- TRX’s trading volume increased along with its price.

- Technical indicators pointed to a continued price increase.

Tron [TRX] has made headlines again as it recently hit an all-time high (ATH) as robust trading activity supported the development.

With this new ATH, TRX moves closer to entering the top 10 list. Will be able to flip TRX Avalanche [AVAX] and claim the 10th spot, or will it be subject to a pullback first?

Tron hits an ATH!

Tron bulls pushed the token price up by more than 28% last week. In the last 24 hours alone, TRX rose over 16% to reach an all-time high of over $0.234.

Currently, the market cap difference between TRX and AVAX is approximately $1 billion. If TRX continues its upward movement, it could surpass AVAX and become the 10th largest cryptocurrency by market capitalization.

Will TRX keep pumping?

To assess the likelihood of TRX continuing its bull run, AMBCrypto analyzed the token’s on-chain metrics.

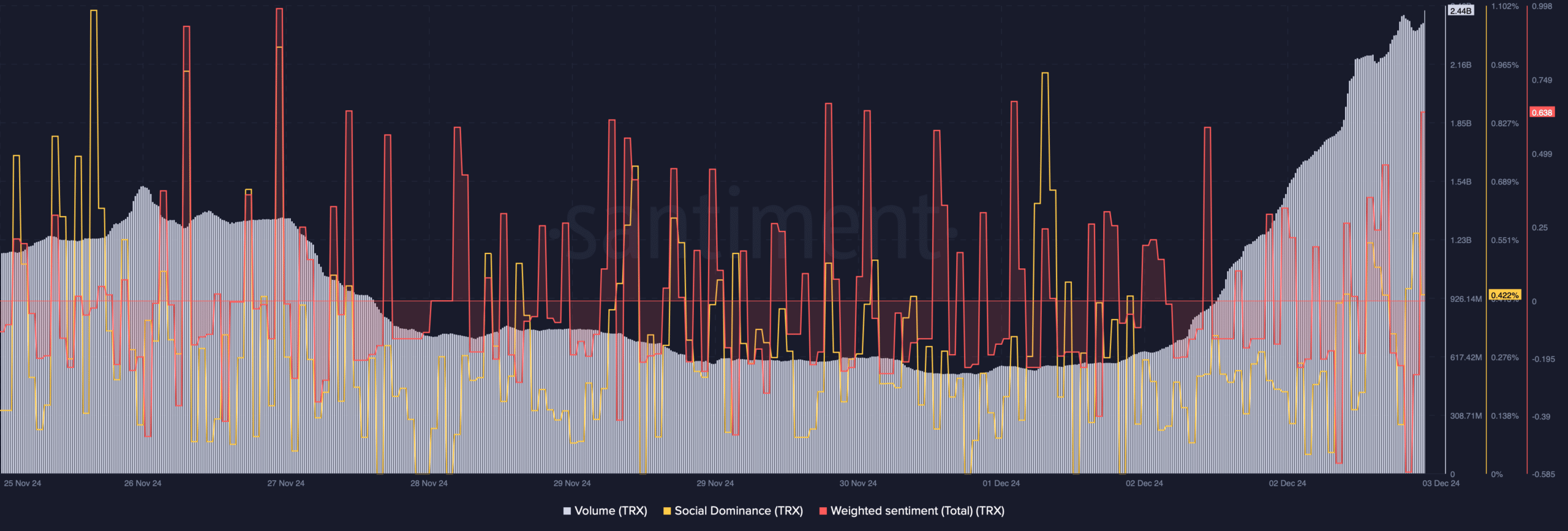

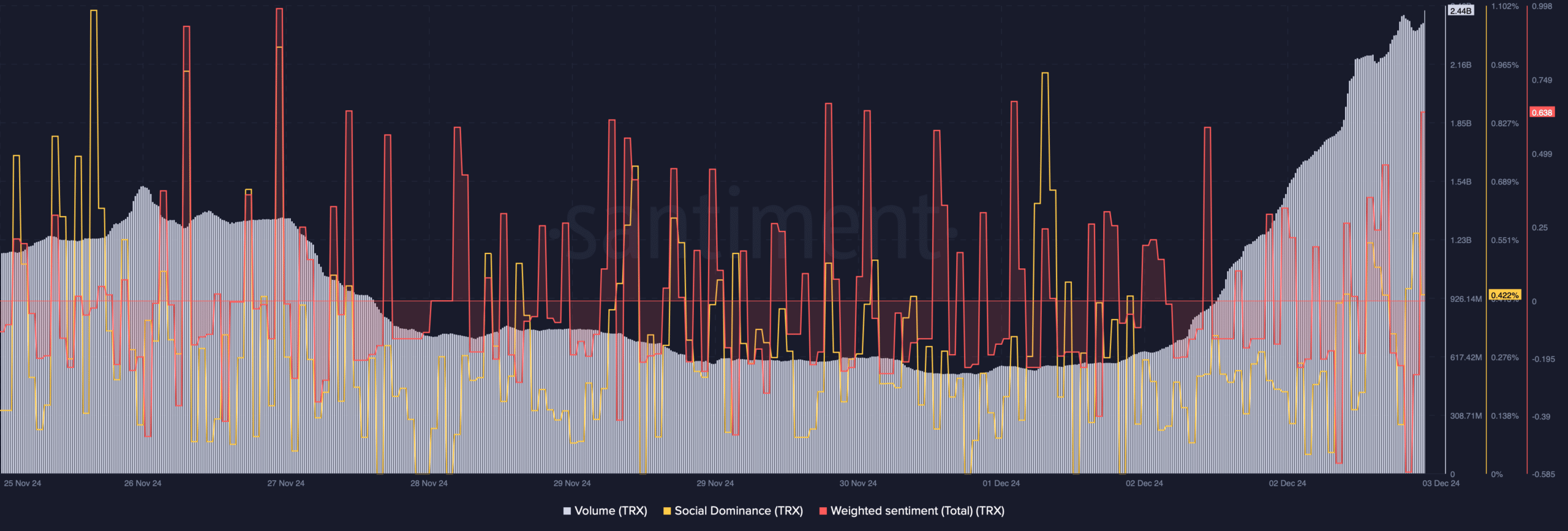

According to Santiment’s data, TRX’s trading volume has increased significantly alongside its price. An increase in volume during a bull run further strengthens the upward momentum.

The recent price increase also positively impacted the token’s social metrics. For example, social dominance remained high, reflecting TRX’s popularity in the crypto space.

However, despite reaching an ATH, TRX’s weighted sentiment fell shortly afterwards, indicating rising bearish momentum.

