- A recent spike in high-volume trades coincided with TON’s price decline, signaling potential near-term weakness

- However, a possible rally could be forming as chart patterns suggested an upward shift could follow

Over the past month, Toncoin [TON] has lost 10.12% of its value – A sign of recent bearish momentum. And yet, the surge in high transaction volumes, combined with emerging technical indicators, suggested this dip could be temporary, with a recovery likely in the near future.

Big sell-off pushes TON into a short-term decline

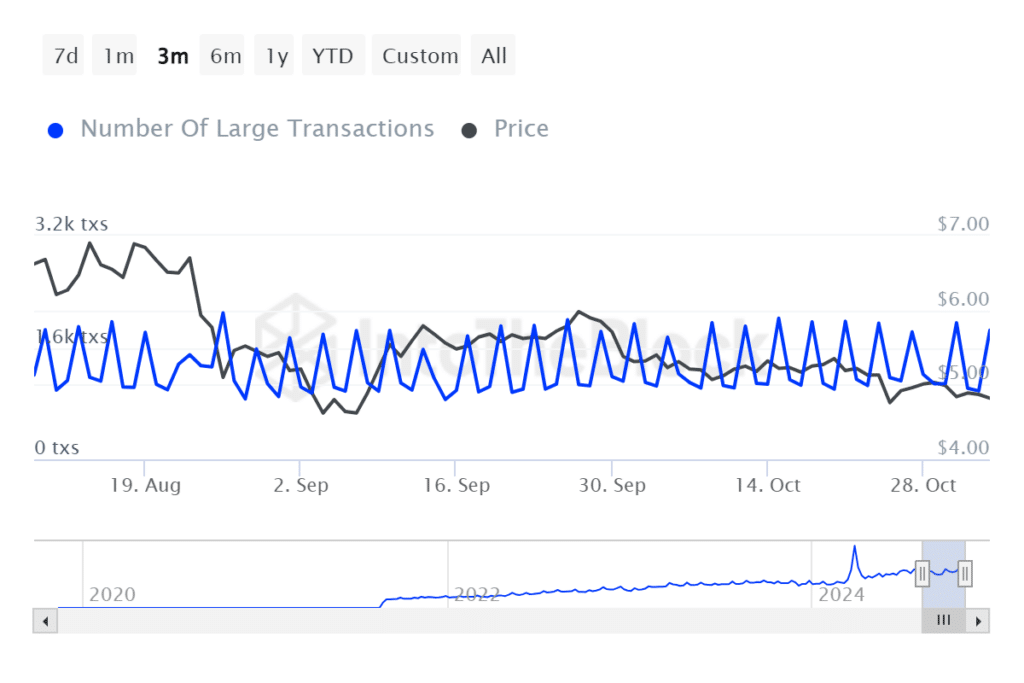

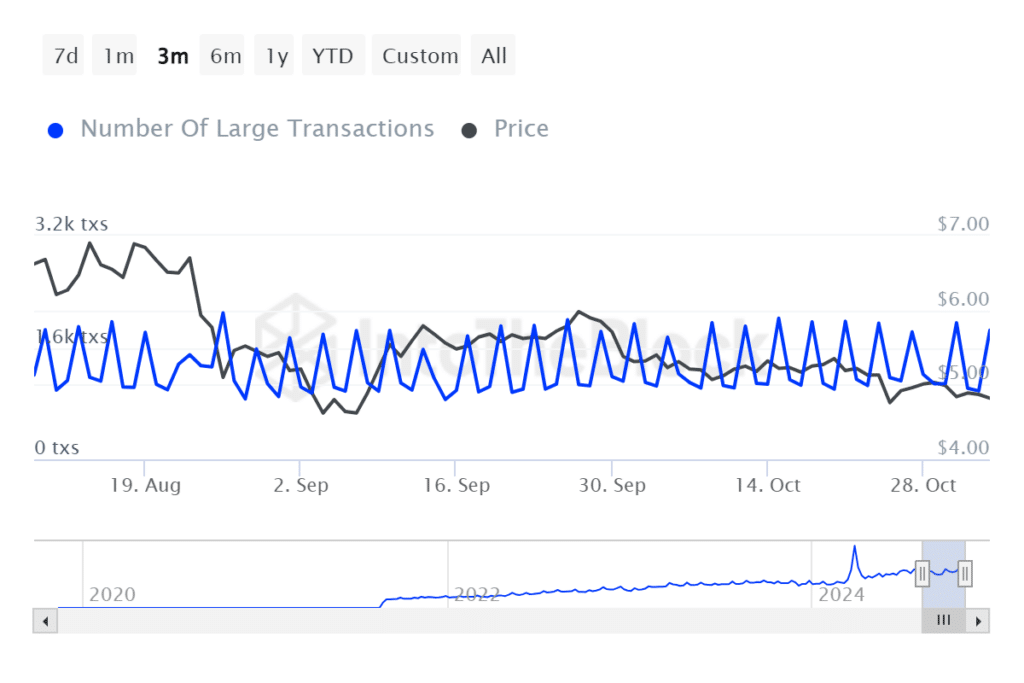

TON has recorded an increase in the number of large transactions over the past 24 hours. According to data from InTheBlokthese transactions have increased to 1,850.

A spike in large trades, coupled with a price drop and a 27% increase in volume to 195.15 million, combined to signal bearish momentum. They also pointed to a further decline as whales are sold.

