- The relevance of BTC’s halving cycle will be over by 2028, says exec

- Analysts forecast this cycle’s high target of $200,000 to $260,000, possibly by the end of 2025

Last Bitcoin Halving cycles were followed by an explosive rise in BTC’s price. This phenomenon has caused most cycle analysts and the market as a whole to expect a parabolic price rally after each event.

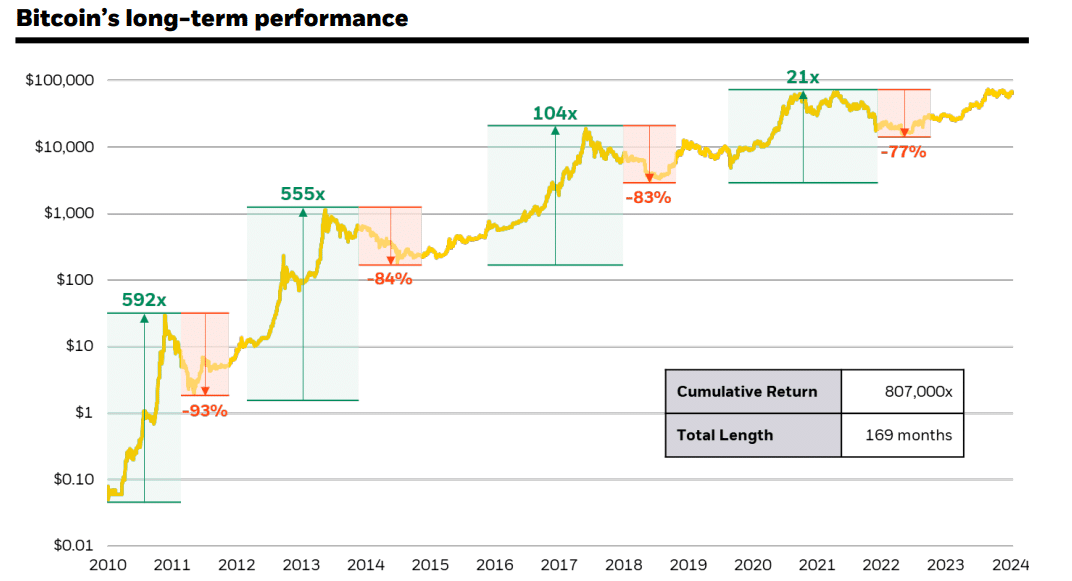

According to a recent Blackrock report, the value of BTC has increased by 592x since its debut in 2009. Subsequent exponential returns were also recorded after each of the past three halving events.

For example, in 2013, BTC made 555x returns, while in 2017, investors made 104x gains. After the halving in 2020, it posted another 21x return. And the trend is expected to repeat after the 2024 event.

Source: BlackRock

The latest impactful BTC halving?

However, Charles Edwards, founder of crypto VC firm Capriole Investments, believes this could be the final halving event to drive a parabolic BTC rally. He said,

“This is the last halving cycle that matters.”

Edwards argued that the next halving cycle will have no impact on BTC, as it is already the most difficult asset, with very low inflation among gold.

“The next halving won’t make much difference because BTC inflation is lower than gold. A huge price drop will therefore not have much influence on this.”

However, Edwards acknowledged that the current cycle has not yet been priced out for potential adoption by nation states. However, he noted that the halving cycles will no longer be relevant by 2028.

“You won’t get huge price increases because the halving events are so well known and the BTC mining industry is so efficient now. I think four-year halving cycles will no longer be relevant in four years.”

Here it is worth noting that market cycle analyst Stockmoney Lizards projected a possible price target of $200,000 – $260,000 per BTC for this cycle top. This could happen in the fourth quarter of 2025.

Source:

In short, there is still more room for BTC growth before reaching this cycle top.

The world’s largest digital asset retested at $66,000 on Friday and was valued at $65.9,000 at the time of writing. That puts it just 8% away from its range-high of $71,000.