- Monthly active users and transactions on the Tron network peaked last month during the launch of SunPump.

- However, daily activity slowed and started to weigh on TRX’s price performance.

The Tron [TRX] blockchain saw a huge increase in use after the SunPump memecoin launch pad went live last month. Per TokenTerminalmonthly fees, transactions, and active users on Tron skyrocketed shortly after launch.

Source:

The USDT offering on Tron has also contributed to this growth, as it has increased from $48 billion at the beginning of the year to $68.9 billion. Tron now controls more than half of USDT’s $118 billion market cap.

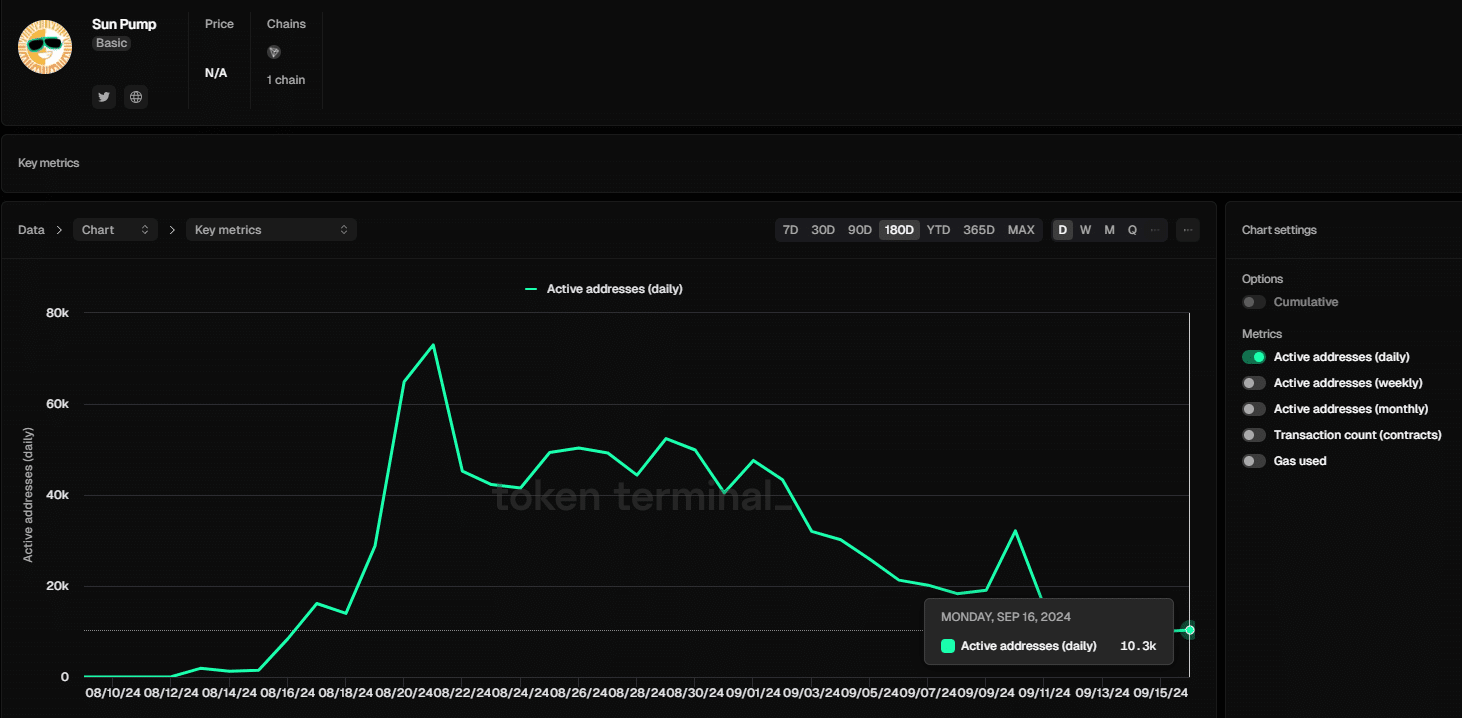

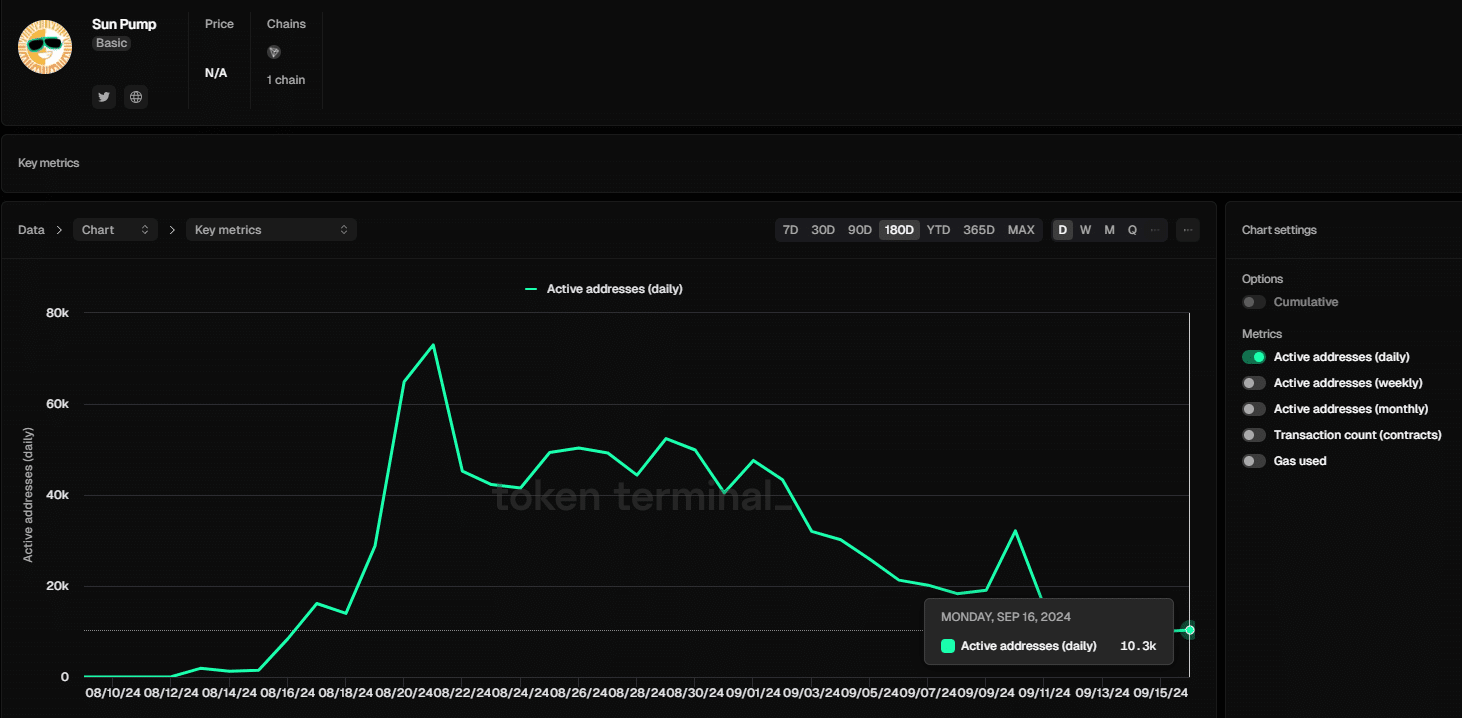

When it comes to SunPump, however, its growth trajectory has weakened. The number of daily active addresses on this protocol has fallen from the August peak of 73,000 to 10,300 addresses.

