TL; DR

-

We’ve hit you in the head with this comparison, a lot of, but it’s worth repeating – because this is the main reason Bitcoin rises over time: Reduced supply + increased demand = increased value.

-

There are 19.51 million BTC in existence, of which 14.85 million are either held long-term or lost forever… That leaves us with 4.66 million BTC (~$124 billion worth) to buy and to trade.

-

If the folks at BlackRock got their Bitcoin ETF approved and allocated just 1.25% of their total assets under management to the ETF (assets totaling ~$10 trillion)…There would literally be no more Bitcoin available to buy.

Full story

We’ve hit you in the head with this comparison, a lot of, but it’s worth repeating – because this is the main reason Bitcoin rises over time:

Reduced supply + increased demand = increased value.

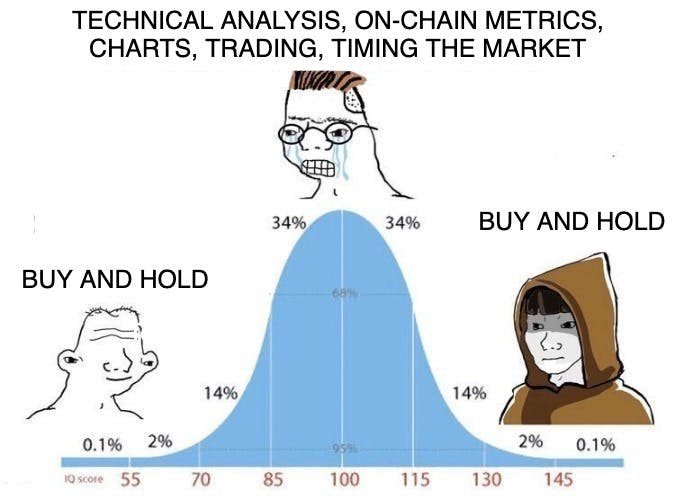

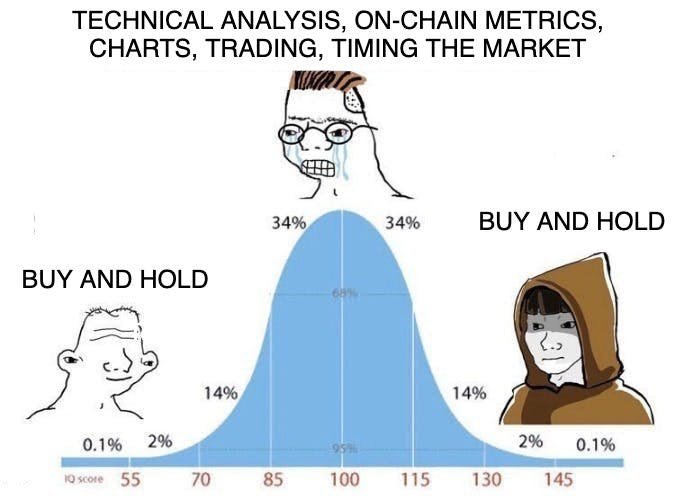

Of course, it’s simple. Stupidly simple. But idiocy and genius are often one and the same in crypto (see header image

What we want to talk about today is the first part of that equation, the “reduced supply” bit.

Because the following currently applies:

19.51 million BTC exist.

14.85 million of those are owned by long-term holders (aka people who have held their BTC for 155 days or more).

And according to Chain analysis – 5.25 million BTC of those 14.85 million BTC that are not ‘long-term’ but are ‘lost forever’.

So. There are 19.51 million BTC in existence, of which 14.85 million are either held long-term or lost forever…

That leaves us with 4.66 million BTC (~$124 billion worth) to buy and trade.

That’s not much!

And it means that Bitcoin will be much more sensitive to any increases in demand than you might think.

All we need now is an increase in demand… which may not be far away. For example:

If the folks at BlackRock got their Bitcoin ETF approved and allocated just 1.25% of their total assets under management to the ETF (assets totaling ~$10 trillion)…

There would literally be no more Bitcoin available to buy.

And as the theory goes: lower supply + higher demand = higher value.

Very exciting!