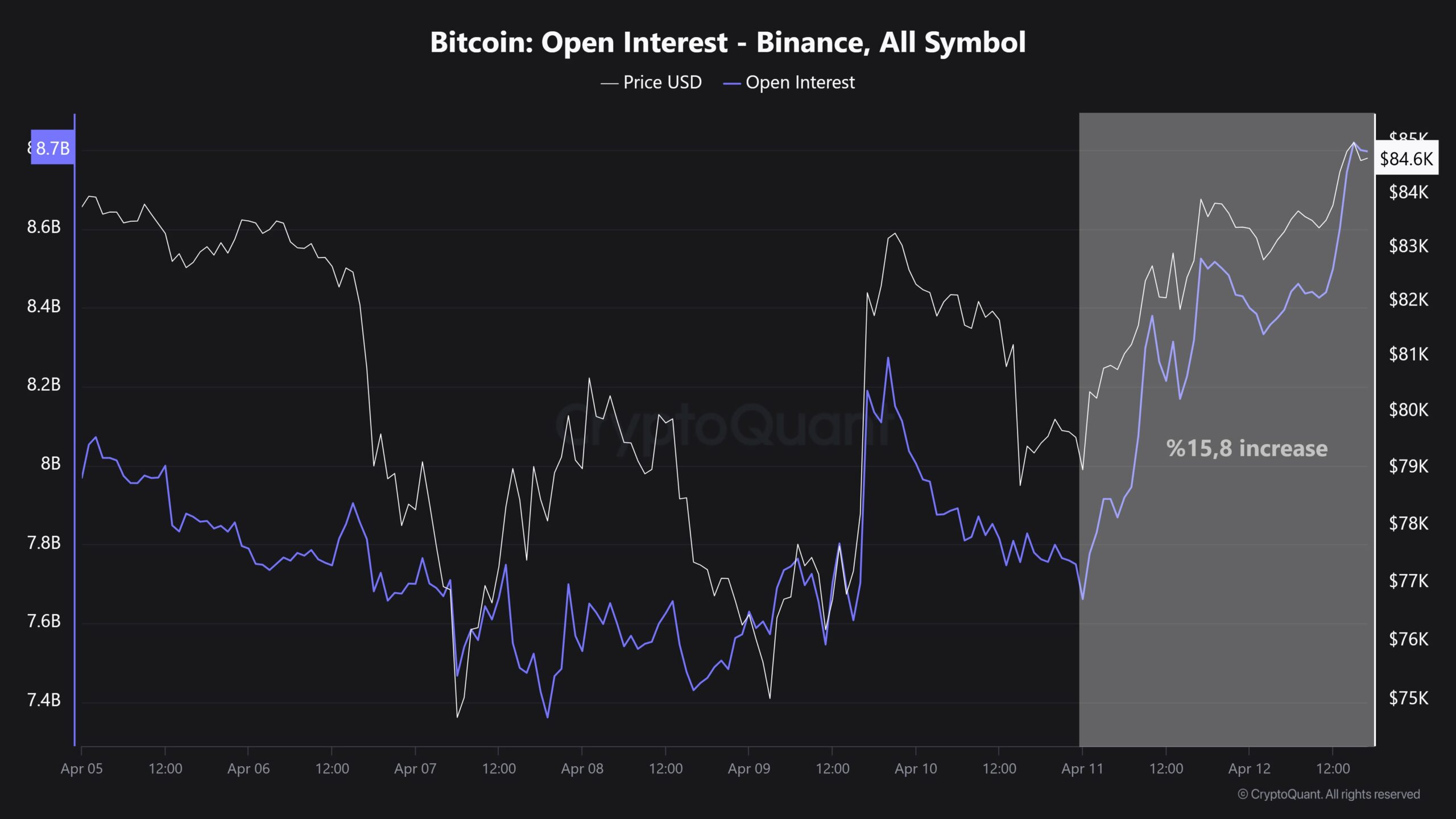

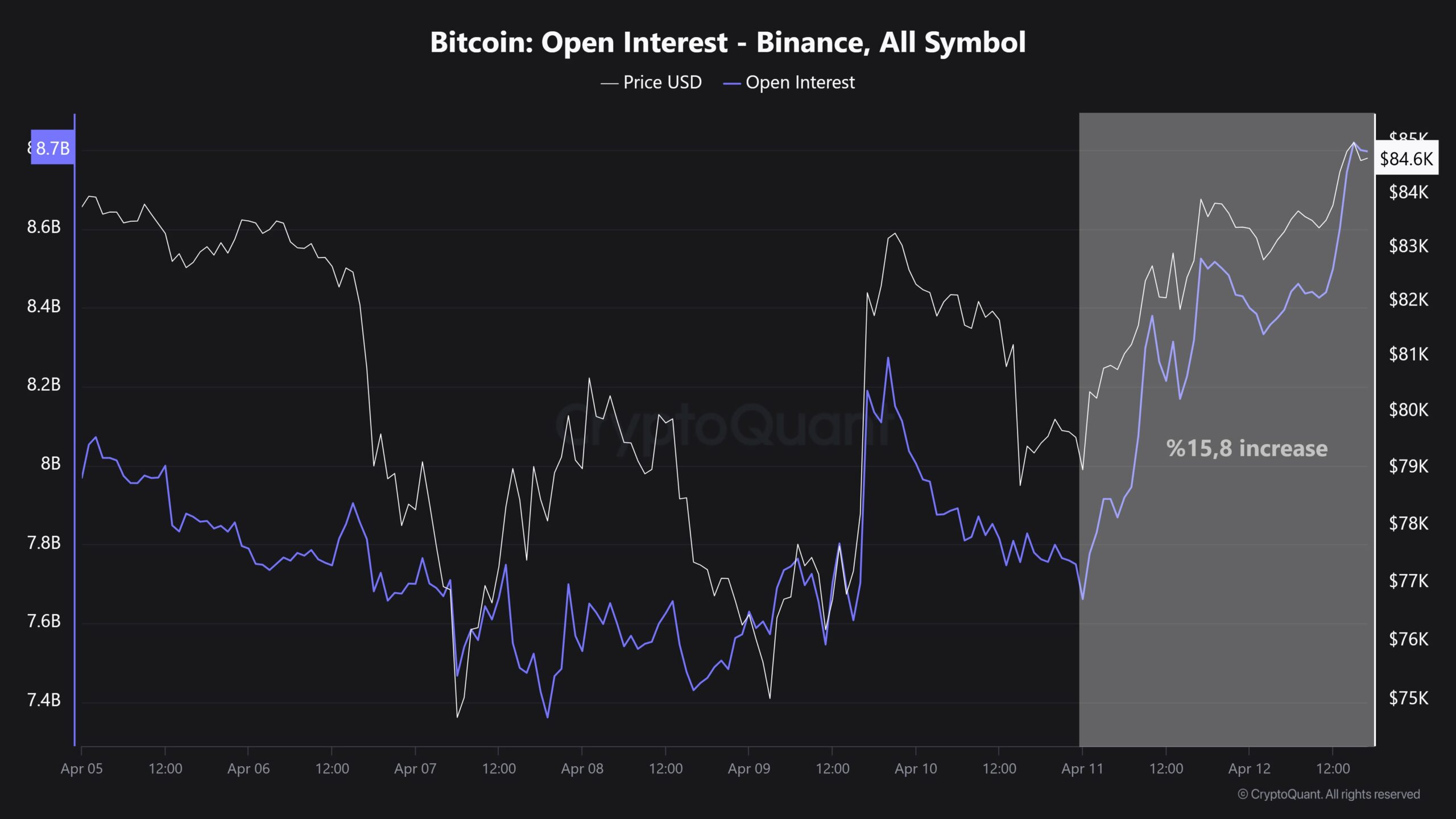

- Bitcoin’s OI made a remarkable jump of 15.8% when the weekly CME Futures closed at $ 84k.

