- The BTC/Gold correlation remained weak at the time of writing.

- Bitcoin surpassed gold in investors’ portfolio allocation, adjusted for volatility.

Bitcoins [BTC] Proponents have long portrayed it as a global store of value, guaranteeing investors guaranteed returns over time regardless of the state of the broader financial market.

Well, 2024 could be the year that dramatically amplifies this story.

Digital gold versus real gold

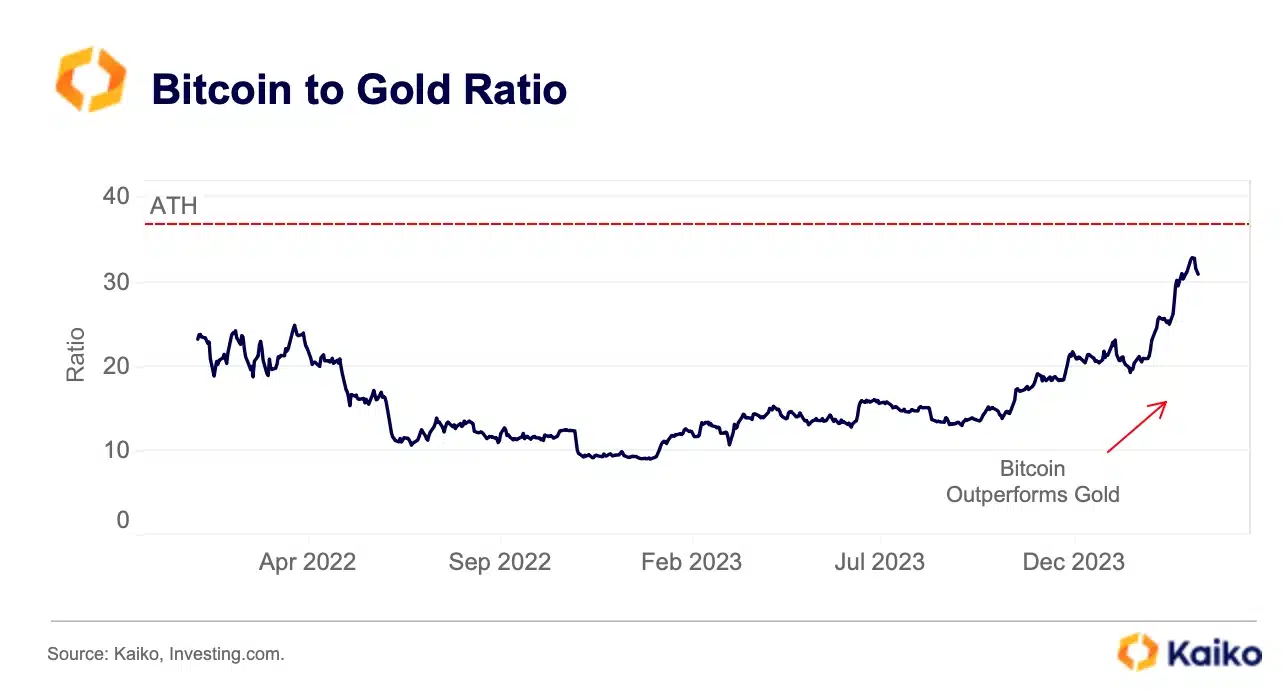

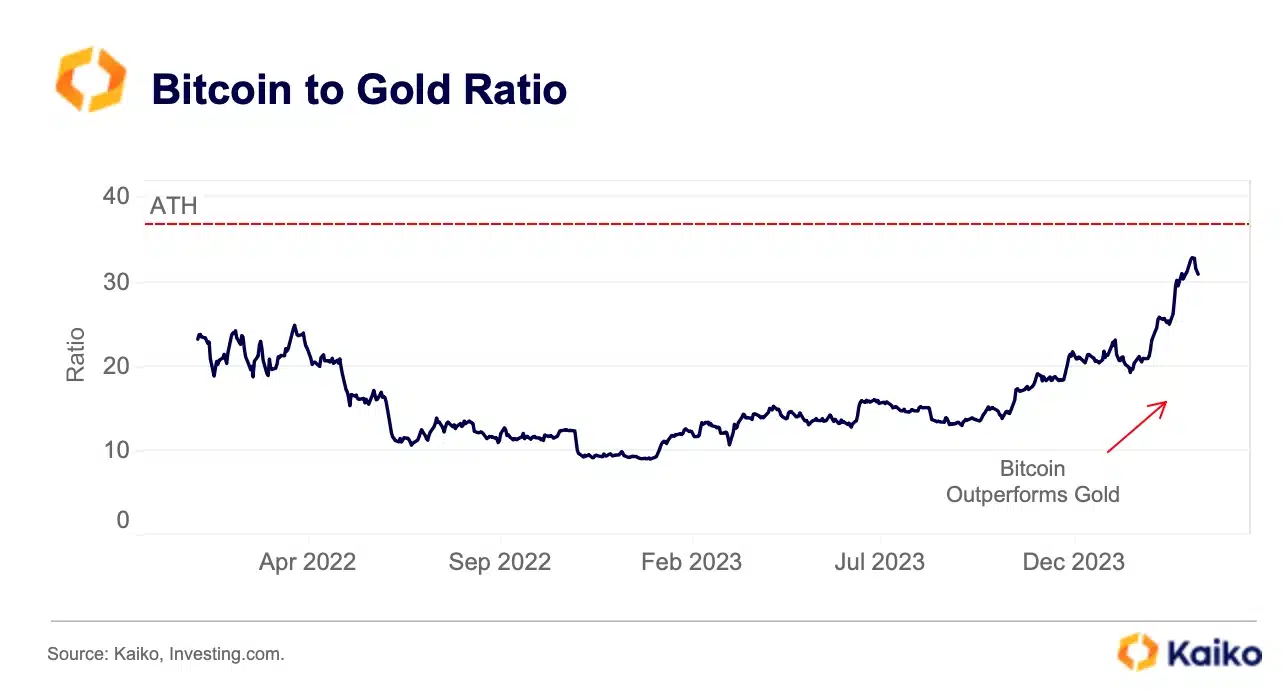

The Bitcoin/Gold ratio has risen sharply since the start of the year, moving closer to the all-time high (ATH) of the 2021 bull market peak, the crypto market data provider said. Kaiko.

The ratio, which measures the relative performance of the two assets, highlighted that the ‘digital gold’ outperformed its real-world counterpart.

Source: Kaiko

The world’s largest cryptocurrency has been strengthened by the launch of spot exchange-traded funds (ETFs) in the US this year.

According to AMBCrypto’s analysis of SoSo value According to data, inflows into spot ETFs have reached $12 billion since their January listing.

Rising demand sent Bitcoin past its ATH earlier this month, and up more than 50% since the start of the year.

On the other hand, the yellow metal could be to grow 4.71% year-to-date (YTD), although the price also recently peaked at $2,179 per ounce.

Furthermore, unlike Bitcoin, physically backed gold ETFs have witnessed net outflows of late World Gold Council.

Is Bitcoin Replacing Gold in Wallets?

