- Toncoin rose to the top as the coin with the highest social and market activity in the past 24 hours

- It is worth evaluating whether these findings could influence TON’s short- or long-term bullish outlook

Could Toncoin be on the verge of an interesting phase of adoption and robust growth in the coming months? Well, the altcoin gained significant popularity in 2024 thanks to TON’s strong focus on play-to-earn games. However, things have cooled on that front since then. And yet the latest set of data sets seemed to suggest that the potential excitement could be building again.

According to LunarCrush social intelligenceToncoin has been on the receiving end of a lot of renewed interest lately. This claim was supported by the fact that at the time of writing it was the highest ranked cryptocurrency in terms of social and market activity over the past 24 hours.

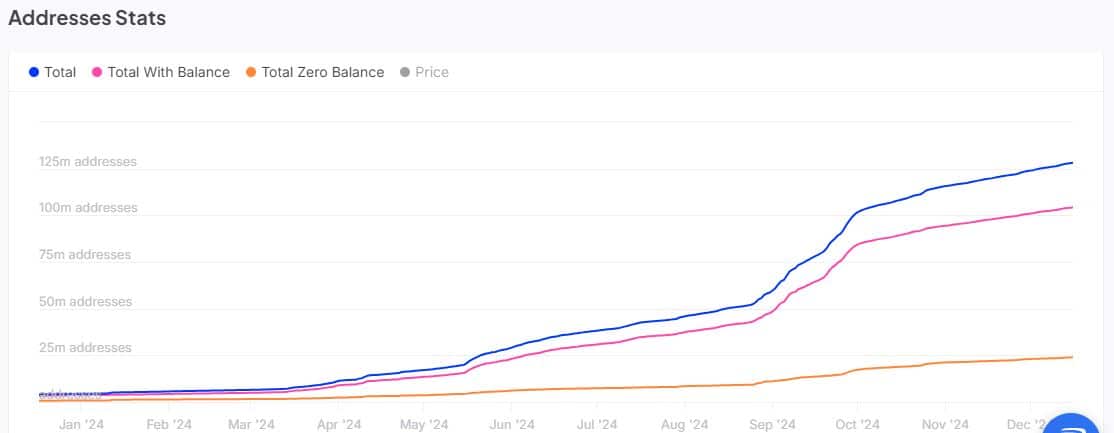

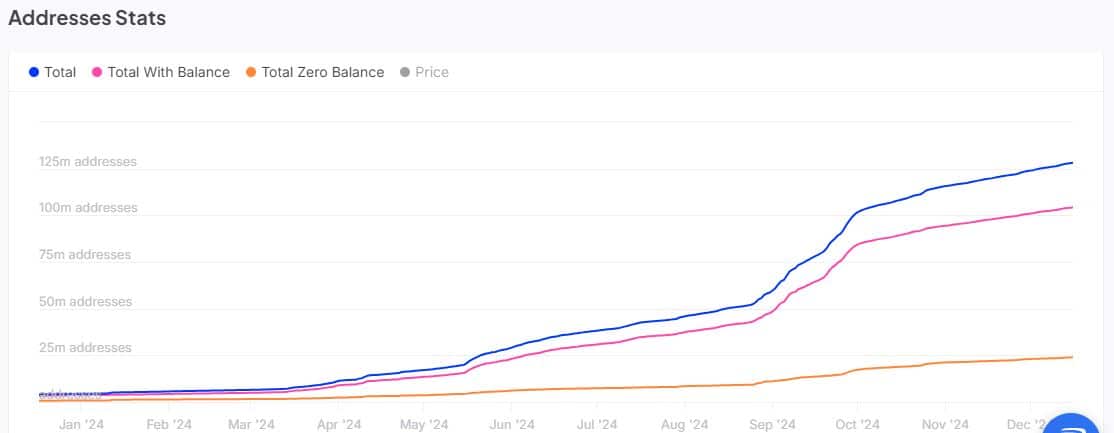

An increase in social activity often indicates a growing or renewed interest. However, will this observation also indicate a growing demand for Toncoin? According to CryptoQuant, TON addresses have been on a positive growth trajectory over the past twelve months.

For context, the network had 4.37 million addresses as of January 2024. About 3.6 million of those addresses had a balance and the remaining were zero-balance addresses. CryptoQuant found that these addresses have since grown to 128.17 million, according to the latest data.

Source: IntoTheBlock

TON grew to 104.24 million addresses with a balance and 23.93 million addresses with a zero balance. This observation confirmed the rising long-term demand for Toncoin. However, this does not indicate a connection with rising social sentiment.

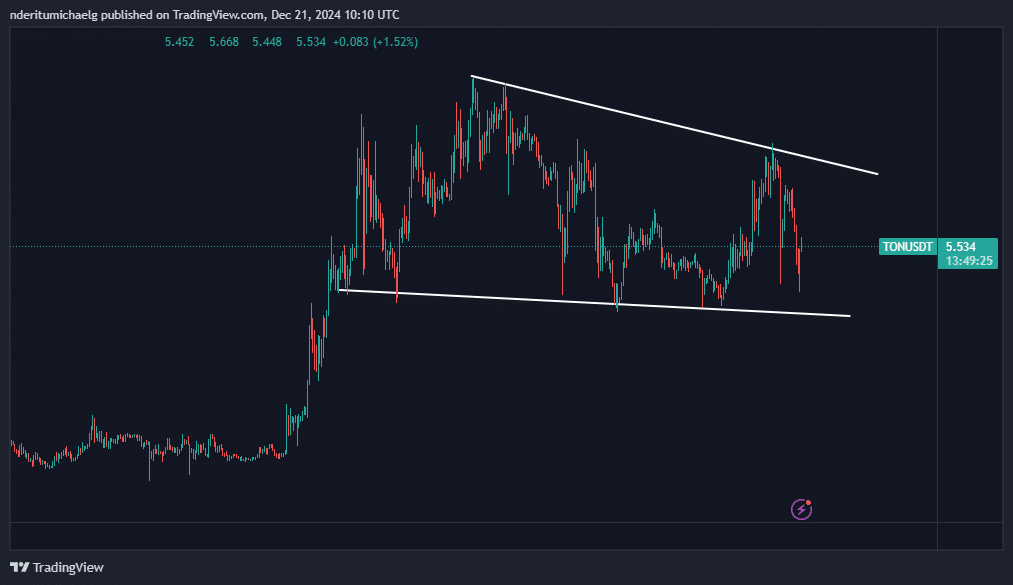

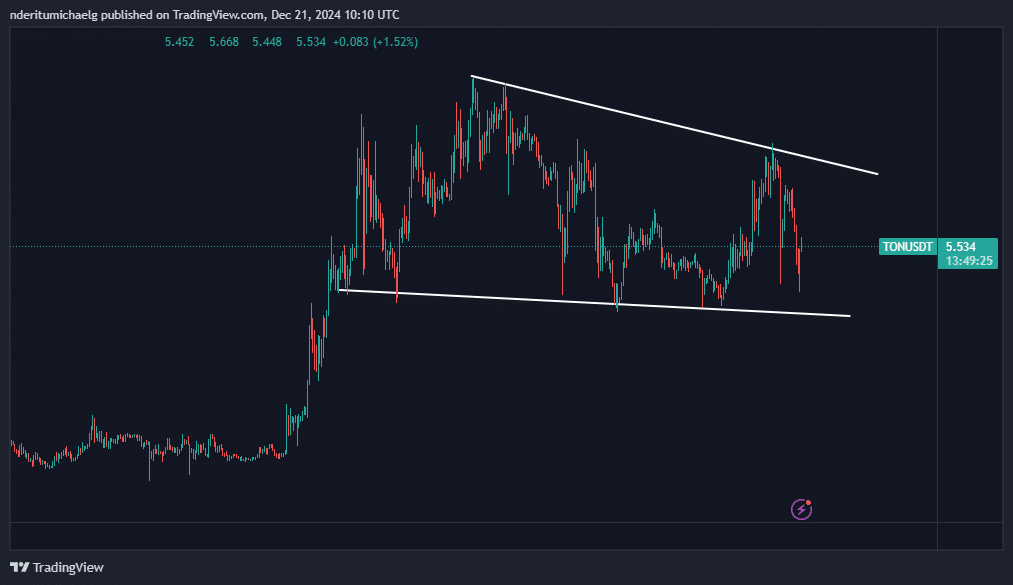

However, short-term price action shows some correlation. For example, the price bounced back over the past two days after an overall bearish week. Toncoin fell 26% from its weekly high to a weekly low on Friday.

The cryptocurrency hit a low at $4.77 on Friday, followed by a 15% rally to the press-time price level of $5.52. This was in line with the spike in social sentiment.

Source: TradingView

Toncoin has also been trading in a long-term bullish flag pattern for the past six months. This suggested that a long-term bullish breakout could occur in 2025.

Some notable observations that could impact near-term price action include a decline in spot outflows since mid-December. This could pave the way for positive flows. This appeared to be associated with a shift from a negative to a positive weighted funding rate over the past 24 hours.

source Coinglass

This also confirmed that the latest selling pressure has caused a sentiment shift in favor of post-discount accumulation.

The shift was also supported by growing volumes in the derivatives segment. TON’s volume was $151.33 million on December 15, while the last 24 hours saw the same increase to $476.66 million.

Source: Coinglass

Continued robust volumes could contribute to more recovery in the coming days. The bulls are likely to be more dominant if renewed social activity exerts enough buying pressure.