- Ethereum exchange reserves recently fell to a critical low

- The main signals seemed to point to a possible short-term rebound at the key level

Ethereum bears have maintained their dominance over the past three months, but how much longer can they maintain this? Well, recent data suggests potential accumulation as ETH flows out of exchanges, highlighting the state of demand at lower prices.

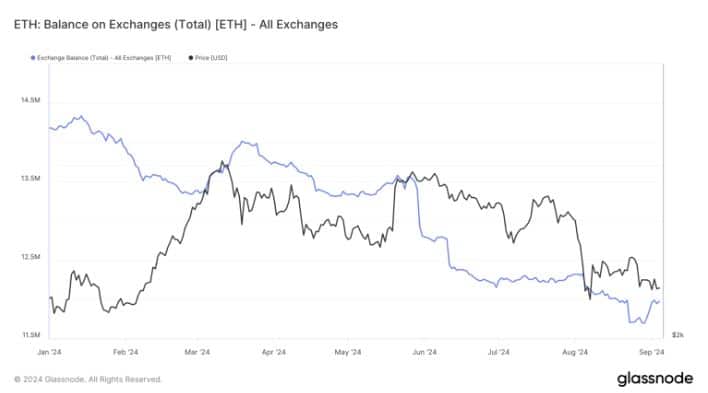

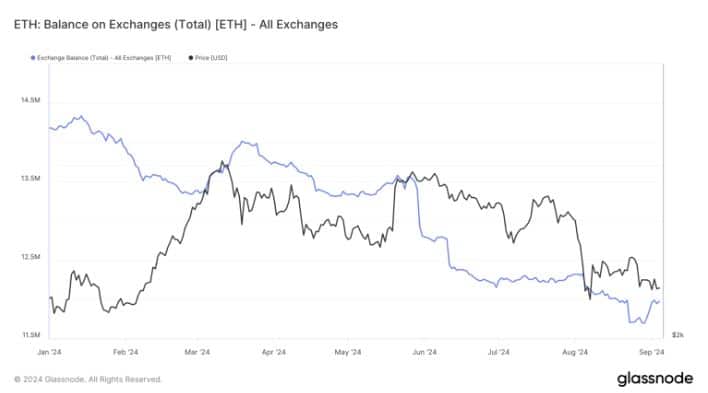

According to Glassnode, Ethereum is flowing out of the exchanges. Even more notable are the recent lows in ETH reserves, which recently retested 2016 levels. Low foreign exchange reserves may have contributed to ETH’s robust price action in the following year (2017). Hence the question: can history repeat itself?

Source: Glassnode

A 2016 historical analysis of Ethereum found that it was experiencing some headwinds. The price of ETH peaked at $18.36 in June 2016, before falling below $12 in September of the same year. In December of the same year, the price even fell to $7.14 before staging an epic rally in 2017.

If Ethereum follows a similar path in 2024, it could point to the possibility that 2025 will produce a strong rally. The fact that ETH is flowing from the exchanges confirms the presence of strong demand at discounted prices. Moreover, the pace of ETH flows has also increased.

