A Bloomberg crypto market analyst says Bitcoin (BTC) will be one of the main beneficiaries of an inevitable return to currency depreciation by the US government.

Jamie Coutts say social media platform

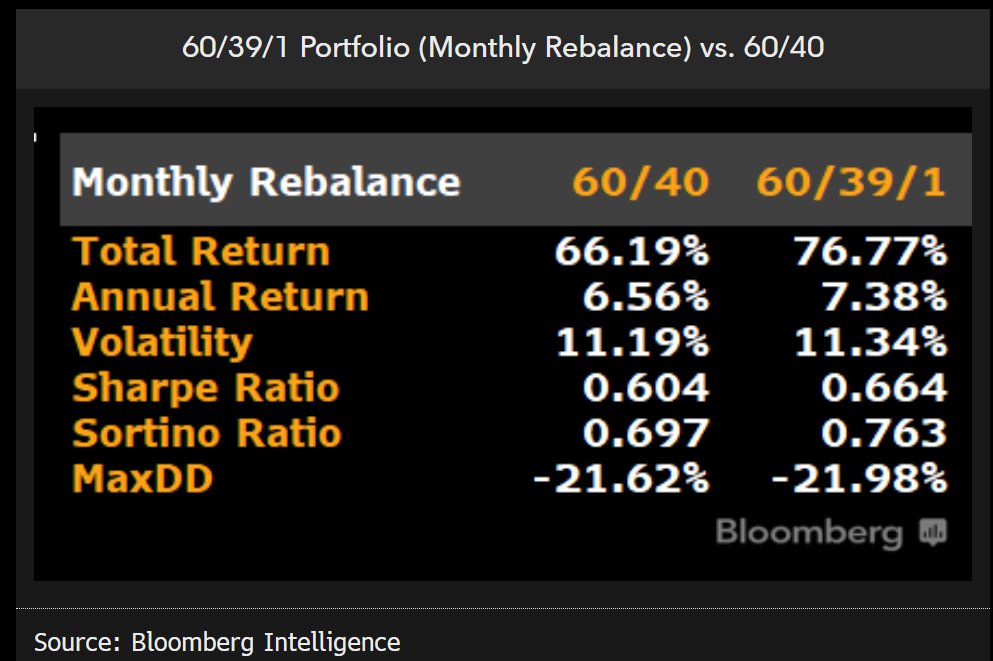

“What happens if you reallocate 1% from bonds to BTC to a 60/40 portfolio?”

However, Coutts say that even the optimized return of a BTC allocation did not allow the average 60/40 portfolio to avoid the currency decline that occurred in those years.

The crypto analyst say that as more investors start factoring currency depreciation into their portfolios, hard assets like Bitcoin will benefit, while government bonds will feel pain.

“For most non-fiduciary constrained investors, the monetary debasement factor should be taken into account when determining position sizing. The nominal return is a useless measure in the current fiat CB (central bank) construction.

Based on the USG’s (US government) finances, reduction is the only option.

Bad for bonds, good for hard assets…

In our view, bonds will likely be the biggest loser in a future where portfolio allocators begin to seriously consider the inclusion of Bitcoin in diversified portfolios.”

Earlier this month, Coutts said Bitcoin triggered a bullish signal on one of Bloomberg’s proprietary trading indicators.

At the time of writing, BTC is trading at $26,926.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney