- TON addresses are growing rapidly and were on track to overtake Ethereum soon.

- Toncoin whales and institutional holders have contributed to the selling pressure.

Which coin between Ethereum [ETH] and Toncoin [TON] has more potential? Both are considered attractive to investors, but are recent CryptoQuant Analysis suggests that TON will likely surpass ETH in terms of number of holders.

Maartunn’s bold claim was based on the average growth rate that TON has maintained in recent months. According to the analysis, TON gained an average of 500,000 new followers per day over the past four weeks.

If the network continues at this pace, the network will overtake Ethereum by the end of December.

However, Maartunn’s analysis noted that ETH holders may also increase and it is also possible that the growth of TON holders could slow down.

How do TON addresses compare to ETH addresses?

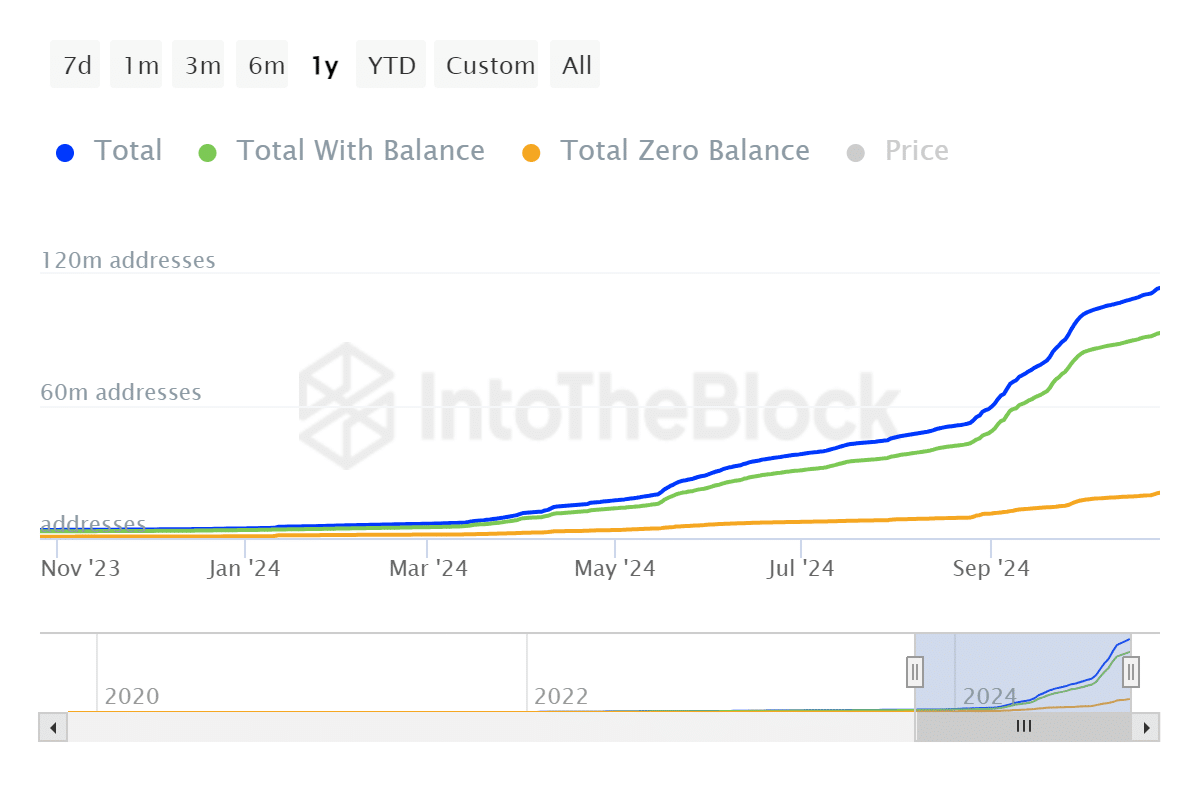

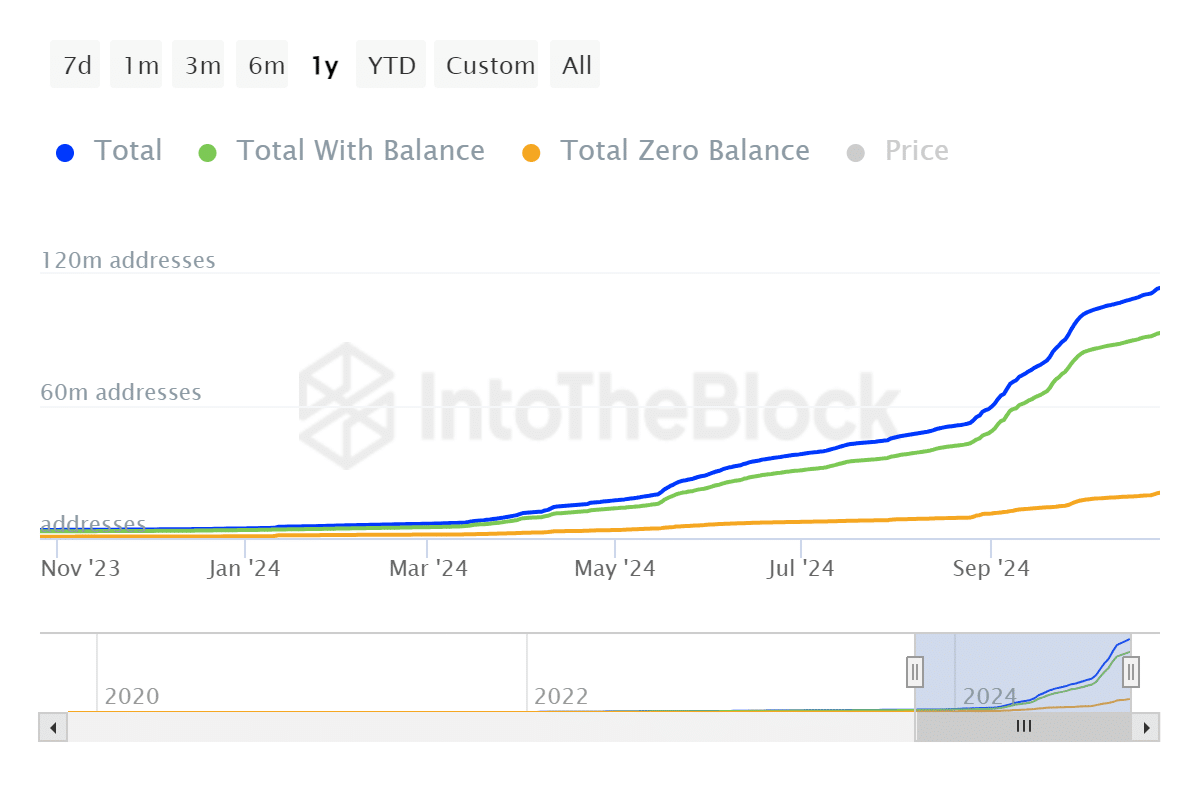

The total number of TON addresses as of October 26 was 113.71 million addresses. 93.18 million of these had a balance, while the remaining 20.54 million addresses had a zero balance.

For context, TON had a total of 3.63 million addresses exactly twelve months ago, increasing the total number of addresses by 3,032%.

Source: IntoTheBlock

In contrast, Ethereum had a total of 309.32 million addresses as of October 26. A significant improvement compared to the 270.35 million addresses exactly twelve months ago.

A growth of 14.42% year on year. This means that TON addresses grew 210 times faster than Ethereum addresses.

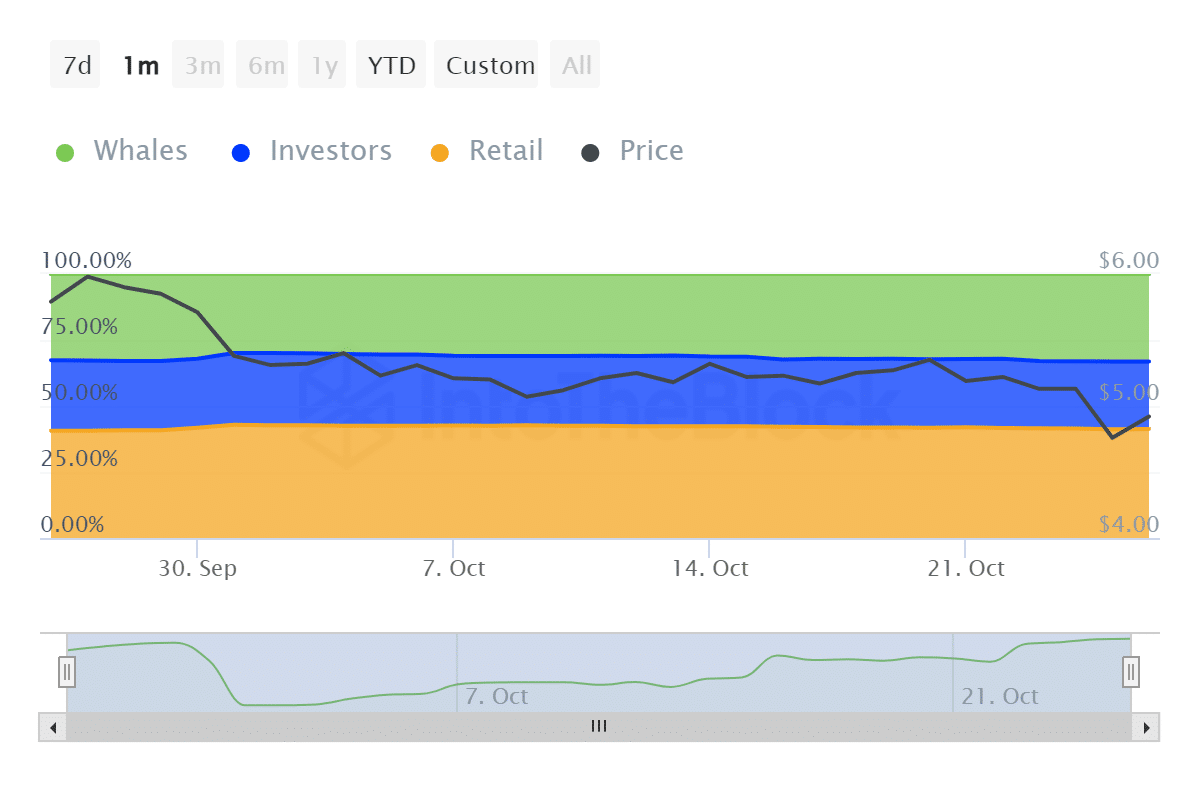

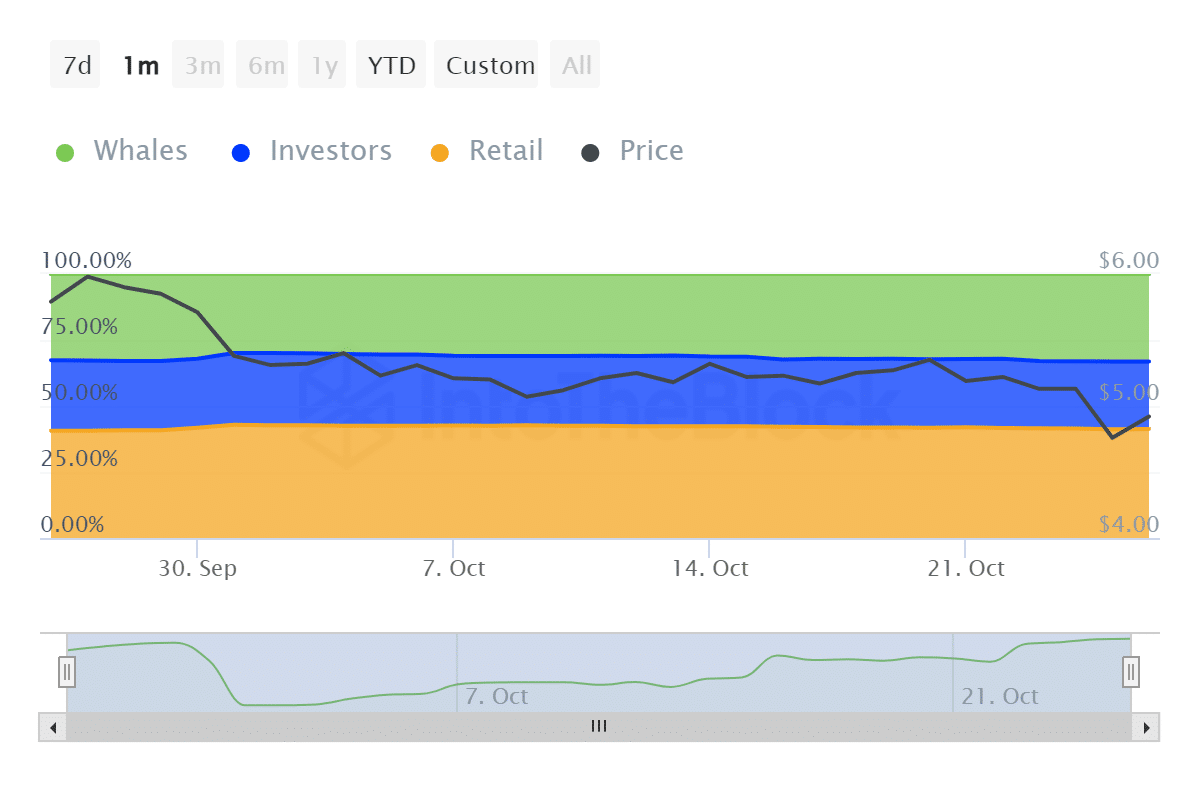

In terms of ownership statistics, historical concentration data showed that demand for Toncoin has been declining over the past 30 days. Whale balances fell from 32.63% on September 26 to 33.19% at the time of writing.

Source: IntoTheBlock

Investor balances have fallen from 26.73% of supply to 25.51% over the past four weeks. Finally, retail TON supply grew from 40.65% to 41.31% over the same period.

This confirmed that whales and investors have trimmed their balance sheets, while retail has accumulated.

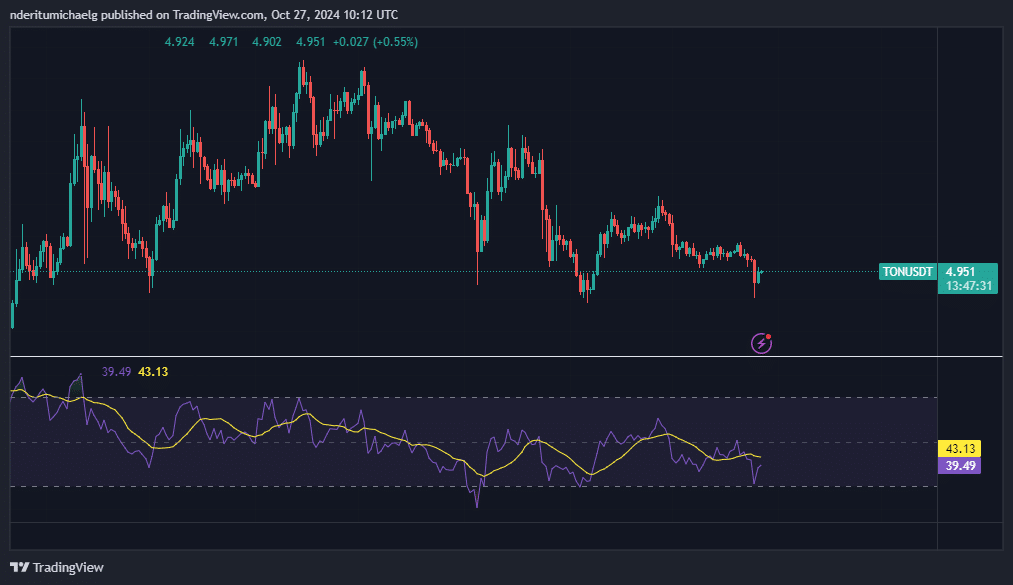

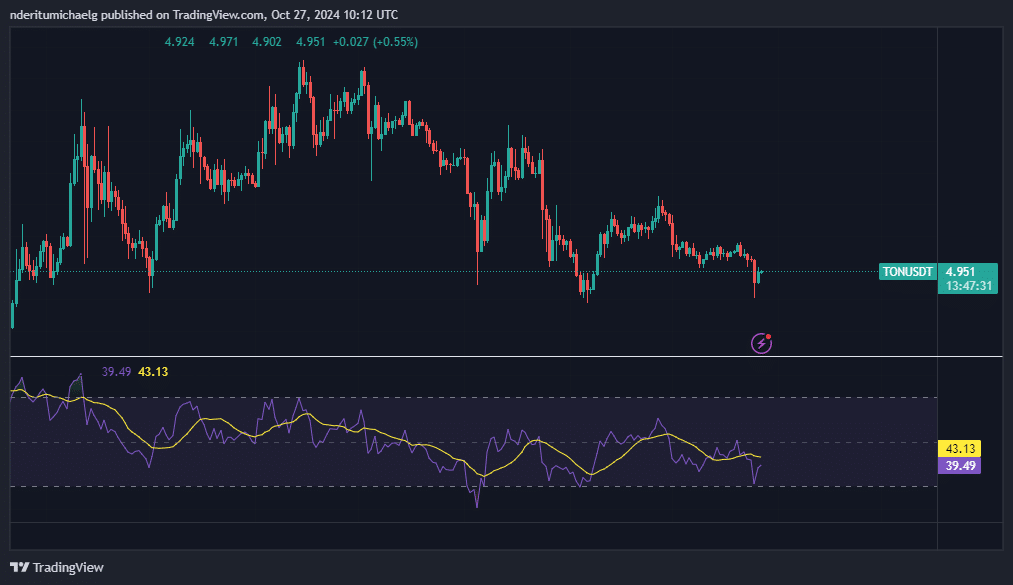

Toncoin price action summary

While most top coins built on September’s bullish momentum, Toncoin’s price action slumped for a retest of September’s lows. The price fell to a low of $4.51 on October 25, which represented a 16% drop from the weekly high.

Source: TradingView

Read Toncoin’s [TON] Price forecast 2024–2025

TON’s latest crash sparked a resurgence in demand, pushing the price to $4.95 at the time of writing.

However, it also highlighted the fact that the cryptocurrency was undervalued and this could attract buyers looking to get in at discounted prices.