- BTC cut through the 50-day SMA, with the next important obstacle as the 200-day SMA for $ 87k.

Binance’s Bitcoin [BTC] Open interest (OI) saw a growth of 15.8% in one day, which increased it from $ 7.6 billion to $ 8.8 billion on the press. The involvement of the market and the trader has increased considerably due to this rapid increase of $ 1.2 billion.

Binance remained dominant in the trade in cryptodivates, because the OI position takes 31.4% of the total OI capital of $ 28 billion.

Quickly rising OI meant the risk of market volatility, because these broad liquidations can influence both long -term long and short positions with high leverage.

Source: Cryptuquant

An increase in OI often indicates a growing bullish sentiment; However, it can also activate opposite market movements or settle a rapid aggressive position.

A sharp rise in OI can lead to short price fluctuations, mainly driven by shifts in market sentiment or failed attempts to maintain critical resistance levels.

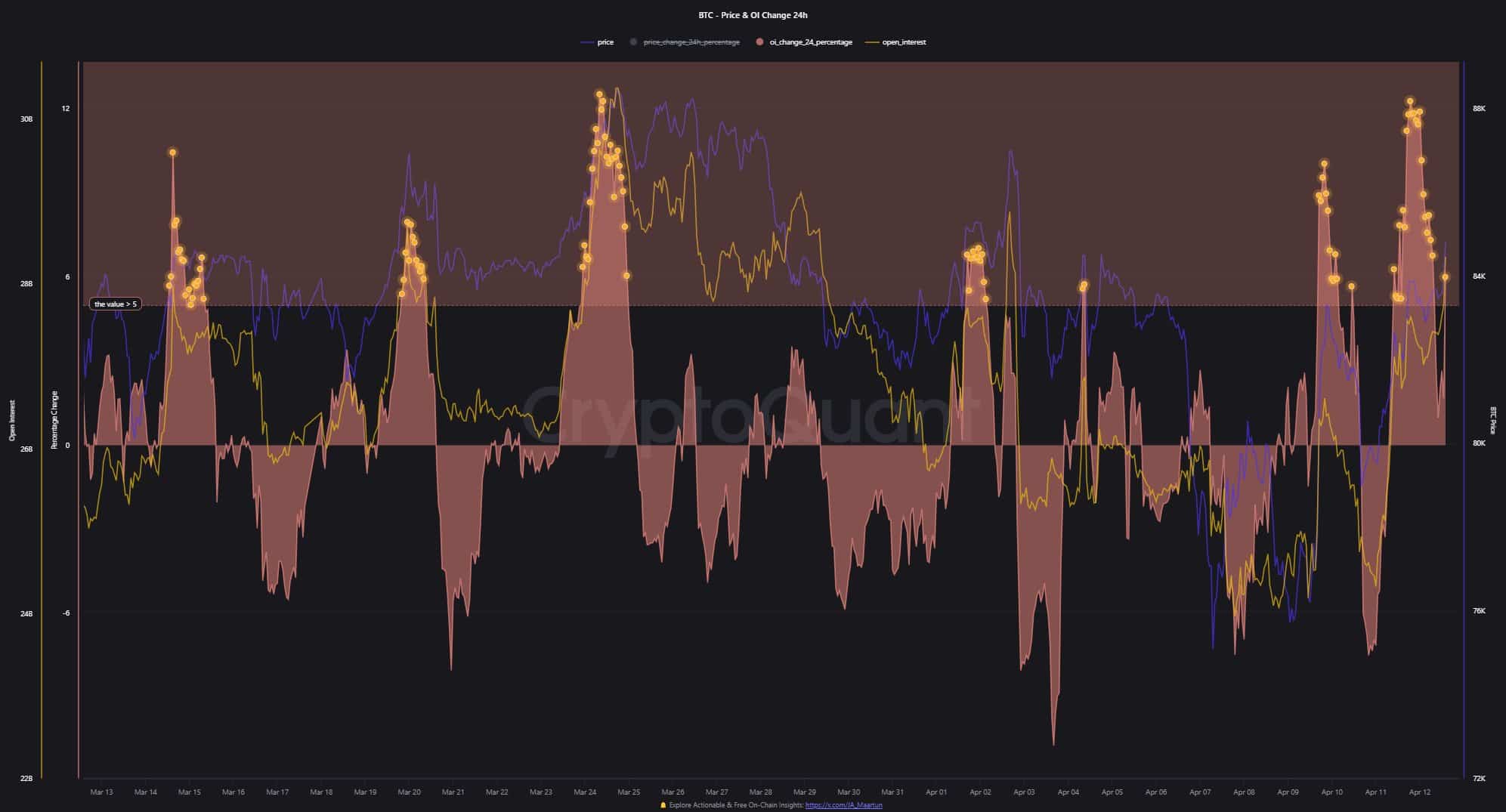

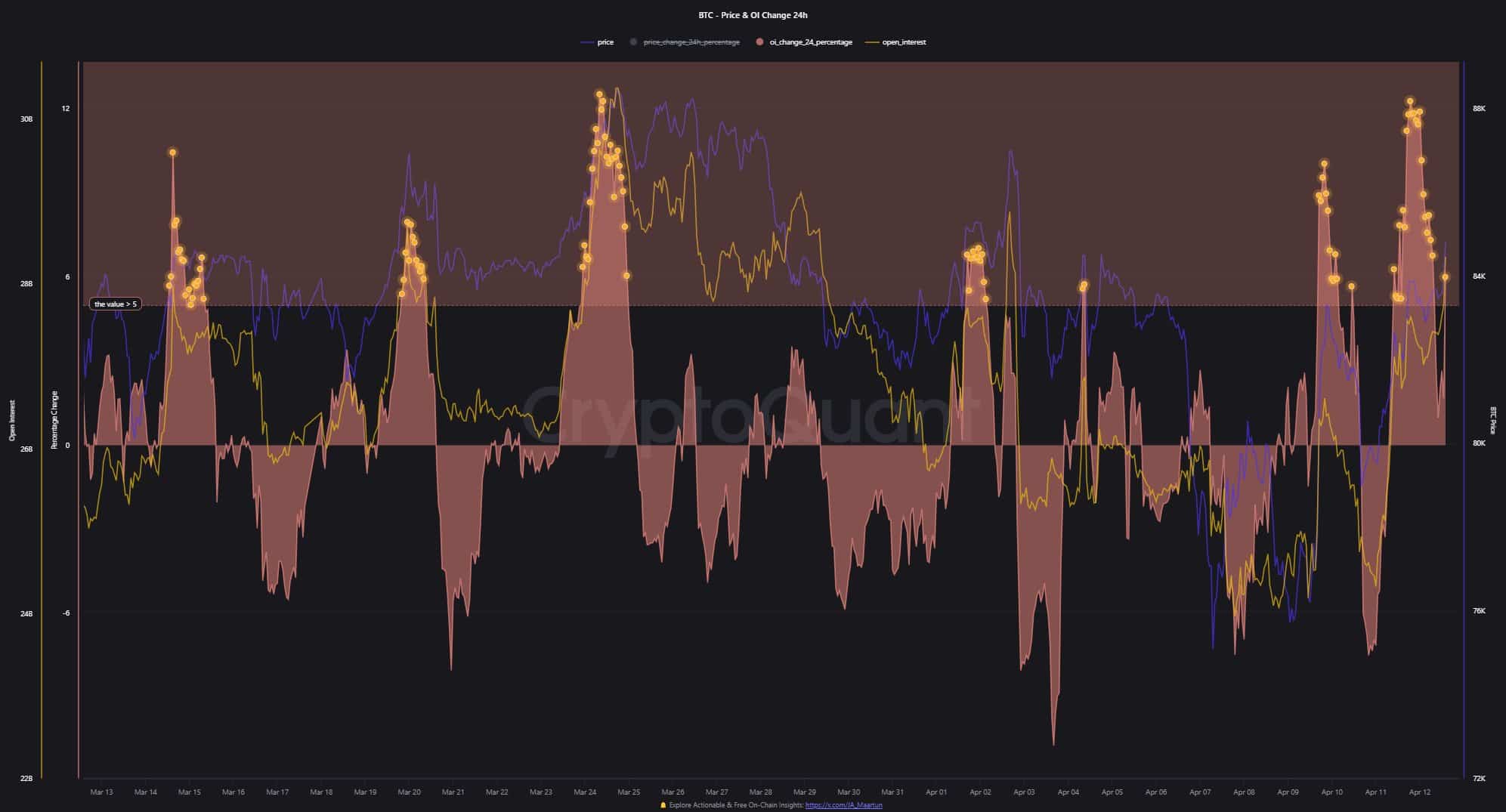

Leverage powered pump and activity

After this, the BTC spot prices closed at the level of $ 84k, as laid down in the weekly CME Futures. The pump was due to the increase in excessive leverage, although this movement caused risks for short -term marketing traders.

This strong upward trend in the 24-hour percentage changes in OI showed several points of more than +5, which indicates an extremely long sentiment.

Source: Cryptuquant

The recent price die, powered by positions with high leverage, emphasized the risk of rapidly forced sale, similar to trends that were observed in the past. This level of market leverage underlined the importance of caution for traders.

