Digital asset manager CoinShares says institutional investors are flooding crypto markets with improved sentiment.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional investors flooded the markets with the highest level of inflows of 2023 following news that BlackRock filed a Bitcoin (BTC) exchange-traded fund (ETF) filing with the U.S. Securities and Exchange Commission (SEC).

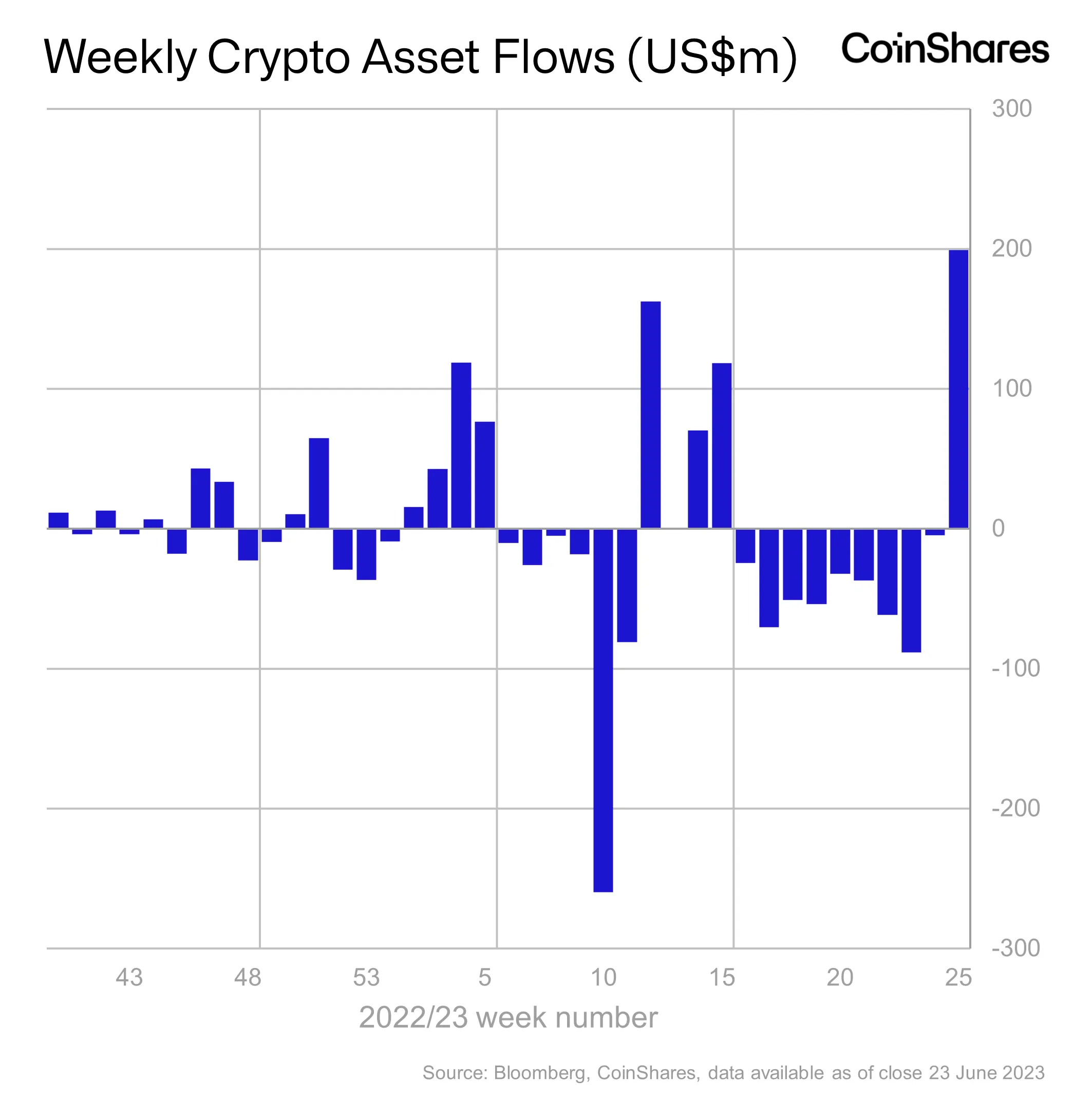

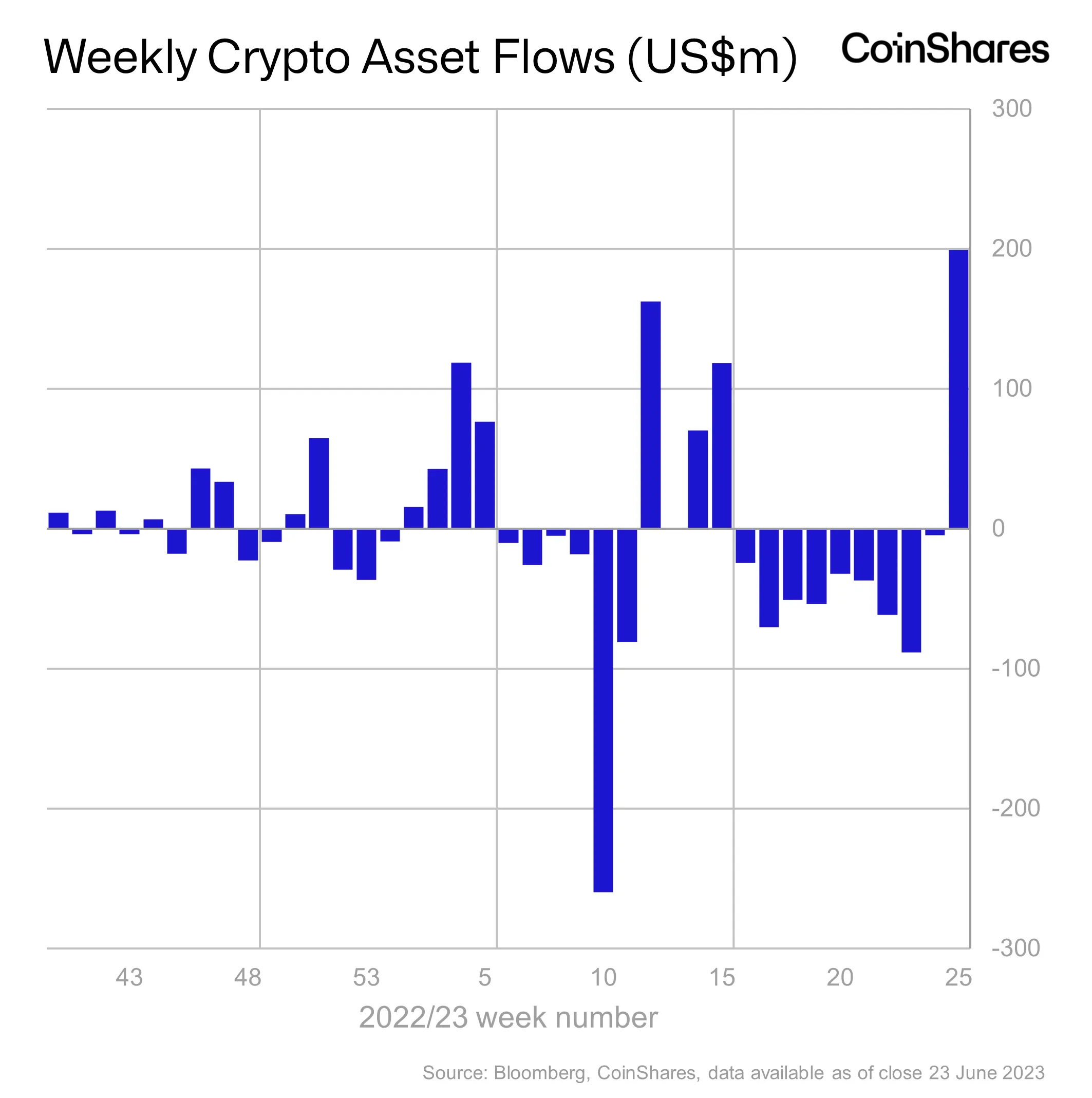

“Digital asset investment products saw the largest weekly inflows since July 2022, totaling US$199 million, correcting nearly half of the previous 9 consecutive weeks of outflows. While ETP trading volumes this year were 170% of average, totaling $2.5 billion for the week.

We believe this renewed positive sentiment is due to recent announcements by high-profile ETP issuers that have filed for physically backed ETFs with the US Securities & Exchange Commission. Total assets under management (AuM) now stands at $37 billion, the highest since before the collapse of 3 Arrows Capital.”

Consistent with its market share, BTC products took the brunt of the $188 million inflow. Meanwhile, short BTC products saw outflows for the ninth straight week.

Ethereum (ETH) and multi-asset exchange-traded products (ETPs) also saw a big jump, receiving inflows of $7.8 and $8.1 million, respectively.

Altcoins XRP and Solana (SOL) also saw minor inflows of $0.24 and $0.17 million last week.

Don’t Miss Out – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Image generated: Midway through the journey

Featured image: Shutterstock/Nikelser Kate