Source: TokenTerminal

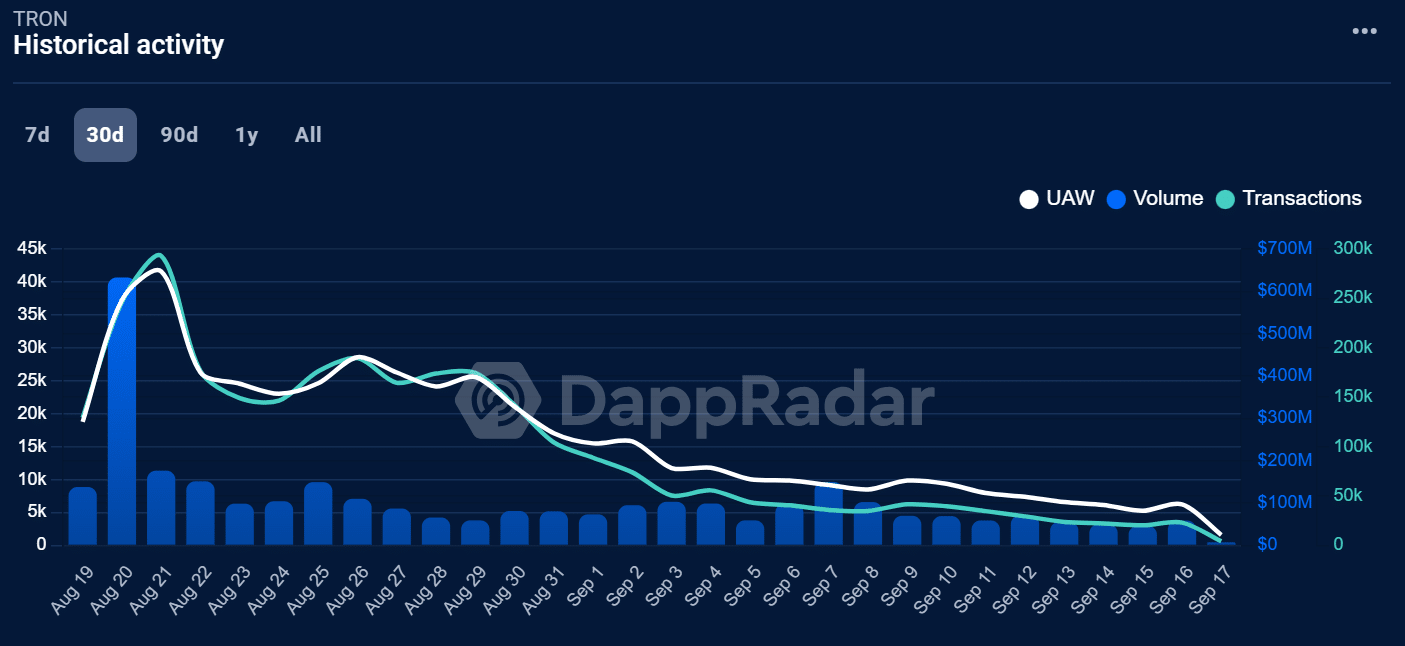

Cooling network activity is further reflected in declining volumes of decentralized applications (dApp).

Per DappRadardApp volumes on Tron have fallen from $73 million at the beginning of the month to $58 million.

Within the same period, the number of Unique Active Wallets (UAWs) fell by more than half from around 15,000 to 6,000, meaning there are fewer users on the blockchain.

Source: DappRadar

Due to shrinking network activity, TRX price has failed to post significant gains and has instead succumbed to bearish pressure.

