- According to Peter Brandt, BTC could fall to $ 76k.

- Mantra crashed by 90% in 24 hours, but the founder denied ‘Trug-Pull’ claims.

Despite the slipping point of $ 74k last week, Bitcoin [BTC] Kwiered back and placed an impressive profit of 7%. It rose shortly above $ 85k, but analysts were divided over the medium term projection.

BTC mixed views

For his part, the renowned trader Peter Brandt expected that it would fall to $ 76k, reference The bearish rising wig pattern on the 4-hour pattern.

Source: X

However, others, such as Coinbase analysts, were optimistic, stating Bullish RSI divigence and renewed interest from long-term holders.

That said, Robert Kiyosaki urged investors to consider BTC to protect wealth in the midst of the current rate -controlled sale.

“Those who take action and really gain gold, silver and bitcoin … come out of this with premeditation …”

Jack Dorsey, CEO of Square, repeated similar feelings and stated That BTC keeps the US and China under control.

Mantra Saga, Virtual, Sol/ETH Ratio Rebound

The best head of this week was mantra [OM] 90% collision On the weekend. Jack Mullin, founder of Mantra, blamed ‘forced liquidations’ of centralized exchanges.

“The market movements were caused by reckless forced closures initiated by centralized fairs on OM account holders.”

Although analysis company Lookonchain a few dumping portfolios marked linked to early investors such as Laser Digital, Mullen denied those claims. He promised to act well ‘for the community’, but the details still had to be seen.

The market size of the Real -World Asset (RWA) platform fell from $ 6B to less than $ 700 million in hours, so investors were exposed to massive losses. Quinn Thompson from Lekker Capital In fact warned of a likely collapse on ONDO[ONDO] – Another RWA project.

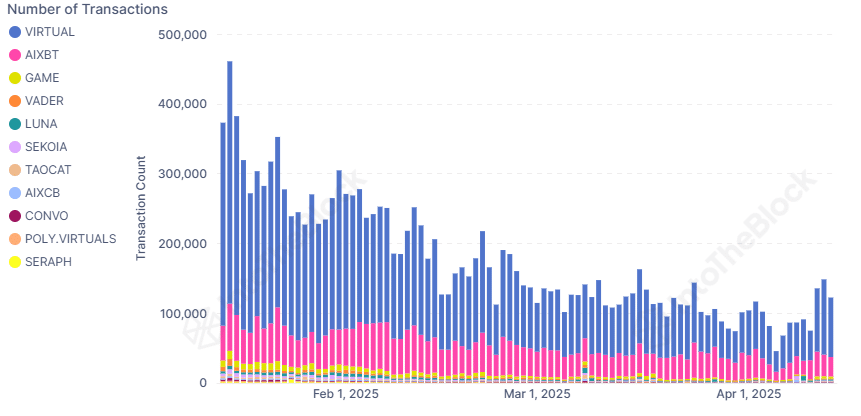

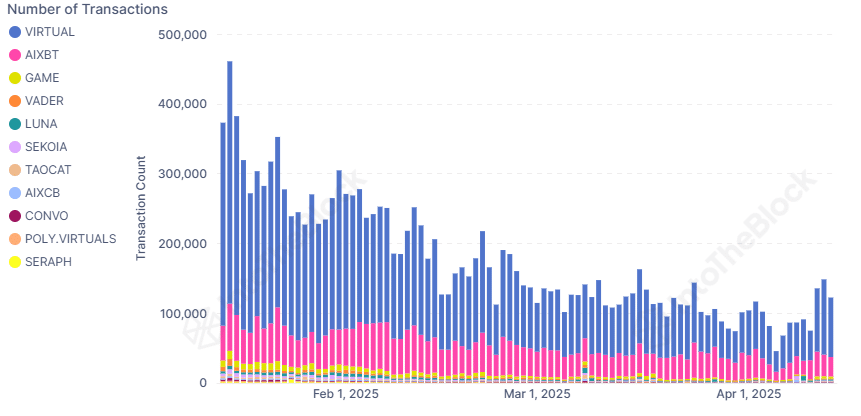

Away from RWA implosion, the virtual ecosystem recovered after more than 90% crash in network activity and traction.

According to analysis company IntotheblockThe ecosystem recovered in April above 100k transaction, a signal that AI -Tokens can make a comeback.