Source: Santiment

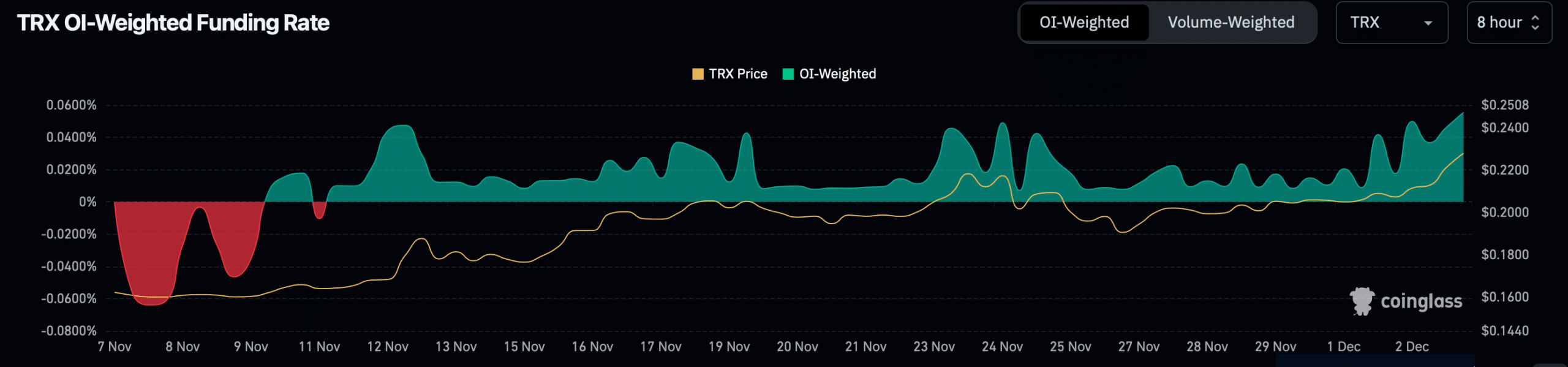

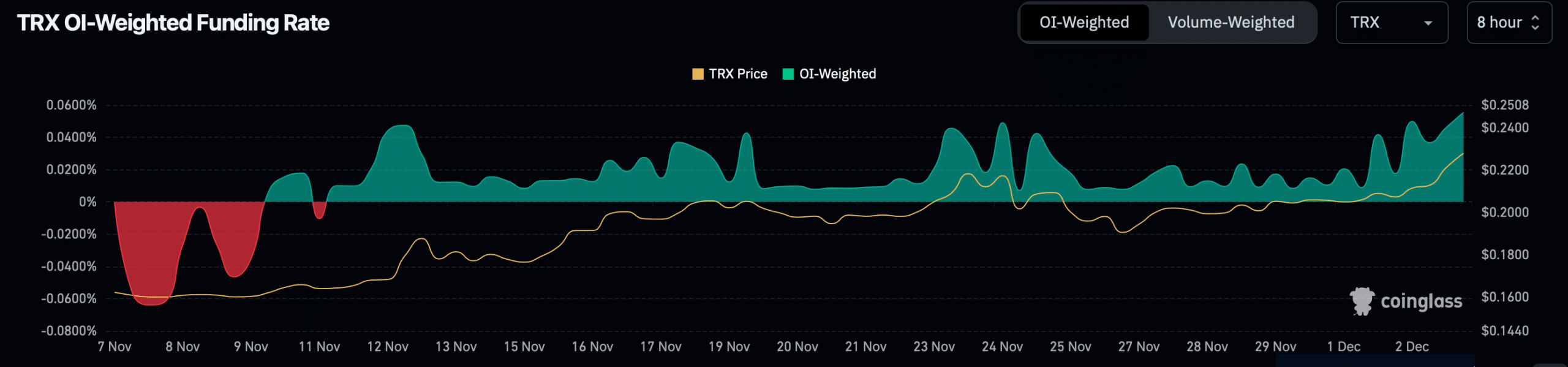

Nevertheless, the token’s derivative metrics seemed optimistic. Mint glass’ facts revealed that Tron’s funding rate increased. A rising funding rate in crypto indicates that the market is bullish and traders expect prices to rise.

This is because traders who believe prices will rise are willing to pay extra to maintain their long positions.