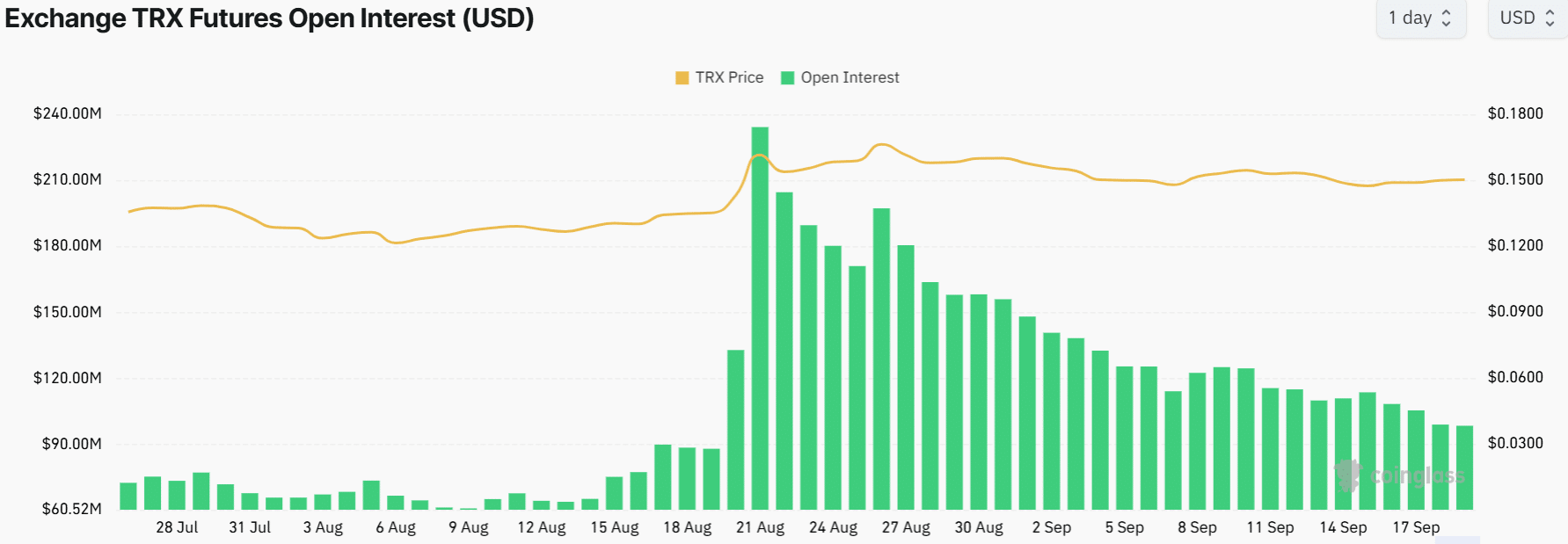

TRX Open Interest Hits One-Month Low

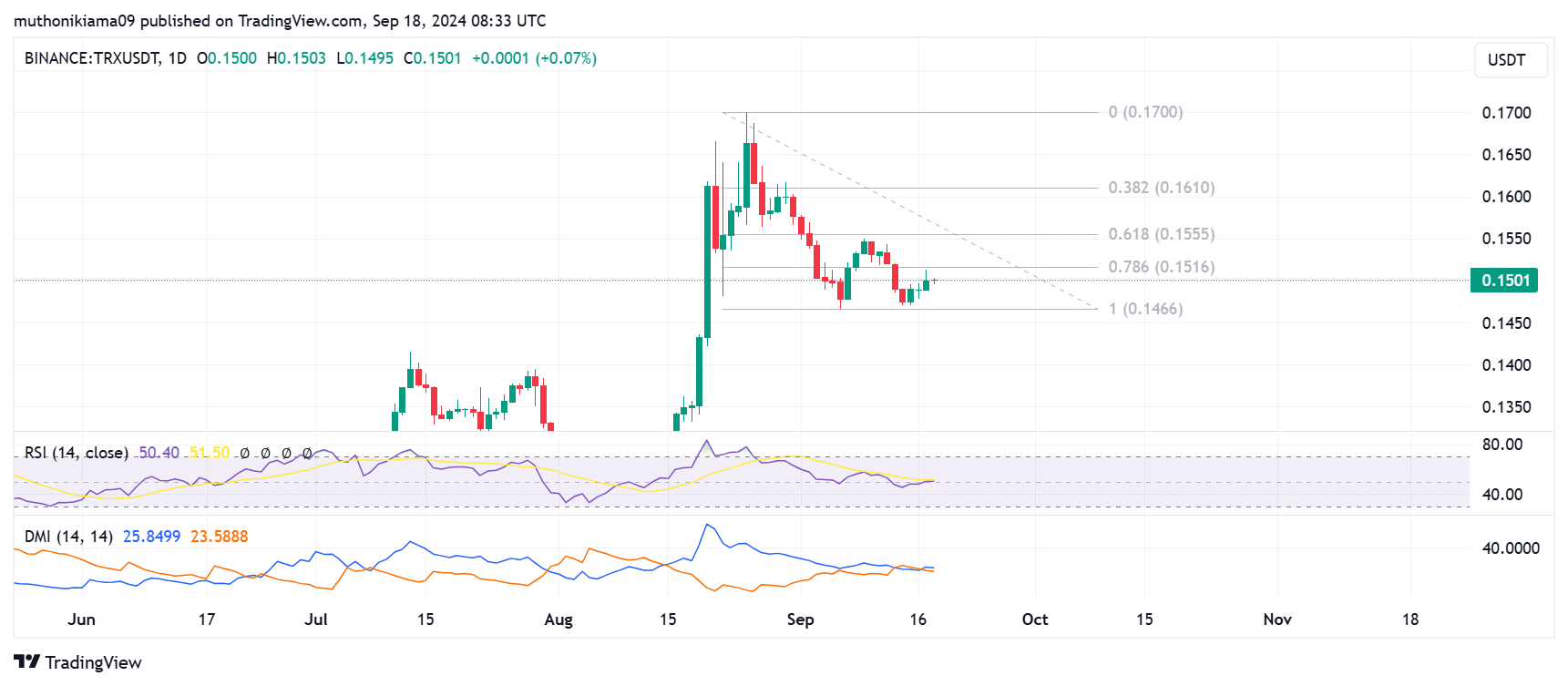

TRX was trading at $0.15 at the time of writing with low volatility as it fluctuated between $0.149 and $0.51.

Coinglass data shows that Tron’s Open Interest has been on a downward trajectory since late August. This statistic recently dropped to its lowest level in one month.

Source: Coinglass

The decline in Open Interest due to price inaction suggests that traders are not opening new positions on TRX, but closing existing ones.

The inactivity around TRX is also reflected in the Relative Strength Index (RSI), which is at a neutral level of 50.

Traders should watch out for a break of the RSI line above the signal line as this could indicate a buy signal and create bullish momentum.

Source: TradingView

A bullish divergence appeared in the Directional Movement Indicator (DMI) after the positive DMI crossed the negative DI. This suggests that TRX could be entering an uptrend.

If buyers intervene, the resulting gains will see TRX aim for resistance at the Fibonacci level of 0.382. The last time TRX broke this resistance, the price rose to a three-year high at $0.17.

Read Tron’s [TRX] Price forecast 2024–2025

It is important to note that 94% of TRX traders are In The Money per InTheBlok facts.

Therefore, if TRX continues to show weakness, these traders might decide to sell and minimize losses, putting more bearish pressure on the altcoin.