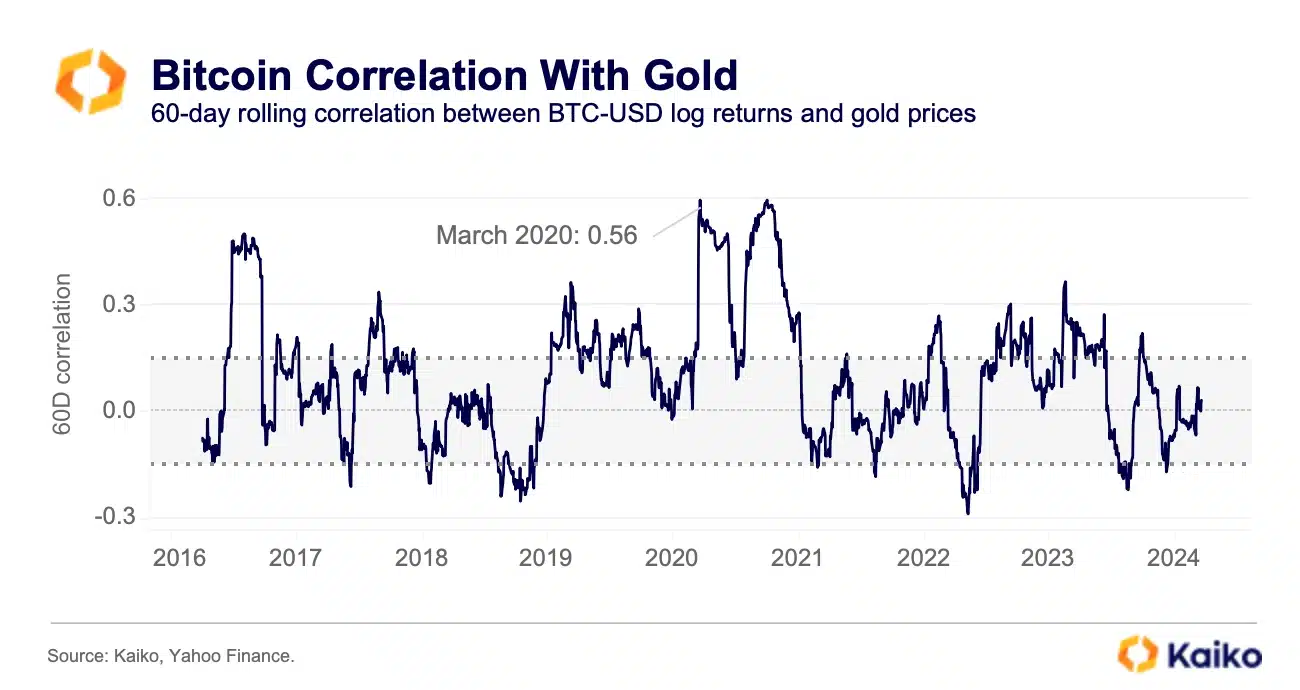

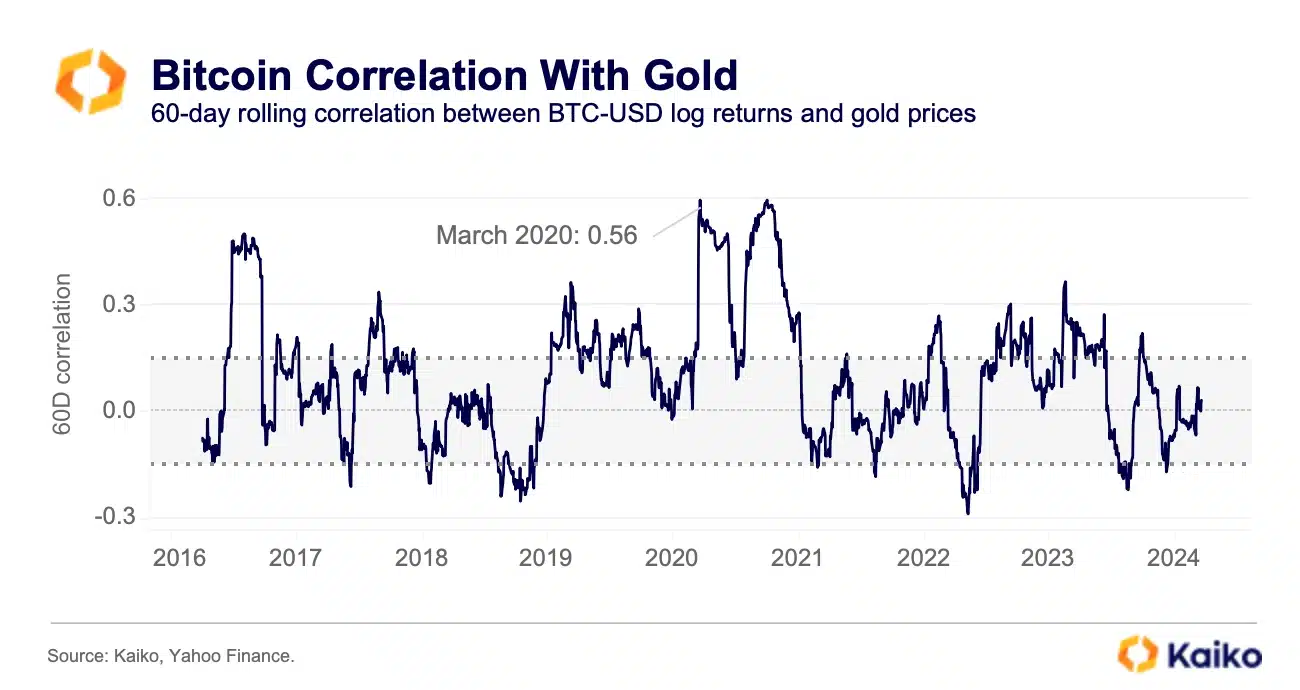

Kaiko further emphasized the lack of an interrelationship between the two asset classes.

The 60-day BTC/Gold correlation has fluctuated between a positive 0.15 and a negative 0.15 for most of the past decade. This implied that the factors influencing demand for the two varied considerably.

If the correlation remains weak, Bitcoin spot ETFs could become a viable alternative to gold investing.

Source: Kaiko

Read Bitcoin’s [BTC] Price forecast 2024-25

JPMorgan analyst Nikolaos Panigirtzoglou recently stated that Bitcoin has already surpassed gold in investors’ portfolio allocation, adjusted for volatility.

This suggested a possible rotation of capital from gold to Bitcoin.