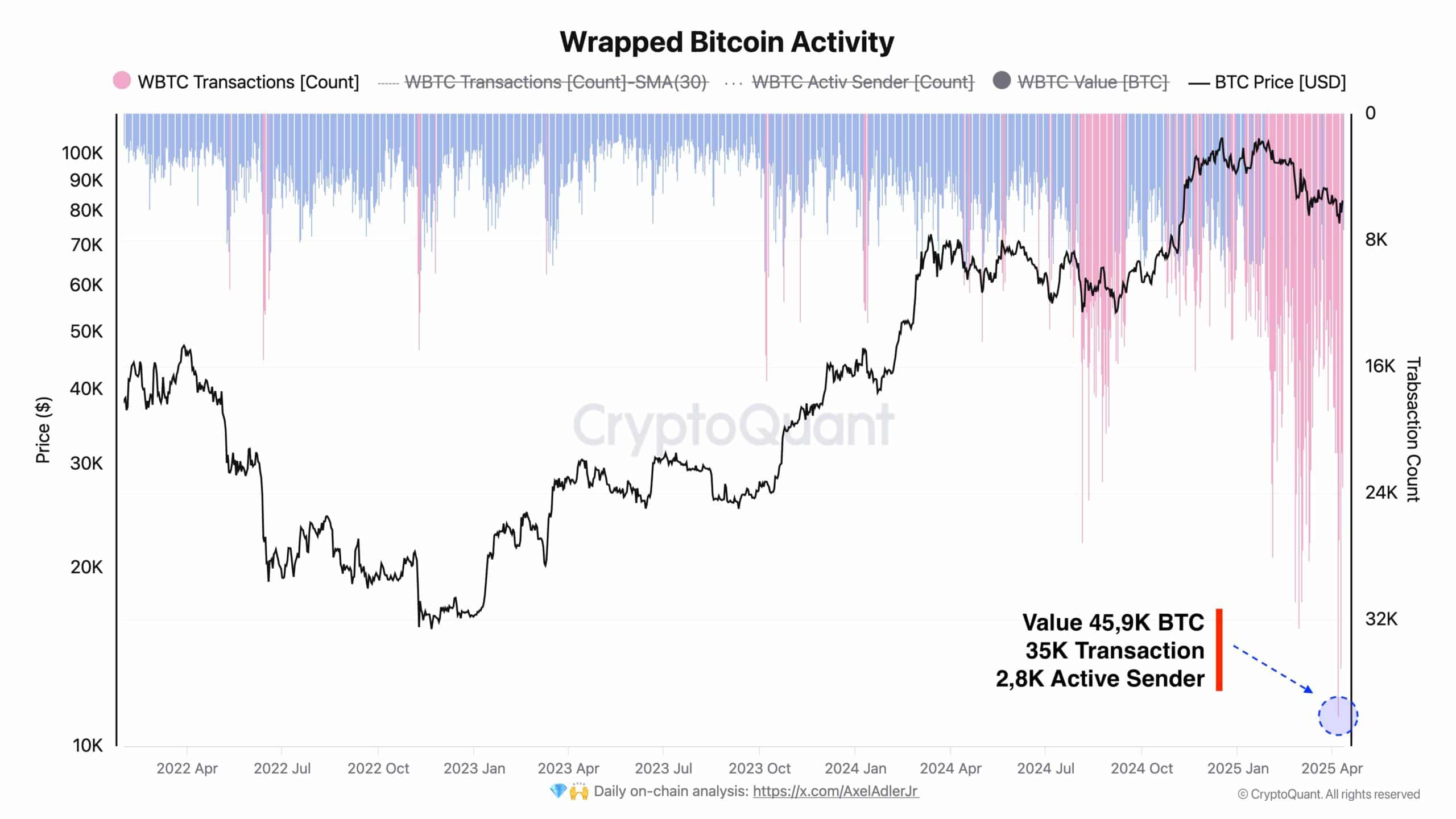

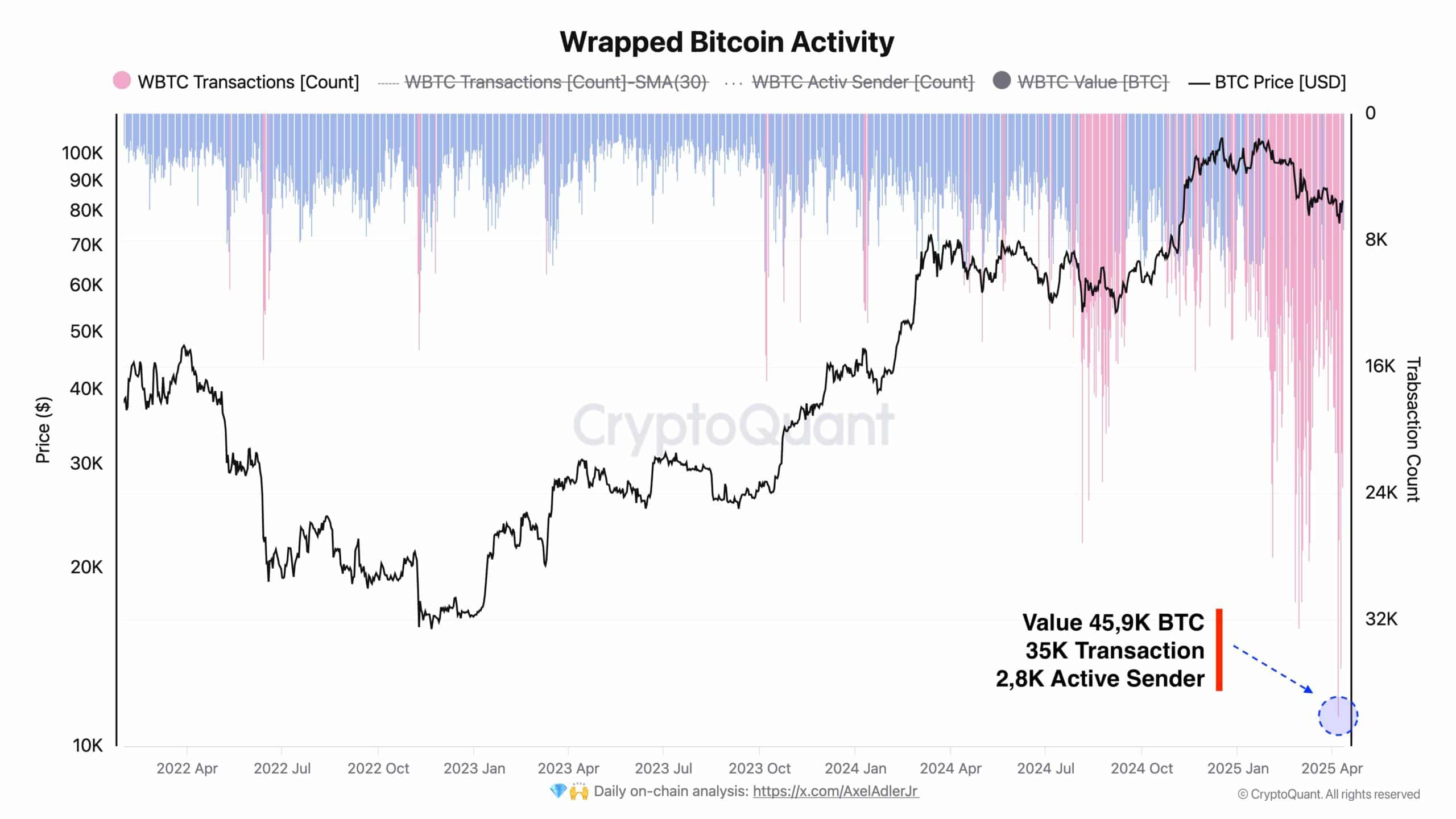

At the same time, packed BTC [WBTC] Activity reached a record high, with 35,000 transactions carried out over 2,800 active portfolios and a total movement of 45.9k BTC.

These developments occurred in the midst of increased market volatility caused by geopolitical crises and trade conflicts between countries. Despite this macro -economic pressure, WBTC users showed resilience and continued to stimulate a remarkable increase in transactions.

Source: Cryptuquant

Despite the two oppositional evaluations in which lifting tree positions seemed to cause price fluctuations in the short term, WBTC activity meant sustainable functionality in the BTC space.

