- Bitcoin fell 8.42% on the weekly charts, leading to a rise in bearish market sentiment

- An accumulation trend score approaching 0 could impact the cryptocurrency

In recent months, Bitcoin has seen extreme volatility on the price charts. While BTC has reached an all-time high of $73,000 in 2024 and the market has become more favorable since the launch of ETFs, it has also seen higher volatility.

At the time of writing, BTC was trading at $54,239, having dropped 8.42% in the past week.

And yet it is still showing some signs of life with a recent increase in trading volume. In fact, the numbers for this have increased by 63.13% to $48.6 billion in the last 24 hours. However, what does this mean for BTC’s market prospects in the short and long term? Can Bitcoin now fully recover?

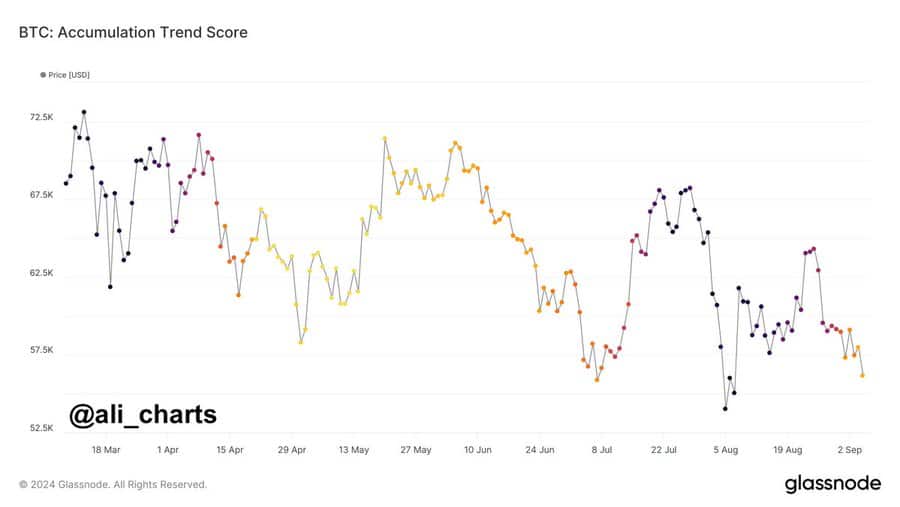

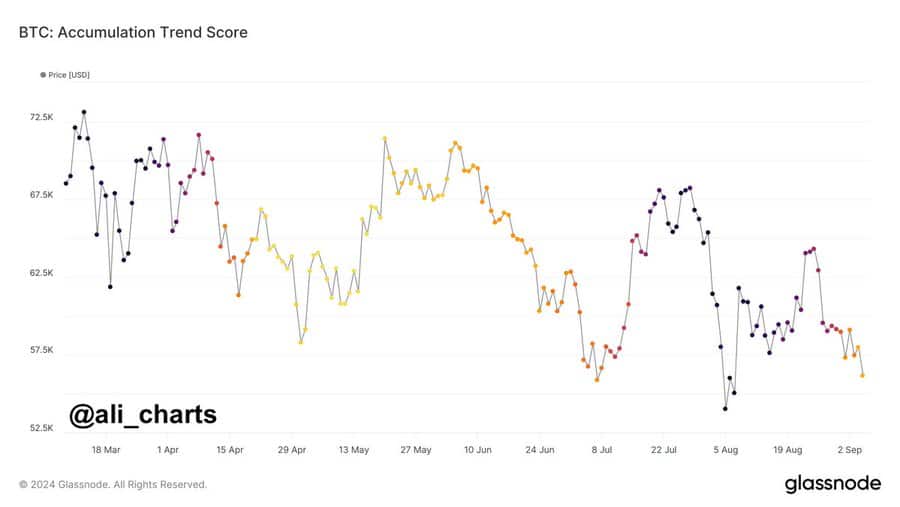

Well, according to the popular crypto analyst Ali Martinez’s According to the suggestion, BTC may see reduced participation. He made this claim by citing the declining accumulation trend score.

Market sentiment analysis

According to Martinez, the accumulation trend score is currently approaching zero. This means that market participants distribute or do not accumulate BTC.

Source:

In context, the accumulation trend score reflects the relative size of entities actively accumulating coins on-chain in terms of BTC holdings. A value close to 1 suggests that participants are collecting coins. A value closer to 0 indicates that participants are dividing their assets.

