant speculators were sharply optimistic, but also offered the possibility of a liquidity chase to flush out overzealous bulls.

Is your portfolio green? Check the TROY profit calculator

The CVD position also jumped higher. Market demand was strong and the asset’s low market capitalization meant further growth was likely, but holders will need convincing. Newcomers should be careful to limit their risk and not get caught with a TROY token in hand.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer