The current volatility in the cryptocurrency market has confused traders and investors. In the midst of this, XRP, the native token of Ripple Labs, is ready for a price decrease, since sentiment shifts to the Bearish side among crypto enthusiasts.

70 million XRP dump on exchanges

Recently a prominent crypto expert posted on X (formerly Twitter) that crypto -whales have dumped more than 70 million XRP tokens in the past four trading days. This enormous sale has received considerable attention from crypto participants.

The market regards dumps as a bearish signal, which may lead to a remarkable price decrease, which is currently being reflected in the XRP price.

Current price momentum

The active is currently being traded in the vicinity of $ 2.97 and has experienced a price fall of more than 4.45% in the last 24 hours. The trade volume has remained stable in the same period, which has no significant change.

XRP Technical analysis and key levels

According to the technical analysis of experts, XRP has been moved on a daily period within a decreasing parallel channel. However, the price has formed a bearish -flooding candlestick pattern and seems to decrease.

Based on recent price action and historic momentum, there is a strong possibility that XRP could fall by more than 8.5% to reach its support level at $ 2.75.

Despite the Anderish Market Outlook, the Altcoin has succeeded in keeping above 200 exponential advancing average (EMA) on the daily period, which suggests that XRP is in an upward trend.

Traders’ Bearish Outlook

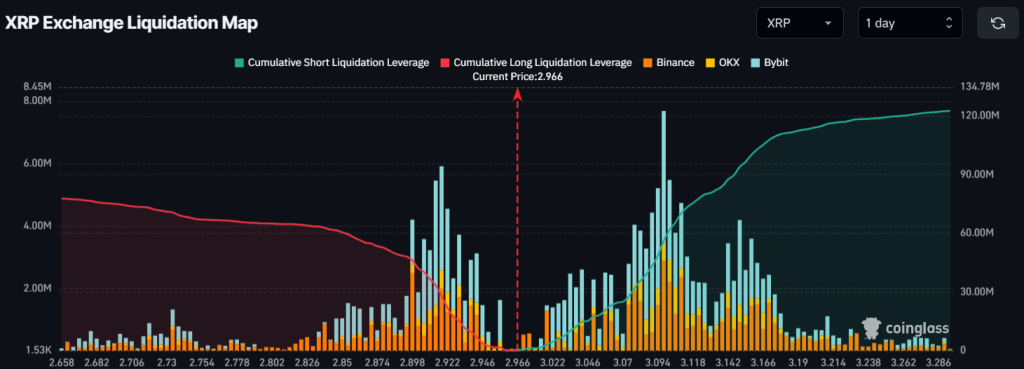

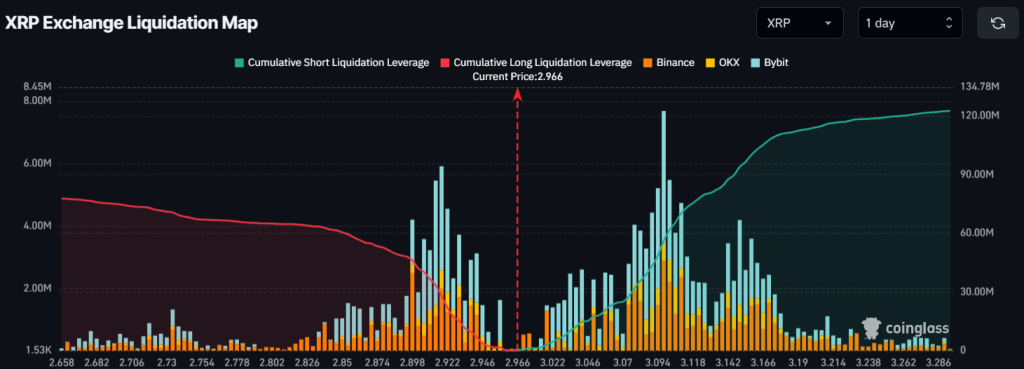

Looking at the Beerarish price action, traders betting strongly on the disadvantage, as revealed by CoingLass data. At the time of the press, $ 2.91 is a level where bulls are used too much, with $ 28 million in long positions. Conversely, short sellers are overlooking at $ 3.10 level, with $ 56.30 million in short positions.

This data indicates that short sellers actively dominate it and can cause a liquidation of the open positions of the bulls if the price falls below the level of $ 2.91.