- AVAX rose 8.2% last week amid strong bullish signals.

- Analysts predicted a potential rally, with price targets of $130 and $228 in the coming months.

Amid a general downturn in the global cryptocurrency market, Avalanche [AVAX] has managed to differentiate itself and has become one of the 20 largest cryptocurrencies with green performance based on market capitalization.

Despite broader market declines, AVAX has seen a notable improvement in performance, with assets up 8.2% over the past week.

This positive momentum has also continued over the past 24 hours, with the asset posting an additional 1.2% gain and currently trading at around $29.46 at the time of writing.

Next target for AVAX?

Amid AVAX’s green performance, renowned crypto analyst CryptoBullet recently took to X (formerly Twitter) to share his views on Avalanche’s current price movement.

According to the analyst, AVAX has broken the multi-month ‘Falling Wedge’ pattern, a bullish technical signal in the market analysis.

Falling wedges typically occur after a long downtrend, where the price consolidates and begins to form lower highs and lower lows, resembling a wedge shape.

Once the price breaks above the upper trendline of this wedge, it often signals the end of the bearish trend and the beginning of a new rally.

CryptoBullet commented about the recent outbreak, stating:

“AVAX broke out of a multi-month Falling Wedge. I expect a good rally in the next three to six months.”

He further shared ambitious price targets for the upcoming rally, predicting that Avalanche could rise to $130 and possibly as high as $228 depending on market conditions.

These price targets, while ambitious, reflect the growing optimism surrounding Avalanche as the crypto market looks for signs of recovery.

Review of the technical characteristics of Avalanche

While technical analysis points to a possible rally for AVAX, a deeper look at the asset’s fundamentals is necessary to assess the likelihood of such a significant price increase.

An important metric to consider is the Relative Strength Index (RSI), which measures the momentum of an asset’s price movements.

The RSI fluctuates between 0 and 100, with values above 70 indicating an overbought situation and below 30 an oversold situation.

Source: CryptoQuant

At the time of writing, Avalanche’s RSI stood at 58 facts from CryptoQuant.

This showed that the asset was in a neutral state (neither overbought nor oversold), which gives room to move up or down based on broader market factors.

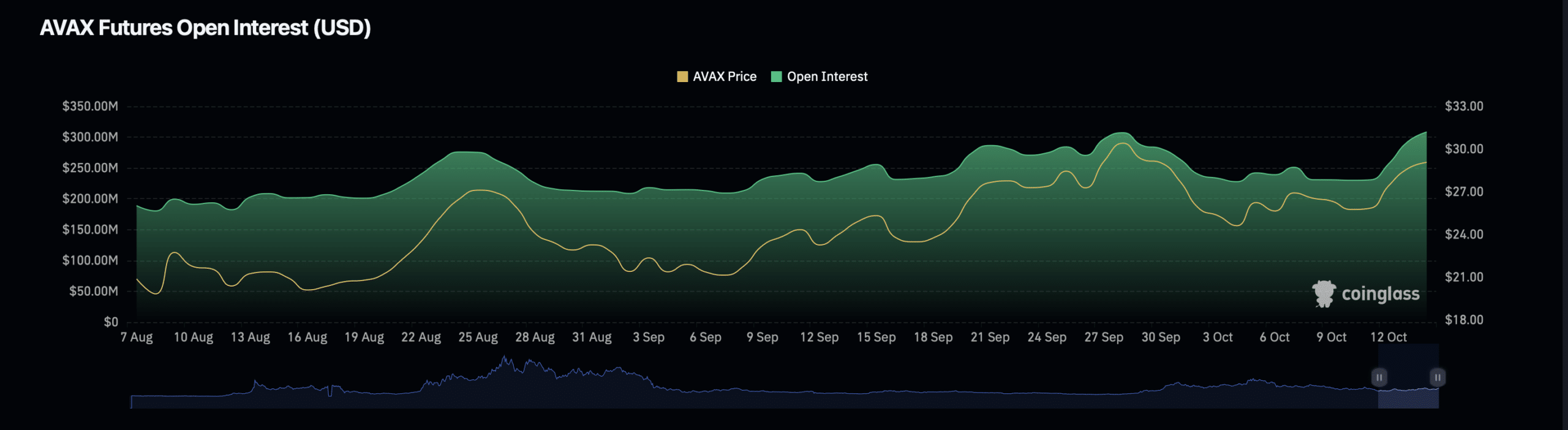

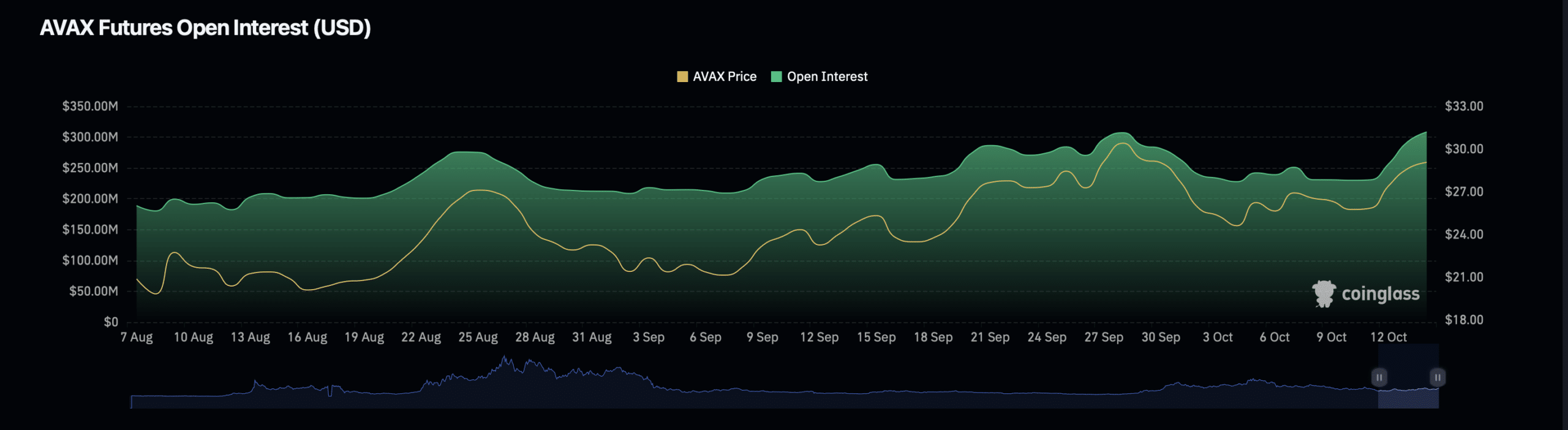

Besides the RSI, another crucial metric is Open Interest, which measures the total number of open futures contracts for an asset.

Facts from Coinglass revealed that AVAX’s Open Interest was down 2.33%, valued at $299.64 million at the time of writing.

Source: Coinglass

Read Avalanche [AVAX] Price forecast 2024–2025

However, this decline was offset by a significant 27% increase in AVAX’s Open Interest volume, which reached $541.01 million.

This indicated growing participation in the AVAX derivatives markets, a factor that could influence the asset’s price movement in the short term.