So when the accumulation trend score flashes 0, it indicates there are no buyers from any cohort, indicating distribution. Whenever BTC hits a low in a bear cycle, it sees a surge in accumulation as investors buy the dip. However, after the bear market cycle continues, a lack of accumulation occurs because they lack confidence in the cycle.

Based on this analysis, the accumulation score from late August to early September 2024 is approaching zero. This means greater dispersion and a weakening of accumulation among participants. Such a scenario suggests that larger players and long-term holders are not buying – an indication of bearish sentiment.

This is also a sign of lack of confidence among investors about the near-term rally. These market conditions result in selling pressure, leading to a price drop on the charts.

What do the price charts say?

While the figures highlighted by Martinez provided a detailed picture of prevailing market sentiment, the broader market has borne the brunt of the recent recovery.

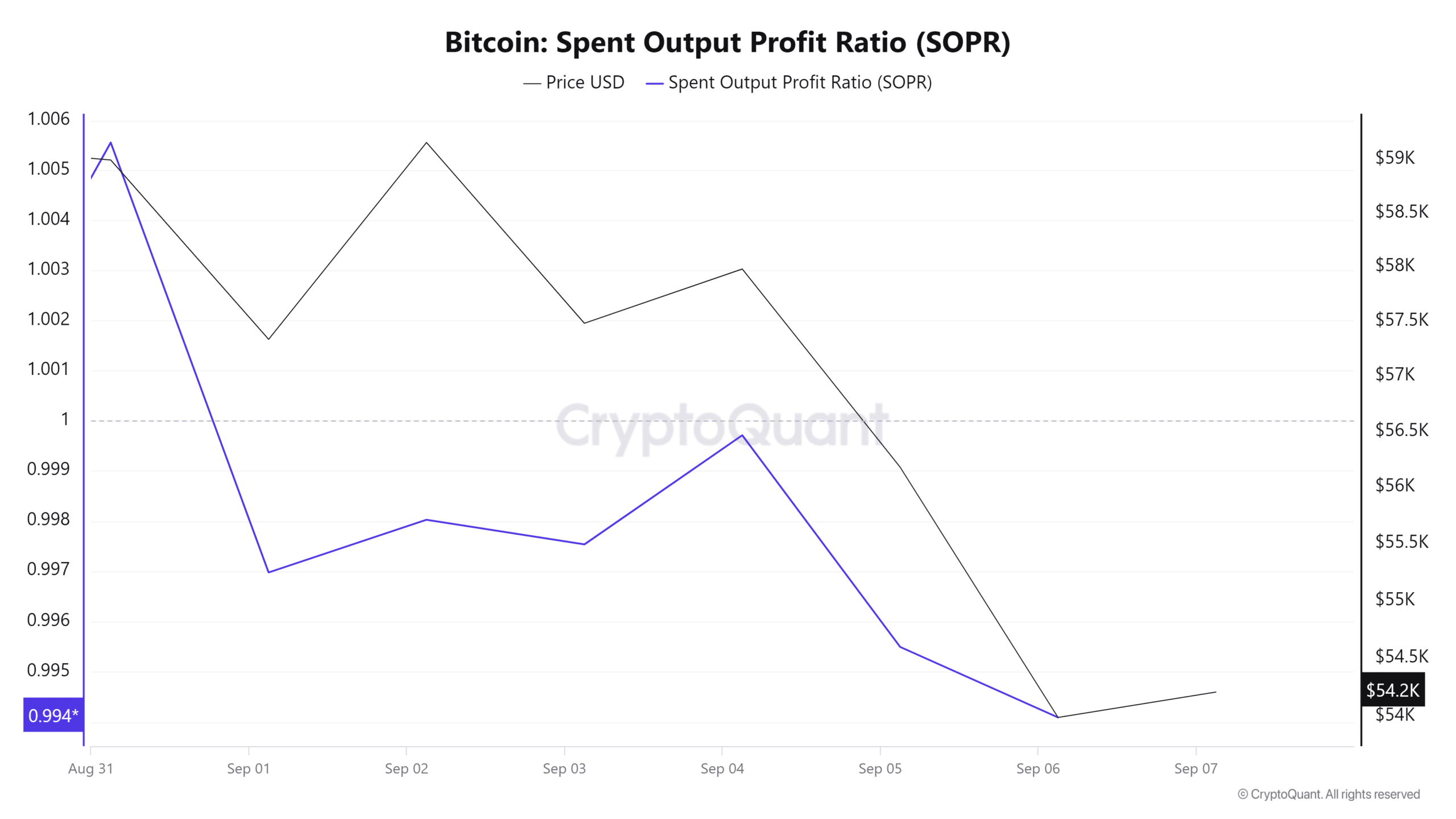

