- Bullish Sentiment builds up with rising long positions in BTC, ETH, SOL and ADA, so that the volatility is fueled.

- The market risks a cascade of liquidations such as important levels such as $ 85k for BTC or $ 2K for ETH are violated.

Bullish sentiment was intensified in the cryptomarkt in the past week, with top assets such as Bitcoin [BTC]Ethereum [ETH]Solana [SOL]and Cardano [ADA] Witnessing a remarkable increase in long positions.

This increasing accumulation emphasizes the growing trust of traders, but also increases market risks. As Leverage builds, the market becomes more sensitive to volatility.

Even small price movements can cause significant liquidations and fast directional shifts in the coming week.

Longs vs. Shorts: Growing Bullish Sentiment

In the last seven days, Top cryptos have seen a clear shift To bullish positioning. Data shows that long positions exceeds Shorts in Bitcoin, Ethereum, Solana and Cardano, which signals renewed trader optimism.

This trend reflects the growing confidence in the upward momentum of the market, especially since BTC is above the most important psychological levels and Ethereum continues to benefit from long -awaited ecosystem developments.

In contrast to earlier consolidation phases, where shorts typically dominated during uncertainty, this wave of long accumulation reflects optimism about persistent profits. However, the rising leverage on the market also increases the risks.

Any unexpected decline can lead to rapid liquidations and step -by -step effects in markets that are heavily biased in the direction of long positions.