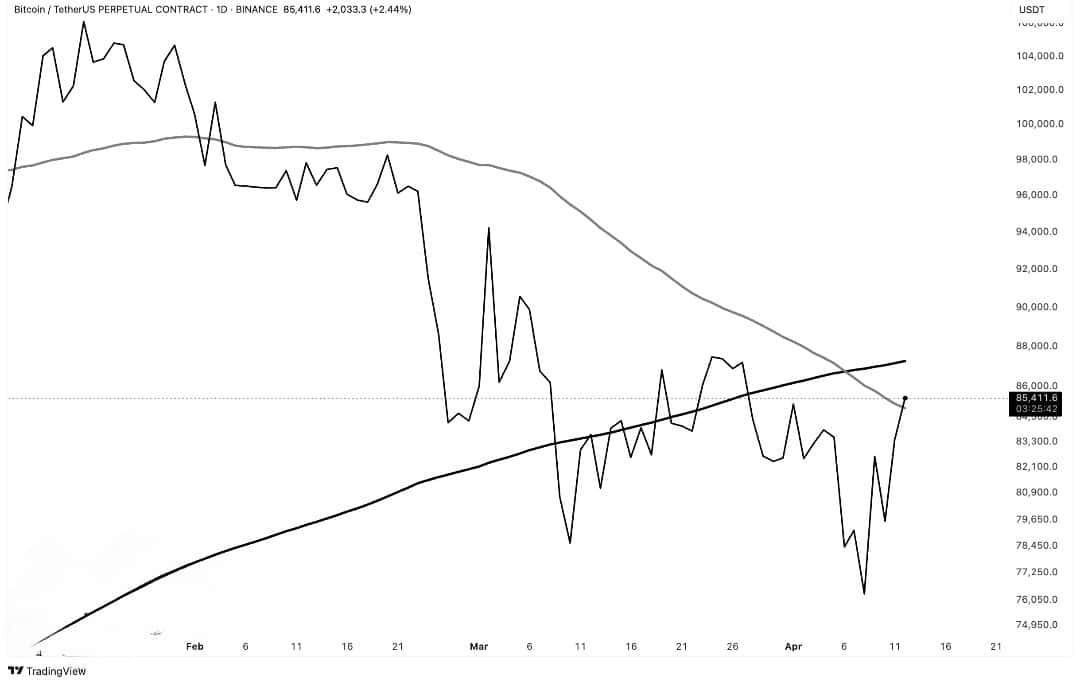

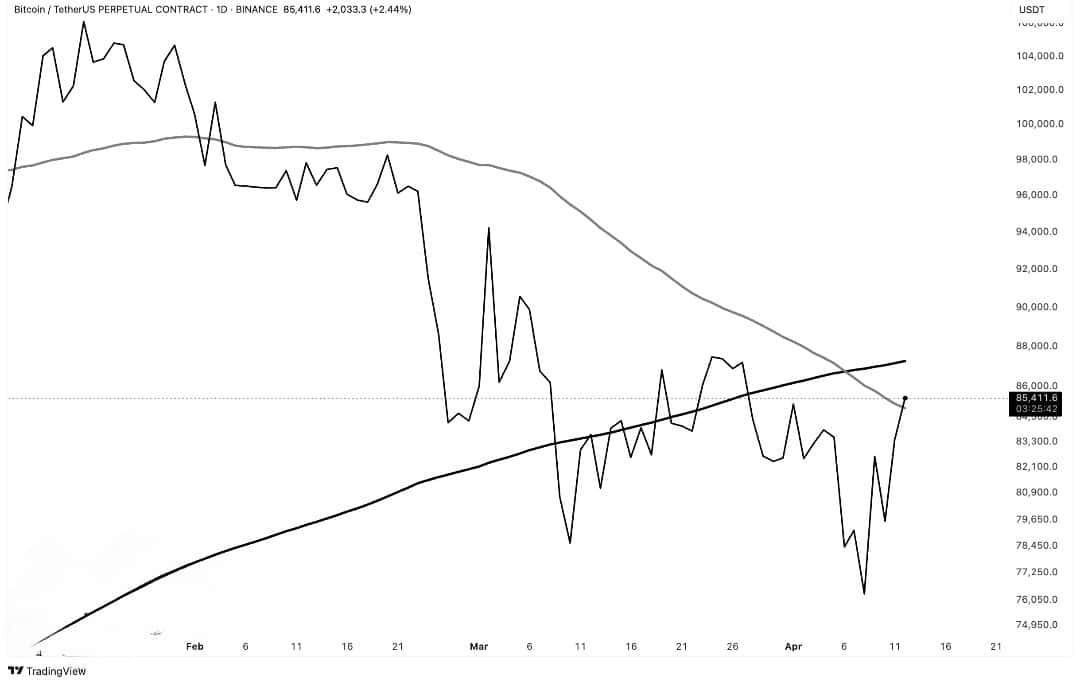

BTC Potential price movements

BTC also cut the 50-day simple advancing average (SMA) while it approached the resistance at the 200-day SMA.

This outbreak showed an increasing bullish trend and a movement above $ 87k could probably validate the current growth to $ 94k, while the seller’s intervention is possible near that level.

If the price remains below $ 87K, this can confirm the warnings related to recent leverage -based pump campaigns.

This may mean that it is as low as $ 79k or $ 76k if prices fall below $ 84k, which would suggest that further bearish Momentum would be.

Source: X

The indecision of the market was confirmed by the stationary movement, which remained between two fundamental advancing averages.

Investors had to observe strong price movements on both sides to get the future direction of BTC.

Market sentiment can turn Bullish if prices are higher than $ 87,000, but continuous Bearish performance below that level will probably retain a consolidation phase or extend the existing correction period.