Source: IntoTheBlock

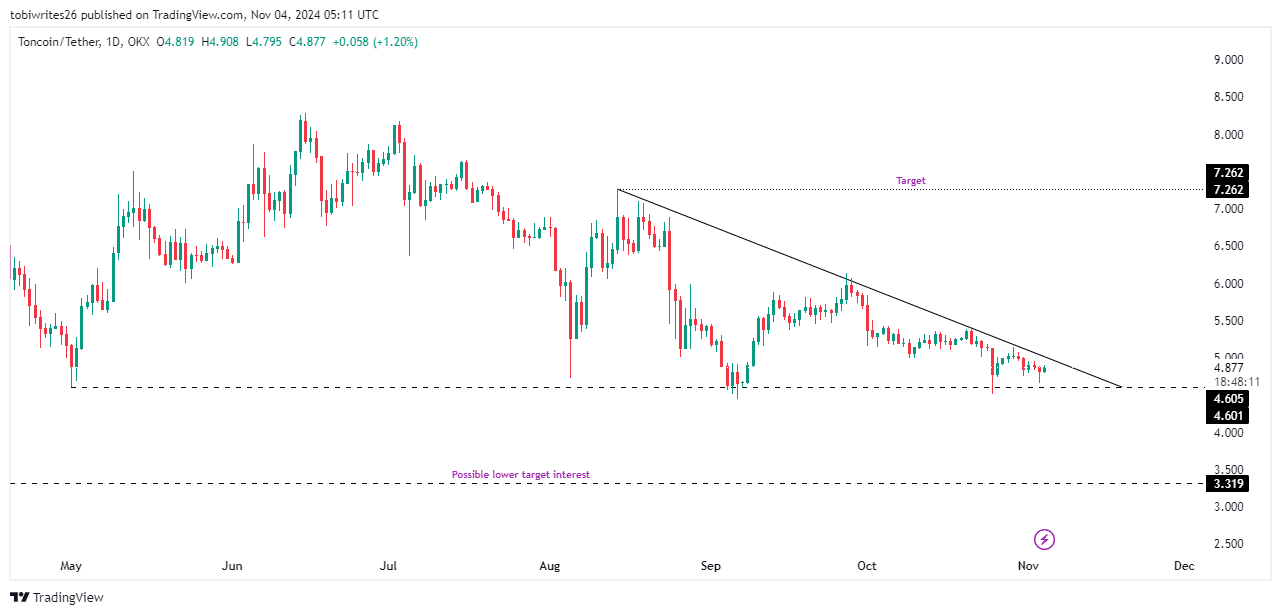

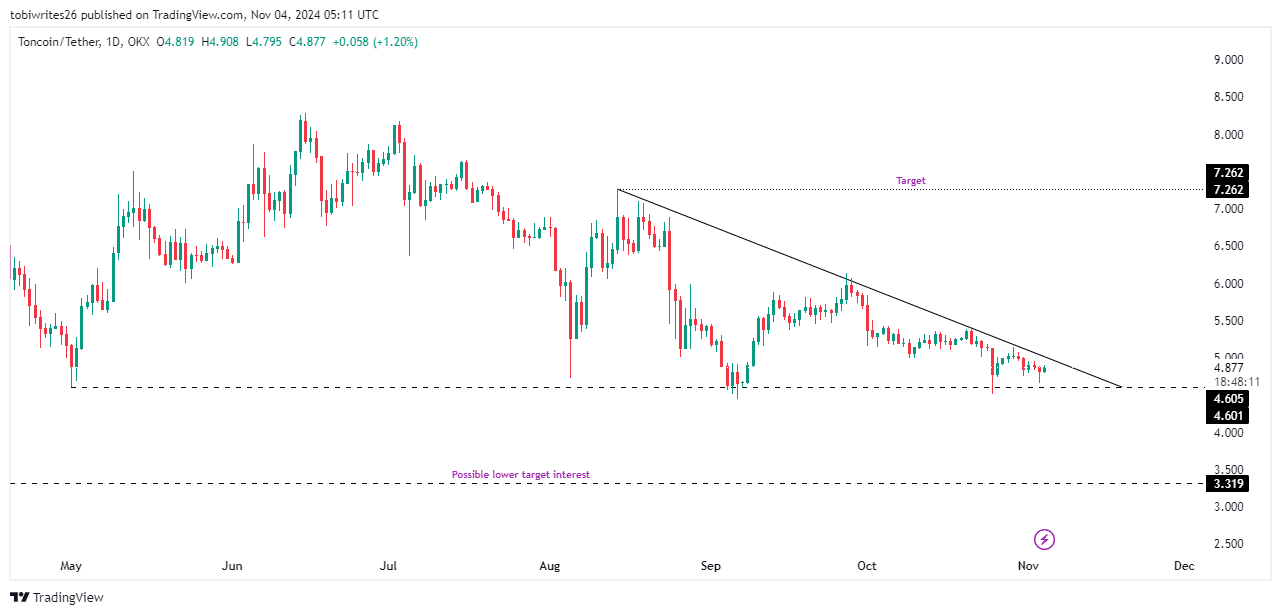

Technically, this downturn is expected to be short-lived, with TON likely to reach a support level around $4,601. This is where a strong buying cluster could trigger a price rebound, which wasn’t far off the press time price of $4,873.

This support appeared to be in line with a bearish line pattern, which could act as a bullish catalyst if TON breaks above the line at a confirmed close. Such a breakout could push the price towards a target of $7,262.

However, if selling pressure increases, TON may instead fall to a lower support level around $3,319.

Source: trading view

The sentiment is consistent with TON’s bullish outlook

The prevailing narrative for TON suggested that a short-term decline could precede a recovery that could drive the asset towards a long-term target.