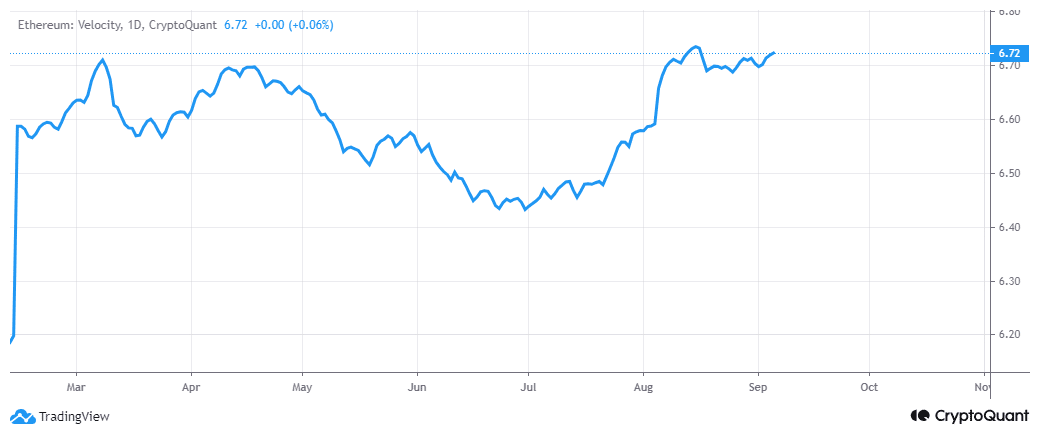

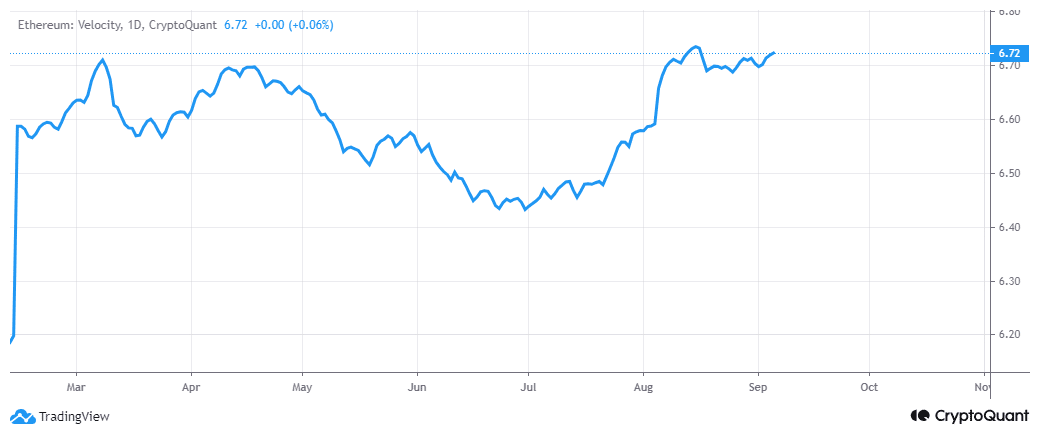

Source: CryptoQuant

Ethereum’s speed has been on an upward trend since July. If this trend continues, coupled with robust demand, a near-term bullish pivot could be in the works.

However, activities in the chain have shown that demand has not yet reached a turning point where it will exceed supply.

Could Ethereum’s Demand Lead to a Pivot?

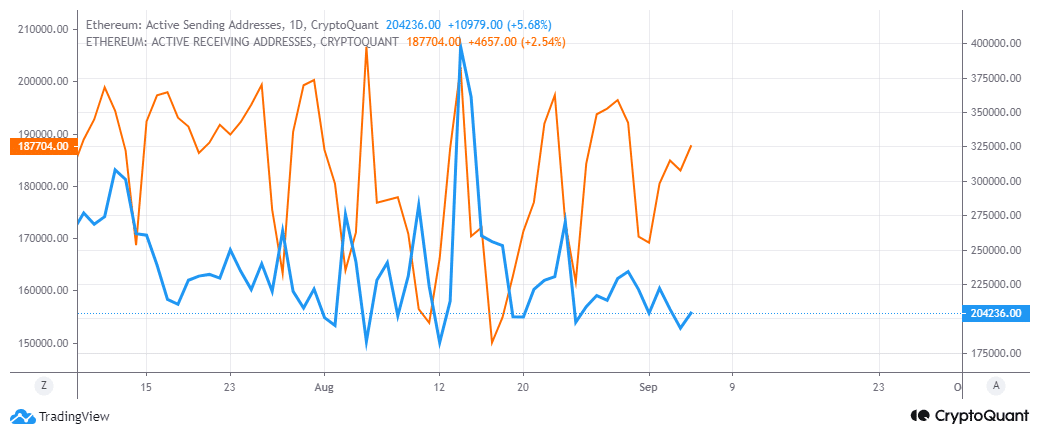

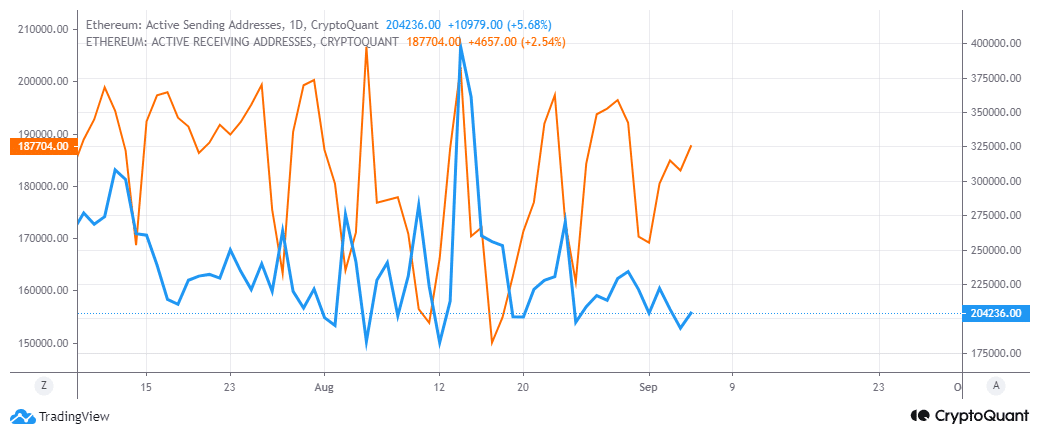

According to Ethereum address data, ETH addresses have seen more outflows than inflows. At the time of writing, there were 204,000 active shipping addresses, compared to almost 188,000 receiving addresses.