Push liquidation risks like Longs Crowd Bitcoin and Ethereum

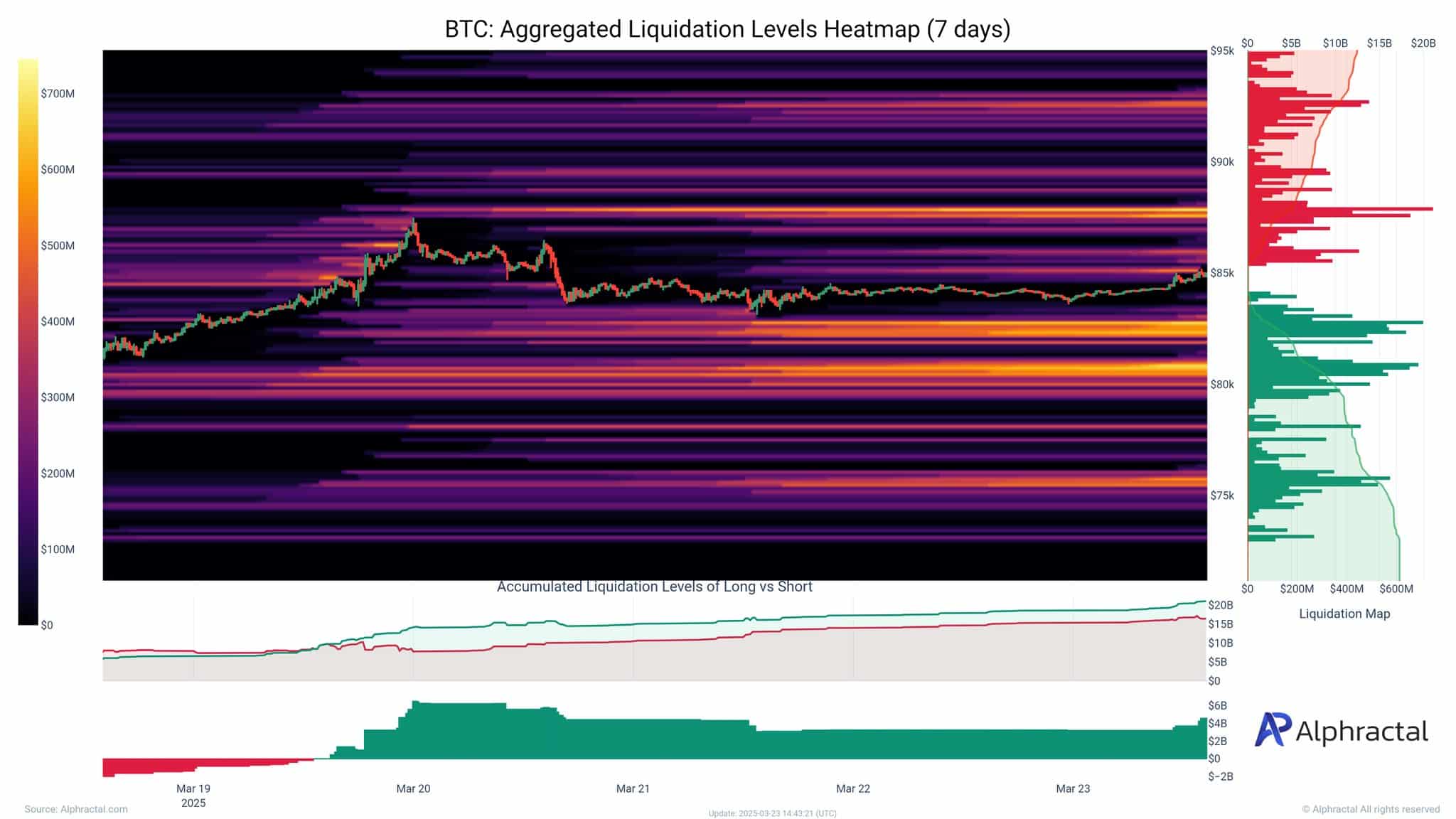

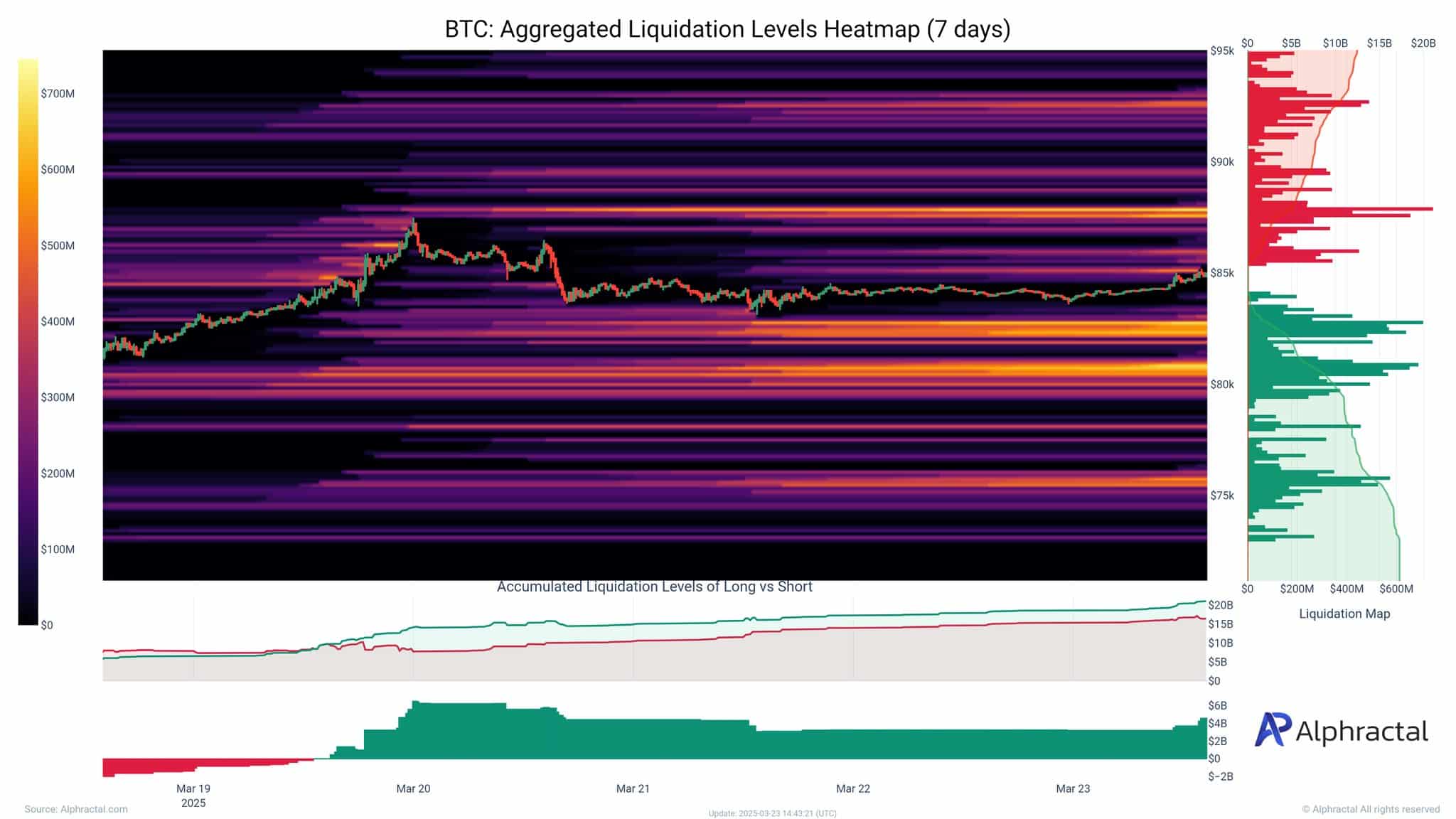

Source: Alfractaal

In the past week, Bitcoin and Ethereum have seen a sharp accumulation in livered long positions, with liquidation heat maps that unveil densely packed risk zones.

For BTC, long liquidations are stacked above $ 85k, with almost $ 20 billion in accumulated liquidation levels – which indicates a potential cascade as prices even somewhat reversing.

