- Buying pressure on Bitcoin has remained high, indicating a price increase

- BTC liquidations will rise sharply towards the $77,000 mark

Shortly after the US presidential election, the crypto market turned bullish, making this possible Bitcoin [BTC] to reach an all-time high on the charts. Although the king coin has since corrected, it was still hovering near that range at the time of writing.

In fact, investors seemed to show confidence in the coin, which could push BTC further in the coming days.

Bitcoin accumulation is increasing

AMBCrypto reported earlier that it reached a new all-time high of $76,849 on November 7. After touching the ATH, the price of BTC dropped slightly. At the time of writing, it was trading at $76,422.29 with a market cap of over $1.5 trillion.

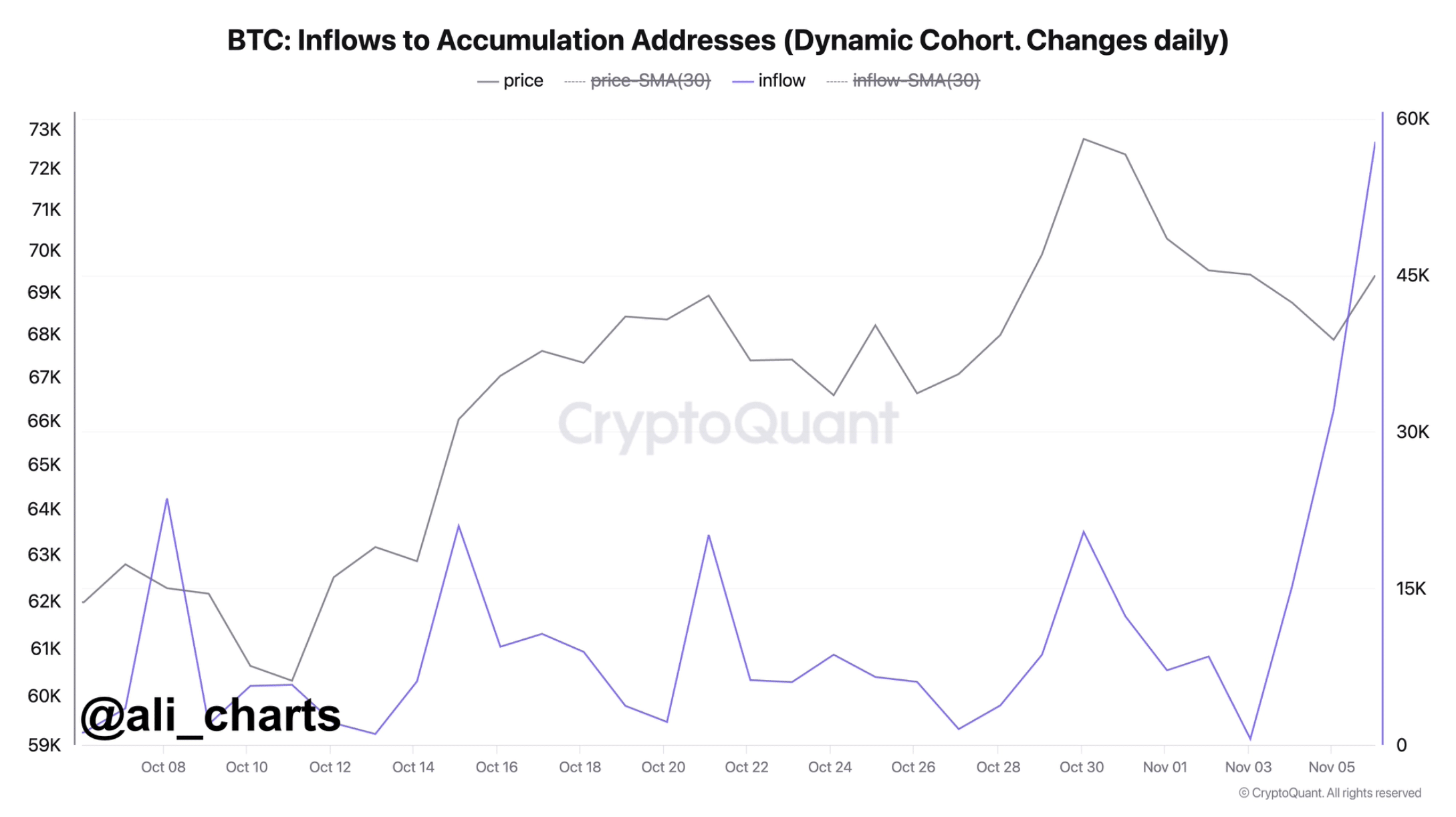

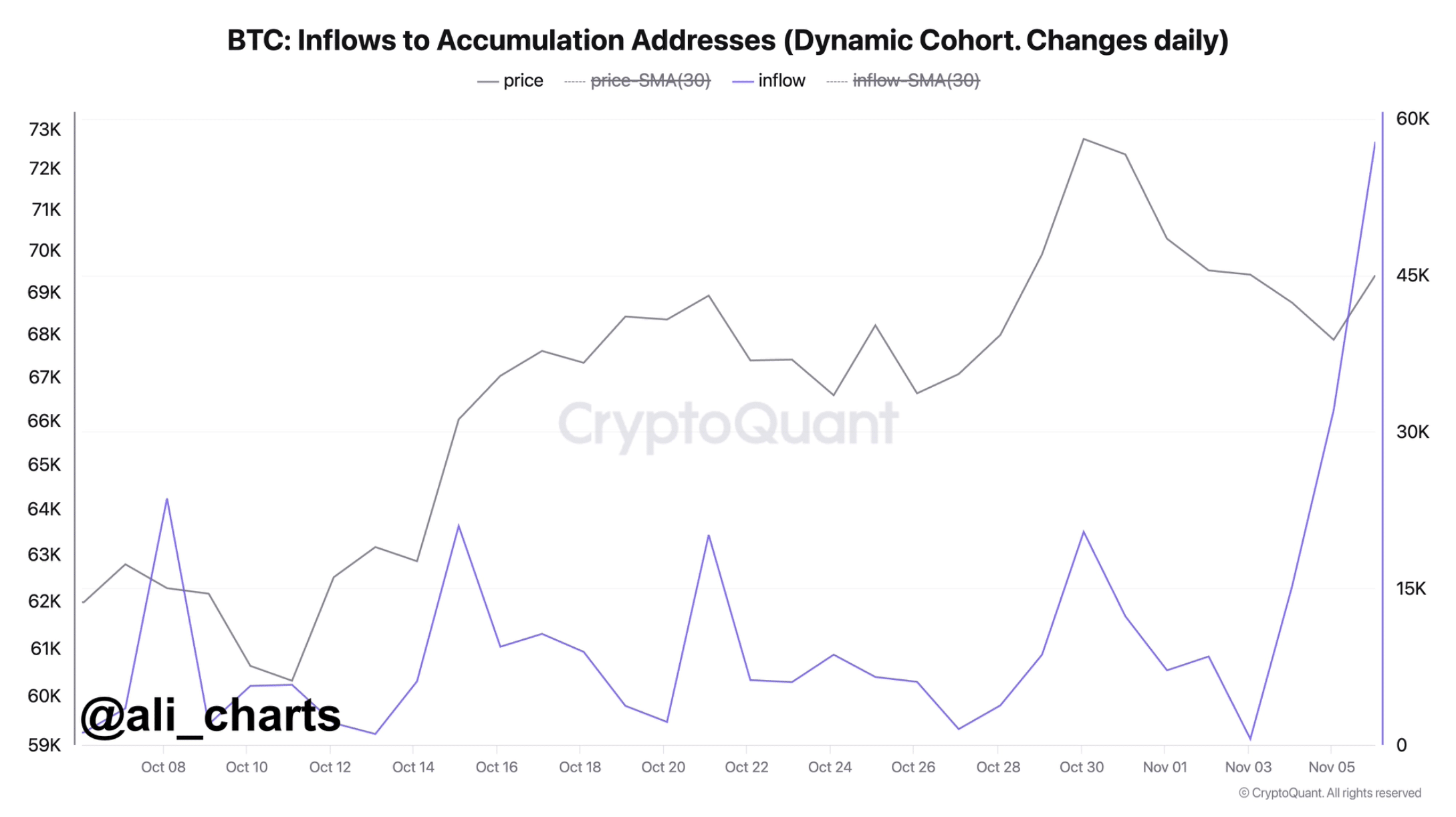

Despite this marginal decline, confidence around BTC has remained high. Ali, a popular crypto analyst, recently shared one tweet shows an interesting development. According to the same, more than 57,800 BTC have moved to accumulation addresses in the past few days. These accumulated BTC were worth over $4 billion.

Source:

This accumulation suggested that addresses holding a significant amount of BTC were expecting a price increase. If that happens, BTC might as well retest its ATH. Therefore, AMBCrypto checked other data sets to find out whether buying sentiment was dominant in the overall market.

Our analysis of CryptoQuant’s facts revealed that Bitcoin’s foreign exchange reserves were falling. A decline in this measure means that investors are considering buying the king coin. The Coinbase premium was also green, meaning buying sentiment among US investors was relatively strong.

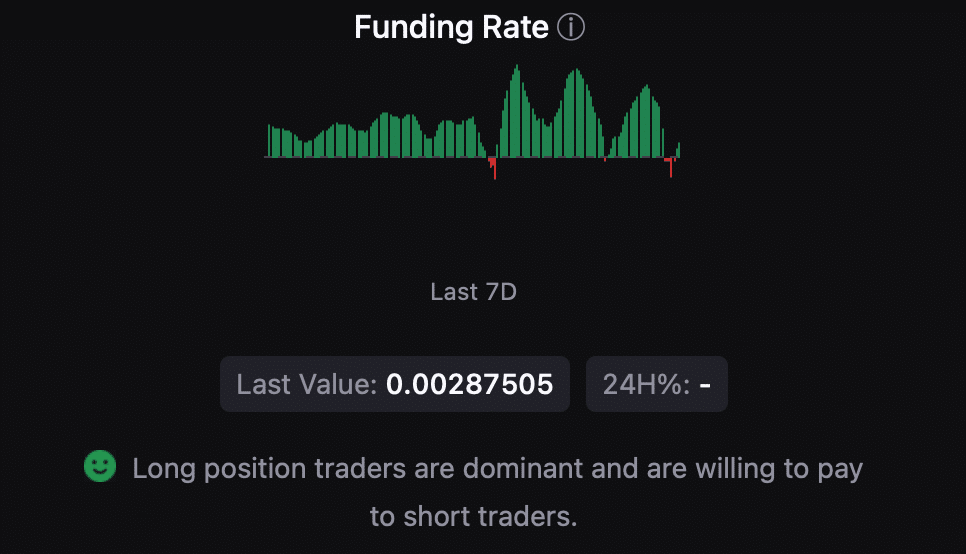

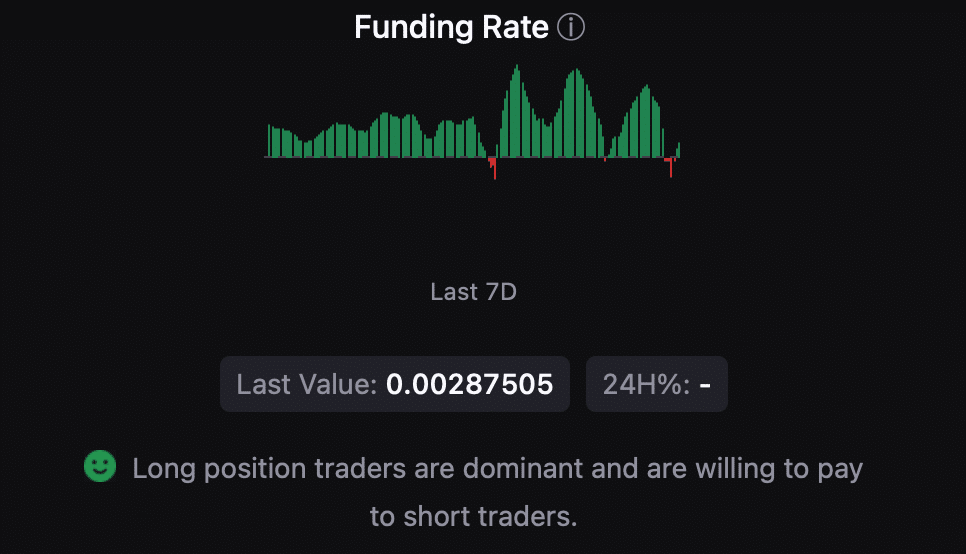

Moreover, things in the futures market also looked quite optimistic. This was reflected in the green funding rate – a sign that long position traders have been dominant and would be willing to pay short traders.

Source: CryptoQuant

Does everything support a retest of the ATH?

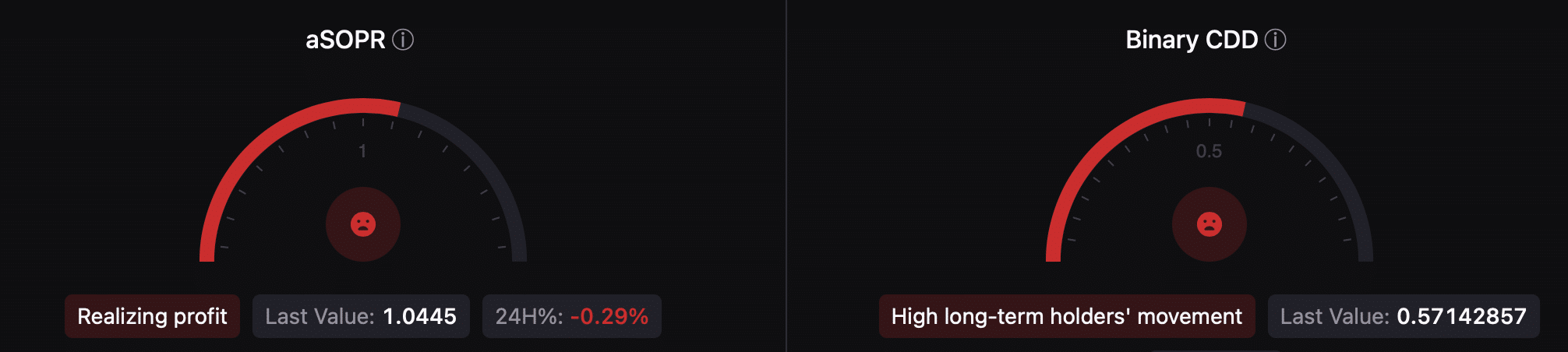

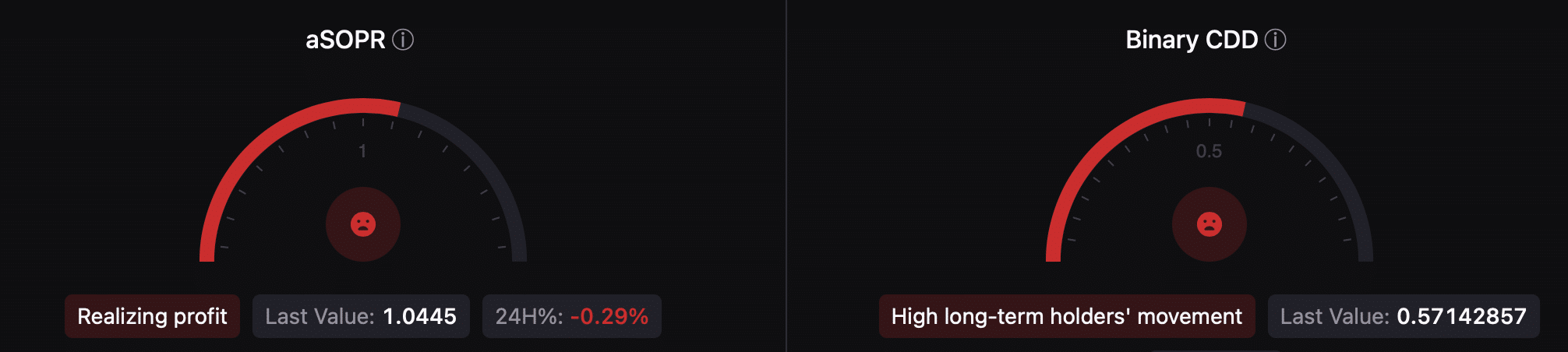

While the above stats gave a bullish idea, it wasn’t all clear cut for Bitcoin. For example, BTC’s aSORP turned red. This indicated that more investors were selling at a profit. In the middle of a bull market, this could indicate a market top.

