After hitting $43,000 last week, Bitcoin traded just below it this weekend. But the cryptocurrency’s price fell significantly on Tuesday, reaching $41,800. After Bitcoin’s surge in December, investors opted to take profits, which led to this decline. There was a significant drop the night before, with Bitcoin temporarily down drop to $40,300.

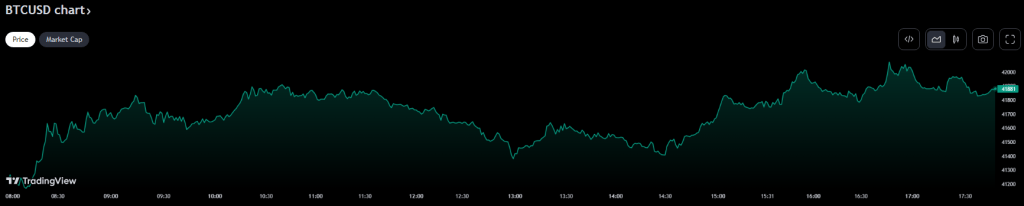

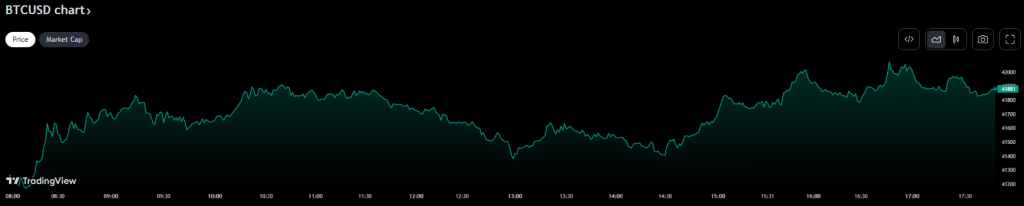

As a result of the drop, almost a week’s worth of gains were erased in just 20 minutes on Sunday evening. According to statistics from TradingView, Bitcoin experienced a dramatic development 7% decrease at approximately 9:00 PM Eastern Time, falling from above $43,200 to a low of $40,290.

Bitcoin Liquidations and Stock Swings

After months of stagnation within a narrow trading range, Bitcoin has risen steadily in recent weeks. The cryptocurrency has seen a notable change in mood and performance after previously experiencing disinterest from the market.

Coinglass data indicates a wave of positions liquidated in the twelve hours beginning Sunday evening, with more than $335 million in liquidations in cryptocurrencies, and about $300 million of that in long positions. The reason for the abrupt decline was not immediately clear. In Bitcoin alone, liquidations totaled more than $89 million.

Source: TradingView

Stock prices have fluctuated this week as investors prepare for a busy events schedule. The expected high volatility this week – the Federal Reserve’s latest monetary policy decision is expected on Wednesday, and key November inflation data due on Tuesday – is driving this concern.

Related reading: Hold Your Horses: Bitcoin Could Fall Below $38,000, These Analysts Say

When assessing Bitcoin’s current rise, chart analysts all agree that a bigger dip in the cryptocurrency would be necessary before reevaluating how strong the rally is.

The sharp decline forced the liquidation of long Bitcoin positions worth over $270 million. Source: CoinGlass.

Rob Ginsberg of Wolfe Research agrees, pointing out that there is a lot of momentum in the continued upward trend. According to the consensus of industry professionals, there is a general belief in the sustainability and longevity of Bitcoin’s upward trajectory.

Still a nice road ahead

The coming year sees a number of favorable catalysts for the cryptocurrency, the first of which is the opportunity Bitcoin Exchange Traded Fund (ETF). Investors expect a price spike in the months following Bitcoin’s expected halving in spring 2024.

BTCUSD trading at $41,877 on the daily chart: TradingView.com

While some investors are excited about the prospect of an ETF, the market as a whole is feeling positive and anticipating significant changes in the cryptocurrency environment.

Bitcoin’s price is up about 150% since the beginning of the year, despite the hiccups. The main driver of the rise is expectations that major financial institutions will soon be able to gain significant exposure to Bitcoin through exchange-traded funds (ETFs).

The market’s general expectation that the US Federal Reserve would begin cutting interest rates in mid-2024 has increased support for Bitcoin’s price rise.

Featured image from Adobe Stock

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.