The enrichment of blockchain-based products takes place at the hands of crypto developers. The RWA field is also of great importance. When we talk about Web3, the next phase of the Internet, we are also talking about the transformation of the existing digital infrastructure as a whole. Finances are also included here. What is RWA and what does it do?

What is RWA and what does it do?

While most crypto investors focus on price speculation rather than technology, many sectors are opening up to the transformation brought about by the trillions of dollars. blockchain ecosystem. By Metaverse to SocialFi, DeFiThe hype of the past few quarters has been RWA. As mentioned earlier, RWA is used in the tokenization of real-world assets.

Websites, banking applications and stock markets use databases. SQL and many other alternatives, along with their combined uses, represent Web2. And then there are blockchain-based applications. SQL data can be modified and manipulated on existing data servers. However, in structures that use blockchain and data feeds, this risk can be eliminated.

Transparency, traceability within the chain, low costs and many other advantages make it necessary to convert traditional, even outdated data pools into blockchain. Are those who think this way just a few eccentric blockchain enthusiasts? Of course not, billion dollar companies also think the same and form partnerships.

RWA and its uses in the real world

One of the key benefits of digital assets is that they can be enriched with all the information and logic that banks, protocols and customers need to interact with assets, including reserve evidence, automated business transactions, identity data, active risk management, reconciliation requirements and daily net asset value ( NAV).

In 1970 we witnessed the transition from paper assets to digital ones. Our grandparents remember the days when stocks were bought and sold like physical paper. What seems absurd to us today was normal then. And now the transition to blockchain begins.

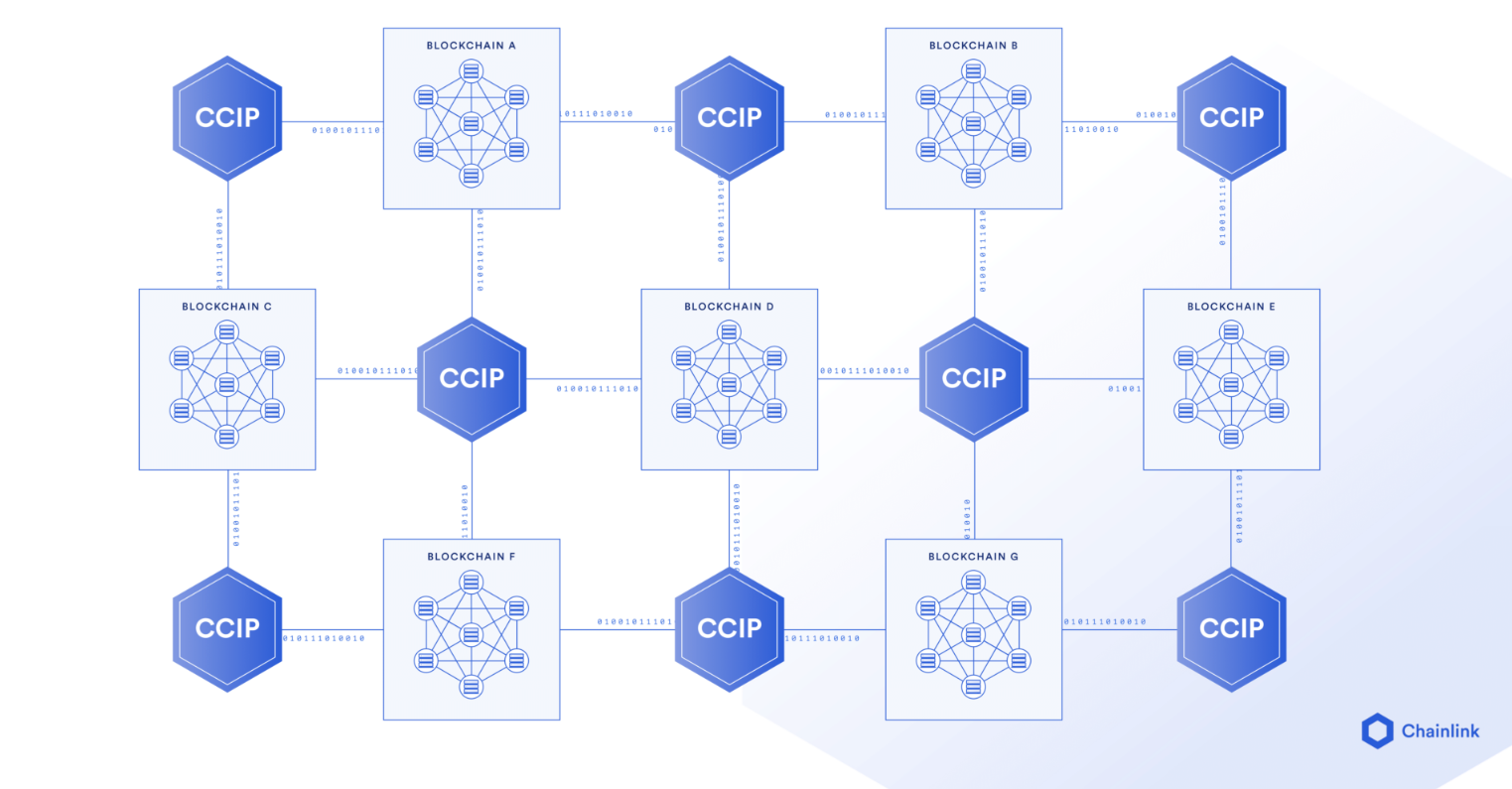

Chain link (LINK) is the most popular and almost monopolized company in this field. While it has competitors like TRB, the luxury of partnerships with CCIP and Swift belongs solely to Chainlink. So, what services do they offer?

