An analyst who continues to build a following with his longstanding Bitcoin calls predicts the timeline for a bull run after BTC’s halving.

Pseudonymous analyst Rekt Capital tells his 353,800 followers on social media platform

The halving, which halves BTC miners’ rewards, is traditionally seen as a bullish catalyst as it significantly reduces the newly issued supply of Bitcoin.

Based on historical data, Rekt Capital says Bitcoin could witness an 18-month bull market after the April 2024 halving.

“In recent years, Bitcoin has taken 518-546 days to reach its peak after its halving. If history repeats itself, Bitcoin could peak in mid-September 2025 or mid-October 2025.”

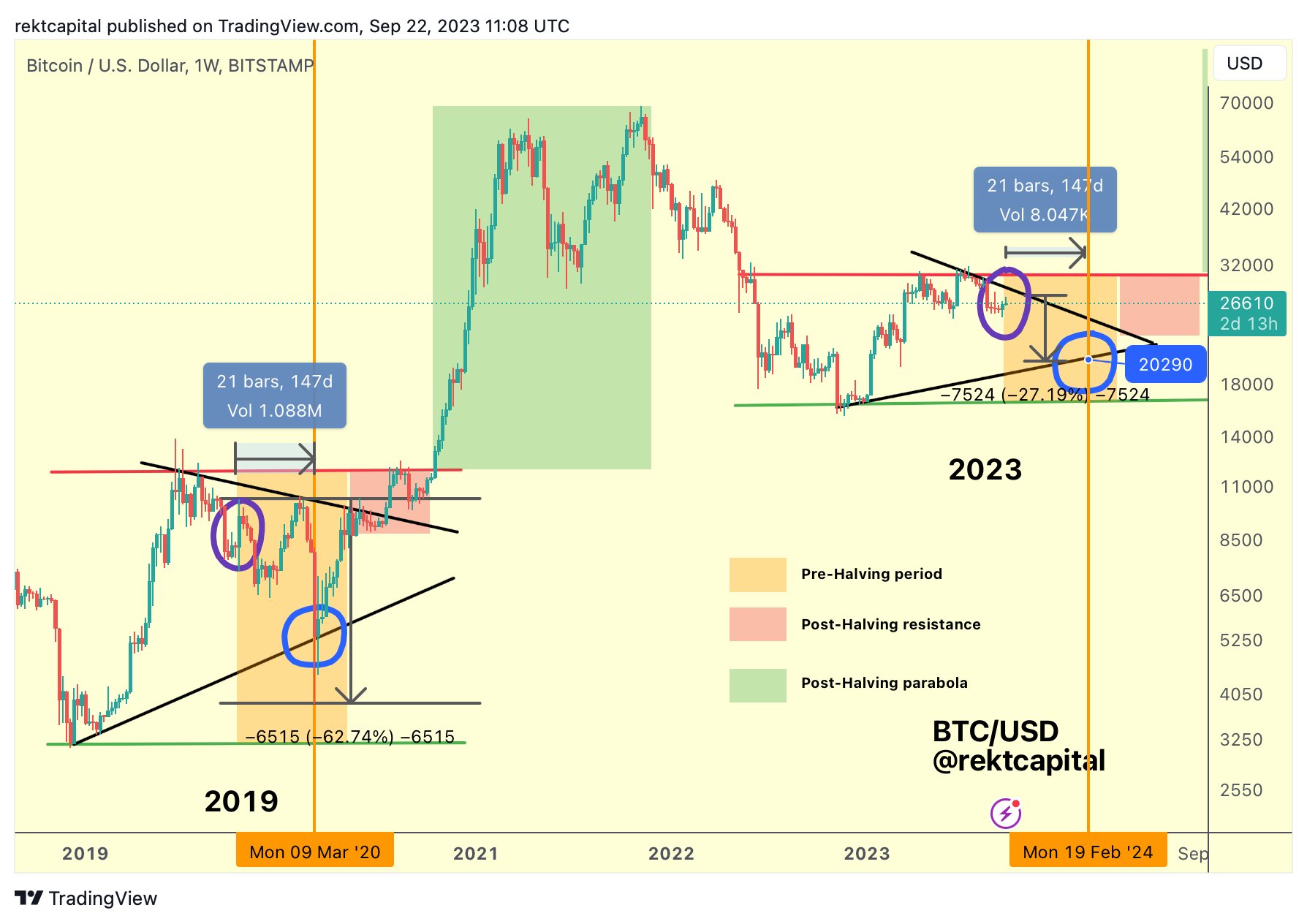

While Rekt Capital is bullish on Bitcoin in the long term, he warns that BTC could collapse in the months leading up to the halving.

“Bitcoin is 210 days away from halving.

At this point in the cycle in 2019, the price formed a lower high (purple).

After this, it took Bitcoin 147 days to crash -62% into the macro high.

What would that look like if history repeats itself in this cycle?

If Bitcoin makes a lower high soon (purple), it would take 147 days for BTC -27% to crash to its macro higher low (blue circle).

That would mean that Bitcoin could revise its macro level by mid-February 2024.

In mid-February 2024, the macro higher low would represent the price of approximately $20,300.”

At the time of writing, Bitcoin is worth $26,258. A move toward Rekt Capital’s downside target indicates a devaluation of more than 22% for BTC.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: ClipDrop