Former CTO of Coinbase Balaji Srinivasan sparked speculation about US regulatory action on Twitter, writing: “The attack on Bitcoin is coming.”

The comment was made in accordance with Alexander Leishmanthe CEO of River Financial, who called on Bitcoiners to remain humble “during all this regulatory drama” as regulators would come for Bitcoin in due course.

In separate enforcement actions against Binance and Coinbase earlier this week, the legal filings made several allegations of violating securities laws, including (in both cases) operating as an unregistered exchange.

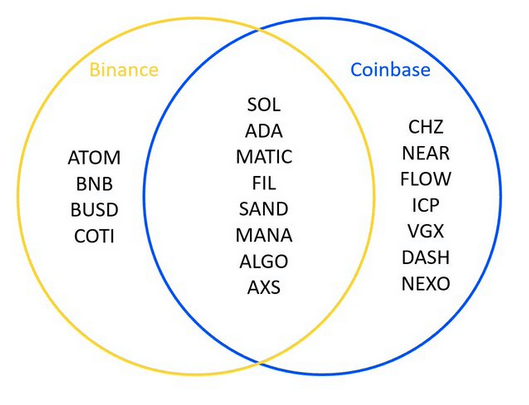

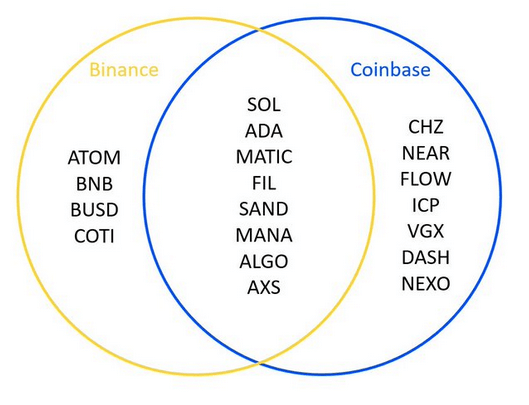

The filings also named several tokens traded on each platform as securities, potentially impacting their US operations or leading to widespread delisting.

Analyst Miles Deutscher collected the 19 altcoins named by the SEC and plots them in a Venn diagram to illustrate crossovers between the two exchanges.

Bitcoin max

Some Bitcoin maximalists supported the SEC enforcement action implying an altcoin purge is needed to accelerate Bitcoinization.

In response, General Practitioner at Castle Island Ventures, Nick Carterposted a lengthy tweet berating maxis who applauded the SEC and said the “cultists” failed to consider Coinbase and Binance’s efforts to move the entire industry forward, including onboarding Bitcoiners and promoting BTC adoption .

“So why are they giddy about the potential destruction of Coinbase and Binance, which have collectively admitted 100 to 200 million individuals worldwide to crypto and, specifically, Bitcoin?”

Carter compared BTC maximalism to religious dogma and the need to find “high morale.” In doing so, he questioned the motives behind BTC maximalism, suggesting that it stems from the need to be correct.

Otherwise it would mean that they are a “God [that] was a fake.”

Gold confiscations

So far, Bitcoin has enjoyed an implicit stamp of approval due to its fair token launch and perceived decentralization. But Srinivasan suggested that regulators will enable Bitcoin soon enough.

He pointed out that President Franklin Roosevelt, who signed Executive Order 6102 in April 1933, also created the SEC after the passage of the Securities Exchange Act of 1934.

Executive Order 6102 required U.S. citizens to sell all but a small amount of personally owned gold to the federal government for cash to bolster the money supply during the Great Depression. Citizens who refused could be subject to severe penalties, including imprisonment or fines of up to $10,000.

Srinivasan argued that the point of SEC and precious metal confiscations “was to establish state control over the economy, “insinuating a repetition of history.”