- Ethereum ETFs see $ 760 million in flowing while investor sentiment shifts to Bitcoin in the midst of favorable conditions.

- Bitcoin ETFs attract $ 785 million in inflow, signaling renewed investor confidence, while Ethereum is confronted with investors retreat.

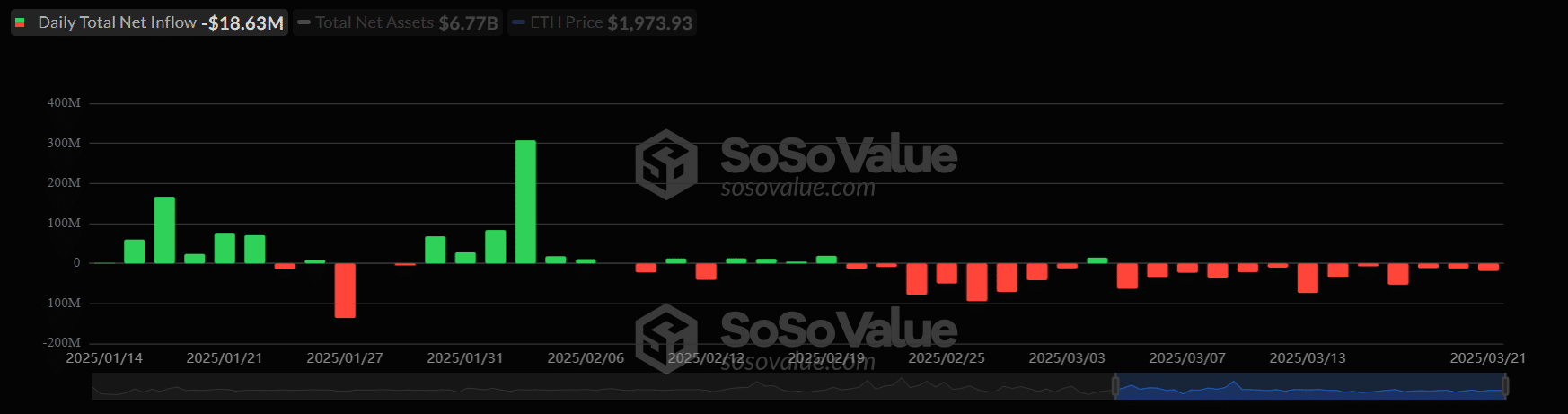

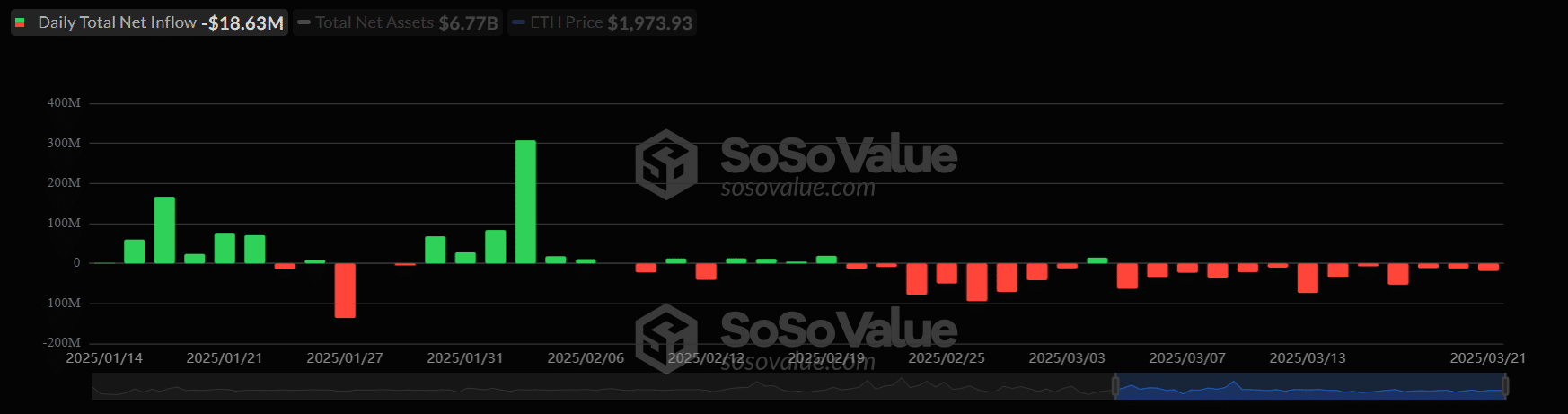

Ethereum [ETH] falls out of the grace – at least for the time being. In the past month, the American Ethereum ETFs have registered more than $ 760 million in, a sharp contrast with the increasing interest in Bitcoin [BTC].

In just the past six days, Bitcoin ETF’s have attracted $ 785 million in fresh capital, which indicates a decisive shift in investor sentiment and raises new questions about the role of Ethereum in the evolving landscape of digital assets.

Ethereum ETFs see stable outskirts while the market sentiment becomes careful

Ethereum ETFs have started a long -term period of investor retreat, so that more than $ 760 million in net outflows were thrown in the past month.

At the end of January, the inflow briefly-in particular with a single day stripe above $ 300 million but quickly returned to consistent outskirts until February and March.

Since mid-February, Red Staves have dominated the graph, to illustrate an almost unbroken piece of daily net outflows that reflect the growing caution for Ethereum.

Source: Sosovalue

Total net assets for Ethereum ETFs are now at $ 6.77 billion, with ETH itself trading slightly less than $ 2,000.

Institutional investors lose confidence in the performance of Ethereum in the short term, especially in the midst of a broader story that is increasingly focused on Bitcoin.

By accelerating the outflow, Ethereum runs the risk of losing its status as the second most favorite crypto activa at ETF investors.