An analyst who accurately called Bitcoin’s pullback this year before the halving charts what he believes could be the most bearish price path for BTC.

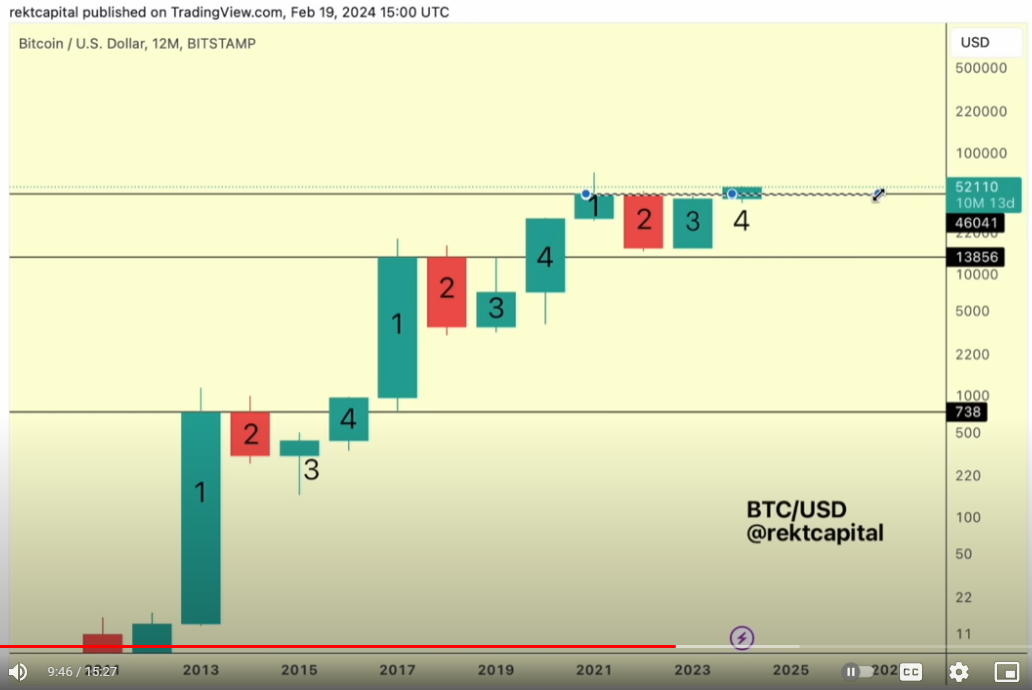

In a video update, pseudonymous analyst Rekt Capital tells its 86,100 YouTube subscribers that Bitcoin historically goes through a four-year cycle based on the halving – when rewards for BTC miners are halved.

Looking closer, Rekt says Bitcoin has faced a “three-year resistance level” in every four-year cycle – dating as far back as 2013.

According to the analyst, Bitcoin needed to break its three-year resistance of around $700 in 2017 and $13,856 during the 2021 cycle before a market top could be printed.

For this cycle, Rekt says the three-year resistance level was $46,000, which BTC has already taken out.

But the trader notes that Bitcoin may revisit the area to retest it as support before making the next move higher.

“Looking at the dynamics of how this transition occurs, candle four tends to set up potential retests of this three-year resistance into new support to propel price to new all-time highs and beyond…

If we focus on candle four and the half-year candle, there is always room for a retest during the year of that three-year resistance, from resistance to new support… And it looks like there is potentially room for a retest from this level to new support. That would mean spending $46,000 for that retest. That would mean that we would have to decline by 19% this month.”

While the trader believes a drop to BTC $46,000 this month is within the realm of possibility, he emphasizes that this is a low likelihood event as Bitcoin is in a halving year and not a bear market.

At the time of writing, Bitcoin is trading at $54,197, up slightly on the day.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: DALLE3