Source: Glassnode

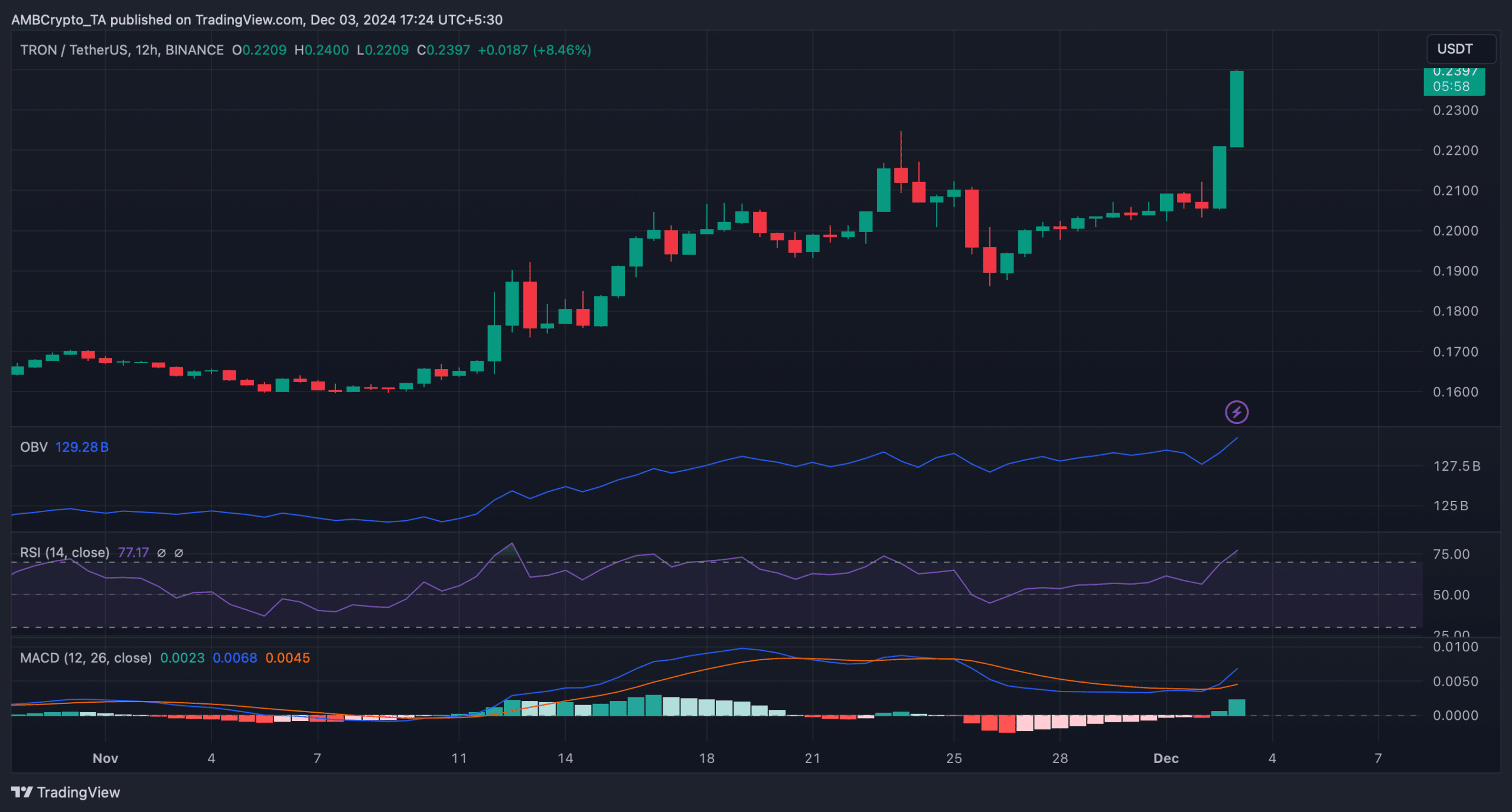

The technical indicator On Balance Volume (OBV) recorded an increase, indicating that trading volume on days with positive price movements exceeded the volume on days with negative price movements.

TRX’s MACD also showed a clear bullish advantage, indicating continued price appreciation. However, Tron’s Relative Strength Index (RSI) entered overbought territory.

This could motivate investors to sell, which could in turn push the price of TRX down.