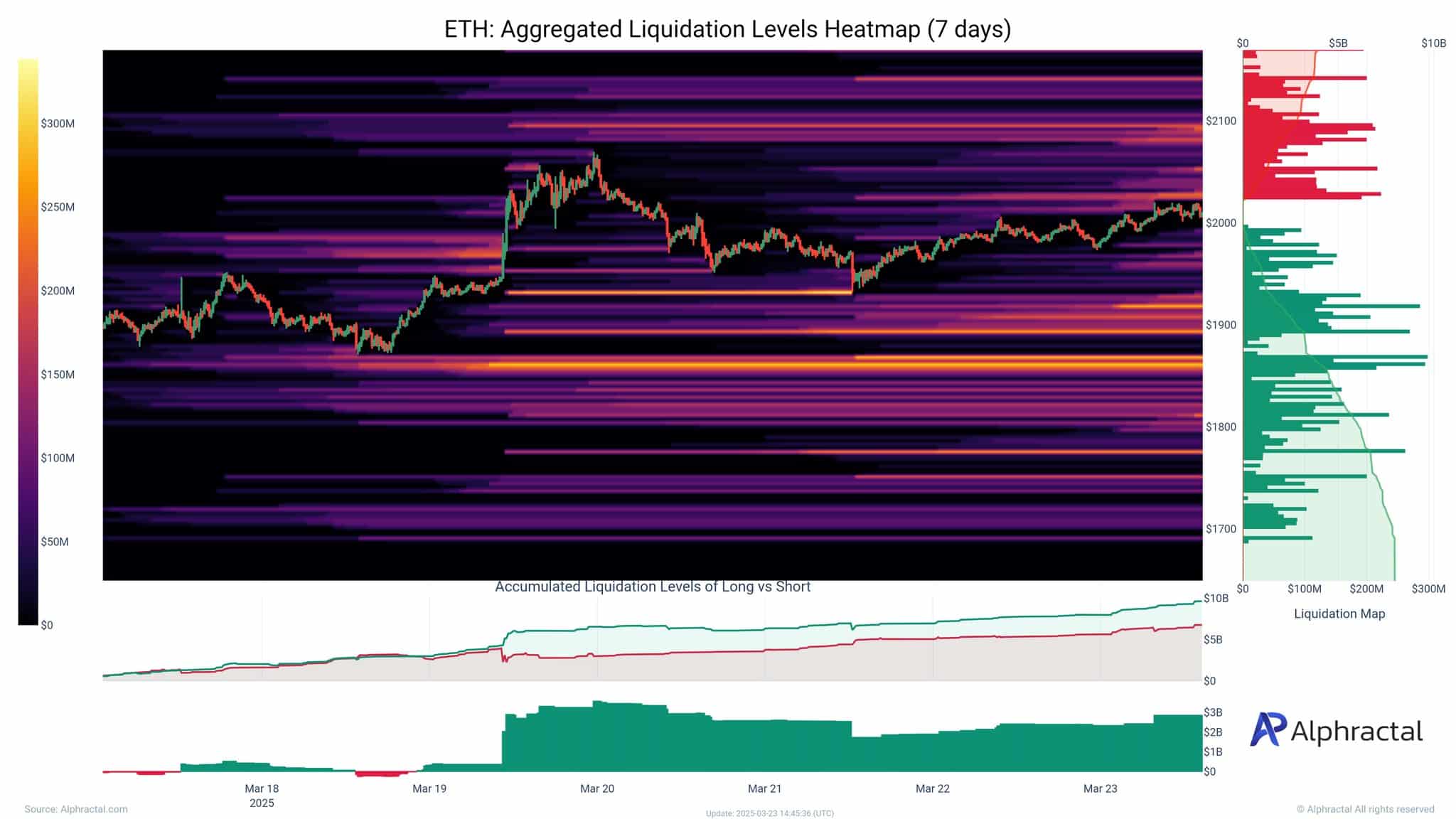

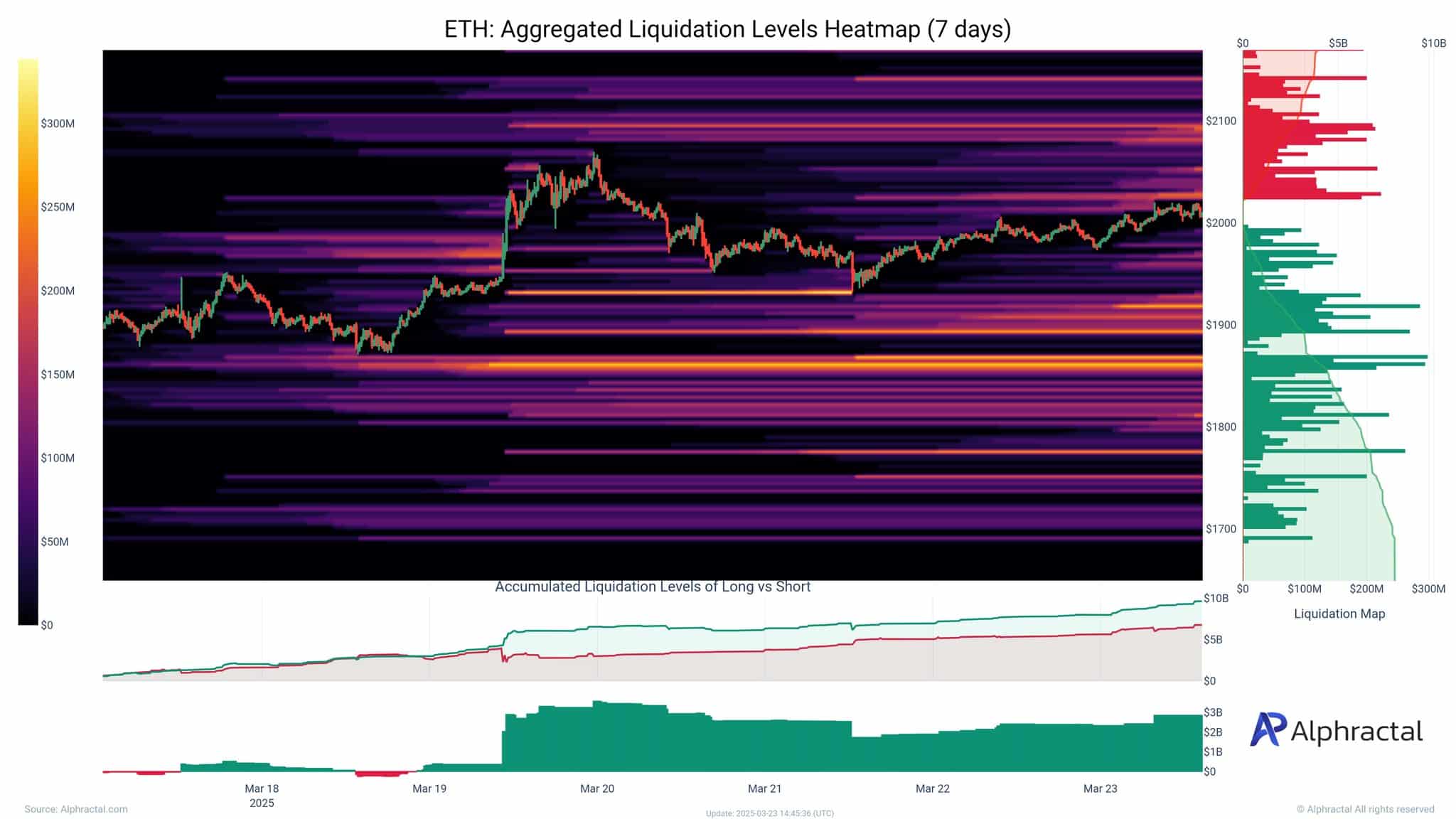

Source: Alfractaal

Ethereum shows similar patterns, with concentrated long positions above $ 2,000 and more than $ 10 billion in liquidation risk. Traders show trust in continuous price growth, but such a heavy positioning creates the fragility of the market.