Source: CryptoQuant

Nevertheless, the data on active addresses also revealed another interesting observation.

Over the past two weeks, active receiving addresses have increased, while active shipping addresses have decreased. This observation could indicate a shift in the dynamics of supply and demand. Moreover, this could be due to the prevailing price level of ETH.

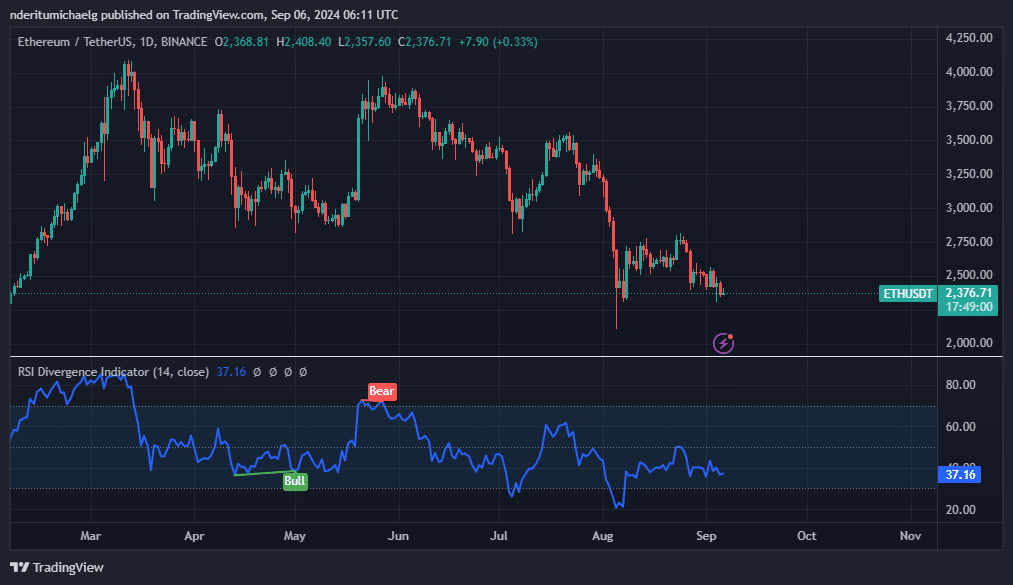

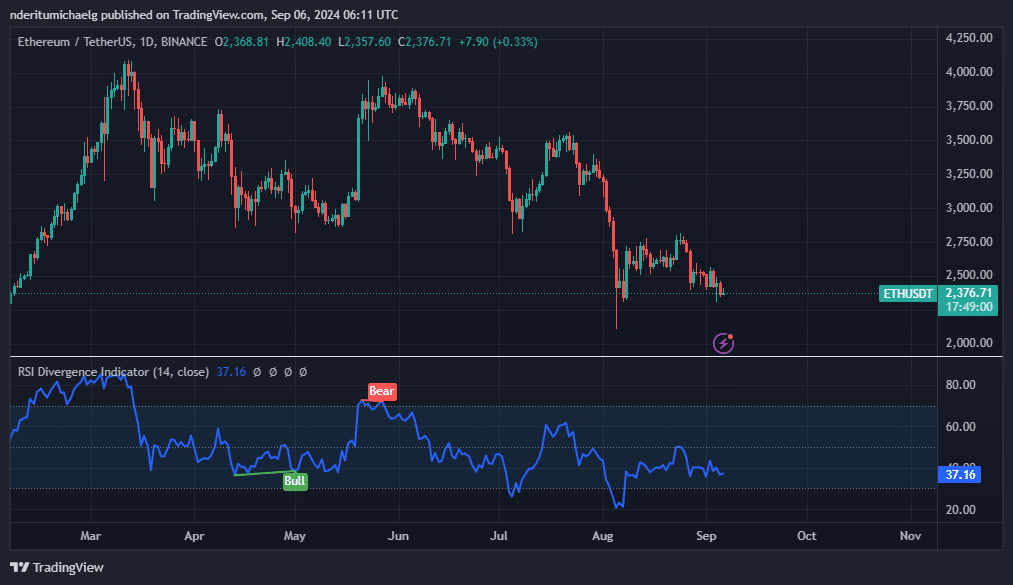

ETH’s latest downside pushed the price to a notable support level near the $2,333 price range. This could be a sign of increasing expectations of a pivot around the same price range. Especially now that the Bears are winding down their offense.

Source: TradingView

Despite these observations, however, the 1-day chart indicated that the bulls have yet to come out swinging.

Moreover, the RSI indicated that the overall trend will remain in favor of the bears, with room for more potential downsides. Possibly towards the lowest price level of August.