This article is available in Spanish.

Crypto analyst Ali Martinez has revealed the bearish sentiment among Binance’s top traders towards Bitcoin. This development suggests that the flagship could experience crypto soon significant downward pressure.

Binance’s top traders are shorting BTC

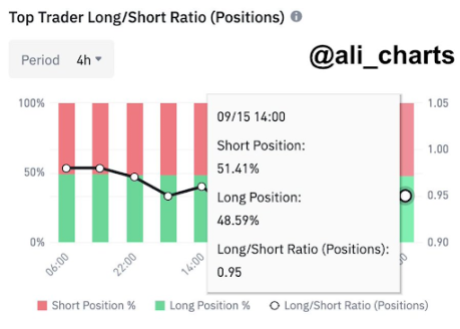

Martinez unveiled in an X (formerly Twitter) after that 51.41% of the top traders on Binance Shorting Bitcoin. This indicates that these traders expect the flagship crypto to experience a price decline despite its price decline recent recovery above $60,000. Indeed, BTC started a price correction this week, dropping to $58,000.

Related reading

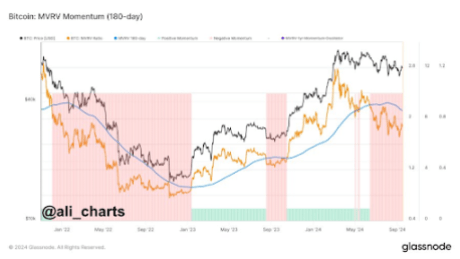

This bearish outlook for Bitcoin suggests that the rise to $60,000 was a relief rather than a bullish reversal. In a recent analysis Martinez also revealed that the flagship crypto was still in a downtrend. He was referring to Bitcoin market value to realized value (MVRV) momentum, which he said shows the flagship crypto has been on a downtrend since falling below $66,750 in June. He added that the trend has not changed yet.

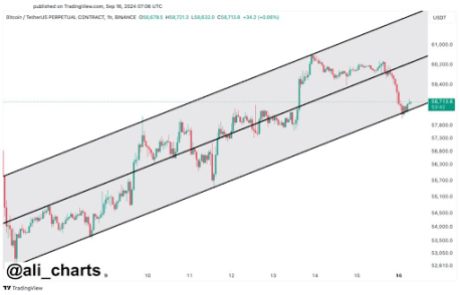

With Bitcoin still in a downward trend, the cryptocurrency is in danger of falling further. Martinez emphasized the Price point of $58,100 as crucial, noting that a break below could lead to a decline towards $55,000. On the other hand, he stated that Bitcoin could return to the mid or upper levels of $60,200 or $62,000 if it holds the lower limit of the parallel channel.

Meanwhile, crypto analyst Jelle recently highlighted $65,000 is the price level Bitcoin needs to regain to enjoy a bullish reversal. However, reaching that price level is difficult for now, especially with the uncertainty surrounding the upcoming interest rate cuts and the US presidential election. Bitcoin bulls appear to be waiting to see how the market reacts to the Fed’s interest rate decision that will be announced on September 18.

It is also worth mentioning that September is historically a bearish month for Bitcoin. This is expected to be no different as investors look to October as the month they return to the market.

Bitcoin could still fall to $15,000

Renowned economist Peter Schiff has warned that Bitcoin could still fall to $15,000. He highlighted what he believes is a triple top on the Bitcoin chart. The expert added that the chart is worse when the flagship crypto is priced in gold. At the very least, the economist expects BTC to fall towards the uptrend line at approximately $42,000but he doubts it will maintain that line of support.

Related reading

As such, he predicts Bitcoin will retest longer-term support between $15,000 and $20,000. While it remains to be seen if that happens, Schiff is known as a Bitcoin bear and it is consistently advocated for gold over the flagship crypto.

At the time of writing, Bitcoin is trading around $58,200, down in the past 24 hours. facts from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com