A popular crypto strategist believes the coming days will be crucial for Bitcoin’s (BTC) future prospects.

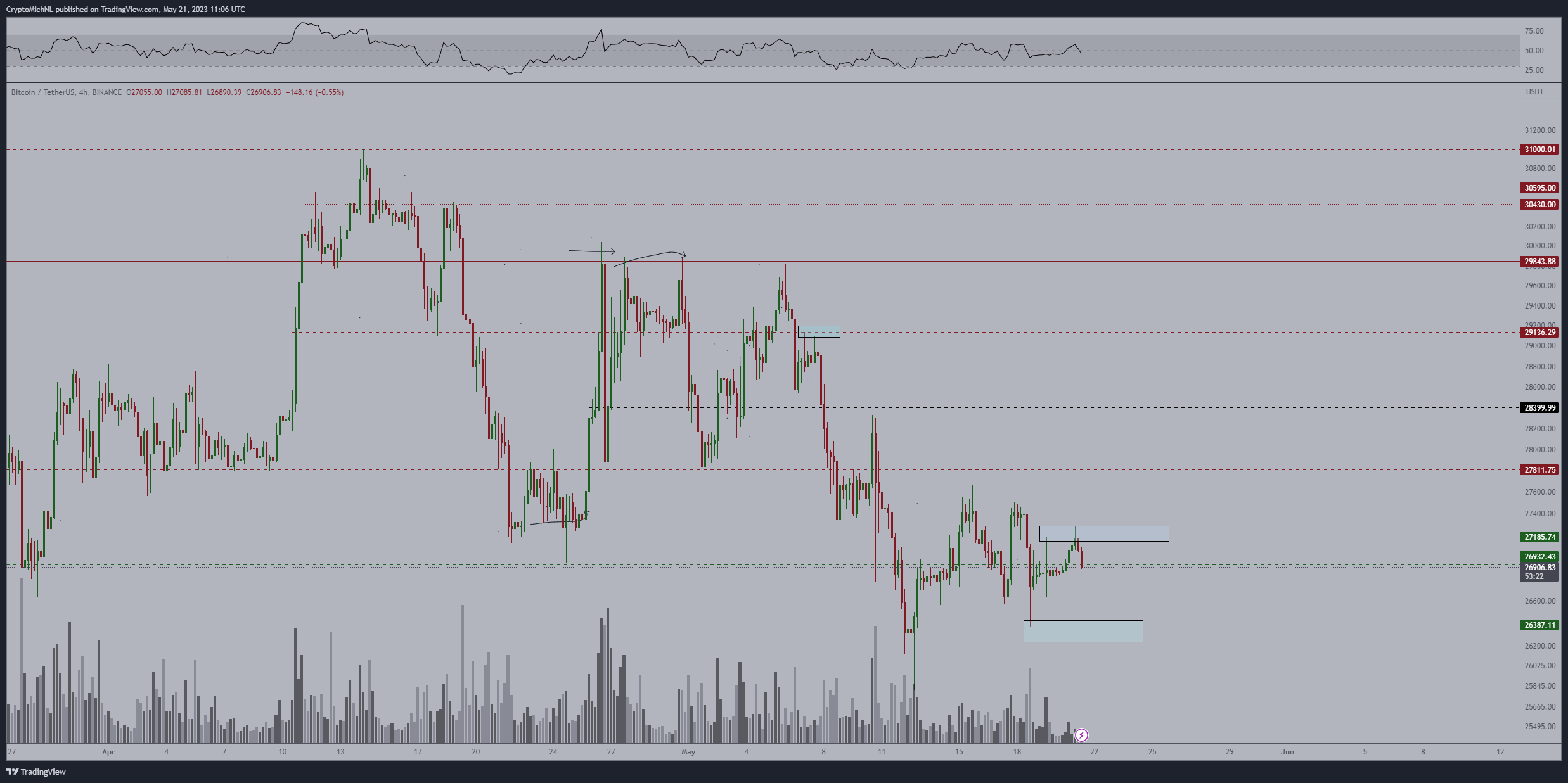

Crypto analyst Michaël van de Poppe tells his 657,000 Twitter followers that he is looking for BTC to retest the 200-week moving average (MA) as support.

According to Van de Poppe, a successful retest of the main technical indicator could suggest that the Bitcoin correction is complete.

“If you go back in history, the 200 (week) MA retest is a great period to collect.

In the past six months, Bitcoin swam underwater for a long time, making it the most undervalued in its history.

Next week it’s up or down. Rapid breakout upwards -> end of correction.”

At the time of writing, the 200-week moving average is hovering at $26,283.

Van de Poppe also says that regaining a key support level on the lower time frame could fuel rallies for BTC. Failure to do so could allow Bitcoin to trade up to $26,000 before a bounce can occur.

“Classic choppy pattern on Bitcoin.

Declining at $27,200 and consolidating as the CME (Chicago Mercantile Exchange) gap is also around $26,900.

Bitcoin needs to break and flip $27,200 if we want to see continued momentum.

Among us, around $26,000-26,500 -> 200 week MA.

At the time of writing, Bitcoin is trading at $26,665, down more than 2% in the past 24 hours.

Don’t Miss Out – Subscribe to receive crypto email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey