- The anxiety and greed in the Bitcoin increased from 37%, which represents fear, to 47%, which indicates neutral, in the last 24 hours.

- Technical and fundamental analysis suggests that the crypto market will get Bullish Momentum.

Bitcoin (BTC) prize led the wider Altcoin market in the recording profits in the last 24 hours. For the first time since the sale of 4 March, Bitcoin Price has risen more than 5 percent in the last 24 hours to trade on Tuesday during the Mid-Noord-American session above $ 91.3k.

The wider Altcoin market marked Bullish Sentiment, so the total crypto market capitalization won more than 3 percent to float around $ 2.95 trillion at the time of this writing. After the increased volatility, more than $ 348 million was liquidated from the crypto-delivered market, usually with short traders.

Today predicted behind Bitcoin and Crypto Pump

Renewed question from whale investors

Since Gold Price came earlier on Tuesday on Tuesday at a new highest point of around $ 3.5k/OZ, data on chains showed that whale investors have shifted the focus on Bitcoin and selective altcoins. The renewed demand for Bitcoin and the Altcoin market, by whale investors, catalyzed bullish sentiment considerably.

In particular, the US Spot BTC ETF -Emitents registered a net entry from cash of more than $ 381 million, possibly an end to a long -term dry spell.

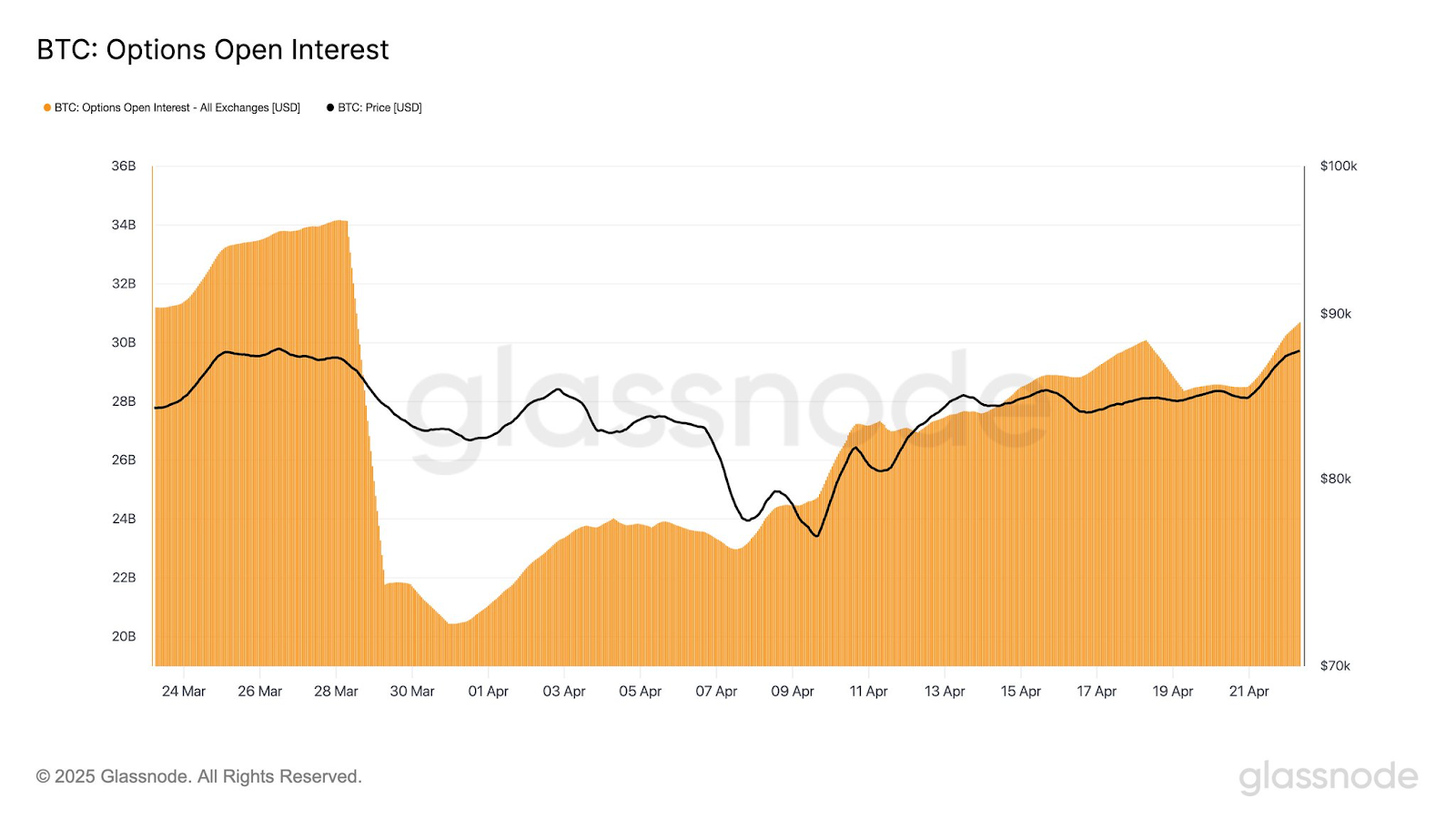

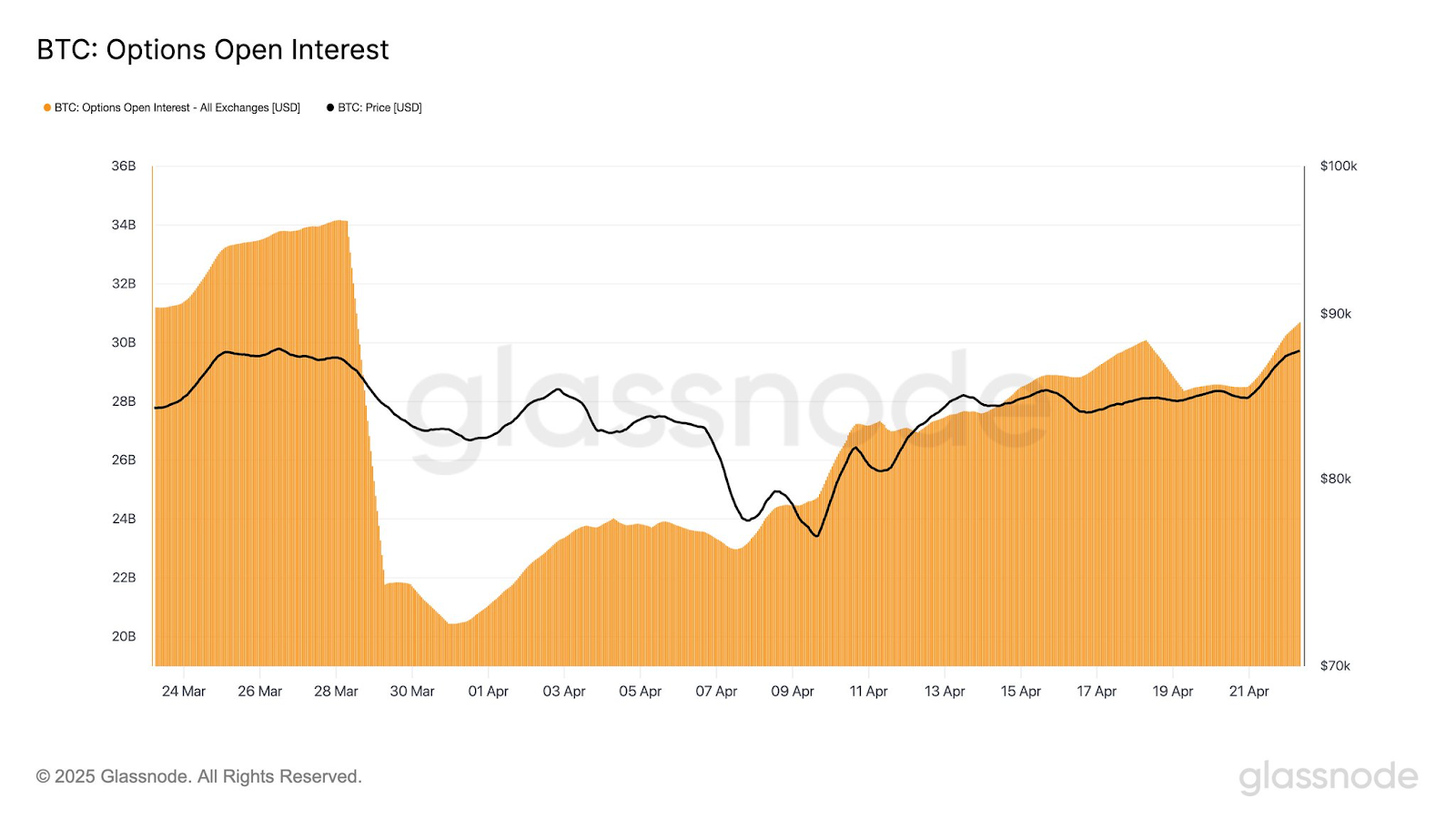

Rising Open Interest (OI)

According to CoingLass market data, the total crypto Open Futures (OI) has risen by around 13 percent in the last 24 hours to float around $ 120 billion. Bitcoin’s OI rose by more than 16 percent in the last 24 hours to float around $ 69 billion at the time of this writing.

Macro -economic racon

The wider cryptomarkt received a bullish prospect on Tuesday, partly catalyzed by remarkable profit in large stock indexes. The Dow, S&P 500 and the Nasdaq indexes had won at least 2 percent during the Mid New York trade session.

The improved negotiations on the global trade war played a crucial role in the bullish prospects.

What now?

From the point of view of technical analysis, the BTC prize is well positioned to gather high in the near future to a new of all time. According to Standard Chartered’s Geoff Kendrick in a memorandum for investors on Tuesday, the BTC prize could gather a new all time if the concern about the independence of the Federal Reserve continues.