Data from the chain shows that investors are increasingly inclined to own Bitcoin. Bitcoin has been on a roll since the start of the month, pushing the price to new yearly highs. At the same time, CryptoQuant’s data exchange shows that it concerns cryptocurrency gearing up for a continued bull run. According to the on-chain analytics platform, Bitcoin’s exchange supply, the amount that can be purchased on exchanges, has fallen to the lowest level since 2017

The stock exchange offering falls to the lowest level in six years

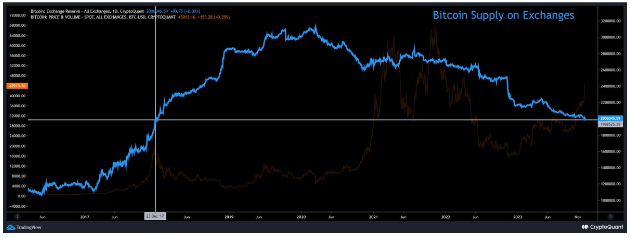

The Bitcoin market is issuing a bull signal that correlates with the expectation of spot Bitcoin ETF applications. CryptoQuant’s currency reserve chart shows that Bitcoin’s supply has steadily declined against centralized exchanges since 2020, when it peaked at over 3.2 million BTC. The outflows were especially exacerbated in the last quarter of 2022, when the collapse of the crypto exchange FTX led to panic and investors started opting for self-custody in cold wallets. During this period, foreign exchange reserves fell from 2.512 million BTC to 2.158 million BTC in a month.

https://x.com/cryptoquant_com/status/1733005131216744749?s=20

Lowest offer of #Bitcoin in six years

“We are in the 45th month of declining supply. For the first time, supply returned to 2017 levels.”

Through @1MrPapi— CryptoQuant.com (@cryptoquant_com) December 8, 2023

Reserves on the stock exchanges began to slowly increase in the first months of 2023, rising again to 2.240 million in May. However, in June, things started to change filed by BlackRock and other investment companies spot Bitcoin ETF trading in the US led to the beginning of bullish sentiment.

Bitcoin slightly below the $44K level today. Chart: TradingView.com

Reserves on centralized exchanges have steadily declined since then. At the time of writing, the foreign exchange reserve has now passed below 2 million BTC, a level it has not reached since December 2017. The six-year low of this measure is particularly interesting, as Bitcoin’s total circulating supply has increased since 2017. the supply now stands at 19,564,812 BTC, a 16% increase from the supply of 16.78 million BTC in December 2017.

Bitcoin Price Outlook: Bull Signal?

Although there are technically more bitcoins available now, the increase in adoption makes it increasingly difficult for traders to get control of the property. Falling stock market supply is a bullish signal for crypto assets, and periods of low stock market supply have historically been associated with the onset of significant Bitcoin bull runs. The last time Bitcoin saw a drastic drop in foreign exchange reserves was in 2020, and the crypto would later hit its all-time high the following year.

Bitcoin does are currently taking the lead in new inflows in the crypto industry, with Coinmarketcap’s Fear and Greed Index now pointing to an extreme greed of 82. Recently the most important asset of the sector broke over $44,000 for the second time this week and is now up 14% in a 7-day span. Bitcoin is poised for extreme gains in 2024, and many analysts have done so predicted a price target above $100,000.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Freepik