The king coin binary CDD was also bearish as it suggested that the movement of long-term holders over the past seven days was higher than the average. If they are moved for the purpose of sale, this could have a negative effect.

Source: CryptoQuant

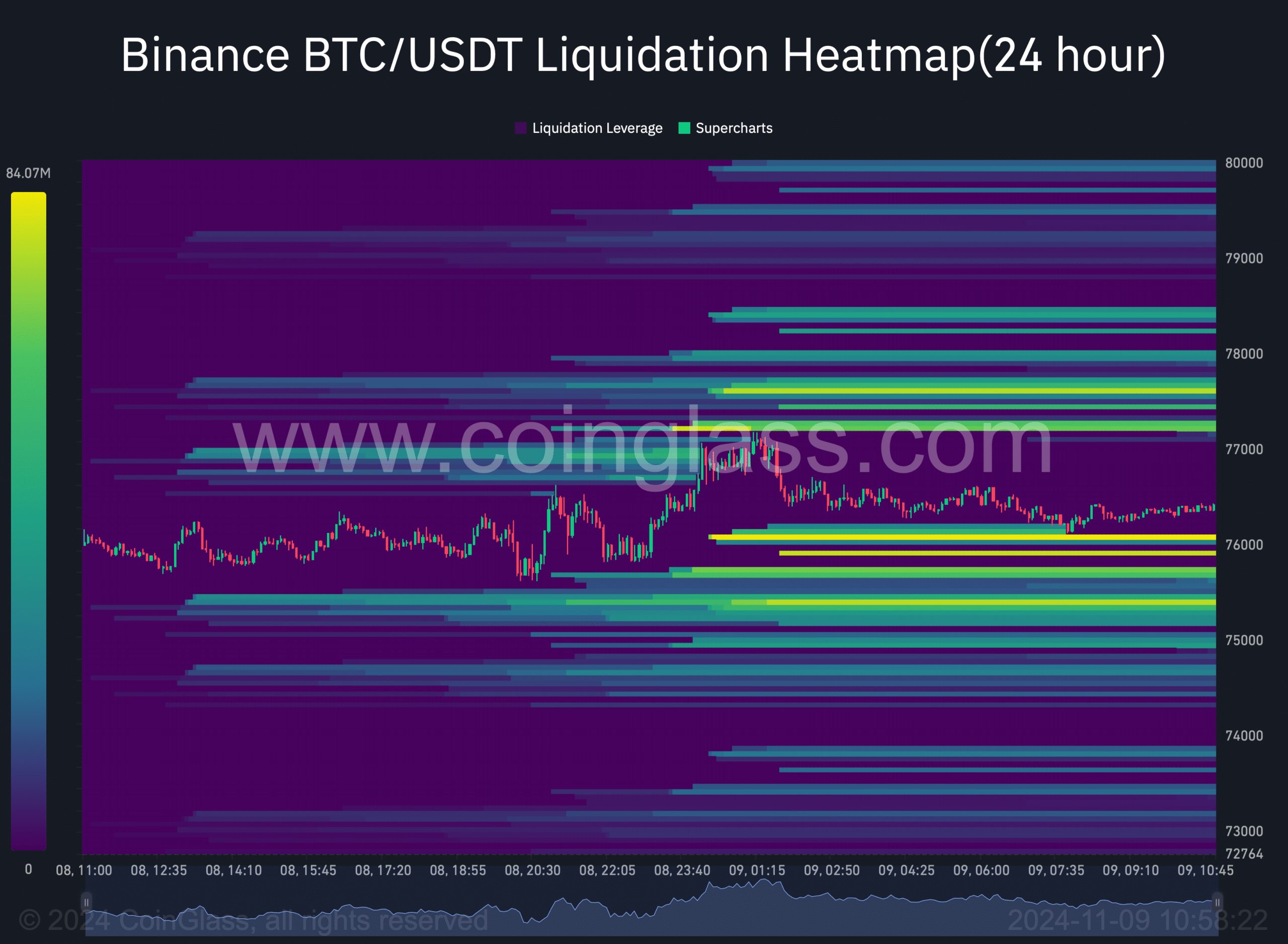

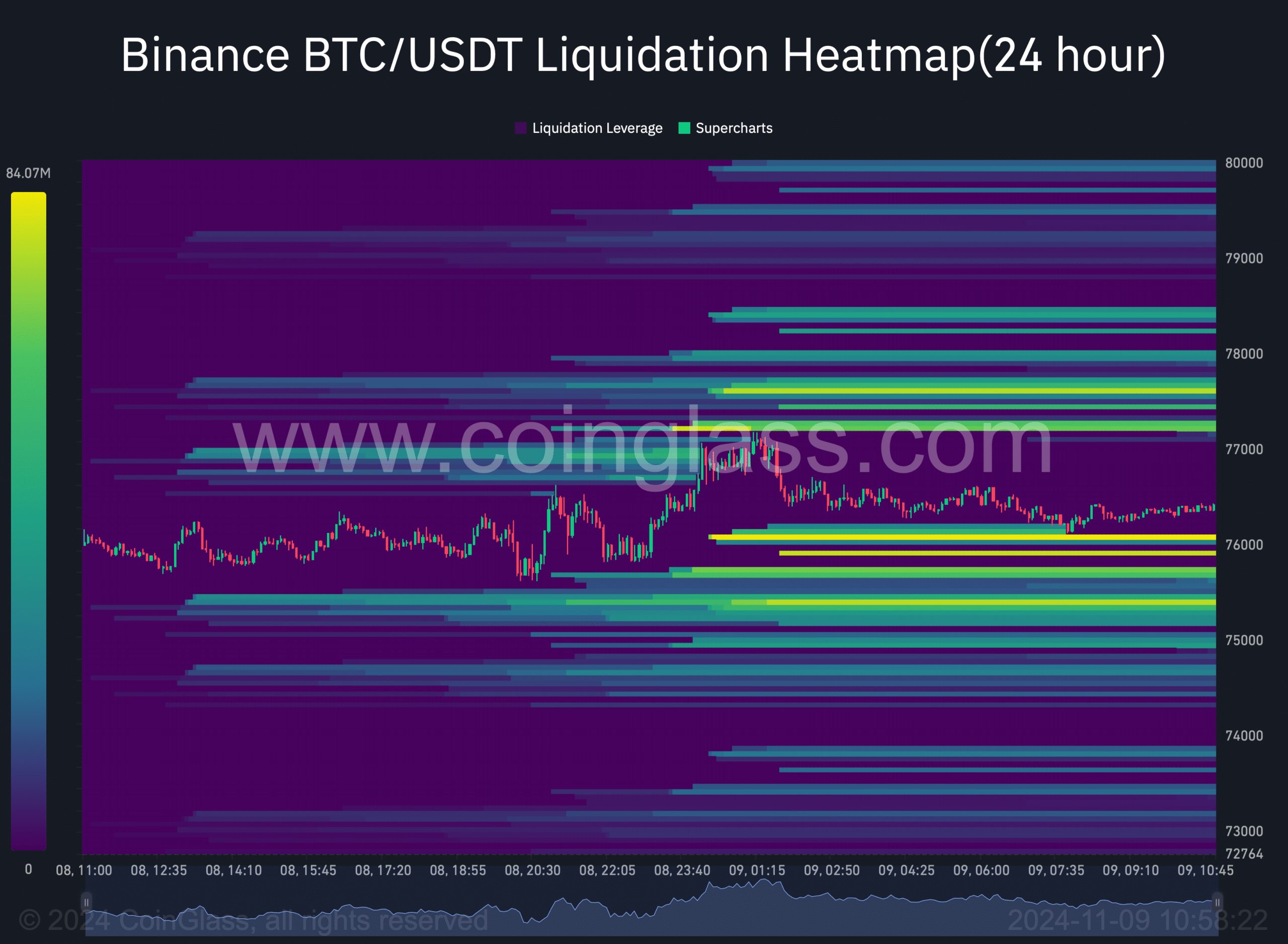

We then checked Bitcoin’s liquidation heatmap to find out if BTC was awaiting a large-scale liquidation. This could cause a price correction before the ATH is tested.

Read Bitcoins [BTC] Price prediction 2024–2025

We found that BTC liquidations will increase after it crosses the $77,000 mark. If accumulation continues and bullish sentiment remains intact, BTC is likely to reach a new ATH.

Source: Coinglass