- Richard Teng of Binance suggests that Bitcoin could thrive as a hedge against economic instability.

- Despite the short -term volatility, the long -term optimism remains strong for Bitcoin in the midst of economic uncertainty.

Since the global markets of renewed trade stresses under the tariff proposals of Donald Trump, the crypto sector is at a volatile intersection.

Binance CEO sketches his belief in Bitcoin

In the midst of this uncertainty, Richard Teng, CEO of Binance, has weighed, which suggests that although the immediate impact could cause market fluctuations in the short term, bitcoin [BTC] could ultimately benefit from the broader economic instability.

According to Teng, investors can increasingly regard digital assets as a cover against macro -economic disruptions – stimulate demand and strengthen the matter for decentralized long -term financing.

Note on the same, Teng noted”

“The revival of trade protection is the introduction of considerable volatility to the global markets – and crypto is no exception.”

He added,

“In the short term, this type of macro illness tends to cause a risk-off response, withing investors withdrawing while waiting to see how things unfold around growth, policy and trade.”

Bitcoin’s price promotion Post-Tariff Shock

Trump’s tariff shock has given a considerable blow to Bitcoin, which was once traded above $ 100k but is now lower than $ 80,000.

From the last coin market cap updateBitcoin traded at $ 77,879.02, which marked a decrease of 1.97% in the last 24 hours.

Despite these short -term fluctuations, however, Teng remains optimistic, such as HE said,

“But looking further ahead, however, this environment can also speed up the interest in crypto as a non-sovereign value shop.”

He added,

“Many long -term holders continue to consider Bitcoin and other digital assets as resilient during periods of economic stress and shifting policy dynamics.”

What do the statistics point to?

Despite the current price dip and BEARISH signals from Bitcoin from indicators such as RSI and MacD, the data also shows further.

