When Bitcoin’s price action is sideways and directionless for the better part of a year, bulls and bears debate which direction will ultimately be chosen.

However, given macroeconomic conditions such as rising interest rates, a declining stock market and mounting debt, the bears are not ready to throw in the towel just yet. But maybe they will after seeing this graph.

Bitcoin price chooses a direction: up and away

Bitcoin and other cryptocurrencies are normally notoriously volatile. But volatility has fallen to virtually nothing since the FTX collapse.

Few have been willing to take the risk on BTC and altcoins as macro conditions teeter on the brink of collapse. It resulted in a big step from the bottom up, but also in more than six months of consolidation and confusion.

But after several months of sideways price action, Bitcoin appears to have chosen a direction and has broken out to form a new trend. However, the bears remain stubbornly short based on market sentiment.

Bearish traders may want to reconsider their positioning after looking at the Directional Movement Index.

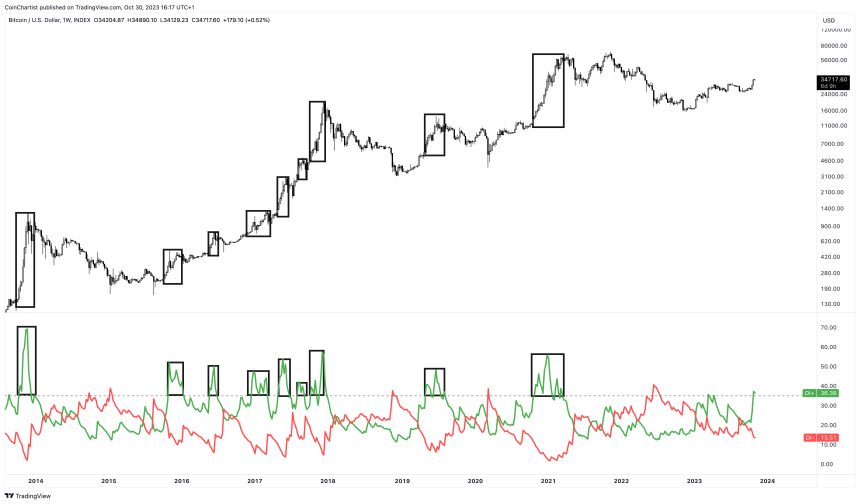

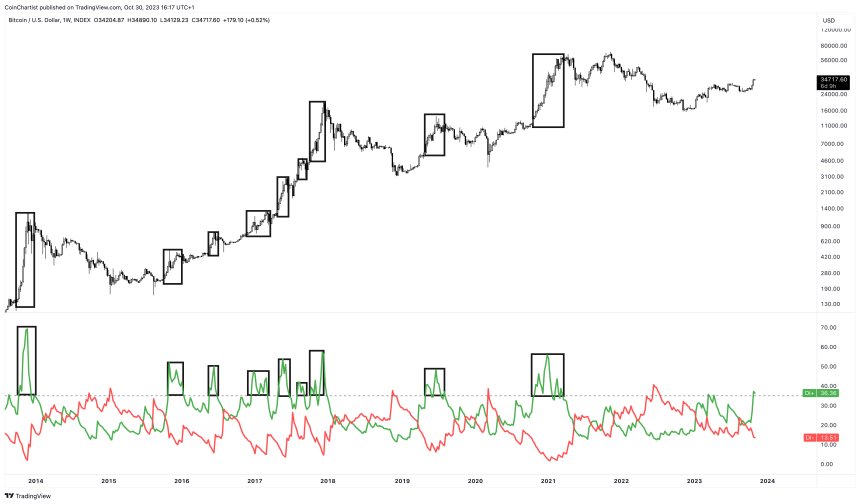

There is no denying: Bulls are in charge | BTCUSD on TradingView.com

Bullish directional moves are anything but average

The Directional Movement Index is usually found bundled with the Average Directional Index and consists of a negative and a positive directional indicator. The premise of the tool is simple: when DI+ (green) is above DI- (red), the asset is bullish and DI- is above DI+ when it is bearish.

This technical analysis indicator currently shows the DI+ rising sharply while the DI- falling and remaining below the 20 line. The 20 line is more noticeable on the ADX, which is not in the photo. When the ADX rises above 20, the tool suggests that a trend is active and strengthening.

Bitcoin is not yet above 20 weekly, but is starting to do so on lower time frames. Given how strong the recent move has been, the ADX could confirm above 20 over the next two weeks. At that point, the bears could finally be forced to admit that a new bull trend has blossomed.