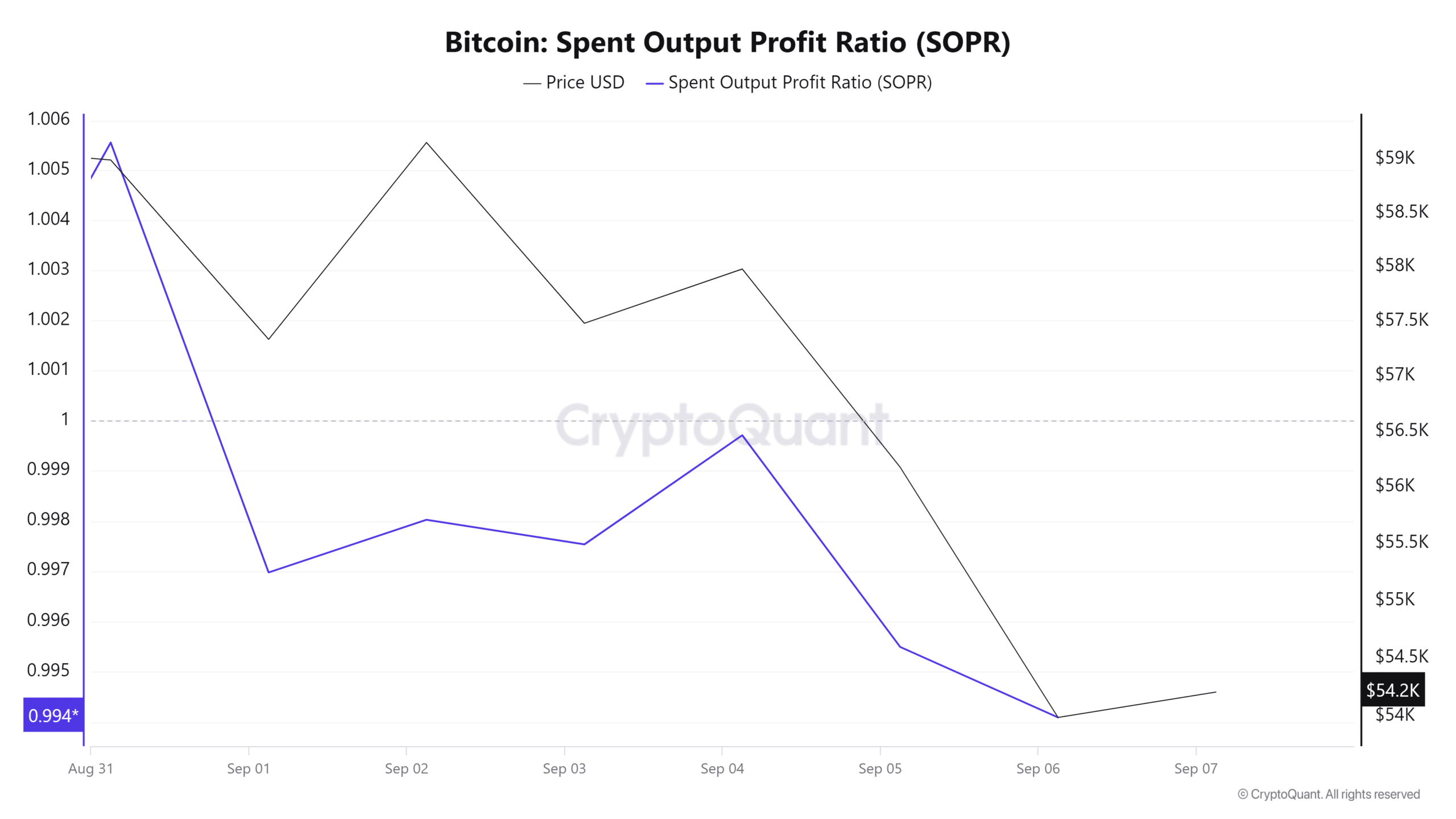

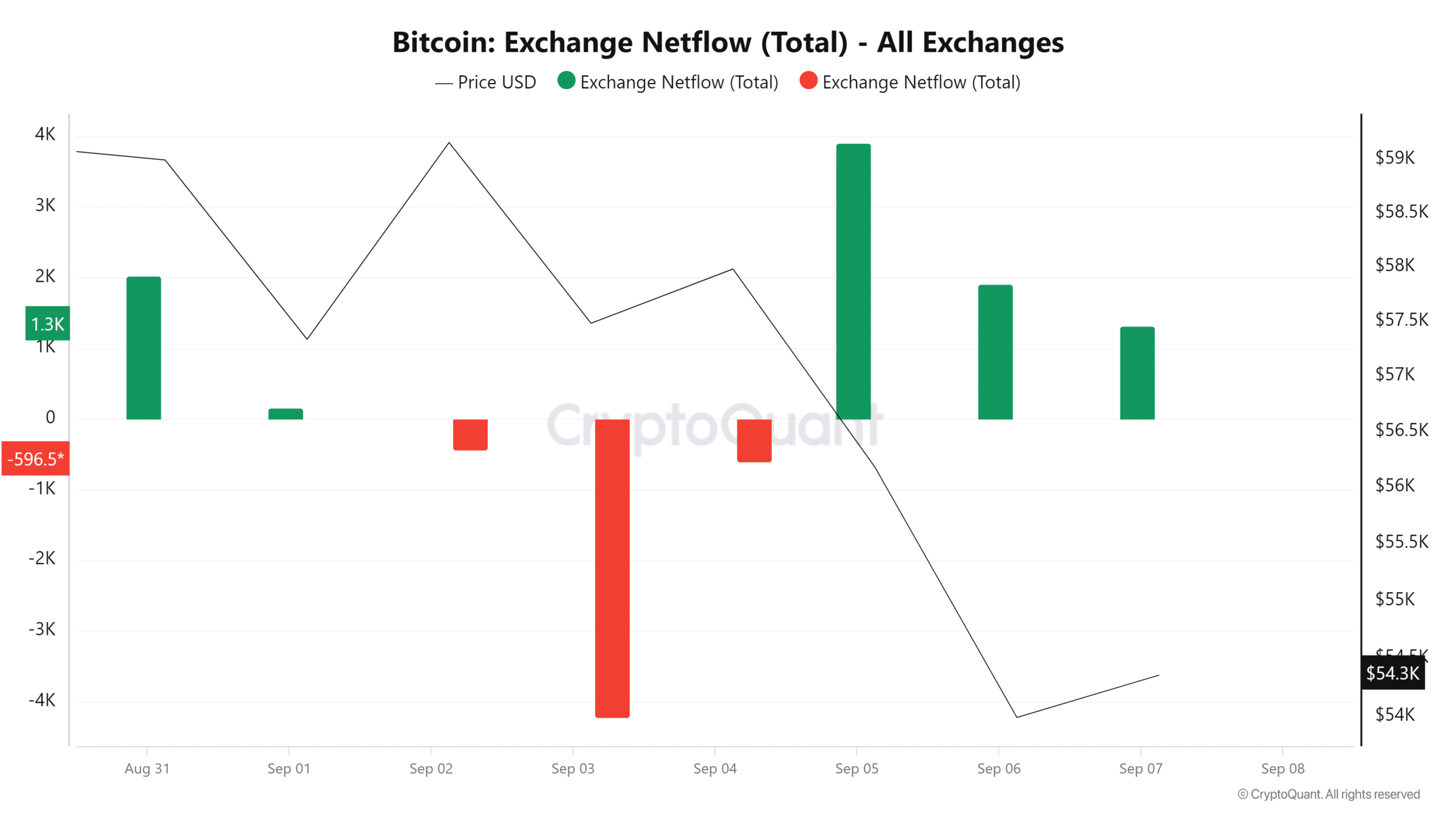

Source: Cryptoquant

For starters, Bitcoin’s major holder SOPR has fallen from 2.4 to 1.6 over the past seven days. This showed that although long-term owners sell at a profit, the size of the profit decreases. Therefore, traders sell at a loss as they become less confident in the short- to medium-term prospects for the asset.

This scenario also seemed to indicate that investors are pessimistic about future price increases and are preparing for a further bearish scenario.

