- A second potential issuer has filed for the US spot XRP ETF.

- However, the altcoin remained muted following the SEC’s appeal against Ripple Labs

Canary Capital is the latest player to join the US space Ripple [XRP] ETF race. The company filed an application on October 8 S-1 forman initial security registration, with the SEC.

The filing comes a week after Bitwise made a similar one application with the controller.

Source: SEC

Canary Capital is a new investment company launched by Steven McClurg, co-founder of Valkyrie Fund.

The company spokesperson cited “progressive regulation” as the reason for the move.

“We see encouraging signs of a more progressive regulatory environment, coupled with growing investor demand for advanced access to cryptocurrencies beyond Bitcoin and Ethereum – particularly investors seeking access to enterprise-grade blockchain solutions and their own tokens like XRP.”

The latest XRP ETF filing has renewed market optimism about the altcoin.

Reactions to the declaration

In response to the filing, ETF Store’s Nate Geraci stated that an XRP ETF approval was a “matter of when, NOT if.” But he added that the outcome could depend on the US elections.

“Another XRP ETF application… Approval is a matter of when, not if, IMO. But that “when” will be *much* further in the future, unless there is a change in management.”

This was the view of most market observers after Bitwise filed a similar filing last week.

Market experts believed that the move depended on the upcoming US elections as the current administration still lacked regulatory clarity, especially for other tokens such as XRP and Solana. [SOL].

Ripple Labs SEC Lawsuit

The ongoing Ripple Labs-SEC lawsuit supported the challenge for an XRP ETF from a regulatory perspective.

On October 2, the regulator appealed a ruling that classified XRP sales to institutional investors as “safety,” but not to the public.

Ripple called the appeal ‘irrational and misleading.’ However, this meant that the regulator was still considering XRP security and could be a stumbling block to approval.

Ergo, market observers believe that a change in the SEC or US government could help clarify the status of the rest of the crypto tokens.