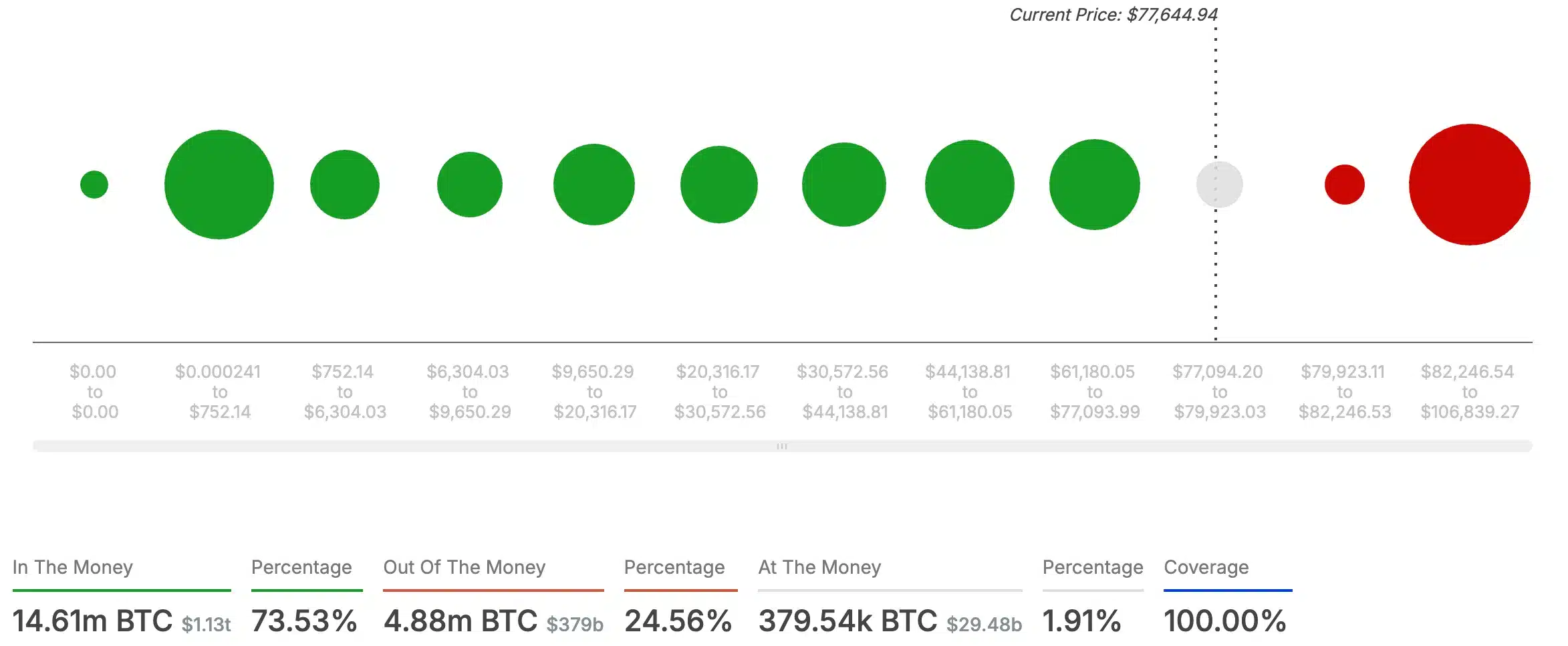

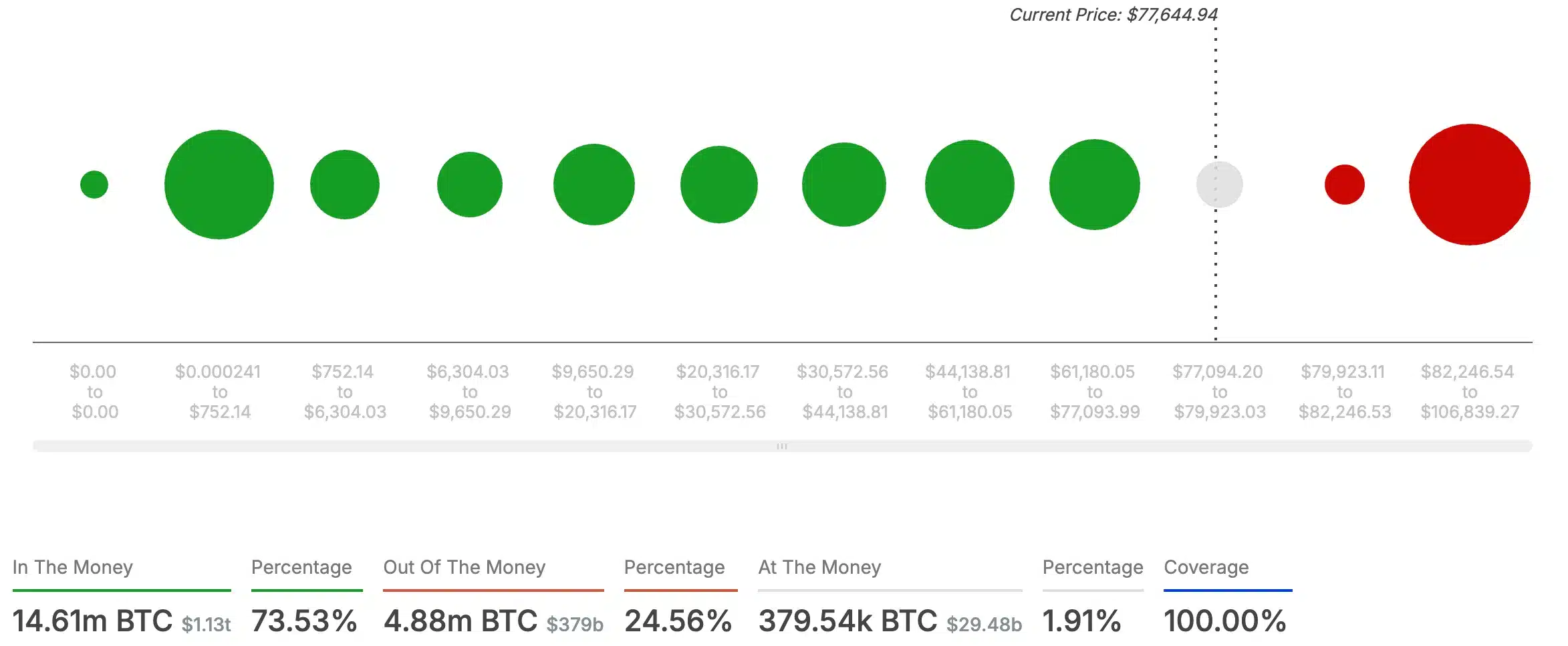

Ambcryptos analysis of Intotheblock statistics reveals that 73.53% of Bitcoin holders ‘are in the money’, which means that their tokens are worth more than their purchase price.

Only 24.56% is ‘outside the money’, suggesting that the underlying bullish sentiment and the potential for a price rally.

Source: Intotheblock

This followed Recent rumors From a potential rate break of 90 days, which briefly fed hope for a marketbound, only for the news that was disproved as false.

Nevertheless, the market reacted with impressive profit.

Bitcoin reflected this rally, peaked 6.5% and surpassed $ 80,000 shortly before he withdrew to his current levels.

Therefore, if a false rumor can cause a significant bitcoin -this clearly indicates the strong resilience and market potential of the King -currency.