Source: Intotheblock

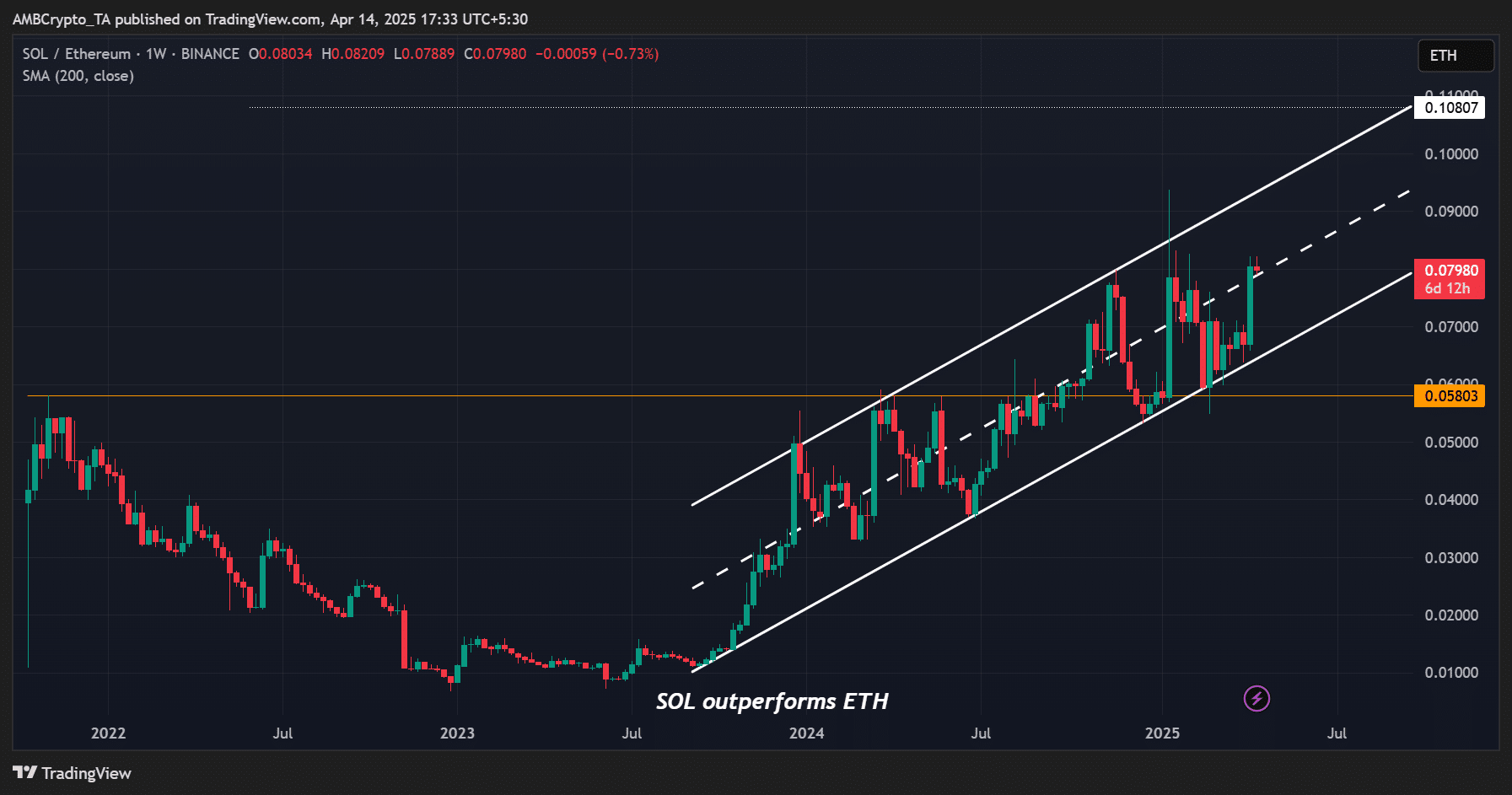

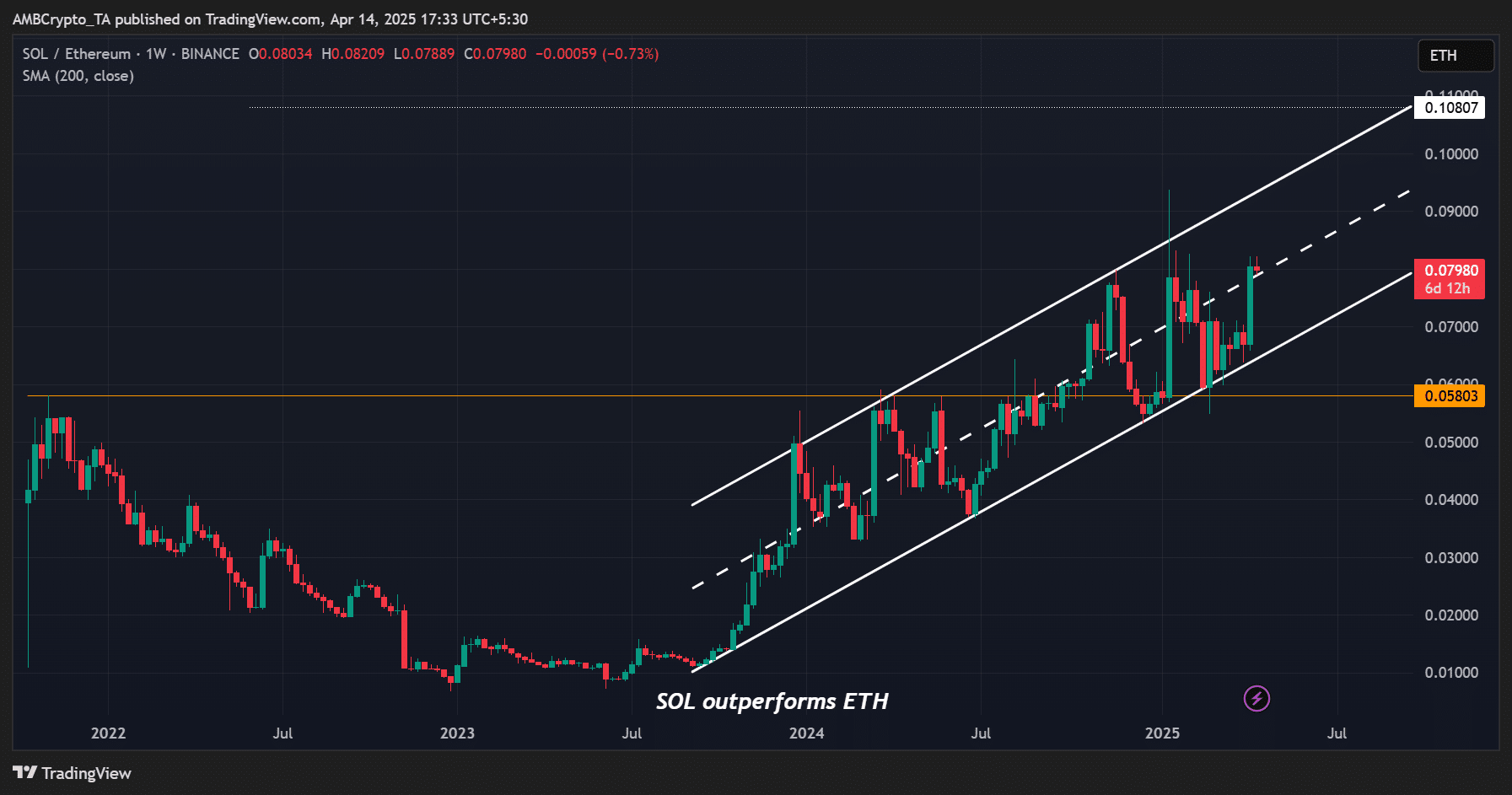

Finally, the SOL/ETH ratio became a record every day and a historic weekly session. Last week the ratio collected 20%, indicating that Sol performed better than ETH.

It closed at 0.08 and won the middle range, which could push the ratio higher to the upper channel of 0.09.

Source: SOL/ETH, TradingView

In the same period, Sol collected more than 21% from $ 95 to $ 133, while ETH achieved a 1% profit. According to Kyle Samani from Multicoin Capital, SOL ETF approval can tip the Altcoin to exceed ETH en masse.