Navigating the complexities of the cryptocurrency market and capitalizing on opportunities requires a mix of innovation, ethical practices, and a deep understanding of distributed ledger technology (DLT).

As blockchain technology reshapes the traditional financial industry and pioneers the expansion of decentralized finance (DeFi), staying informed and adaptable is the key to success. The transformative potential of DLT thus highlights its impact on financial inclusion, payment efficiency and the broader economic ecosystem.

The step towards tokenization

Hedera President Charles Adkins told BeInCrypto that blockchain technology has emerged as a fundamental force in transforming transactions, lending and investments. He attributed the success to the inherent capabilities that allow for simultaneous access, validation and updating of records.

This innovation mainly impacts cross-border payments, trade finance and end-to-end payment transfers.

It enables banking institutions to perform near ‘atomic’ international settlements with fewer manual interventions and lower costs. Such improvements increase the efficiency of payment models and expand financial services to previously unbanked populations, promoting greater financial inclusion.

“Blockchain technology aims to enable individual collaboration and enable societies to play a role in determining the future of technological innovation. For example, DLT has created new layers of trust that enable individuals, businesses and governments to generate collective social impact without the risk of bad actors gaining influence,” said Adkins.

Read more: Implementing Blockchain Infrastructure: Challenges and Solutions

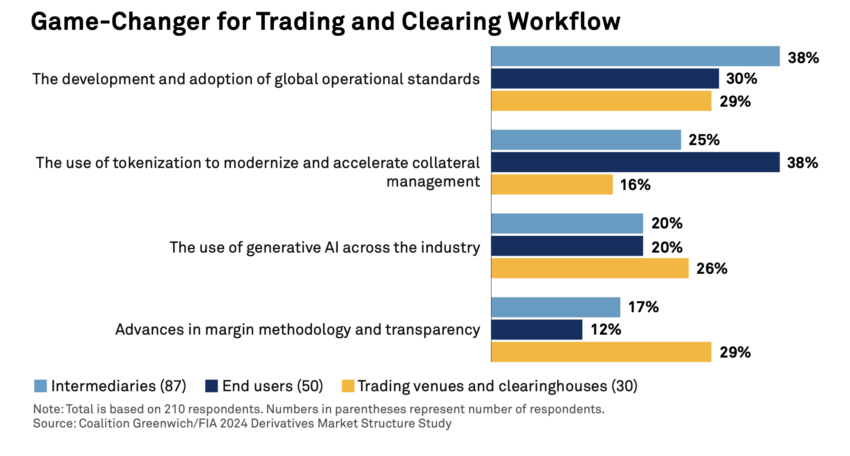

Distributed ledger technology in commerce. Source: Greenwich Coalition

DLT is at the forefront of financial innovations such as fractional tokenization, promising to democratize access to wealth opportunities. A recent survey by Coalition Greenwich found that stakeholders in the derivatives industry are prioritizing the adoption of tokenization. It helps improve collateral management over the implementation of generative artificial intelligence (AI).

In fact, for end users, tokenization emerged as the most important potential innovation in trading and clearing workflows.

“Many large asset managers are working on projects to test the usability options [tokenization] to move cash and securities more efficiently. From their perspective, the transformation of financial assets into tokens and the use of distributed ledgers to manage transfers could lead to significant reductions in time and costs,” wrote analyst at the Coalition Greenwich.

For this reason, Adkins envisions a future where DeFi and traditional financial technologies converge, improving the financial system for institutions and individuals.

Blockchain beyond financial markets

The potential of DLT extends beyond financial markets to address pressing issues such as climate change and greenwashing. By enabling accurate tracking and reporting of carbon emissions, DLT enables organizations to optimize their processes, adapt to environmental standards and provide transparency to consumers and policymakers.

However, to achieve this it is crucial to build trust and understanding between developers, policy makers and the public. Commitment to education, cryptocurrency advocacy, and collaboration among Web3 projects are examples of efforts to ensure security and transparency in the public and private sectors.

“DLT plays a critical role in preventing greenwashing attempts by organizations, an issue that has become increasingly important due to difficulties in verifying companies’ adherence to sustainability goals. Because data is publicly available on the distributed ledger, organizations cannot falsify their carbon footprint or make unsubstantiated claims about their sustainability efforts,” Adkins points out.

One notable project, as discussed in a University of Copenhagen study, involves the use of blockchain technology to create a detailed and transparent overview of companies’ carbon footprints. This project, called REALISTIC, enables the accurate documentation of the CO2 emissions of goods during their production and supply chain processes.

Implementing such technology will help companies comply with new EU legislation mandating carbon footprint reporting. It also paves the way for consumers to verify the environmental impact of their purchases via QR codes.

“[With a pen, for instance] we don’t know the equivalent carbon association of each of the parts… So if you want to purchase the different parts of the pen, you’ll know exactly how to weigh which part comes from where, and understand the impact in terms of carbon [footprint]” said Chief Revenue Officer at SAP Sustainability Deb Kaplan.

Read more: Top 9 eco-friendly cryptocurrencies to invest in

The Climate Ledger Initiative (CLI) is another important player. It focuses on integrating digital innovations such as blockchain, the Internet of Things (IoT) and artificial intelligence for climate change mitigation and adaptation. The CLI supports various use cases and provides a platform for testing digital innovations in real-life scenarios. Therefore, it highlights the role of DLT in scaling up carbon markets and improving their environmental integrity.

Adkins believes that integrating DLT with AI is poised to address disinformation and data integrity issues. As blockchain technology matures, he anticipates its mainstream adoption, unlocking social and economic benefits, especially in asset management and beyond.

“DLT will enable developers to address challenges with biased and unverified low-quality data, providing data sharing infrastructures open to all researchers and developers, and transparency at every point of the AI data entry process is guaranteed,” concludes Adkins.

Staying at the forefront of the markets requires an unwavering commitment to innovation, ethical governance and community involvement. By embracing the principles of DLT, individuals and institutions can ensure trust and integrity in the digital age.