Source: TradingView

Read TRONs [TRX] Price prediction 2024-25

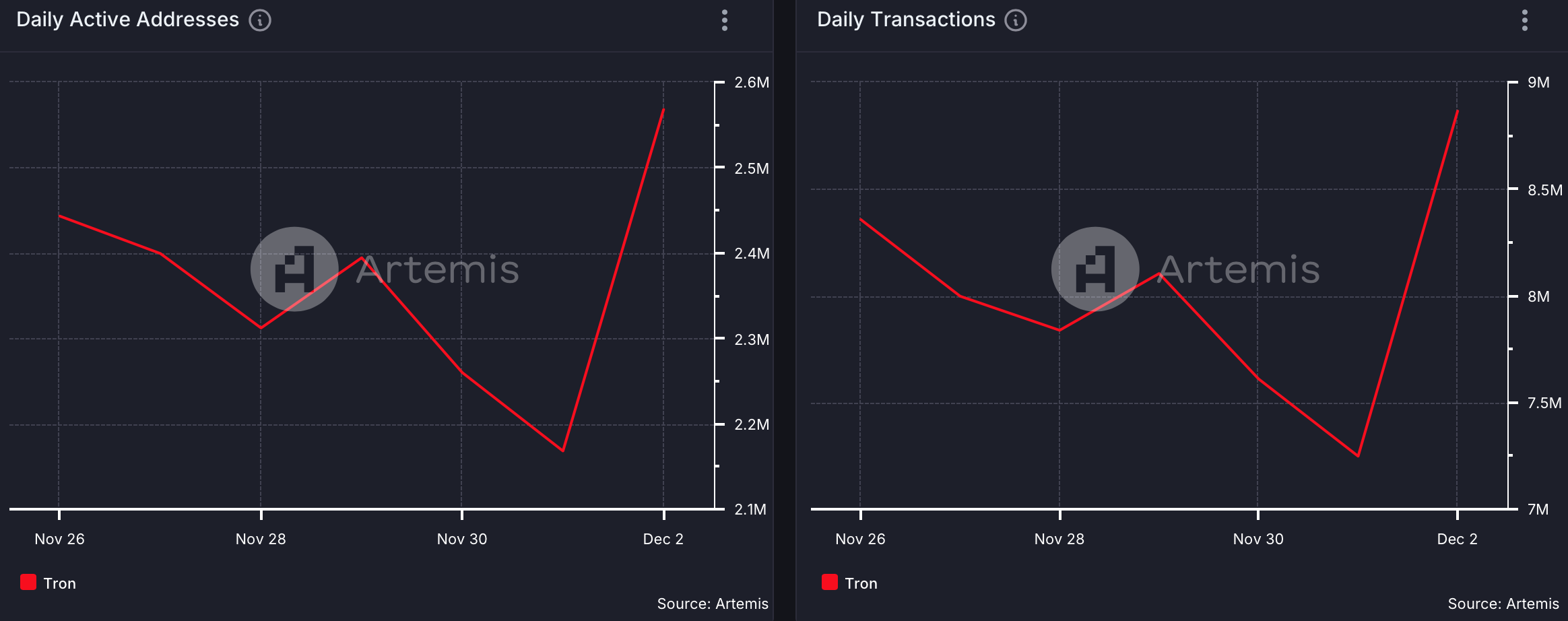

Interestingly, as TRX reached new highs, network activity also saw an increase. Artemis data shows a sharp increase in TRX’s daily active addresses.

A similar upward trend was also noticed in the daily transaction chart. This meant that the new ATH was realized thanks to the support of increasing network activity.

Source: Artemis