Impact on XRP

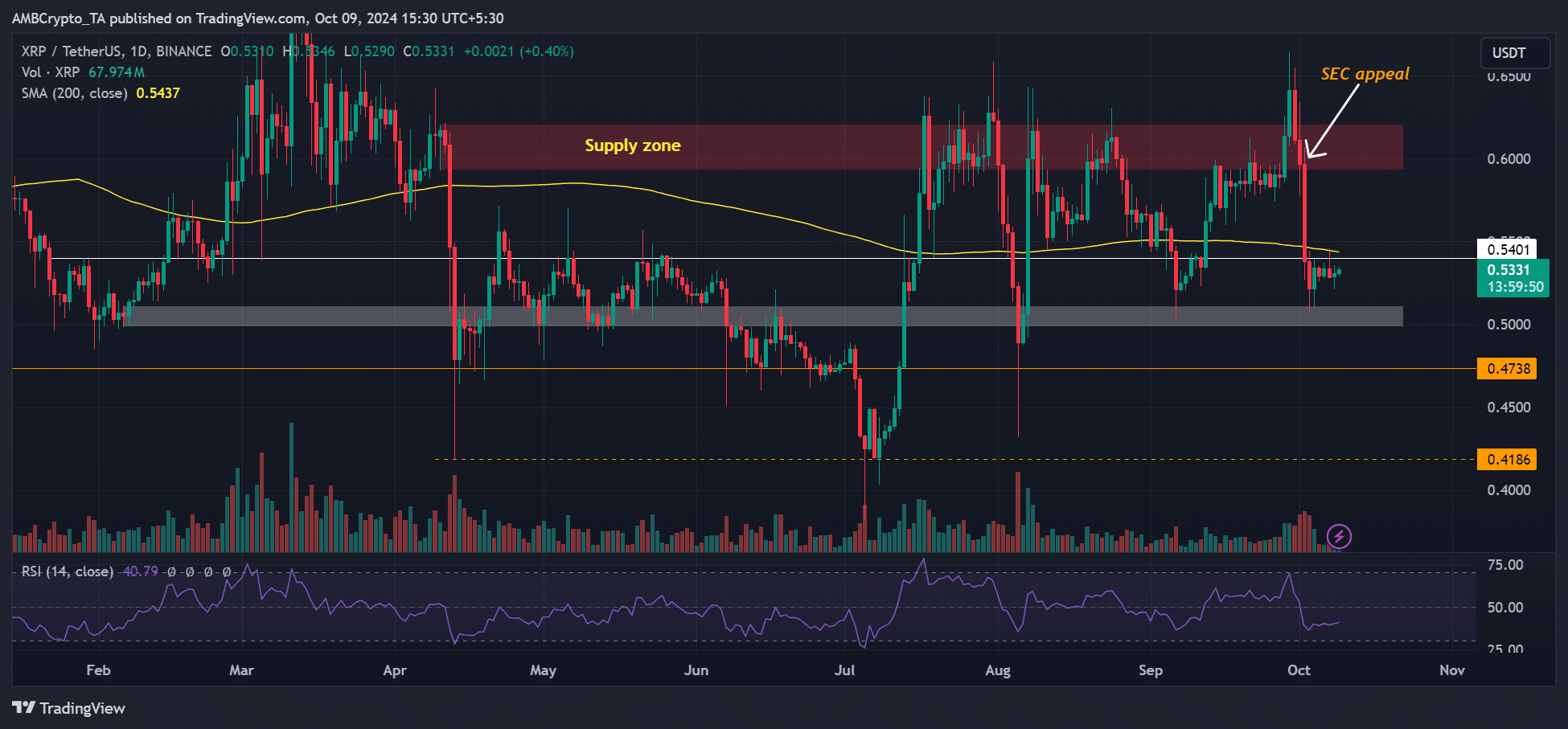

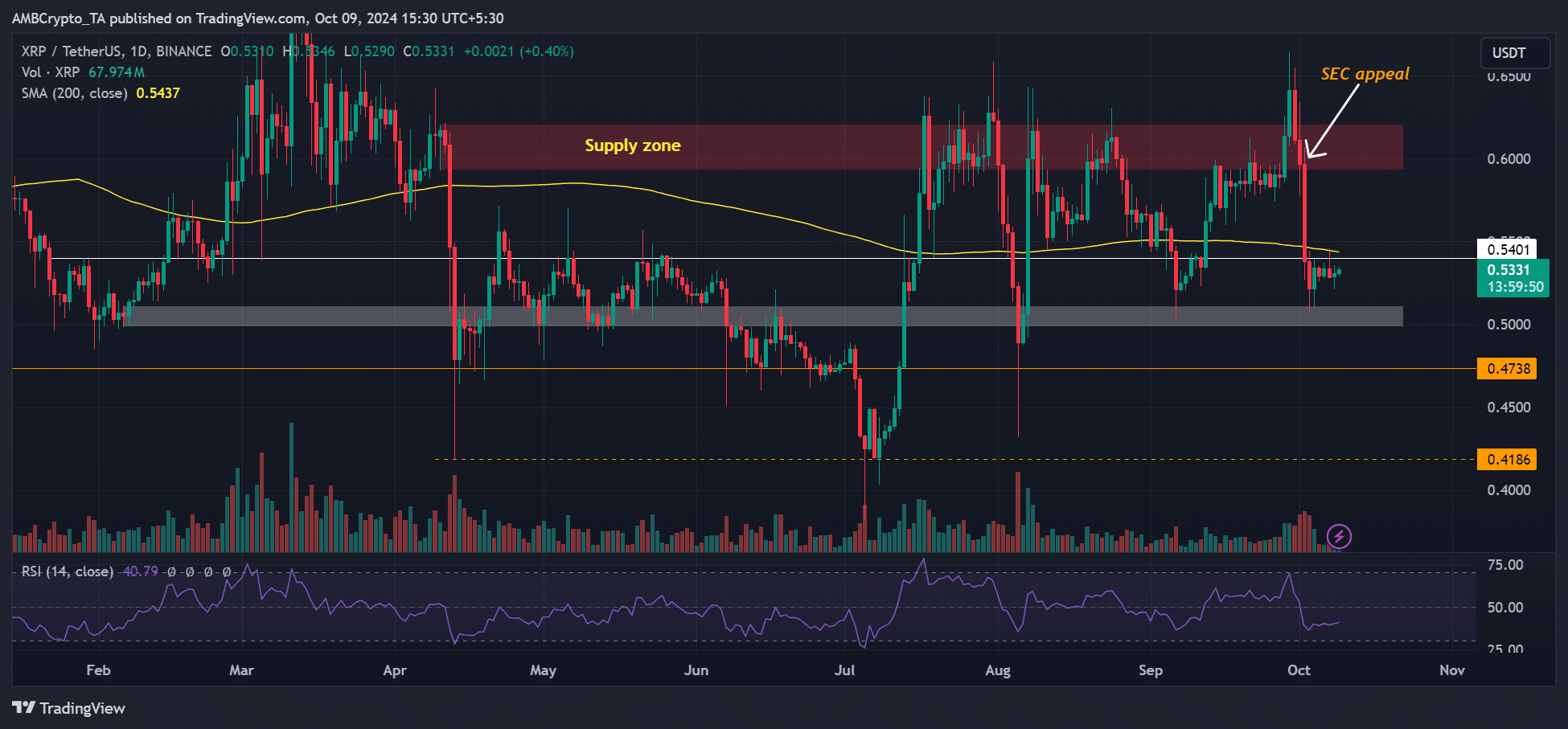

Source: XRP/USDT, TradingView

Since the SEC’s October 2 call, XRP has fallen from $0.6, turning the market structure bearish after falling below the 200-day moving average (MA).

The latest XRP ETF update didn’t change much at the time of writing. The price consolidated below $0.54 in recent days.