- Reserve Proof: Enables tracking of cross-chain or off-chain reserves supporting tokenized RWA for consumers, monetary authorities, asset issuers and on-chain applications. This provides them with advanced transparency and enables the implementation of circuit breakers that protect users if the value of off-chain assets differs from the value of on-chain tokenized assets.

- Identity: Identity verification is necessary for regulatory compliance for all financial transactions. DECO is an oracle protocol that uses zero-knowledge technology to tokenize RWA and allows institutions and individuals to prove the source and ownership of tokenized RWA without disclosing personal information to third parties.

- Data Feeds: Ensures the secure delivery of raw materials, inventory and any other data you can think of. Today we know that the most popular DeFi applications benefit from this Chainlink Prize feeds.

RWA altcoins

Investors need to realize that there are many cheaters in the world of cryptocurrencies. For example, when the metaverse hype emerged, we saw the rapid launch of fake metaverse projects whose sole purpose was to deceive investors. We have experienced similar things in every area.

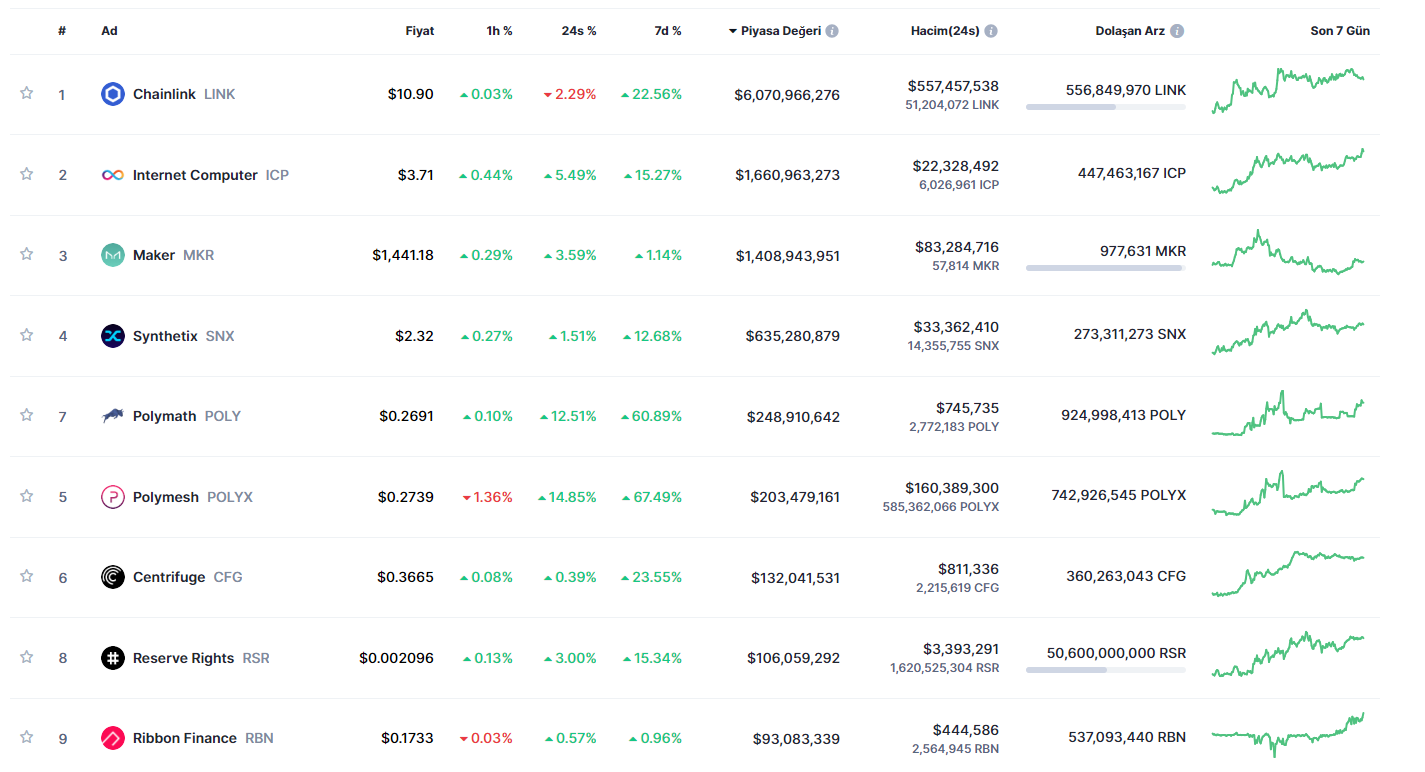

There are many altcoins listed in the RWA field by CoinMarketCap. It is important that investors carefully research and consider these based on the criteria we have shared in our research guides. The ranking of RWA coins on market value is as follows. It should also be noted that there are tokenless initiatives and efforts from major financial institutions, such as Binance Oracle.

Disclaimer: The information in this article does not constitute investment advice. Investors should be aware of the high volatility and associated risks of cryptocurrencies and should do their own research before making any trades.