- Justin Sun refers to potential tron ETF if TRX focuses on institutional market expansion.

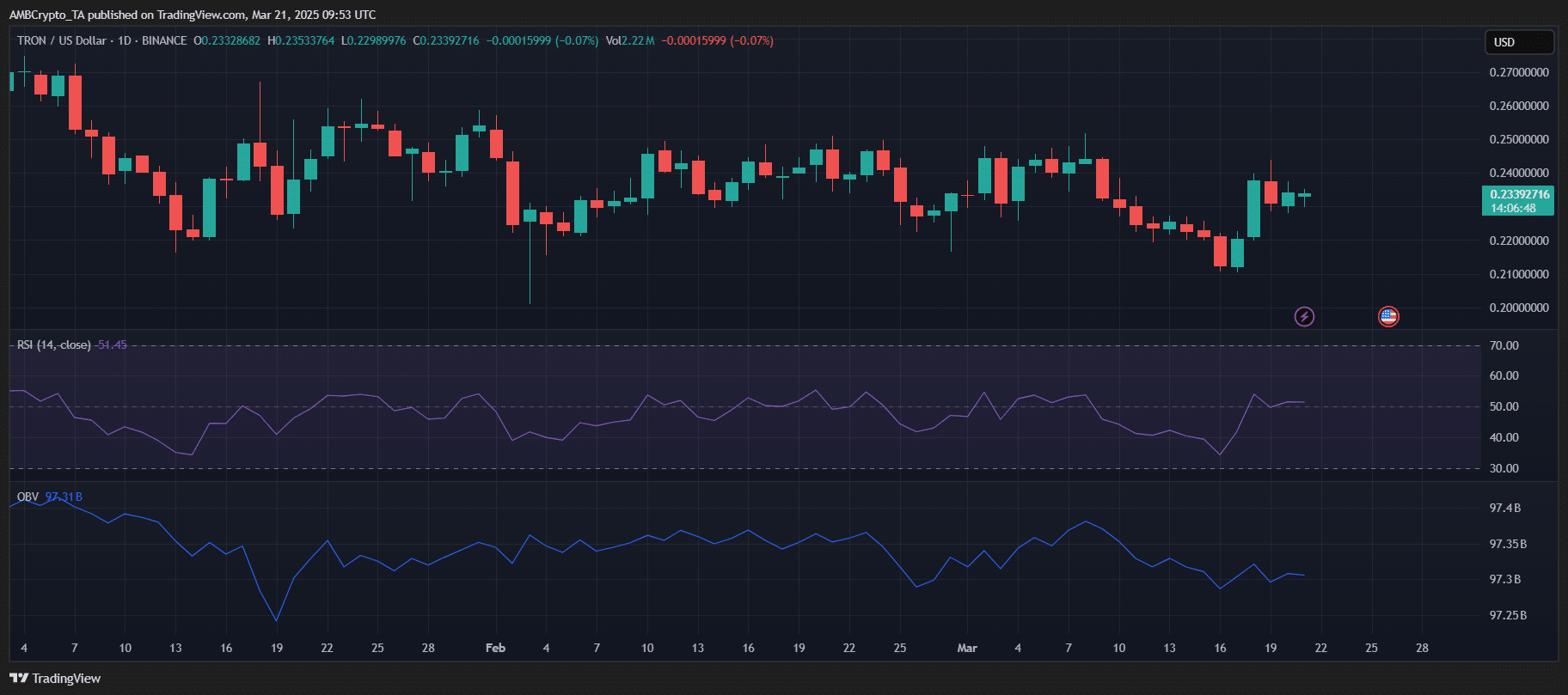

- Tron’s USDD Stablecoin is growing steadily, while TRX shows signs of recovery in the midst of a low volume.

Justin Sun is in the spotlight again, this time with hints of a possible ETF for Tron [TRX].

Together with the recent expansion of TRX to the Solana blockchain and the continuous growth of its algorithmic Stablecoin, USDD, TRX seems to be working on greater institutional involvement and broader market integration.

In the midst of market insecurity and consolidation, TRX focuses on compliance with the regulations, the integration of the cross-chain and the development of the Stablecoin. This strategy positions TRX to take advantage of the next phase of the acceptance of crypto.

Why are Tron ETF rumors throwing?

In a recent message on social media, Tron founder Justin Sun hinted on a Tron ETFThis speculation appeals to whether TRX can soon be in line with the ranks of regulated crypto -finance products.

The timing is remarkable: with Bitcoin and Ethereum spot ETFs already approved, the traditional financing is warming up for the more established assets of Crypto.

Source: X

Blackrock and Fidelity are actively going to new applications, and Tron could follow soon. Although no official application has been confirmed, the Sun hints on institutional interest rate continuous efforts behind the scenes.

If a TRX ETF becomes a reality, this would be an important step in Tron’s transition from a niche project to regular financial markets.

USDD’s steady climb

Tron’s USDD Stablecoin is gaining strength and recently surpasses a market capitalization of $ 270 million. In the midst of an increased control of algorithmic stablecoins, USDD’s resilience is striking, in particular in emerging markets where dollar-pegged assets are vital for daily transactions.

Sun remains committed to expanding USDD over several blockchain networks, which extends the reach of the Tron ecosystem.

As one of the most used innovations in Crypto, Stablecoins emphasize the broader goal of TRX to achieve the usefulness instead of just speculative.

With the rising global demand for stable, censorship -resistant assets, the growth of USDD could play a crucial role in shaping the next chapter of TRX.