A sudden drop under $ 80k for BTC or $ 1,900 for ETH could activate liquidations, which intensifies the downward volatility.

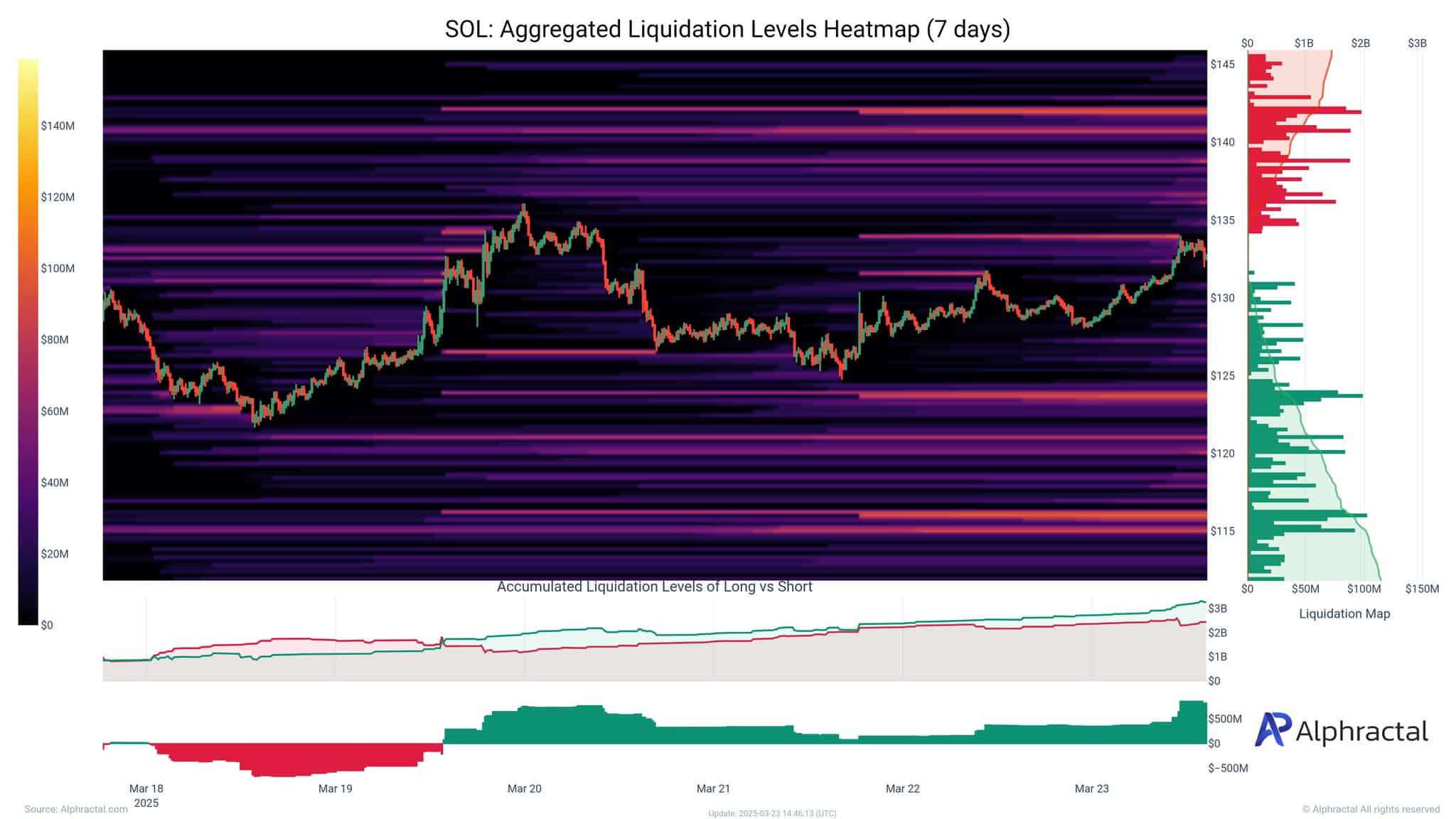

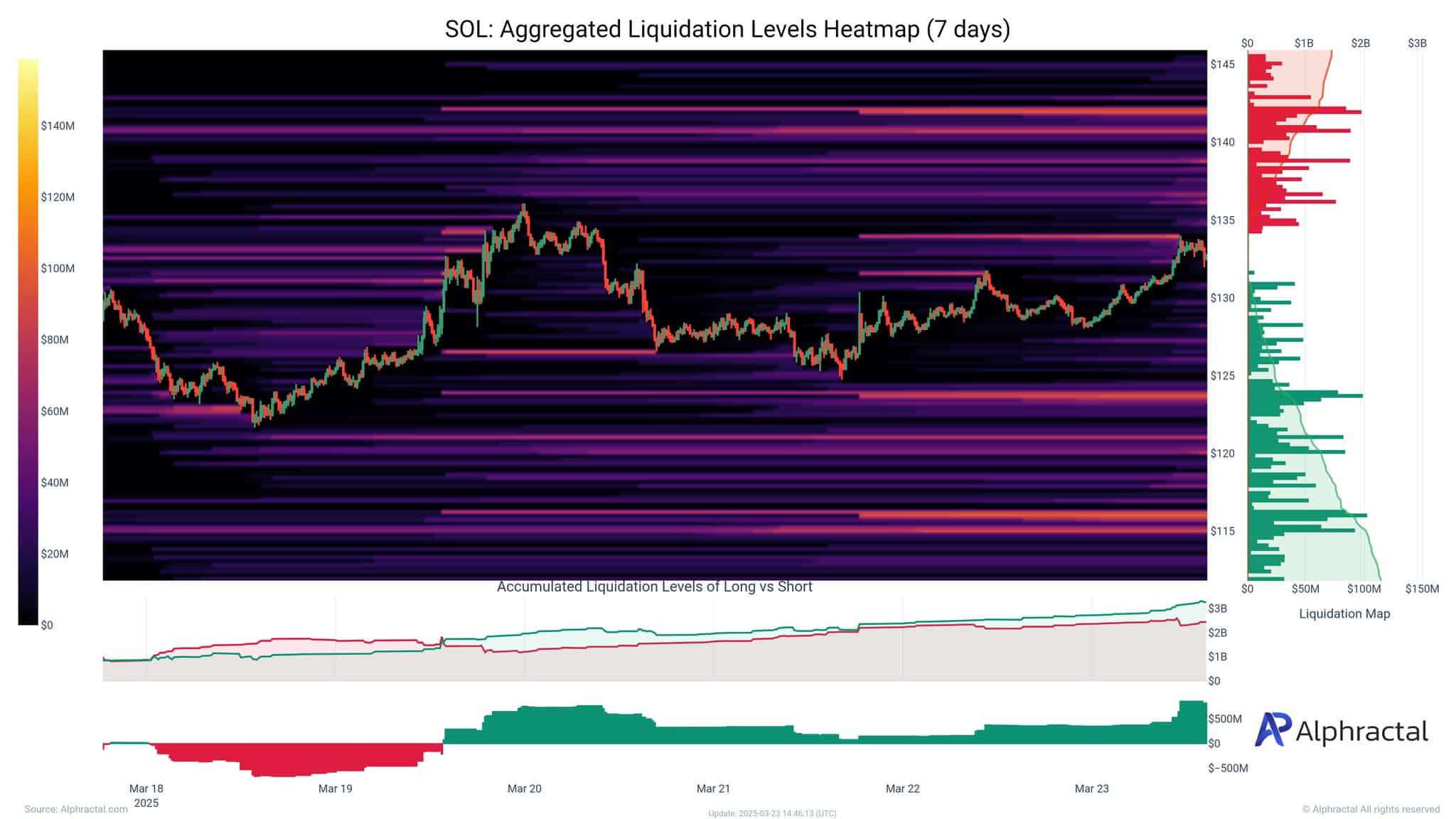

Solana and Cardano: zones with high deployment

Source: Alfractaal

Solana shows a remarkable concentration of long liquidations clustered between $ 140 and $ 145, with accumulated long positions of more than $ 3 billion. This indicates a growing risk of sharp downward volatility as a price momentum stalls.

