Data from Santiment shows that several altcoins have recorded an increase in address activity, which could make them worth keeping an eye on.

Bitcoin Cash and other altcoins have seen a rise in the number of active addresses

As explained by on-chain analytics company Santiment in a new after on

The indicator of interest here is the ‘daily active addresses’, which track the total number of unique addresses of a given coin that interact with the blockchain in some way every day. The statistic takes into account both senders and recipients.

What ‘unique’ here means is that each address that participates in transaction activity on the blockchain is counted only once, regardless of how many transfers it is involved in.

This limitation provides a more accurate picture of actual activity on the network, because just a few addresses performing hundreds of transactions cannot skew the metric on their own.

When the value of the indicator is high, it means that a large number of unique addresses are currently participating in transaction activity. Such a trend implies that the blockchain is currently receiving a large amount of traffic.

On the other hand, low values imply that not many users are interacting with the network, a possible sign that interest in trading the cryptocurrency is currently low.

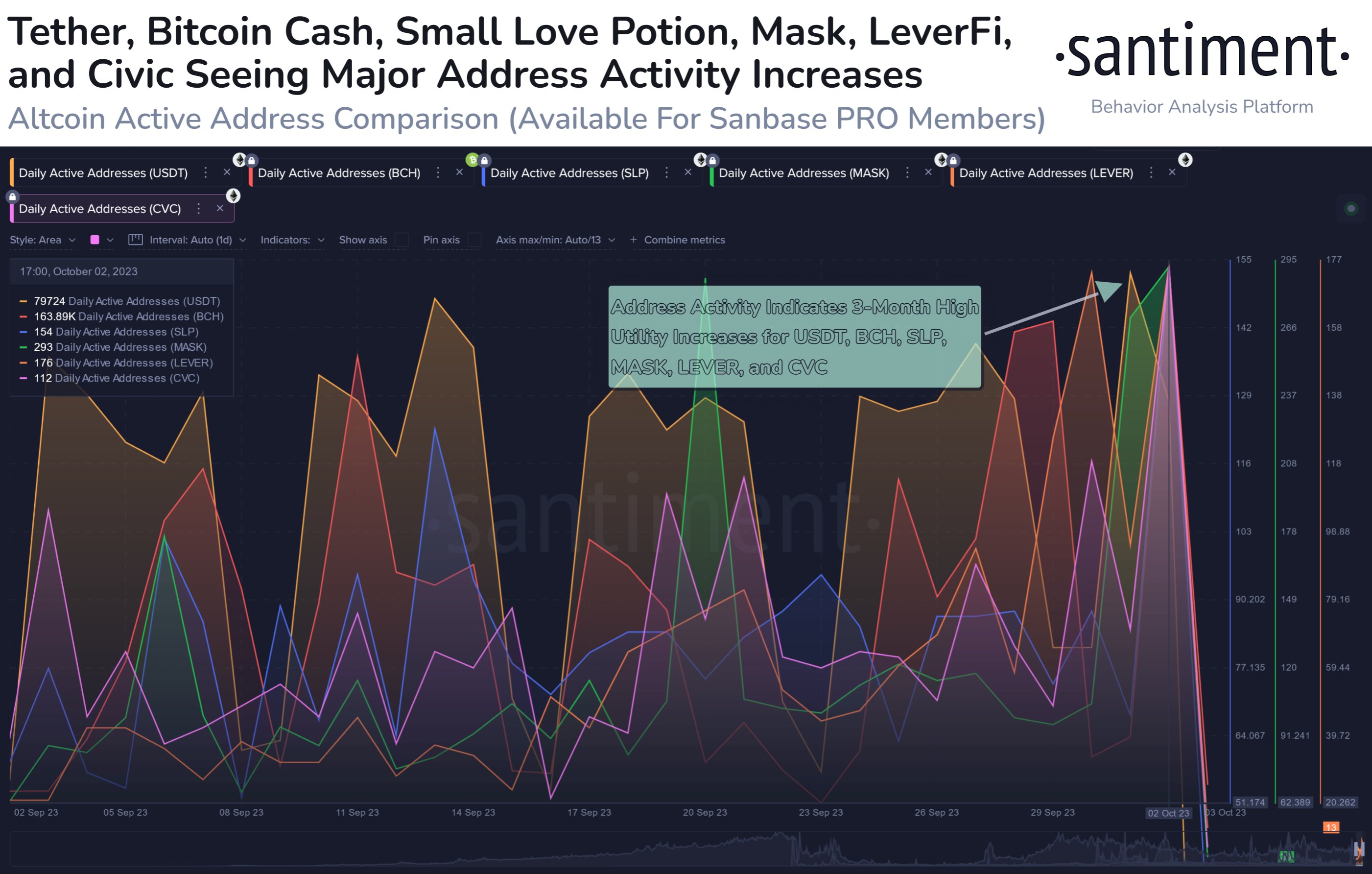

Here is a graph showing the trend in daily active addresses for various altcoins over the past month:

Looks like the value of the metric has been high for all of these assets recently | Source: Santiment on X

As shown in the chart above, the daily active address indicator has seen a sharp increase in recent days for the altcoins mentioned here: Bitcoin Cash (BCH), Small Love Potion (SLP), Mask (MASK), LeverFi (LEVER) and Civic (CVC).

According to Santiment, these latest highs in the metric correspond to the highest levels these cryptocurrencies have seen in about three months. Such high activity obviously indicates that there is currently a lot of interest in these coins among investors.

However, most of these are small-cap coins, but there is one that has a very notable status in the rest of the market: BCH. The 16th-ranked asset in the sector has seen a decline over the past two days, as has the broader sector, but the asset’s number of active addresses is still high.

Usually, high address activity is a good sign for rallies, because a large amount of active traders means the move has a better chance of finding the fuel it needs to keep itself going.

Interestingly, in addition to these altcoins, the largest stablecoin in the sector, Tether (USDT), has also seen its indicator skyrocket during this period. Investors use stablecoins to store their value in a more secure form and to purchase other assets, so the high address activity could potentially be a sign that some movements are happening in the background.

BCH price

Bitcoin Cash had previously surged past the $250 mark, but with the latest drawdown, the altcoin has fallen to $230.

Looks like the altcoin has reversed its recovery | Source: BCHUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Santiment.net