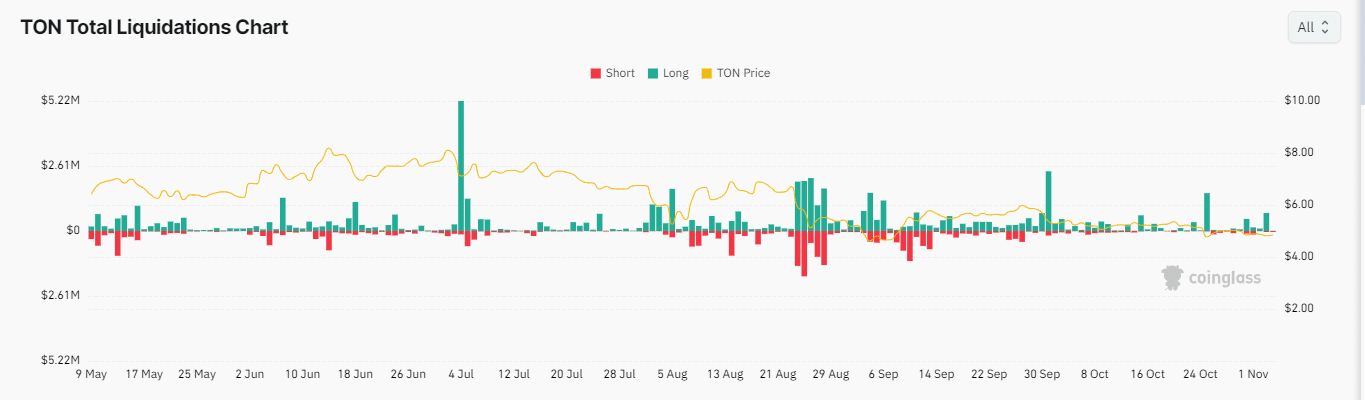

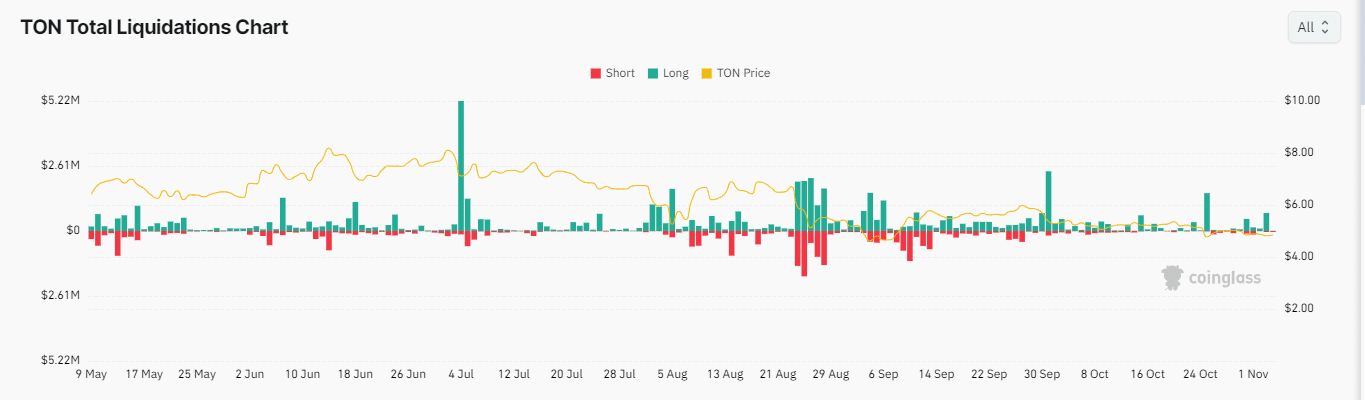

Market sentiment at the time of writing pointed to a possible short-term decline. Especially if liquidation details Over the past 24 hours, long traders have suffered significant losses – a sign of potential downside pressure.

More specifically, long traders have lost $340.9k, a notable contrast to the $76.76k lost by short traders. This disparity is a sign that the market is moving against the side of the market with higher losses – a sign of even more downside for TON.

Source: Coinglass

However, as short liquidations were relatively close to the level of long liquidations, selling pressure remained subdued. What this means is that any decline could be limited and set the stage for a quick recovery.

Further supporting this potential reversal was the Weighted Funding Rate – a fee exchanged between traders on perpetual futures markets based on long and short positions. At the time of writing it had turned positive.

A positive funding rate means that long positions are paying off short positions – a sign of increasing bullish sentiment. This shift suggested that despite a possible short decline, TON’s price could soon find support and turn north.

In summary, while TON could see a pullback in the short term, rising bullish sentiment and subdued selling pressure suggested that any decline could be short-lived. This could potentially push the asset towards an accelerated recovery.