The Heatmap emphasizes lower support zones around $ 125 and $ 115, where considerable liquidity is possible – possibly if a magnetic levels such as sentiment bearish.

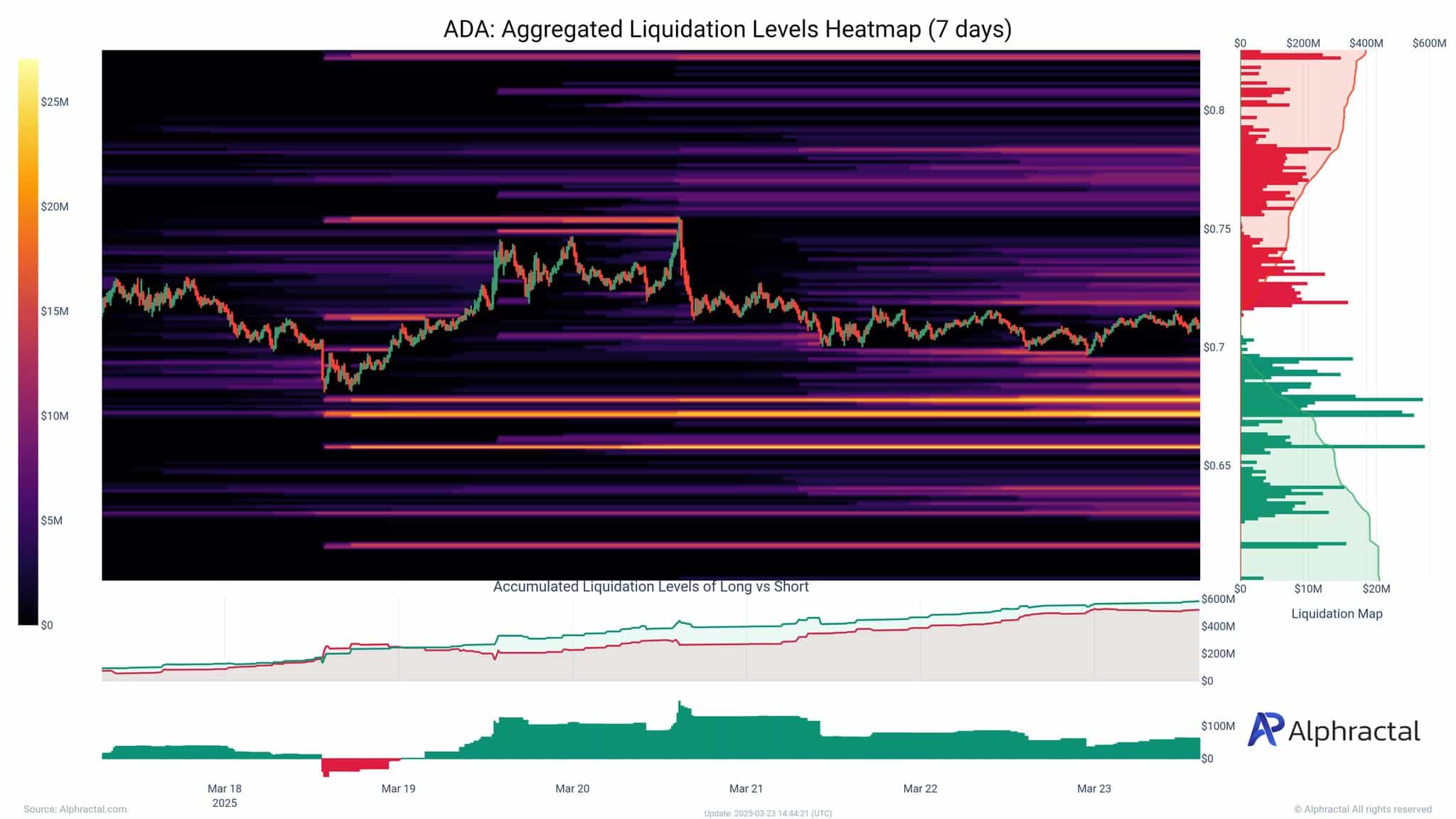

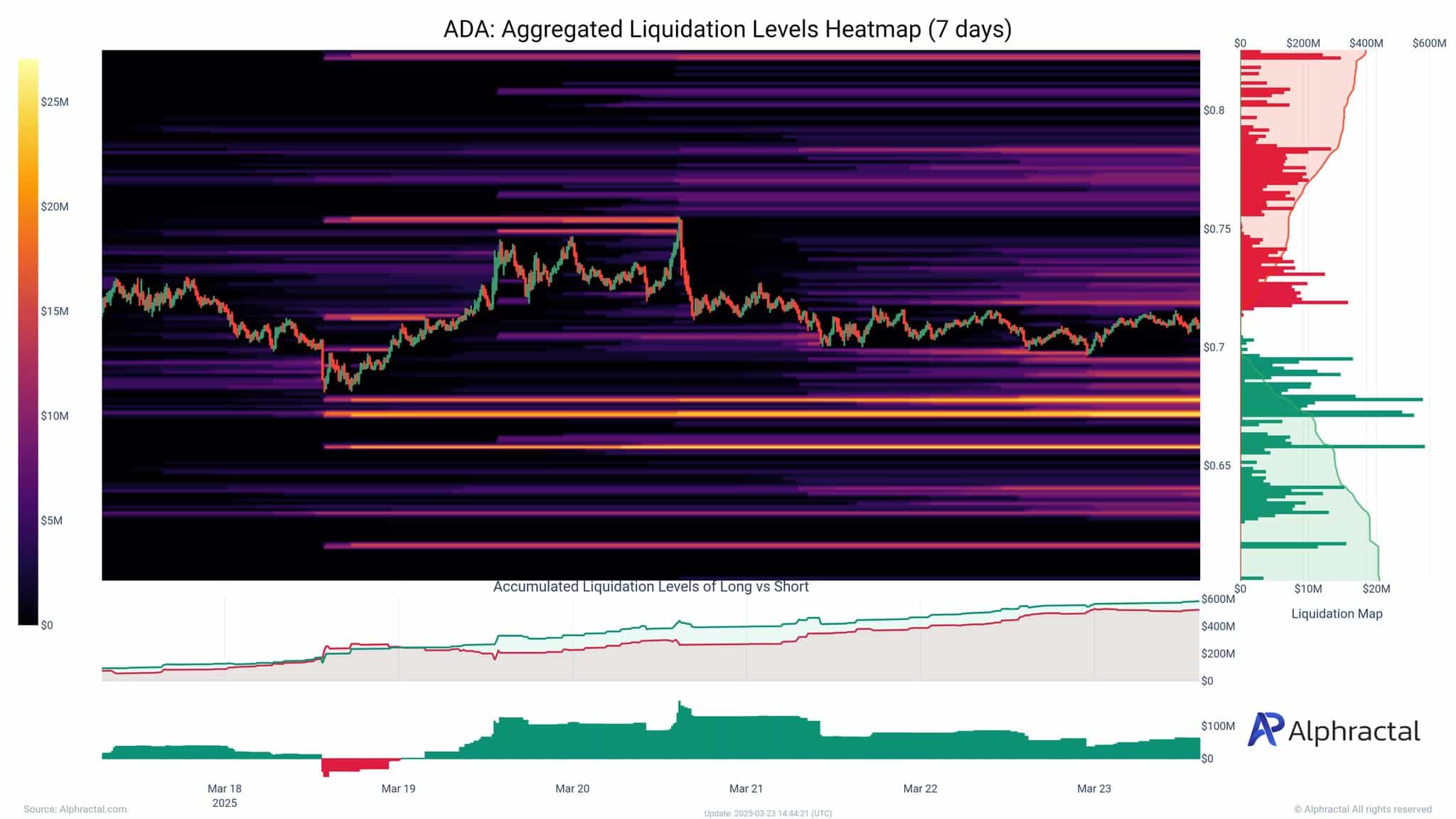

Source: Alfractaal

For Cardano, the heatmap reveals long liquidations that are closed around $ 0.75, in accordance with a recent increase. With more than $ 600 million in accumulated positions, every retracement in the direction of the region of $ 0.65 – $ 0.68 can train that cause liquidations in the cascade.

These zones represent both risk and opportunities, because traders anticipate reactive price behavior around them.