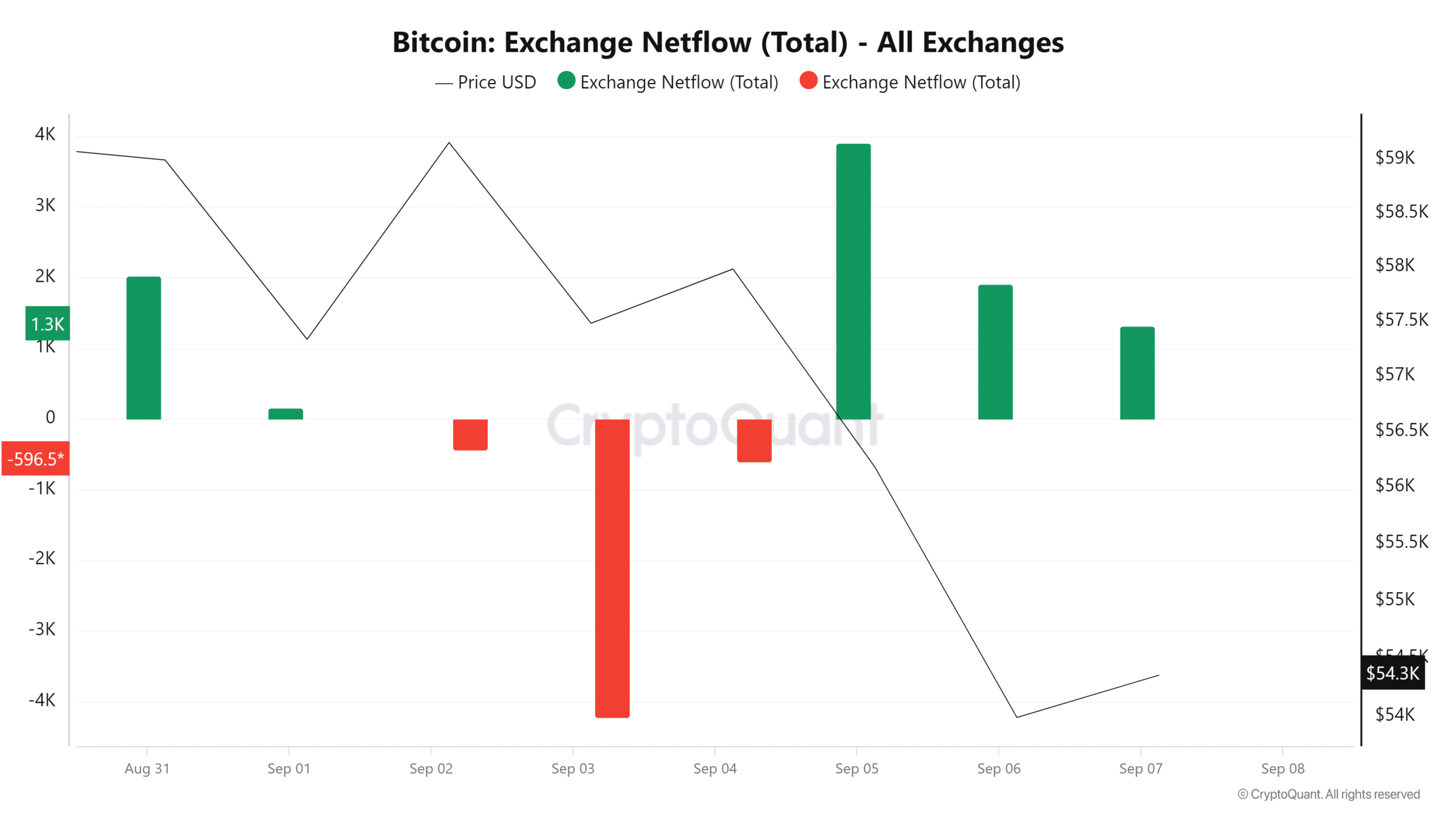

Source: Cryptoquant

Moreover, Bitcoin’s AC flows have remained relatively positive over the past seven days. In seven days, there have been positive AC flows in four days – a sign that more investors are preparing to close their positions. Here, an increase in inflows on the stock exchanges can result in distribution, if it leads to sales.

In light of all these factors, it can be predicted that if selling pressure continues, BTC is at risk of falling below $50,000.